If you’re looking for a Terra Classic price prediction, you’re probably wondering if LUNC still has any real potential. It’s one of those coins that once made headlines — then crashed, hard. But surprisingly, it’s still alive and trading.

As of the end of October 2025, Terra Classic (LUNC) is priced at $0.000045. Earlier this month, on October 3, it peaked at $0.000058, while just two weeks ago, on October 11, it dipped to $0.000017. The current price is about a 160% jump from the recent bottom — not bad for a token many had written off.

In this article, we’ll take a close look at what Terra Classic really is, how it works, and where its price might be heading. Whether you’re curious about LUNC’s price predictions or just wondering if it’s worth the risk, we’ll break it down in simple terms. No hype. Just facts, history, and real insight.

| Current LUNC Price | LUNC Price Prediction 2025 | LUNC Price Prediction 2030 |

| $0.000045 | $0.00015 | $0.0033 |

Terra Classic (LUNC) Overview

Terra Classic is the original version of the Terra blockchain. It was once one of the biggest and most promising projects in the crypto world. The network was built by Terraform Labs, a company founded by Do Kwon and Daniel Shin. Their goal was bold: to create a stablecoin-powered ecosystem for real-world payments.

At the heart of the system was LUNA, Terra’s native token, and UST, an algorithmic stablecoin. The two worked together to keep UST pegged to $1. If UST dropped below $1, the system would burn LUNA to mint more UST. And if UST went above $1, it would mint LUNA and burn UST. In theory, this was supposed to keep everything balanced.

But in May 2022, everything collapsed. The system couldn’t handle a massive wave of withdrawals. UST lost its peg, and the protocol printed billions of LUNA trying to fix it. Instead of helping, it made things worse. The price of LUNA fell from over $100 to less than a fraction of a cent in just a few days. Over $40 billion in value was wiped out, and many retail investors were hit hard.

After the crash, the Terra community split. A new chain called Terra 2.0 was launched, and the old chain was renamed Terra Classic. Its token, LUNA, became LUNC (LUNA Classic). The original ecosystem stayed alive but lost most of its momentum.

Today, Terra Classic is a community-driven project. Most of the original developers moved on, but loyal supporters kept building. The chain still runs and even added some new features, like staking and community-led governance. Some investors see it as a comeback story. Others see it as a ghost of a failed experiment.

Still, LUNC continues to be traded on major exchanges. Binance, for example, has supported LUNC token burns, removing billions of tokens from circulation. That’s one of the reasons why the price has seen occasional spikes, even years after the crash.

In short, Terra Classic is a high-risk, high-volatility coin with a dramatic past. Whether it has a real future or not depends on what the community can build—and how the broader market responds.

| Current Price | $0.000045 |

| Market Cap | $250,172,020 |

| Volume (24h) | $7,670,370 |

| Market Rank | #167 |

| Circulating Supply | 5,495,810,111,470 LUNC |

| Total Supply | 6,485,116,103,208 LUNC |

| 1 Month High / Low | $0.000058 / $0.000017 |

| All-Time High | $119.18 Apr 05, 2022 |

How Does Terra Classic Work?

Terra Classic was built to support decentralized payments. At the center of it was a system that used two tokens: LUNA (now called LUNC) and UST, a stablecoin. The goal was to keep UST always worth $1, without holding real dollars in a bank.

Here’s how it worked. When UST went above $1, people could trade $1 worth of LUNC to get 1 UST. That increased supply and brought the price down. If UST dropped below $1, they could trade 1 UST for $1 worth of LUNC. That reduced supply and pushed the price up.

This design was called an algorithmic stablecoin system. Instead of using dollars or gold, it used code and market incentives to stay balanced. In good times, it worked smoothly. But when too many people wanted to cash out, the system broke.

Once UST started falling in 2022, people rushed to sell it. The system tried to mint more and more LUNC to keep the peg. But this created inflation, so much LUNC was printed that the price dropped to almost zero. That’s how the crash happened.

Today, UST is no longer the focus. Terra Classic still uses LUNC as its main token. The community has moved away from the failed algorithmic model. Now, the focus is on staking, community governance, and reducing supply through token burns.

Validators keep the network running using a Proof-of-Stake (PoS) system. Anyone can stake their LUNC tokens to earn rewards and help secure the chain. Proposals are made and voted on by the community, making Terra Classic fully decentralized.

Terra Classic Features

Terra Classic is a layer-1 blockchain, just like Ethereum or Solana. It has its own network, validators, and native token LUNC. After the collapse of UST, Terra Classic shifted its focus to features that support decentralization, community control, and token utility.

One of the key features is its Proof-of-Stake consensus. This means that instead of using energy-heavy mining, the network is secured by validators who stake LUNC. Users can delegate their LUNC to these validators and earn rewards in return. The more you stake, the more you can earn—this gives people a reason to hold the token.

Another major feature is on-chain governance. Anyone who holds LUNC can vote on proposals. These can include changes to the protocol, new development ideas, or token-burning plans. This system puts the future of the chain directly in the hands of its users.

Speaking of burning, token burn mechanisms are now central to the project. The community and some exchanges, like Binance, regularly burn LUNC tokens. This reduces the supply and could increase the price over time. It’s one of the few ways the community is trying to bring back long-term value.

The chain also supports smart contracts through CosmWasm. This allows developers to build decentralized apps (dApps) on Terra Classic, similar to how they do on Ethereum. While activity is still low, the tools are there.

Finally, Terra Classic remains compatible with Cosmos SDK, meaning it can connect with other blockchains in the Cosmos ecosystem. This offers technical flexibility and future integration potential.

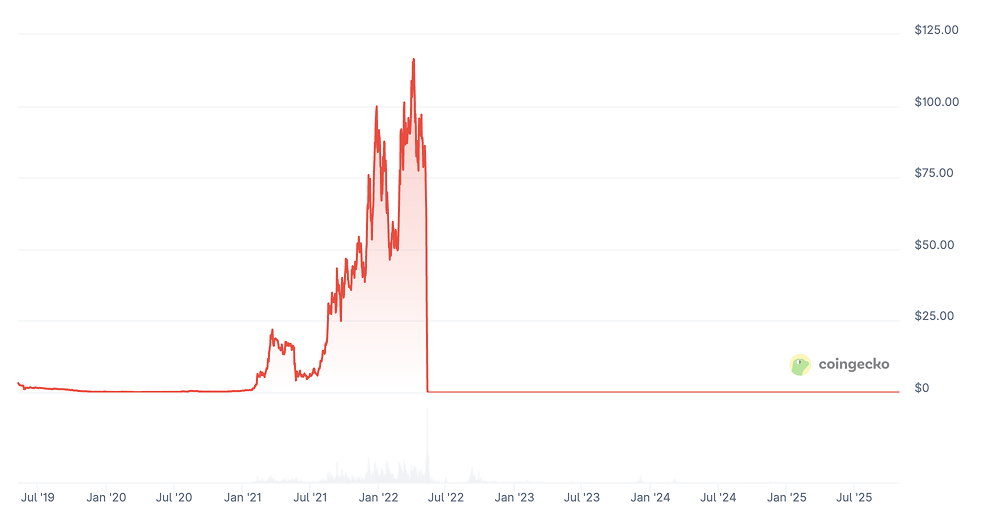

LUNC Price Chart

CoinGecko, October 29, 2025

Terra Classic Price History Highlights

Terra was launched in 2019 with the aim of changing the way people use money. During its early days, the native token LUNA was sold for $0.18 during a seed round and $0.8 in a private sale. Back then, it was seen as a promising project.

In 2020, LUNA traded between $0.1 and $0.5. It was a quiet year, but the foundation was being built. Then came 2021, when things took off. By December, LUNA hit over $90, gaining more than 58% in one month alone.

The real turning point came in 2022. In April, LUNA reached an all-time high of around $119. But soon after, the algorithm behind its stablecoin UST failed. The collapse caused LUNA’s price to crash almost overnight—dropping to just a fraction of a cent. By the end of 2022, LUNA had become LUNC and joined the Terra Classic chain. On December 1, Binance burned over 6 billion LUNC, helping the price recover slightly to $0.00018 by the next day.

In 2023, LUNC had a volatile year. It briefly jumped to $0.0002 in February, then dropped again. The launch of LUNC 2.0 in June pushed it to $0.0001, but the excitement didn’t last. Still, it managed to reach $0.000275 in December.

2024 started strong. In March, LUNC hit $0.0002 again, following a broader market rally. But by mid-year, it dropped to $0.000064. In December, it saw a small rebound, ending the year near $0.00017.

Now, in 2025, the price remains unstable. LUNC moves between $0.00004 and $0.0006, showing no clear trend.

Many investors are watching closely, hoping for Terra Classic comeback. Others stay cautious, still remembering the dramatic fall of 2022.

Terra Classic Price Prediction 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.000056 | $0.00041 | $0.0002 | +345% |

| 2026 | $0.000134 | $0.036 | $0.015 | +33,000% |

| 2030 | $0.000298 | $0.023 | $0.05 | +111,000% |

| 2040 | $0.0346 | $3.19 | $1.5 | +3,333,000% |

| 2050 | $0.053 | $12.85 | $6 | +13,333,000% |

Terra Classic Price Prediction 2025

According to DigitalCoinPrice, Terra Classic (LUNC) could rise to a minimum of $0.000056 in 2025, which would be around +25% from its current price of $0.000045. On the other hand, they forecast a maximum of $0.000137, which equals a potential +205% gain.

Analysts from PricePrediction are slightly more optimistic. They expect LUNC to trade between $0.000074 and $0.000084, meaning potential returns of +65% to +85% from today’s price.

Telegaon is the most bullish for 2025. Their projections place LUNC between $0.000076 and $0.00041, which implies a +70% rise at the low end and a massive +800% increase at the high.

LUNC Crypto Price Prediction 2026

For 2026, DigitalCoinPrice expects LUNC to trade between $0.000134 and $0.000161, representing gains of +200% to +260% from current levels.

PricePrediction.net estimates a price range from $0.000107 to $0.000130. That would translate to a return of +140% to +190%.

Once again, Telegaon provides an ultra-bullish outlook. Their forecast ranges from $0.00043 to $0.00086, indicating possible gains of +850% to +1,800%.

Terra Classic Price Prediction 2030

By 2030, DigitalCoinPrice expects LUNC to reach between $0.000298 and $0.000337. That means potential growth of +560% to +650%.

PricePrediction is slightly more bullish, estimating a minimum of $0.000480 and a maximum of $0.000589—or +960% to +1,200%.

Telegaon, however, predicts an explosive rally. Their 2030 forecast ranges from $0.0072 to $0.023, which equals a jaw-dropping +16,000% to +51,000% gain.

LUNC Price Prediction 2040

In 2040, PricePrediction projects LUNC to hit a minimum of $0.0346 and a maximum of $0.0431, showing potential returns between +77,000% and +95,500%.

Telegaon gives an even more optimistic long-term view, predicting a price range from $2.06 to $3.19. If accurate, that would mean returns of +4,577,500% to +7,088,700%—an almost unimaginable leap.

Terra Classic Price Forecast 2050

Looking ahead to 2050, PricePrediction estimates LUNC could range between $0.053 and $0.060, delivering gains of +117,600% to +133,100%.

Telegaon sees even higher prices by mid-century. Their forecast spans from $9.64 at the low to $12.85 at the top. That would represent an astounding +21,422,000% to +28,555,000% rise from today’s levels.

Terra Classic LUNC Price Prediction: What Do Experts Say?

Many investors are wondering if LUNC still has room to grow. Expert opinions on Terra Classic price prediction vary, from extremely bullish to cautious and realistic. Let’s break down what some well-known voices are saying.

Javon Marks, a crypto technical analyst, is one of the most optimistic. He predicted that LUNC could surge by 830% from its current level. That would bring the price to $0.0004295. He points to a massive consolidation breakout and strong technical indicators, including rising trading volume and bullish divergences. Marks believes that if momentum continues, a breakout could come faster than expected. He also mentioned a potential target of $0.000693 by early 2026.

While this might seem ambitious, Javon’s analysis is based on clear chart patterns and historical behavior. Still, reaching those levels would require significant interest and fresh demand.

Another voice from the Terra Classic community, Bull.LUNC, shared ultra-bullish long-term predictions (it’s not available anymore, as his X account got banned). According to him, LUNC could hit:

$0.009 to $0.9 in 2025,

$1 to $5 in 2026,

Even $10 to $30 by 2027.

These numbers are far beyond what most analysts consider likely. Community reactions have been mixed—some see hope, others call it unrealistic.

On the other end of the spectrum is the Gate Research Team, offering a more grounded view. Their 2025 forecast ranges from $0.00004341 to $0.00008682, with an average of $0.00006292—almost identical to the current price.

LUNC USDT Price Technical Analysis

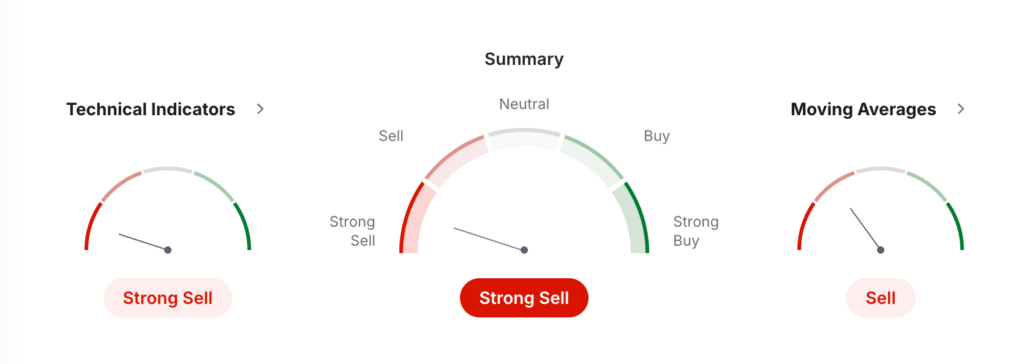

Based on data from Investing the technical outlook for Terra Classic (LUNC) has shifted to a strongly bearish sentiment. The chart now indicates a “Strong Sell” signal, a reversal from the previously bullish setup.

Investing, October 29, 2025

An analysis of technical indicators reveals a decidedly negative picture. Out of the key indicators, a majority of 6 are flashing “Sell,” with only 1 signaling “Buy” and 1 remaining “Neutral.” The Relative Strength Index (RSI) stands at 41.686, which points to a “Sell” signal, suggesting downward price pressure. Further reinforcing this bearishness, the Rate of Change (ROC) indicator is also giving a “Sell” signal at -25.438. While tools like the Stochastic Oscillator and StochRSI are in “Oversold” territory, which can sometimes precede a price bounce, the ADX, a measure of trend strength, is neutral at 19.311, indicating the current downward move lacks strong momentum.

Confirming the bearish trend, the moving averages are now predominantly signaling “Sell.” Key short-term averages like the MA10 and MA20, as well as the long-term MA200, all point to a downward trajectory. This is a significant shift from the previous analysis, where these averages were aligned for a “Buy.” This alignment across multiple timeframes suggests sustained selling pressure

Pivot point analysis provides a clear structure for potential price movements. The central pivot level is at 0.0000616. For any bullish reversal to occur, the price would need to overcome the primary resistance level at 0.000073. Meanwhile, the key support level to watch is 0.0000502; a break below this could signal further declines. According to the ATR indicator, the market is currently experiencing less volatility.

In summary, Terra Classic’s technicals show significant weakness, with an overarching “Strong Sell” signal supported by both momentum indicators and moving averages. While the community continues initiatives like token burns with support from exchanges like Binance, the current market sentiment reflected in the charts is negative. The technical ratings across daily, weekly, and monthly timeframes all suggest a “Sell,” advising caution for traders and investors.

What Does the Terra Classic Price Depend On?

The price of Terra Classic (LUNC) depends on several key factors, both inside and outside the project. One of the most important drivers is community activity. After the original collapse, the project became fully community-led. This means that development, governance proposals, and marketing efforts now come from token holders, not a central company. When the community is active—burning tokens, proposing upgrades, or promoting LUNC, price often reacts positively.

Another major factor is token burns. LUNC has a massive supply, which puts pressure on the price. To fight this, users and exchanges like Binance have been burning tokens to reduce the circulating amount. Every time a burn event occurs, supply decreases slightly. If these burns continue regularly, they could slowly raise the token’s value over time. However, the effect is often small unless large amounts are burned at once.

Market sentiment also plays a big role. LUNC often follows the general mood of the crypto market. When Bitcoin and other major coins go up, LUNC tends to move too. But when fear takes over the market, LUNC drops quickly, sometimes even harder than others. This is because it’s considered a high-risk asset with a history of failure.

The lack of utility is another issue. Unlike Ethereum or Solana, Terra Classic doesn’t have a strong ecosystem of apps, games, or DeFi tools. This limits demand for the token. If developers return and start building real use cases on Terra Classic, the value could grow. But for now, most activity is driven by speculation, not real-world usage.

Finally, regulation could shape the future of LUNC. If stricter rules come into play, projects like Terra Classic might struggle to stay listed or traded on major exchanges. On the other hand, clear regulations could also create space for more trust and adoption.

Terra Classic Price Prediction: Questions and Answers

Is LUNC a Good Investment?

LUNC is a high-risk investment with a troubled past. Its value mostly depends on community efforts and speculation. It may offer short-term gains, but without strong fundamentals, it’s not considered a safe long-term asset by most experts.

Does LUNC Coin Have a Future?

LUNC may have a future if the community continues development and attracts new use cases. However, the project lacks strong utility. Its survival depends on ongoing burns, staking interest, and renewed ecosystem activity.

Will LUNC Ever Recover?

A full recovery to pre-crash levels is unlikely without major changes. Still, short-term rallies can happen if trading volume spikes or token burns accelerate. Long-term recovery would require more than just hype—it needs real development.

Will LUNC Go Up in Price?

LUNC could go up if demand increases or large-scale token burns reduce supply. However, price growth is uncertain and often based on market speculation. Without strong use cases, any gains may not last.

Will Terra Classic Reach 50 Cents?

At its current supply, reaching $0.5 would require an enormous market cap—larger than most major cryptocurrencies. That’s highly unrealistic unless a massive token burn happens or a complete system overhaul is introduced.

Will Terra Classic Reach $1?

No, LUNC is very unlikely to ever reach $1 with its current token supply. A price of $1 would push its market cap beyond reasonable limits. Major structural changes would be needed for this to be possible.

How High Can Terra Classic (LUNC) Go?

Most realistic estimates suggest LUNC could hit between $0.0002 and $0.001 in strong market conditions. Anything beyond that would require massive burns or a major ecosystem revival, which has yet to happen.

What Will Terra Classic Be Worth in 2025?

Estimates for 2025 vary. Conservative price predictions place LUNC between $0.000043 and $0.000086. More optimistic predictions go up to $0.0004. But all depend on market conditions and continued community action.

How Much Will LUNC Coin Price Be in 2030?

By 2030, LUNC could range from $0.0001 to $0.001 depending on supply, demand, and ecosystem growth. Without major changes or real utility, prices are unlikely to exceed that range significantly.

How Much Will Terra Classic Cost in 2040?

In 2040, LUNC may trade between $0.001 and $0.01 if the community revives the network and maintains token burns. Higher prices are possible only with massive ecosystem adoption or extreme market shifts.

What Is the Price Prediction for Terra Classic in 2050?

Most experts don’t offer forecasts that far ahead. However, unless LUNC gains real-world use and drastically cuts supply, it’s unlikely to see massive growth. Estimates range from $0.001 to $0.05 under very optimistic scenarios.

Exchange Terra Classic (LUNC) at the Best Rates

StealthEX is here to help you swap Terra Classic crypto if you’re looking for a way to invest in this cryptocurrency. You can buy LUNC privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.