KEY TAKEAWAYS

Humanity Protocol surged 135% in 24 hours after whales accumulated 100 million tokens.

The AO and CMF confirm rising bullish momentum amid the H token price surge.

The altcoin’s next target is $0.19, with key support holding near $0.13 and $0.14.

H, the native token of Humanity Protocol, has become one of the market’s hottest performers after the price soared by 135% in the last 24 hours.

The token recently shattered its previous high and is currently trading at $0.18 at press time.

This impressive rally happened due to aggressive whale accumulation. The surge in large-scale purchases has pumped strong liquidity into the market, sparking a wave of bullish momentum across multiple exchanges.

With traders eyeing the next move, one key question remains: will H price push beyond its new record high?

H Bulls in Charge

On the 4-hour chart, the Awesome Oscillator (AO) continues to flash consistent green bars, currently holding at 0.065. This reading shows that bullish momentum remains strong, with buyers clearly dominating market sentiment.

The indicator highlights rising buying pressure as bulls tighten their grip on the price action.

The Relative Strength Index (RSI) confirms this trend. At 87.98, it has climbed deep into overbought territory, signaling that buying activity has reached overheated levels.

This aggressive push by traders reflects confidence that the Humanity Protocol price still has room to rally higher.

If this strength holds, H’s price could extend its upward run, potentially setting new record highs.

Whales Add Their Part

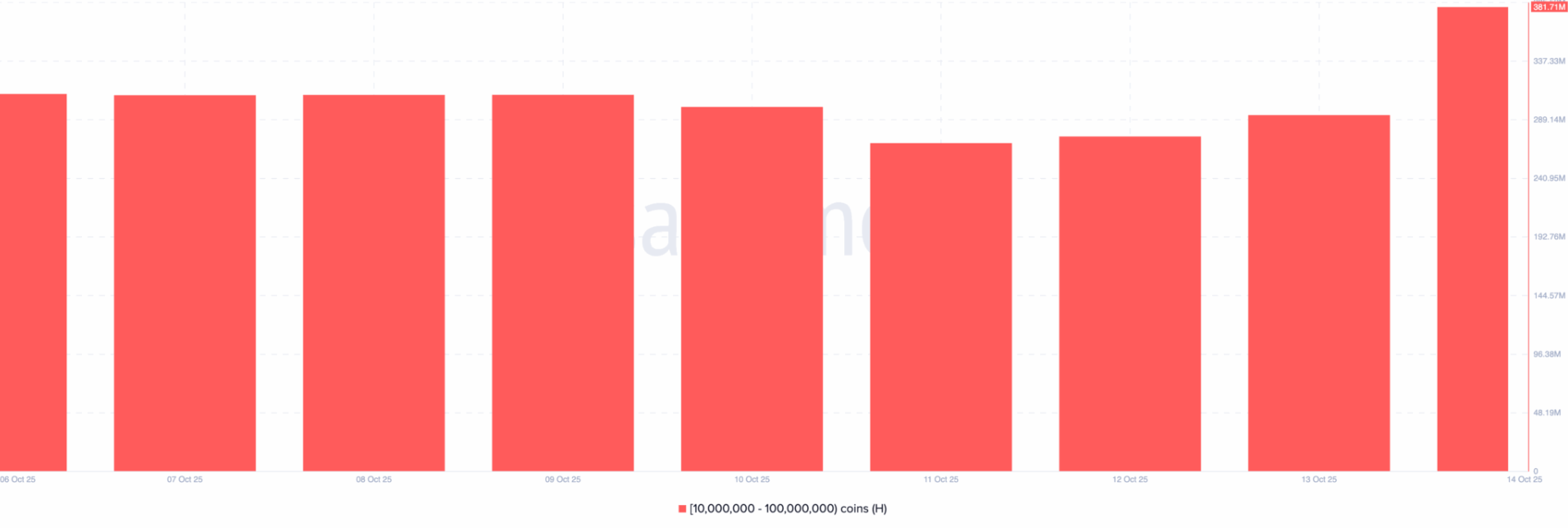

Outside the technical setup, on-chain data from Santiment shows that whales have played a pivotal role in driving the latest surge.

On Oct. 11, wallets holding between 10 million and 100 million H tokens collectively held around 280 million tokens.

Fast forward to today, and that figure has skyrocketed to 381.71 million, meaning whales have accumulated roughly 100 million additional tokens in just a few days.

Such an increase in whale holdings typically signals rising institutional or high-net-worth investor confidence.

When large holders expand their positions this aggressively, it reflects a strong belief in near-term appreciation.

If this accumulation continues, the Humanity Protocol price could experience another leg up in the short term.

H Price Prediction

Momentum on the daily chart further supports this outlook. The Bull Bear Power (BBP) indicator indicates that buyers are firmly in control, with its bright green histogram bars signaling sustained bullish sentiment.

Similarly, the Chaikin Money Flow (CMF) remains positive at 0.16, confirming strong capital inflows and growing investor confidence. The positive reading indicates that buying volume outweighs selling pressure, reinforcing the market’s bullish strength.

To discover H’s potential path, Fibonacci retracement levels offer vital insight into key support and resistance zones.

Using the latest swing low to its record high, the 1.0 Fib level projects an upside target near $0.19, a likely area where traders may begin to secure profits.

Below this, the 0.786 Fib level around $0.16 stands as short-term resistance that could test the rally’s durability. A daily close above this mark would confirm that bulls maintain market control.

Meanwhile, the 0.618 Fib level near $0.13, aligned with the $0.14 support region, forms a strong accumulation zone. Buyers could re-enter at this level if the market retraces, thereby maintaining the bullish structure of the H token.

However, dropping below the 0.382 Fib level at $0.094 could invalidate the bullish setup, potentially sending H lower toward $0.073.

A deeper correction could push prices further to $0.069, signaling a possible shift in sentiment.

If the current momentum persists, H’s price could challenge higher resistance zones and push deeper into price discovery territory beyond its all-time high.