Dogwifhat price continues to trade quietly around the $0.38 region, moving within one of its tightest trading ranges in weeks as market participants wait for a decisive shift in momentum.

Despite the recent uptick in daily price performance, the broader trend shows hesitation, leaving traders focused on open interest dynamics and key support and resistance levels that may dictate the asset’s next directional move.

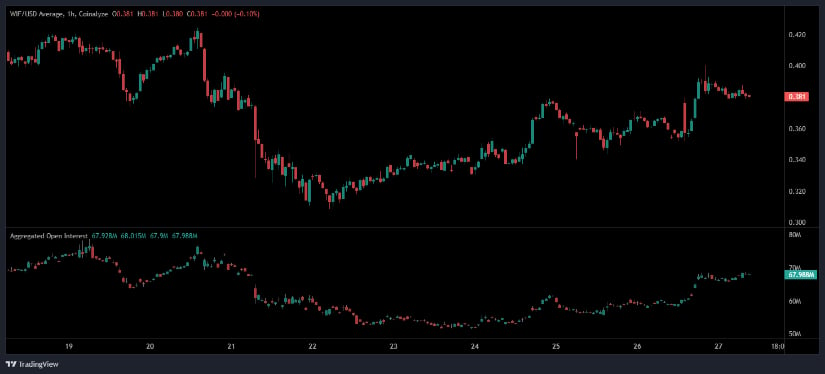

Consolidation Between $0.36 and $0.40 as Open Interest Rebuilds

At the time of writing, WIF/USD is priced at $0.381, slipping a marginal 0.10% on the hour while remaining firmly locked within the $0.36 to $0.40 consolidation zone. The hourly chart highlights how the token has steadied after earlier volatility, creating a tight structure that reflects the market’s indecision. Both buyers and sellers have been reluctant to push aggressively, allowing the range to compress as momentum cools following the multi-week downtrend from higher levels.

Source: Open Interest

Open interest currently sits at 67.99 million, modestly higher than levels earlier in the week but still noticeably lower than the peaks seen during the prior rally phase. This gradual rise in open interest suggests speculative traders are slowly rotating back into positions, yet the market has not established a clear directional bias. Rising open interest during sideways trading often indicates that both long and short positions are building simultaneously, setting the stage for a future breakout once volume and volatility expand.

For bullish traders, clearing the $0.40 ceiling remains the key objective. A sustained move above that level, especially if accompanied by rising volume and continued growth in open interest, would signal the start of a more convincing bullish shift.

Conversely, losing the $0.36 support zone would expose the token to a potential acceleration to the downside as stop orders are triggered and traders reduce exposure. Until one of these conditions materializes, the market is likely to remain trapped in its current low-conviction structure.

WIF Gains 4.26% on the Day as Volume Rises

Market data from BraveNewCoin places WIF at $0.38127, reflecting a 4.26% increase over the past twenty-four hours. The token’s market capitalization sits at approximately $381 million, with daily trading volume reaching $165 million.

This volume recovery is notable, as it shows that traders are becoming more active again after a period of declining participation. However, the price remains confined to a narrow band, confirming that rising volume alone has not yet been sufficient to break the coin out of its tight structure.

The available supply of the token t stands at 998.9 million tokens, and the asset holds a ranking of 192 globally. While the broader memecoin sector has shown signs of life, the coin’s intraday behavior continues to reflect caution rather than conviction, making the current price level more of a stabilization point than a clear trend shift.

Downtrend Remains Intact Despite Fading Bearish Momentum

From a technical perspective, the TradingView chart shows that WIF has remained in a steady downtrend for several months. Previous attempts to break resistance have failed, and each rally has produced a new lower high, confirming persistent bearish pressure. The most recent candles display low volatility with tightening consolidation around the $0.37 to $0.40 range, suggesting fading momentum yet not enough strength to confirm a reversal.

Source: TradingView

The MACD histogram has recently turned slightly green, with the MACD line curling upward toward the signal line. This indicates that bearish momentum is beginning to soften. However, because both MACD lines remain below zero, the larger trend continues to reflect weakness. A bullish cross below the zero line may support a short-term bounce, but without an expansion in volume or a shift in market sentiment, it typically does not trigger a full reversal.

Meanwhile, the Chaikin Money Flow hovers near −0.07, signaling mild capital outflow. Although not deeply negative, this reading shows that buying pressure is still insufficient to support a strong upward movement. For a trend reversal to gain traction, CMF must move into positive territory, indicating sustained accumulation rather than passive buying.