On-chain data shows reduced sell pressure as JUP’s funding rate turns positive, signaling optimism.

JUP’s 2025 bullish forecast ranges from $0.60 to $5.00, fueled by post-BTC halving market growth.

By 2035, JUP could reach $24.50-$50.00, driven by DeFi advancements and blockchain technology maturity.

Jupiter (JUP) Overview

| Cryptocurrency | Jupiter |

| Ticker | JUP |

| Current Price | $0.8506 |

| Price Change (30D) | -5.50% |

| Price Change (1Y) | -46.80% |

| Market Cap | 1.43 Billion |

| Circulating Supply | 1.68 Billion |

| All-Time High | $2.04 |

| All-Time Low | $0.4557 |

| Total Supply | 9.98 Billion |

What is Jupiter (JUP)?

Jupiter (JUP), the native token of Solana’s leading DEX aggregator, has captured the crypto community’s attention with its potential to alter decentralized trading. Launched in October 2021, Jupiter simplifies DeFi by aggregating liquidity across multiple decentralized exchanges, ensuring users get the best possible swap rates with minimal slippage.

Jupiter has solidified its dominance in the ecosystem by handling nearly 80% of all DEX trades on Solana. The platform offers a seamless trading experience with features like Jupiter Swap, which taps into Solana’s diverse liquidity pools, Jupiter Limit Orders, which provide precise price execution during volatile conditions, and Jupiter DCA, which automates investments to reduce risk over time.

Its advanced tools and user-centric design make it accessible to novice and seasoned traders. But the real buzz centers around the JUP token. As Jupiter’s governance backbone, JUP empowers its holders to shape the platform’s future by voting on developments and ecosystem grants.

With a total supply of 9.98 billion tokens and a community-first distribution strategy—including a major airdrop for early users—JUP signals a focus on decentralization and sustainable growth. This dynamic foundation has many speculating about the token’s price trajectory.

Could JUP emerge as a top contender in the DeFi space, driving exponential returns for holders? Learn more regarding JUP’s future trajectory in this CryptoTale’s price prediction.

Jupiter Price History

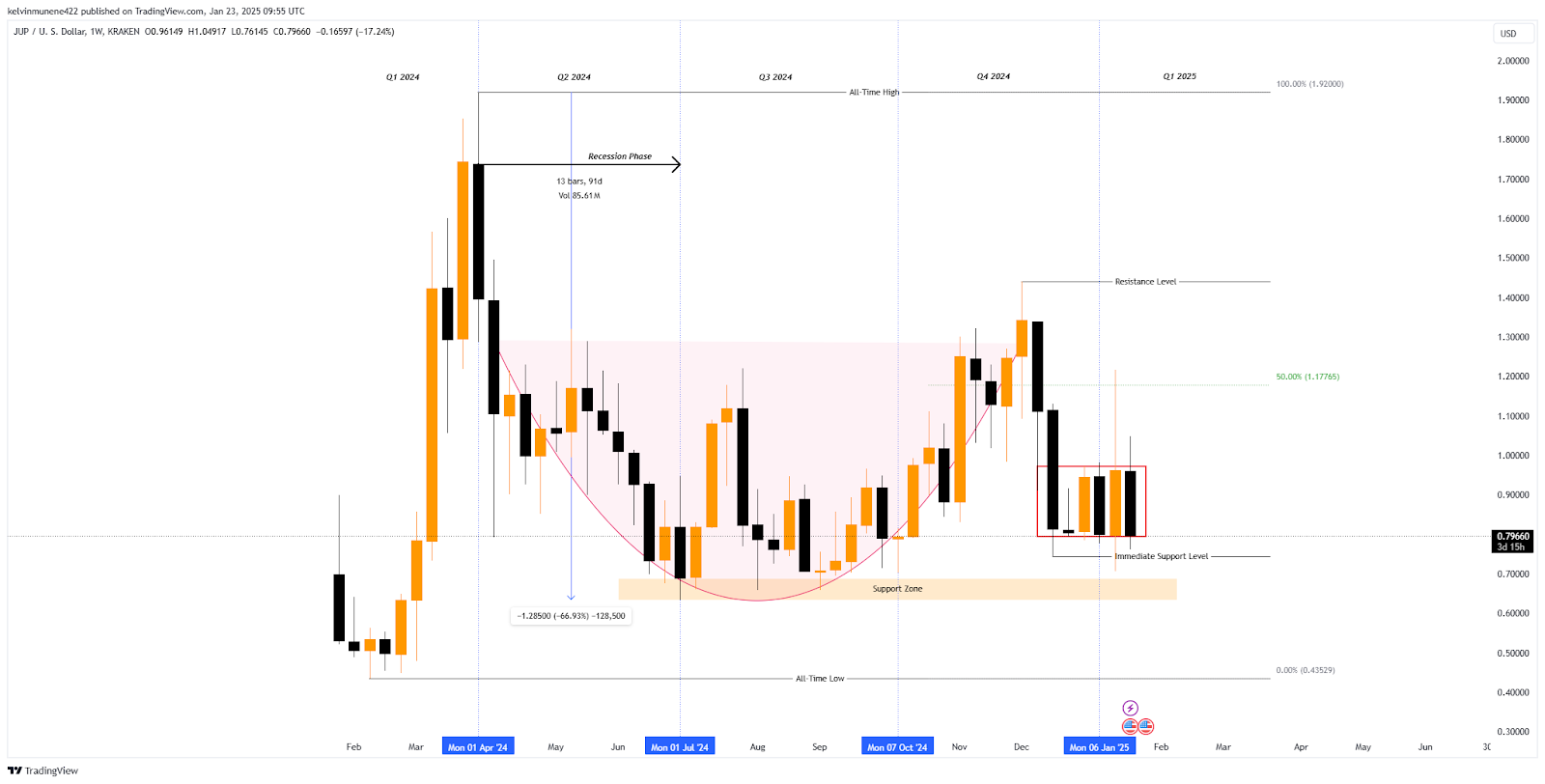

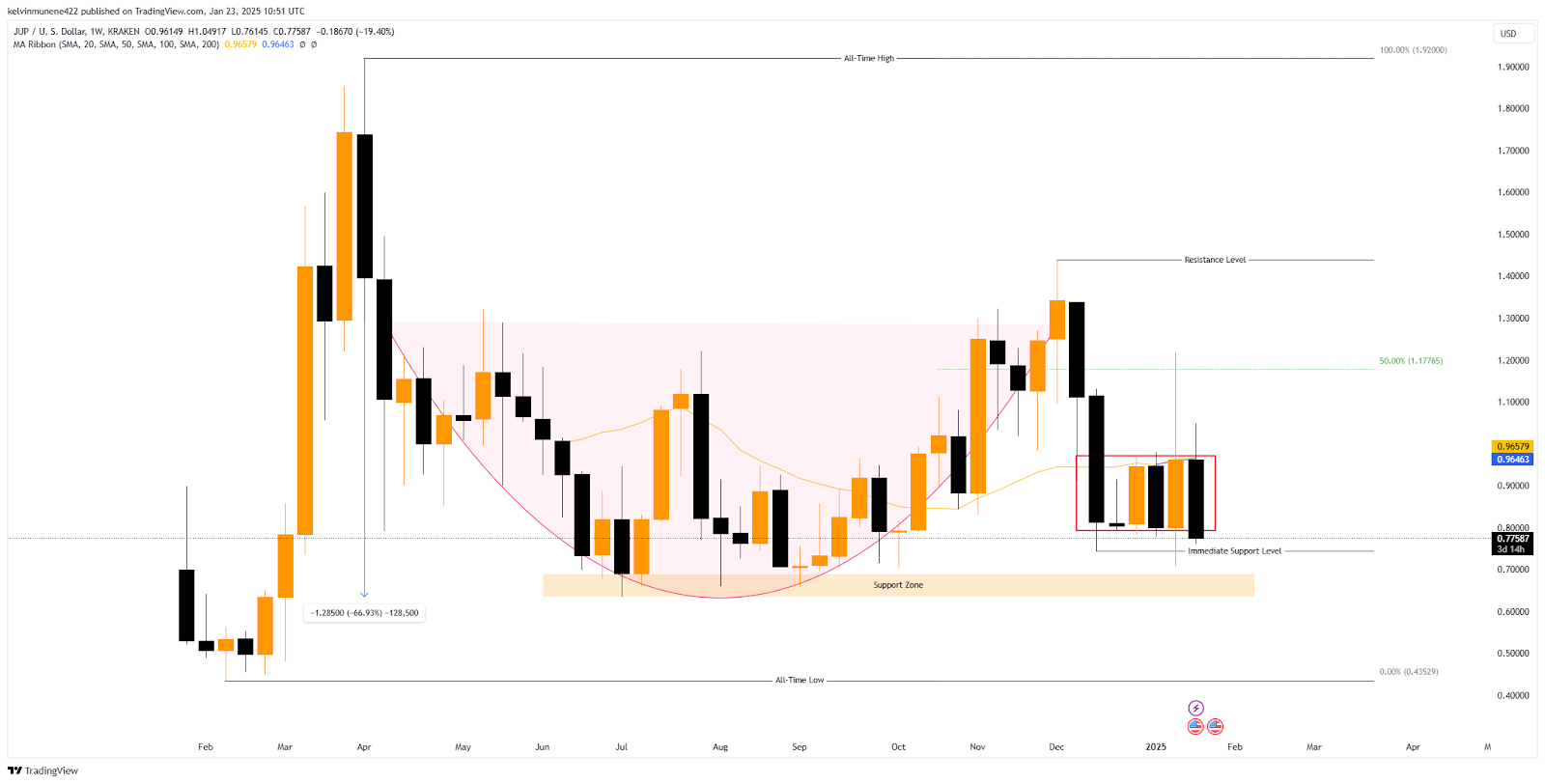

Over the first quarter of 2024, JUP exhibited a sharp bullish rally, reaching a peak price close to $2.04, according to CoinMarketCap, marking it as its all-time high. However, a prolonged correction followed, characterized as a “recession phase,” resulting in a price decline of approximately 66.93%, as indicated by the downtrend arrow.

This correction brought JUP to a strong support zone near $0.63 to $0.68 by mid-2024. Following the slump phase, JUP’s price began a recovery attempt, climbing to a high of $1.43. However, this upward momentum encountered sturdy resistance at that level, causing a reversal that pushed the price back to a low of $0.74 by the end of Q4 2024.

Source: TradingView

Since then, the token has entered an accumulation phase, as indicated by the consolidation pattern within the red rectangle, reflecting its current price range. This consolidation highlights indecisiveness in the market, with price fluctuations between the $0.79 support level and resistance near $0.97.

Despite this consolidation, the current sentiment appears neutral-to-bearish, with JUP’s price trading below the 50% Fibonacci retracement level of $1.17765 from its all-time high. However, technical analysis points to potential recovery.

The cup-and-handle formation suggests that the token may prepare for a bullish breakout if it breaches resistance at $1.43 in the coming months. A successful breakout could propel JUP toward its all-time high, while failure to hold the immediate support of $0.74 risks further downside to historical lows of $0.63 or even target its all-time low.

JUP’s On-Chain Data Hints a Neutral-to-Bullish Market Trend

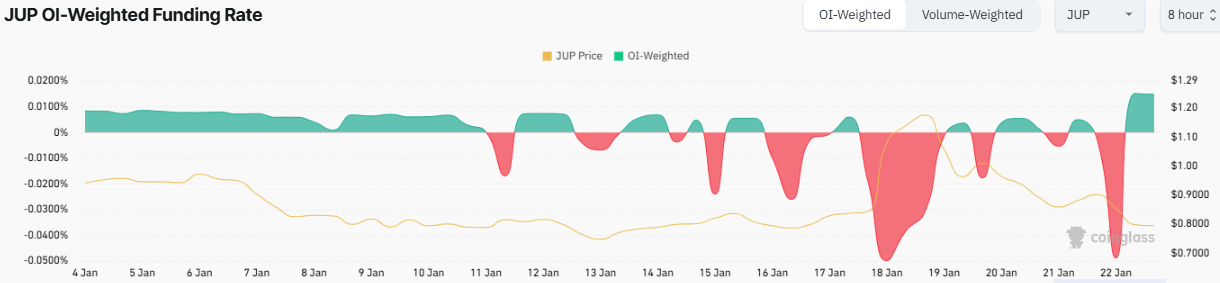

The funding rate chart reveals a series of sharp oscillations in the OI-weighted funding rate, alternating between positive and negative values from January 4 to January 22, 2025. This volatility suggests indecisiveness among traders, reflecting a tug-of-war between long and short positions.

Source: CoinGlass

Notably, the funding rate turned profoundly negative several times, coinciding with a JUP price decline to $0.79. However, the OI-weighted funding rate reading bounced back to the green zone at press time, indicating that bearish sentiment temporarily dominated before shifting to a more neutral-to-bullish outlook.

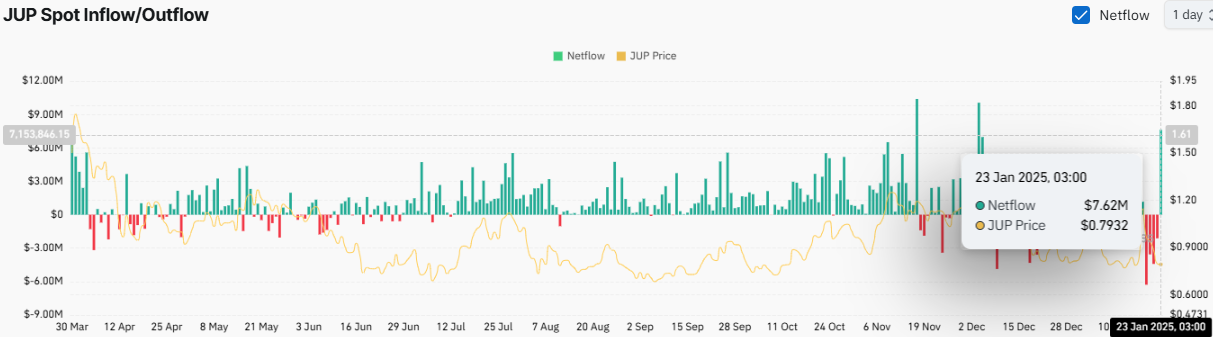

The spot inflow/outflow chart complements this analysis, showing heightened activity in net inflows and outflows over the same period. On January 23, 2025, the net inflow spiked to $7.62 million, coinciding with a slight JUP price recovery to $0.7932.

Source: CoinGlass

This suggests strong buying interest at lower price levels, hinting at market participants’ accumulation. However, the overall trend reflects inconsistent price action as JUP struggles to establish a clear direction. Together, these metrics signal a market in consolidation, with participants balancing between bullish optimism and cautious uncertainty.

Yearly Highs and Lows of Jupiter

| Year | Jupiter Price | |

| High | Low | |

| 2024 | $2.04 | $0.4557 |

Jupiter Technical Analysis

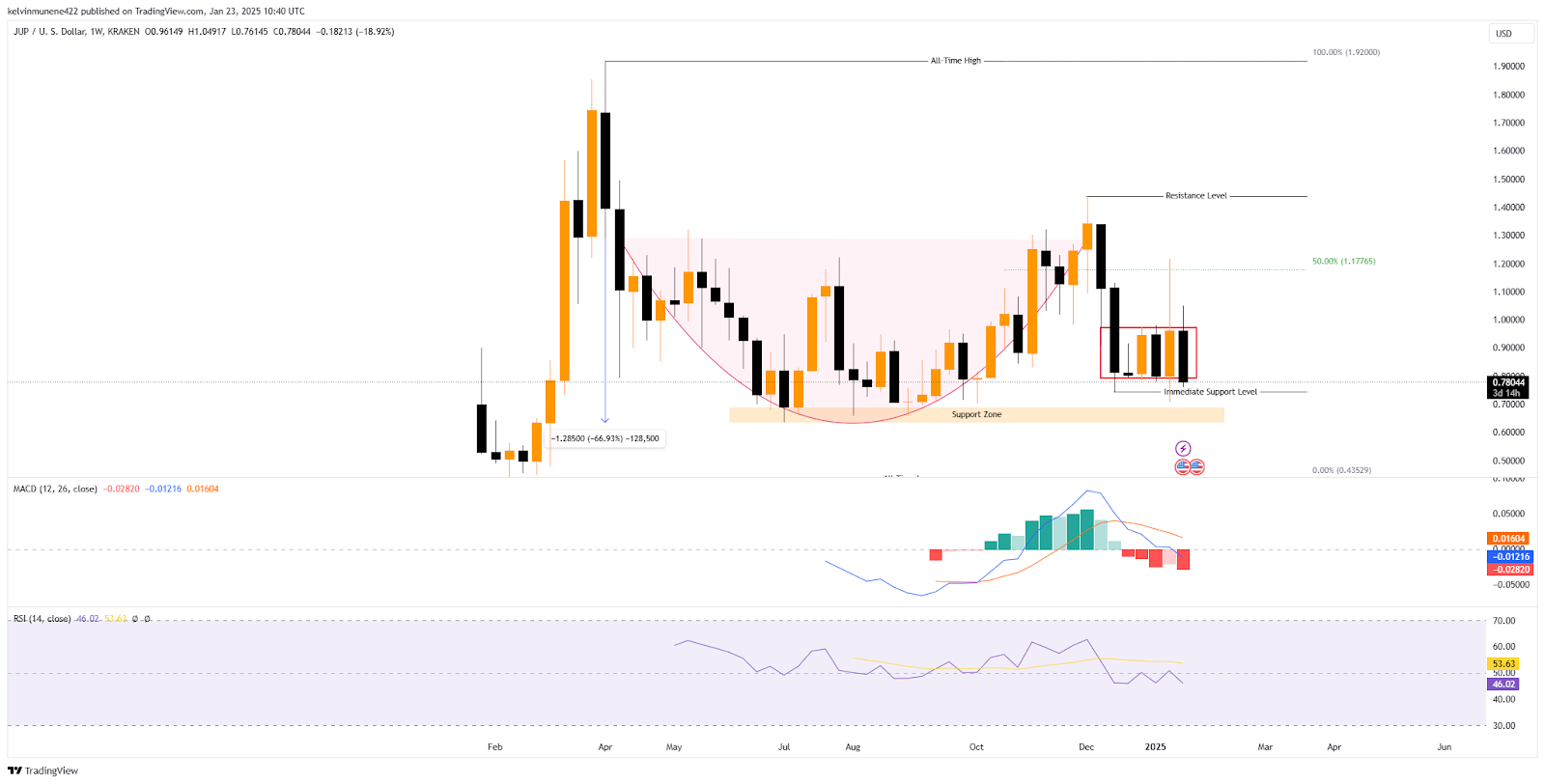

The weekly MACD indicator for JUP reveals bearish momentum, with the MACD line at -0.01216 trending below the signal line at 0.01604. This crossover indicates that selling pressure has intensified recently, aligning with the token’s decline to $0.78, as shown in the current price action.

Furthermore, the histogram displays increasing negative bars, reflecting a strengthening bearish trend that may push the price closer to its immediate support zone at $0.74. Similarly, the Relative Strength Index currently stands at 46.02, signaling neutral sentiment but leaning toward oversold conditions.

Source: TradingView

Previously, the RSI attempted to climb toward the midline of 50 but failed to sustain bullish momentum, correlating with the token’s failure to break above the $0.90 resistance level. This suggests that buyers lack sufficient strength to overcome selling pressure while they are present.

Overall, JUP’s technical outlook is cautious. The token remains in a consolidation phase, and the technical indicators suggest a potential test of lower support levels if bearish sentiment persists. Nonetheless, if RSI rebounds above 50 and the MACD line crosses above the signal line, JUP could see a recovery toward its 50% Fibonacci retracement level at $1.18.

Jupiter (JUP) Price Forecast Based on Fair Value Gap

The JUP’s chart highlights a Fair Value Gap (FVG) on the daily timeframe, positioned between $0.59 and $0.68, aligning with the token’s key support zone. This FVG represents a potential area of liquidity imbalance, often attracting price action as the market seeks to fill the gap.

If JUP’s price continues to struggle close to its immediate support level of $0.74, there is a high likelihood that the token could descend into the FVG, testing the $0.68-$0.63 support and possibly dipping further toward the FVG’s lower band at $0.59.

Source: TradingView

Historically, the price tends to revert to such gaps during bearish corrections before resuming upward momentum. Moreover, the FVG coincides with the lower boundary of the consolidation range seen earlier in 2024, reinforcing its importance as a potential reversal zone.

On the other hand, the daily timeframe shows that JUP’s price has been unable to sustain a breakout above the $1.17 resistance, creating downward pressure that increases the probability of the gap being revisited.

If the FVG is filled and buying interest emerges, it could serve as a springboard for a recovery toward the 50% Fibonacci retracement level at $1.17765. However, failure to hold within this gap may expose the token to further downside, targeting its all-time low.

Jupiter (JUP) Price Forecast Based on MA Ribbon Analysis

The MA Ribbon on the chart indicates that JUP’s price is trading below key moving averages, including the 20-week MA at $0.96579 and the 50-week MA at $0.96463. This positioning underscores a bearish trend in the short term, as the price has failed to reclaim these crucial resistance levels during recent attempts.

Historically, such a setup suggests intense selling pressure in the market, keeping JUP confined to its current consolidation range near $0.77. The downward slope of the 20-week MA highlights a lack of upward momentum, signaling that short-term sentiment remains bearish. Meanwhile, the 50-week MA acts as a critical pivot zone.

Source: TradingView

Despite a brief recovery attempt earlier, the token failed to breach this level decisively, correlating with its inability to surpass the $0.90 resistance within the consolidation phase. If the price can break above the 50-week MA and sustain momentum, it would open the possibility for a recovery toward the 50% Fibonacci retracement level at $1.18.

However, failure to do so may see JUP retesting its immediate support at $0.74, with further downside risks toward the long-term support zone. Overall, the MA Ribbon reflects a cautious outlook, with JUP needing a strong catalyst to shift the trend.

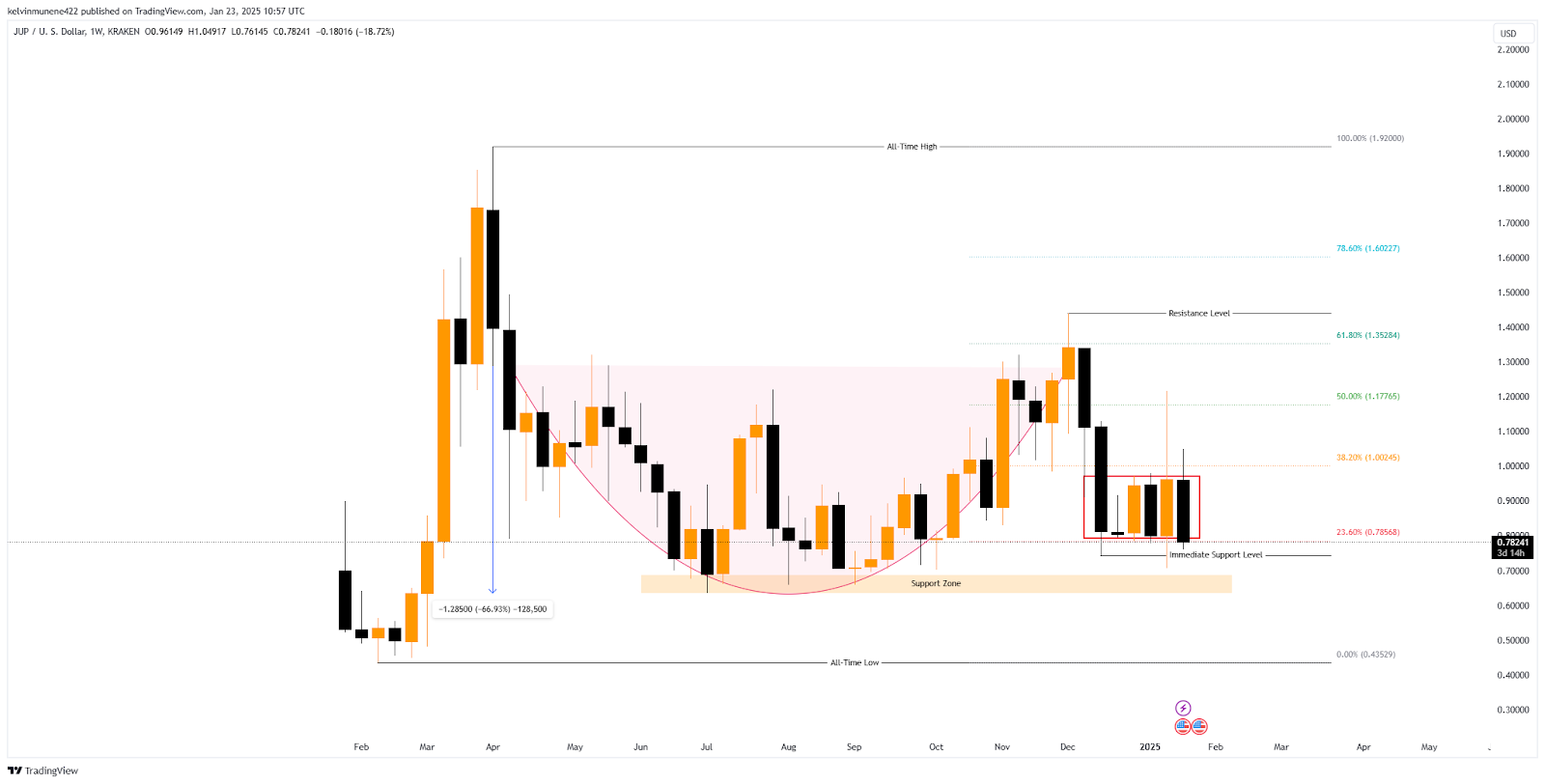

Jupiter (JUP) Price Forecast Based on Fib Analysis

Currently, the token is consolidating near the 23.6% retracement level at $0.78, suggesting it is testing a significant support zone. This level serves as a crucial floor, with any breakdown exposing JUP to further downside risks toward its low of $0.63 or even lower to its all-time low.

On the upside, the 38.2% level at $1.0024 represents the next key resistance. A breakout above this point could pave the way for a rally toward the 50% retracement level at $1.17765, which aligns with prior failed recovery attempts.

Source: TradingView

Beyond this, the 61.8% retracement level at $1.35284 and the 78.6% level at $1.60227 mark pivotal resistance zones that must be cleared for JUP to target its all-time high. Analyzing recent week’s data, the token’s inability to breach the 38.2% level indicates that bullish momentum remains weak.

However, sustained buying interest around the 23.6% level suggests that accumulation may be underway. Overall, the Fibonacci retracement tool emphasizes critical levels to watch, with a decisive move above $1.0024 signaling potential recovery, while a drop below $0.74 could extend bearish sentiment.

Jupiter (JUP) Price Prediction 2025

Per CryptoTales’ projections, JUP could reach $0.60-$5.00, driven by post-BTC halving hype and market expansion. Renewed interest in DeFi and increased adoption of Jupiter’s tools may push the token beyond its all-time high of $2.04.

Jupiter (JUP) Price Prediction 2026

According to our price forecast, JUP may retrace to $1.80-$3.00 as the market enters a correction phase following 2025’s peak. Reduced euphoria and selling pressure across the crypto space will likely bring a bearish downturn.

Jupiter (JUP) Price Prediction 2027

CryptoTales predicts JUP could trade between $1.00 and $2.50, reflecting the trough of the market cycle. The recession phase and reduced speculative interest could push the token’s prices closer to its previous support levels.

Jupiter (JUP) Price Prediction 2028

Per our analysis, JUP could recover to $2.00-$8.00, buoyed by optimism surrounding the fifth BTC halving and renewed investor confidence. Additionally, accumulation by long-term holders and increased utility within the Jupiter ecosystem may boost price recovery.

Jupiter (JUP) Price Prediction 2029

CryptoTales forecasts JUP at $5.00-$16.50 as bullish momentum accelerates post-halving. Enhanced adoption of DeFi tools like Jupiter Swap and strong community support will likely sustain upward momentum during this expansion phase.

Jupiter (JUP) Price Prediction 2030

Following the peak in 2029, JUP may drop to $2.50-$10.00 amid correction phases. Regulatory concerns, profit-taking, and declining speculative demand may lead to heightened retracement across the crypto market.

Jupiter (JUP) Price Prediction 2031

CryptoTales predicts JUP might stabilize between $1.80 and $8.00 as the market reaches its cyclical trough. Investor confidence may rebuild, particularly if the Jupiter ecosystem expands its DeFi offerings and increases adoption.

Jupiter (JUP) Price Prediction 2032

2032, JUP could recover to $6.50-$20.00, supported by optimism tied to the sixth BTC halving. Renewed capital inflows and improved on-chain metrics may fuel gradual price appreciation.

Jupiter (JUP) Price Prediction 2033

CryptoTales projects JUP at $14.00-$35.00, driven by market expansion and heightened adoption of DeFi. Improved liquidity and user participation across the Jupiter platform may push prices to new peak levels.

Jupiter (JUP) Price Prediction 2034

By 2034, JUP could trade between $19.00 and $41.00 as blockchain advancements and the global adoption of decentralized finance mature. Sustained growth in Jupiter’s ecosystem and broader DeFi trends will likely propel the token to new highs.

Jupiter (JUP) Price Prediction 2035

According to our projections, JUP could achieve $24.50-$50.00 in 2035 as the market experiences its cyclical peak. Elevated demand, combined with broader blockchain advancements, could push JUP to new all-time highs during a euphoric bull run.