MicroStrategy’s stock (MSTR) plunged sharply on Tuesday, hitting its lowest level since April, as the company faced a double blow: a renewed Bitcoin correction and a controversial decision to loosen its equity issuance rules.

MSTR Tumbles in Lockstep with Bitcoin

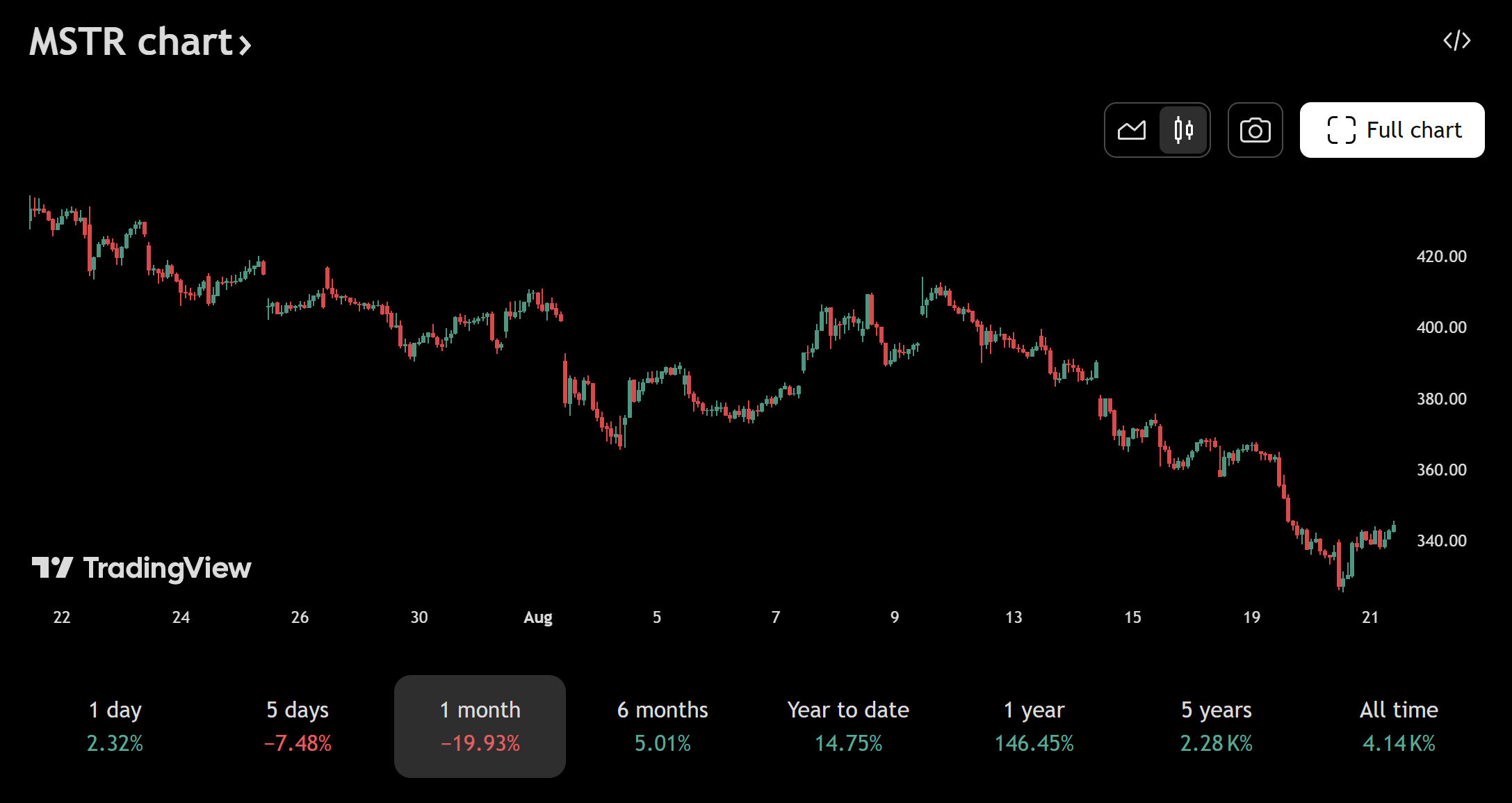

Shares of MicroStrategy closed at $336.57, down more than 7% on the day, with further losses in after-hours trading. It marks the stock’s weakest level since April 21, a far cry from the nearly $456 peak seen just a month ago during Bitcoin’s summer rally.

The correlation is clear: when Bitcoin rises, MSTR soars. When the crypto giant pulls back, as it has recently, sliding toward $113,000, MicroStrategy takes a hit.

Unlike other crypto-exposed firms such as Coinbase or Robinhood, which can rely on trading or diversified revenue streams, MicroStrategy has bet everything on Bitcoin. Its singular focus makes the stock a highly leveraged proxy for BTC, with all the volatility that entails.

Equity Issuance Rule Sparks Investor Doubts

The sell-off wasn’t just about Bitcoin. Investors reacted nervously to MicroStrategy’s decision to scrap a long-standing safeguard on issuing new shares.

Previously, the company committed not to sell stock below 2.5x net asset value per share, except in specific cases like debt repayments or dividends. That restriction is now gone, giving management flexibility to issue shares whenever it sees fit, even at lower levels.

Officially, the move is designed to provide greater flexibility to raise capital, manage financial obligations, or buy more Bitcoin. But many shareholders see it as a breach of trust.

“One red line erased at the first opportunity,” an investor complained on X (formerly Twitter). Critics argue the shift undermines confidence in management’s promises, especially as Michael Saylor remains fixated on accumulating Bitcoin at all costs, even if it means diluting shareholder value.

Strategy today announced an update to its MSTR Equity ATM Guidance to provide greater flexibility in executing our capital markets strategy. pic.twitter.com/xSwwcWubIq

— Michael Saylor (@saylor) August 18, 2025

The Risk of a “Bitcoin-Only” Bet

Since 2020, Saylor has transformed MicroStrategy into a de facto Bitcoin holding vehicle, turning the company into a symbol of institutional crypto adoption. During bull markets, the strategy has delivered outsized gains, attracting both hedge funds and die-hard crypto believers.

But the model has a glaring vulnerability: when Bitcoin corrects, so does MicroStrategy, hard. Every financial maneuver becomes a litmus test of market trust, amplifying both upside and downside.

Broader Crypto Stock Sell-Off

MicroStrategy wasn’t alone. The entire crypto sector sank on Tuesday:

Coinbase dropped nearly 6%

Robinhood fell more than 6%

Galaxy Digital plunged 10%

Bullish and Circle also declined

The Nasdaq Composite shed 1.46%, adding to the downward pressure.

Yet MicroStrategy remains in the spotlight. By positioning itself as the ultimate Bitcoin investment vehicle, the company inevitably magnifies investor scrutiny. Each rule change or governance decision becomes a flashpoint in the ongoing tug-of-war between Saylor’s Bitcoin maximalism and shareholder caution.