In the $40 billion United States fraud case, a new hearing has been scheduled for today. Intriguingly, the latest legal documents reveal that Do Kwon, the controversial crypto entrepreneur that was the mastermind behind Terra Luna (LUNA) & the algorithmic stablecoin UST, which was later rebranded to Terra Classic USD (USTC).

For the uninitiated, Terra Luna’s ecosystem crumbled to pieces back in May, 2022, when the UST stablecoin saw a horrendous de-pegging from $1 to fractions of the original peg in days. The company’s founder Do Kwon fled the scene in weeks, but was later caught boarding a plane to Dubai & eventually faced a 4-month sentence for numerous counterfeit passports.

District Judge Expects Do Kwon’s Confession On LUNA

Now, the eyes of legal authorities are back on Terra Luna’s fiasco in 2022, and it looks like Do Kwon has something to say. According to a fresh report by Blomberg, the United States District Judge Paul Engelmayer has planned a meeting with Do Kwon for a change of plea.

NEW: Terra founder Do Kwon has a new hearing scheduled for tomorrow after the court has been advised he may change his plea ahead of his trial ? pic.twitter.com/e0tXHDjsbv

— Zack Guzmán (@zGuz) August 11, 2025

Originally pleading not guilty back in January, 2025, Terra’s Do Kwon battled the extradition case for over two years, even though he got charged in both native soil of South Korea & The United States (USA). While serving a four-month sentence in Podgorica, Montenegro, Do Kwon’s TerraForm Labs settled for a $4.47 billion fine with the United States Securities & Exchange Commission (SEC).

In short, the SEC’s civil case claimed that TerraForm Labs representatives misled investors by claiming that Chai, a popular Korean payment processor, was actively using Terra Luna’s (LUNA) blockchain for transactions, but that never actually happened. Moreover, the jurors claim that the UST stablecoin was not even algorithmically pegged to $1, but rather controlled.

LUNA, LUNC Prices Dip Amid Kwon’s Change Of Heart

Both the revamped 2.0 Terra blockchain and the original Luna Classic chains lost a significant amount of relevancy when it kicked the fan. The refurbished version of the downtrodden chain, Terra (LUNA) 2.0, dipped by as much as 99.2% since the inception on May 28, 2022. Now, this coin barely makes the TOP 500 by crypto’s global market cap & is just 24% above all-time lows.

Things are somewhat different on Luna Classic’s (LUNC) side, as this game-tested altcoin is constantly seeing revitalization efforts from the caring crypto community. Even Binance, the largest crypto exchange across the globe, is contributing 50% of LUNC-related trading fees every month to reduce the damage done by TerraForm Labs’ downfall.

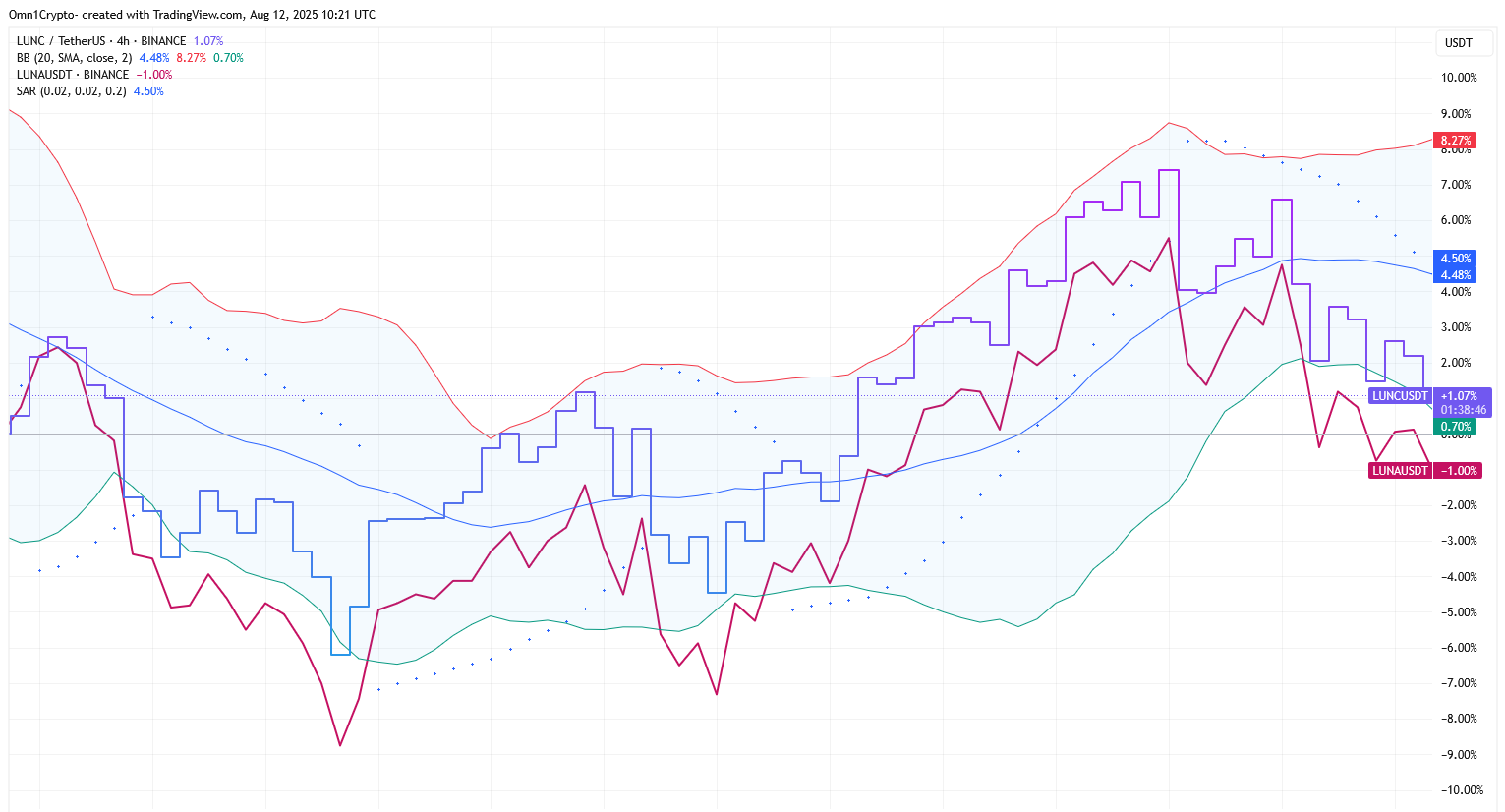

However, LUNC is barely used for transactions, consuming just between $10 million to $20 million trades daily. Naturally, the Parabolic Stop & Reverse (SAR) is flashing a sell sign, depicted in the blue dots above the price. Falling out of crypto’s TOP 200, the $331M worth Luna Classic would need big exchange re-listing & a far more modern & diverse DeFi ecosystem to gain serious public traction again.

On The Flipside

Terra Luna Classic (LUNC) is no longer directly tied with Do Kwon, as the Layer-1 chain was given to the volunteer community after TerraForm Labs’ demise.

Why This Matters

Affected investors are still looking to gain closure on Terra Luna’s 2022 drama, for which the bankrupt company opened up a crypto claim portal. Looking up further, the lawsuit in U.S. & South Korea can set a precedent for digital asset regulation in a more comprehensive way.