Bitcoin (BTC) is navigating a critical juncture as market volatility intensifies, testing key support zones and Fibonacci retracement levels that could influence its short- and mid-term trajectory.

Trading around $90,700, the cryptocurrency exhibits mixed signals: buyers are defending crucial levels, while on-chain and technical metrics suggest potential corrective moves toward $45,880.

This analysis integrates on-chain data from CryptoQuant, technical levels derived from Fibonacci retracements, and Elliott Wave structures to provide a data-driven perspective while acknowledging uncertainties inherent to crypto markets.

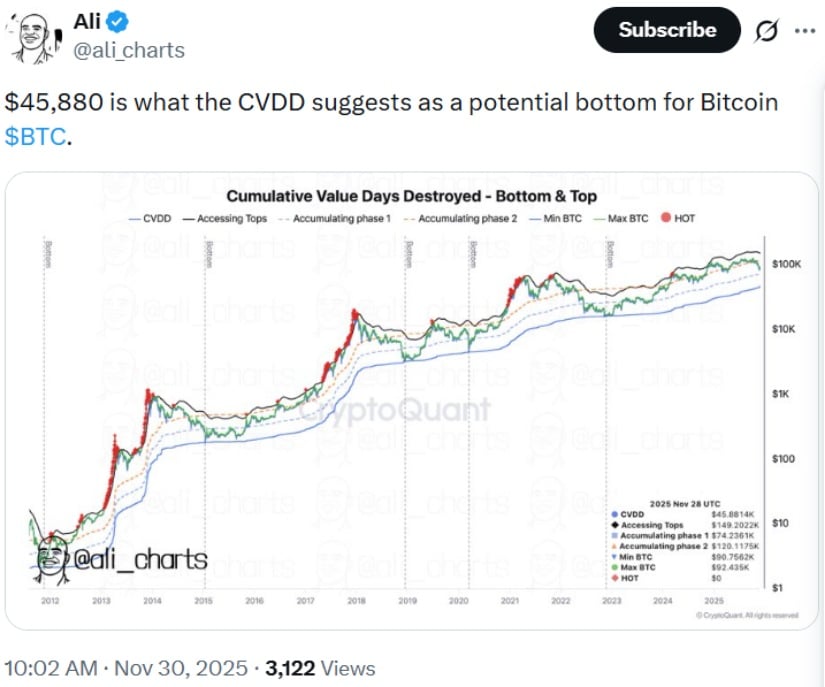

Is Bitcoin Eyeing a Potential Bottom Near $45,880?

On-chain metrics indicate that Bitcoin could reach a deeper corrective bottom near $45,880. This estimate derives from the Cumulative Value Days Destroyed (CVDD) metric, which compares the value of coins moved against their “age” on the blockchain. Historically, CVDD lows have aligned with major cycle bottoms: $3,200 in 2018 and $16,000 in 2022, according to peer-reviewed blockchain research.

CryptoQuant’s CVDD metric indicates a potential Bitcoin bottom near $45,880, aligning with past cycle lows and signaling possible deeper corrections amid recent market volatility. Source: Ali Martinez via X

Crypto analyst Ali, who specializes in on-chain analysis, commented, “The CVDD alignment with previous cycle lows provides a historically validated framework for potential bottoms, even amid ongoing market volatility.” It is important to note that CVDD signals are probabilistic, not deterministic, indicating potential zones of capitulation rather than exact price points.

The November 2025 decline, with Bitcoin dropping roughly 17% from $110,000 to $91,000, highlights ongoing volatility. Traders should consider that deeper corrections may test the $70,000–$45,880 range, depending on market liquidity, macroeconomic conditions, and investor sentiment.

Bitcoin Holds Key $90K Support Amid Q4 Volatility

Despite the recent downturn, Bitcoin has found short-term support between $90,300 and $90,500, at the bottom of a rising price channel. This level has repeatedly attracted buying interest, signaling that investors are defending a critical zone rather than reacting in panic.

Technical observations provide further insight: small-bodied candles with long lower wicks suggest accumulation, as opposed to a sharp sell-off. Meanwhile, trading volumes have moderated from prior peaks, indicating a consolidation phase rather than panic-driven liquidation.

Bitcoin is trading near $90,400 at the bottom of a rising channel, with buyers defending support, low selling pressure, and a likely bounce toward $92.5K–$93.4K, unless the channel breaks. Source: DirtDemon on TradingView

Analysts from Cointelegraph note that this zone is crucial for determining whether a rebound can develop into a sustained recovery. Short-term resistance levels are observed at $91,200, $93,400, and $95,000. A failure to hold the lower channel support could open a path to deeper corrective levels near $88,000 or $82,000, according to historical channel behavior.

Fibonacci Levels Define the Next Major Move

Fibonacci retracement levels provide context for potential trend reversals. Bitcoin’s price is currently near the 38.2% retracement level at $98,100, derived from the March–November 2025 impulse range where BTC historically reacted during mid-cycle retracements.

Bitcoin needs to reclaim the 38.2% Fibonacci level and break the Reload Zone to confirm a potential reversal. Source: Titan of Crypto via X

The 61.8% retracement near $108,900 represents the next target for confirming trend continuation, while the upper end of the reload zone around $116,527 is historically a high-probability reaction area. Failure to reclaim these levels could leave BTC vulnerable to renewed downside pressure. Conversely, a clean breakout above these retracements may signal the resumption of a broader bullish cycle.

Wave Structure and Mid-Term Projection

Using Elliott Wave analysis, Bitcoin appears to be in Wave 4 of an impulse cycle, with corrective movements likely testing the $80,000–$69,000 zone before any potential continuation. Wave 4 typically retraces 23.6%–38.2% of Wave 3, and BTC’s current correction aligns with this structure.

Bitcoin is in Wave 4 near $90,700, with support at $90K, a potential downside to $69K, and Wave 5 targets between $147K and $213K. Source: kacraj on TradingView

If Wave 4 holds, Wave 5 could push BTC higher, with projections clustering between $147,000 and $213,000, though this remains contingent on defending the $80K–$69K corrective range. Profit-taking strategies often consider resistance zones near $147K, $168K, and $190K–$213K. It is essential to understand that these forecasts are conditional and rely on current wave assumptions; shifts in market structure could invalidate the projection.

Q4 Performance and Market Context

Bitcoin’s Q4 2025 performance has been historically weak, with returns around -20.44%, ranking as the second-worst quarterly result after Q4 2018’s -42.16%. This downturn coincided with forced liquidations exceeding $1 billion, a technical “death cross,” Federal Reserve hawkish signals, and ETF outflows, reflecting broader risk-off sentiment across equity markets.

Bitcoin’s Q4 2025 fell -20.44%, its second-worst quarter, driven by liquidations, a death cross, Fed signals, and ETF outflows, with a potential Q1 2026 rebound if volatility eases. Source: Cointelegraph via X

While historical patterns suggest potential recovery in subsequent quarters, continued whale activity, macroeconomic uncertainty, and liquidity fluctuations warrant caution for investors.

Looking Ahead: Neutral Stance Amid Technical Signals

Bitcoin’s current consolidation phase presents a mixed outlook. Short-term support near $90,000 has held, while deeper corrections toward $45,880 remain plausible. The next decisive movement depends on reclaiming key Fibonacci levels and confirmation of Wave 5 momentum.

Bitcoin was trading at around 90,850.12, up 0.01% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Traders and investors should monitor:

Technical confirmations (e.g., breaks above $108,900 and $116,527)

Liquidity conditions across spot and derivatives markets

Macro factors, including Fed policy and ETF flows

With these factors converging, BTC remains at a pivotal juncture where on-chain metrics, historical cycle patterns, and price structure will shape its trajectory, highlighting the importance of data-driven decision-making.