Altcoin season used to signal major rotation plays and quick wins across speculative tokens – but that narrative is falling apart in late 2025. Instead of flowing into small caps, traders are retreating to Bitcoin, pushing its dominance above 54% and freezing momentum for newer assets.

Even as Bitcoin rebounds to $91,623, the altcoin market remains paralyzed. And with regulatory shifts and macro pressure building, a new kind of token is quietly gaining traction: infrastructure plays like $BEST, designed to serve real utility during risk-off cycles.

Bitcoin’s Gravity Pulls Harder Than Ever

While BTC has flirted with dips below $90K, it continues to command nearly 55% of total crypto market cap, a level not seen since the last liquidity crunch. Its rise to $91,623 is not just a price event – it’s a narrative one.

Daily trading volume has surged past $73 billion, over 10× the combined total of most altcoins. The ETF boom, macro uncertainty, and the preference for regulated exposure are reinforcing BTC’s role as crypto’s “safe haven.”

For investors, the message is clear: the crypto casino mentality is fading. Traders want scalable, trusted infrastructure, not high-risk meme coin rotations. And that shift leaves traditional altcoin cycles in limbo.

Why Altcoin Season Isn’t Starting

Historically, altcoin runs followed BTC stabilization. But not this time.

Despite a mild bounce in ETH and some Layer 1s, the altcoin season index hovers near 29 – far from the 75+ threshold that signals full risk rotation. Most tokens show volatility without conviction. Even major narratives like Ethereum restaking or Solana dApps are attracting attention, not capital.

The macro backdrop explains a lot. Liquidity is tight, and the October crash – when $19B in leveraged positions vanished – is still shaping risk appetite. Traders aren’t piling into new tokens. They’re watching. Waiting. Playing defense.

As George Mandres of XBTO Trading put it, “October 10th is definitely a longer-lasting shock than it appears.” That cautious sentiment hits altcoins hardest.

Dominance Holding – or Redefining the Cycle?

What if altcoin season isn’t just delayed – but obsolete?

That’s the growing belief among analysts tracking current flows. Bitcoin isn’t just a safe store anymore – it’s evolving into a foundational infrastructure layer. Every advance in BTC scalability, cross-chain compatibility, or Layer 2 tech pulls market attention away from isolated experiments.

Even Timothy Misir of BRN calls Bitcoin today “the most leveraged expression of macro tightening.” That’s not altcoin language – that’s finance desk language.

So if altcoin cycles are on hold, what comes next? Projects that serve Bitcoin’s gravity instead of fighting it.

Altcoin Season May Return – But Infrastructure Is Winning Now

In this market, altcoin season has no spark. Bitcoin isn’t giving up dominance. It’s expanding it – not just as a coin, but as a framework.

That’s why the most strategic capital is bypassing meme coin cycles and moving toward infrastructure tokens like $BEST. There’s just one day left in its current round, and those who wait risk entering at a higher tier or missing the utility window entirely.

For those still holding out for altcoin season, it may come – eventually. But wallet utility, scalability, and layer tools are building quietly in the background. And that’s where smart buyers are positioning now.

$BEST Token: Riding the New Wave of Infrastructure-Led Presales

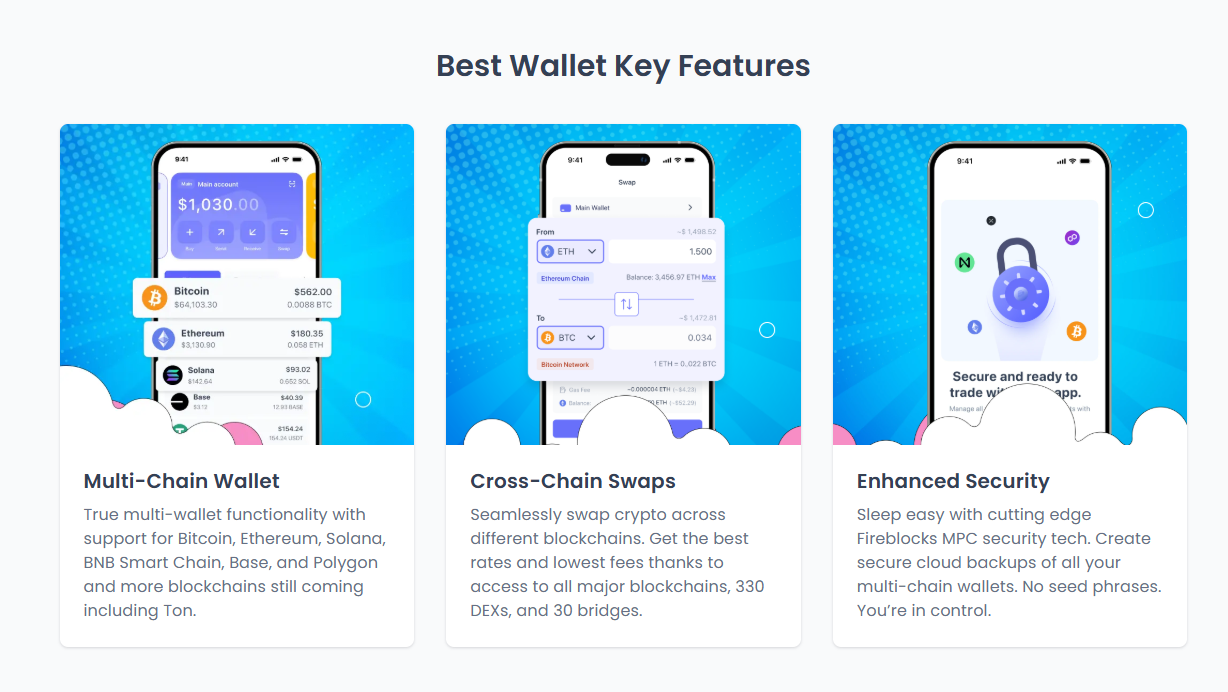

As capital concentrates in trusted networks, wallet infrastructure has become a new battleground. And that’s exactly where $BEST Token enters the picture.

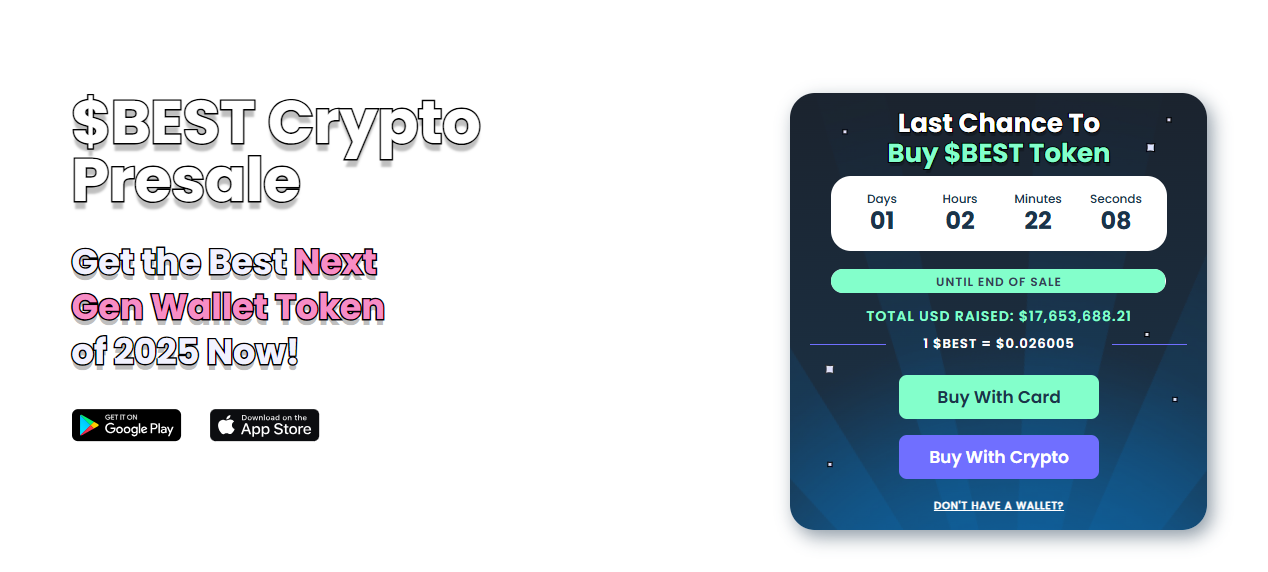

With just hours left in its current presale phase, $BEST has already raised over $17.6 million, pricing each token at $0.026005. But this isn’t just another presale – it’s part of a wallet-first, chain-agnostic platform that’s positioning itself as a utility layer during this Bitcoin-dominant cycle.

Presale Stage Nearing Close

Over $17M Raised in Active Demand

1 $BEST = $0.026005

Fiat & Crypto Payment Options

What makes $BEST stand out is its structure. No volatility. No guessing games. Just fixed-tier allocations, wallet integration tools, and product-ready roadmap. In a climate where altcoins are floundering and Bitcoin rules the airwaves, tokens like $BEST offer purpose – and a real entry point.

Buyers understand the new game: tools > tokens. Utility > speculation. And timing is everything.