Cardano has had one of the weakest months in the market. The ADA price is down more than 31% in November, even as Bitcoin and Ethereum recovered 6–8% in the same period. Over the past seven days, the Cardano price has gained only about 1.9%, showing very little momentum.

Key supply and big money signals now point to deeper weakness unless conditions stabilize soon.

Supply Pressure Builds as Money Flow Weakens

Cardano’s recent move shows clear stress on two fronts: large money flow and coins moving across age bands.

The first signal comes from CMF (Chaikin Money Flow), which reflects the strength of big money. Between November 24 and November 28, ADA’s price reached a higher high, but CMF formed a lower high and then broke below its descending trendline, which had been in place since October 11.

The same breakdown occurred on November 2, and ADA fell by more than 20% after that move. CMF is also under zero this time, which usually means big capital is stepping back rather than flowing in.

Money Flow Weakens: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The correlation is clear. Between November 10 and November 17, the big money flow fell sharply by more than 240%, and ADA corrected by more than 36% in the same period and even in the following days.

Since ADA reacts strongly to CMF trends, this fresh breakdown signals more downside risk.

The second red flag comes from the Spent Coins Age Band, which tracks how many coins across all holding groups move on a given day.

On November 29, it dropped to a monthly low of 93.23 million ADA. But instead of stabilizing as the month ended, the value jumped to 114.66 million — a roughly 23% increase. It is now at the highest weekly level.

More ADA Moving Now: Santiment

A rise in spent coins means more supply moving, and when that happens, while money flow is weakening, pressure on the price often increases.

Both signals now align. Larger inflows are waning at the same time, and more supply is being released. Together, they create a backdrop where the ADA price struggles to hold any short-term bounce.

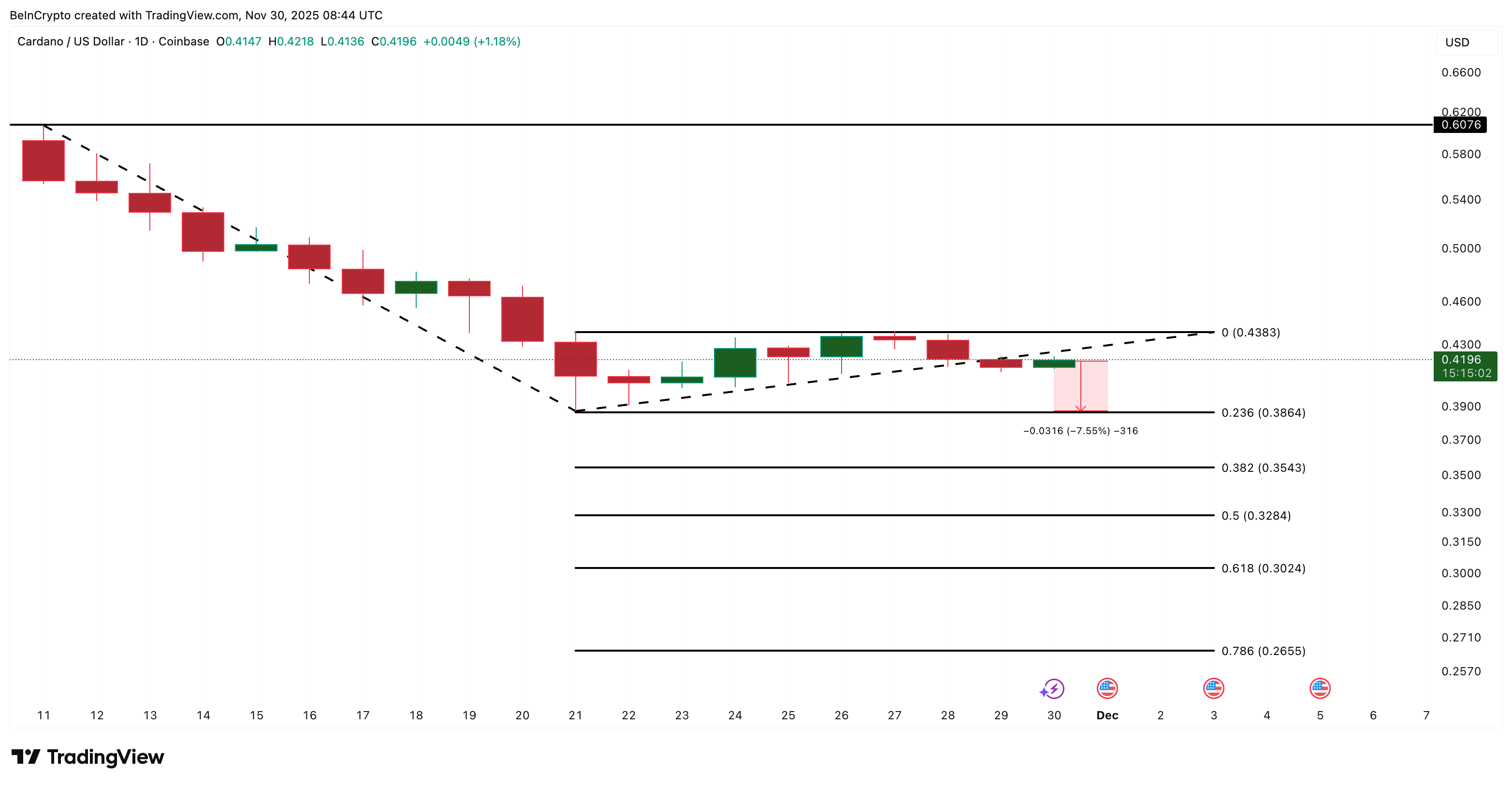

Key Levels Show Cardano Price Might Not Be Done Correcting Yet

ADA has been in a clear downtrend since November 11, and the broader structure has not reversed. Trend-based extension levels indicate where the Cardano price may move if pressure persists.

If ADA loses the $0.386 support, the next levels appear at $0.354 and $0.302. These are the natural continuation zones for this downtrend, especially if CMF stays below zero and spent-coin activity remains high.

Cardano Price Analysis: TradingView

A recovery is still possible, but it needs a clean break above $0.438 with a full candle close. Only then can ADA attempt a move back toward $0.607, but that requires two conditions to flip:

CMF must return to above zero, and the spent-coin reading must cool off again. Historically, whenever the Spent Coins Age Band spikes, ADA has struggled to sustain any recovery. The current rise reinforces that risk.

Currently, the Cardano price is trading near $0.419 and shows no signs of a reversal. Without improvements in money flow and supply movement, the 31% monthly drop may not be the final leg of this correction.