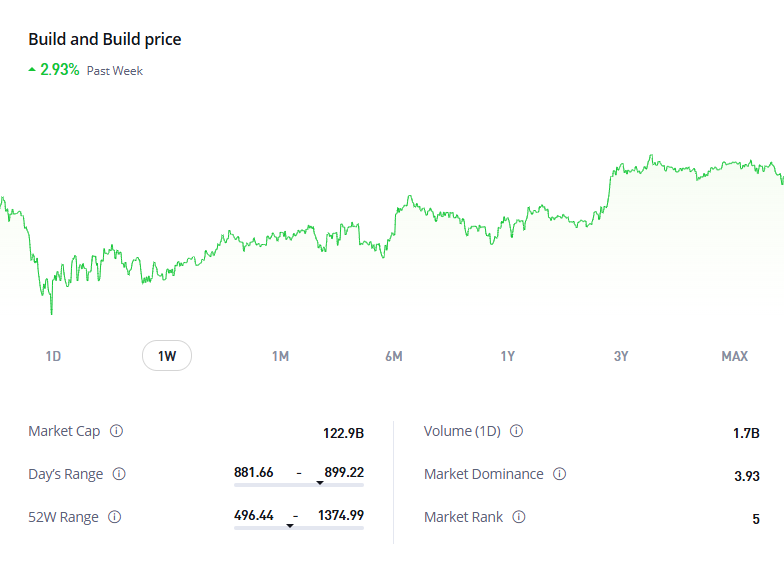

BNB price prediction remains steady as Binance Coin (BNB) hovers at $892.84, marking a marginal 0.15% decrease over the past 24 hours. Trading volume fell sharply by over 22%, landing at $1.71 billion, signaling lower market engagement ahead of the weekend.

Despite the pullback in activity, BNB’s market cap of $122.97 billion confirms its strong fifth-place position in the global rankings, with its total and circulating supply fully released at 137.73 million BNB.

While major moves appear limited for now, chart analysts and macro watchers are keeping close eyes on the coin’s potential path into 2026 and beyond. Meanwhile, retail attention is rapidly shifting toward Best Token, where today marks the final countdown before launch – and the opportunity window for early access is nearly closed.

BNB Shows Resilience Around $900 – What Comes Next?

At the current price of just under $893, BNB has spent the past several sessions consolidating within a narrow band, holding ground against broader market volatility.

The relatively unchanged volatility-to-market cap ratio of 1.38% reflects a balanced buyer-seller dynamic for now.

With a fully diluted valuation (FDV) also at $122.97 billion, there are no inflationary concerns or token unlocks on the horizon, giving investors a level of confidence in its price structure.

The critical question remains: Will BNB break upwards toward the $950–$1000 mark, or fall back under $880 support? The answer, as always, lies in momentum and confirmation. Right now, there are no major catalysts coming from Binance itself, but that doesn’t mean momentum is gone.

Traders Rely on Charts to Predict BNB Price Movements

Technical traders continue to dissect BNB’s current levels using standard tools like support and resistance zones, moving averages, and momentum oscillators. The 50-day, 100-day, and 200-day averages are being monitored closely, with BNB currently trading near those key lines.

Staying above these averages typically signals strength, while dropping below could indicate weakening momentum.

The Relative Strength Index (RSI) remains in a neutral band, neither overbought nor oversold, suggesting the market is still undecided. Fibonacci retracement zones from the last major move up point to $880 as a soft support level, with $910 and $940 emerging as resistance checkpoints.

Chart watchers are also analyzing candlestick formations to detect sentiment shifts. In recent sessions, BNB has printed small-bodied candles, a common sign of indecision.

However, those who look deeper note that green closes with higher lows are starting to form – a subtle but potentially meaningful bullish indicator if confirmed by volume expansion in the coming days.

Long-Term Outlook: What Will BNB Be Worth by 2040?

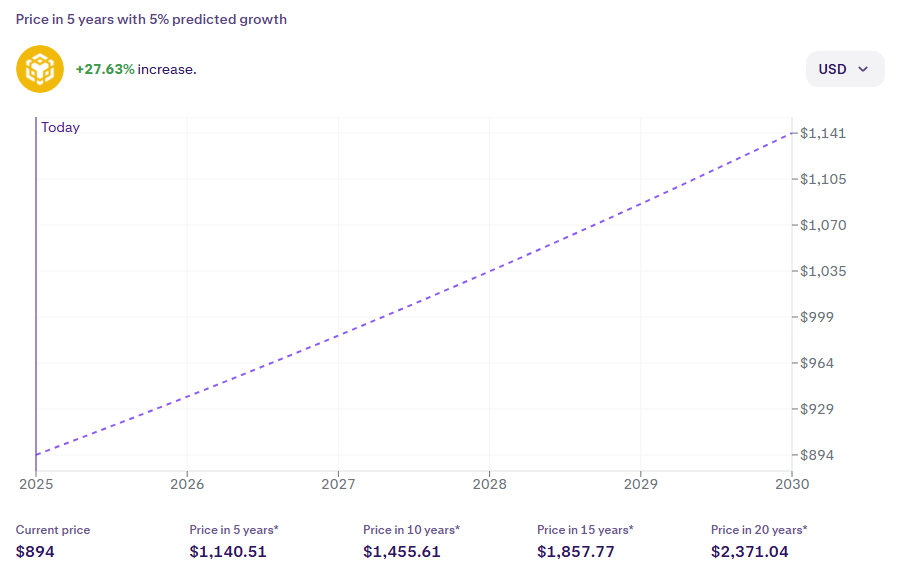

Although short-term movement may appear sluggish, BNB price prediction models continue to project strong performance through the next decade. Using a conservative 5% annual compound growth rate, analysts estimate BNB could reach $938.30 by 2026, $1,140.51 by 2030, and $1,857.77 by 2040.

Even under basic linear models, BNB is positioned for reliable appreciation. It has already avoided the inflation pitfalls that have plagued other top-10 assets and remains one of the few large-cap tokens with active quarterly burns – a mechanism that directly reduces circulating supply.

Best Token Presale Ends Today – Last Chance Before the Launch

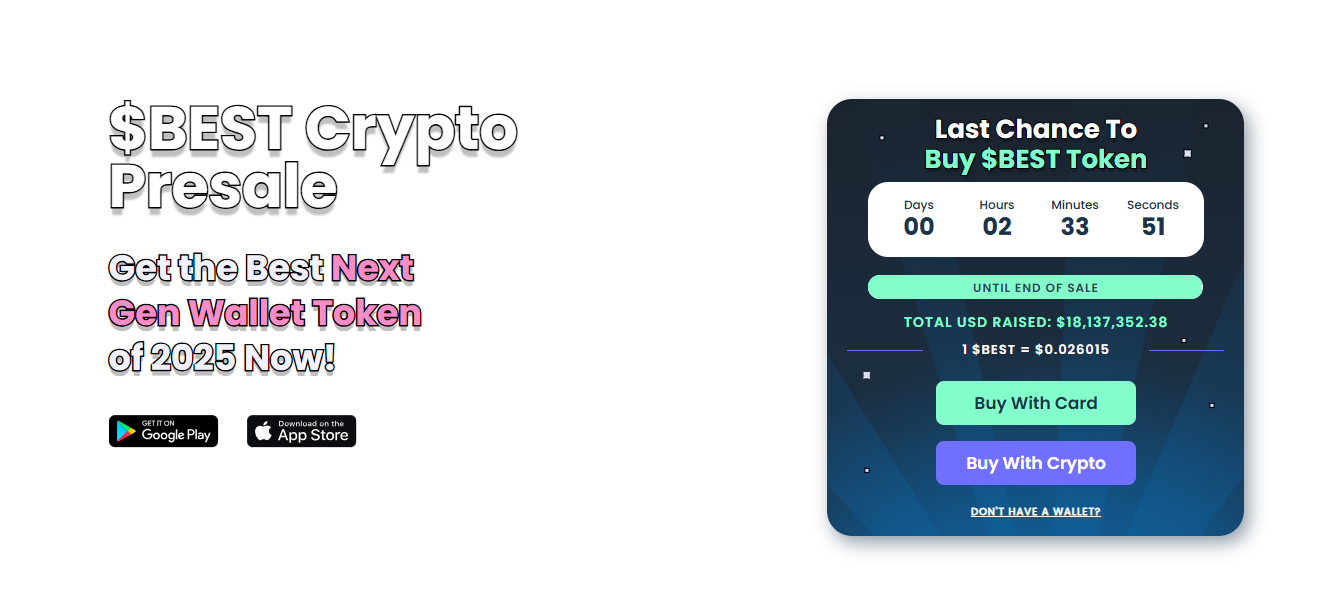

While BNB consolidates and long-term models look bullish, the more immediate action is unfolding elsewhere. Best Token, an emerging project with real-time traction, is about to wrap its presale – and the final countdown has already started.

At a fixed price of $0.026015, and with over $18.1 million raised, the project has crossed multiple investor milestones and is now entering the final hours before open-market trading begins.

This is the moment when experienced traders typically make their move. With no slippage risk and guaranteed entry pricing, the last wave of buyers is expected to rush in just before the timer expires.

For those watching from the sidelines, this is the last chance. Once the presale ends, public pricing will be dictated by demand – and the chance to buy at $0.026015 disappears.

Projects with strong fundamentals, high presale demand, and fixed supply structures tend to reward early participants best. Traders looking for a fresh entry point in a rising market cycle may want to act now – before launch fever takes hold.