What Is HEMI? (Project & Vision)

HEMI is a modular Layer-2 protocol designed to merge Bitcoin’s strong security with Ethereum’s smart contracting capabilities, offering developers a hybrid platform that draws on the best aspects of both ecosystems. At the core of HEMI’s design is the Hemi Virtual Machine (hVM), which integrates a full Bitcoin node into an Ethereum-compatible environment, allowing developers to write smart contracts that can interact directly with Bitcoin data. This stands out from existing solutions that typically rely on wrapped or synthetic BTC assets.

To secure its network, HEMI employs a consensus model called Proof-of-Proof (PoP), which imports Bitcoin’s security guarantees without depending on direct miner involvement.

Another notable feature of HEMI is its trustless tunneling system, a cross-chain mechanism that enables assets to move securely between Ethereum, Bitcoin, and HEMI itself. This architecture supports native BTCFi applications, where actual Bitcoin can be deployed in DeFi protocols such as lending, staking, and liquidity provision without wrapping.

Complementing these innovations is HEMI’s modular approach, positioning the protocol as part of a broader cross-chain super-network. With developer resources such as the Hemi Bitcoin Kit (hBK) and modular chain-building tools, the project aims to accelerate the growth of Bitcoin-based decentralized applications and create a more interconnected blockchain landscape.

Overview:

Name: HEMI

Project Website: HEMI Official Website

Whitepaper: HEMI Whitepaper

Explorer: HEMI on Etherscan

Total Supply: 10.00 billion HEMI

Contract Address: 0xEb964A1A6fAB73b8c72A0D15c7337fA4804F484d

Community: @hemi_xyz

Supported CEX: CoinEx

Tokenomics & Market Data

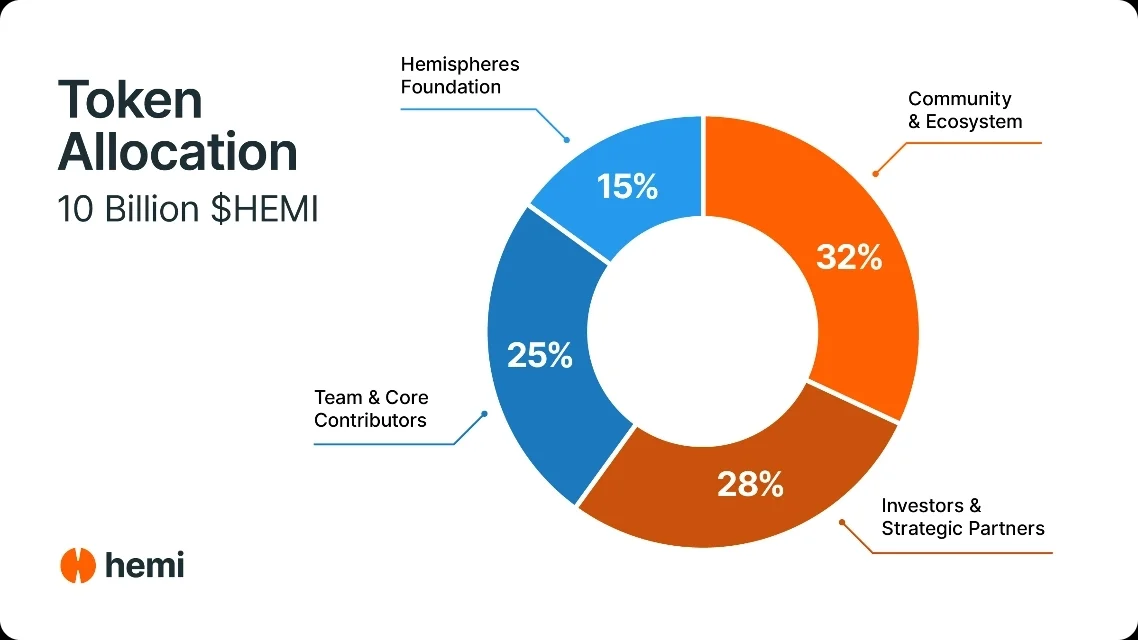

Here is a snapshot of HEMI’s token metrics (as of September 23, 2025)):

Community & Ecosystem (32%) : 3,200,000,000

Hemispheres Foundation (15%) : 1,500,000,000

Investors & Strategic Partners (28%): 2,800,000,000

Team & Core Contributors (25%): 2,500,000,000

Total: 10,000,000,000

Pros and Cons

Pros:

• Integrates Bitcoin’s security model with Ethereum’s flexibility for powerful hybrid applications.

• Enables native BTCFi reducing reliance on wrapped assets and lowering counterparty risks.

• Supports cross-chain composability for seamless asset and logic interoperability.

• Provides modular infrastructure and developer tools such as hBK.

• Growing exchange listings and liquidity indicate rising adoption and momentum.

Cons:

• High price volatility typical of new tokens.

• Relies heavily on ecosystem development and application adoption.

• Trustless tunneling cross-chain bridges have inherent security risks.

• Faces strong competition from other modular and Layer-2 projects.

• Large token supply yet to be released could create sell pressure if demand lags.

Interpretation & Key Takeaways

High volatility typical of new tokens

The huge intraday swings shortly after listing (e.g. +45 % one day, −23 % the next) exhibit the speculative behavior common to new listings. Market participants are testing price ranges, and liquidity is still being established.

Rapid run-up, partial retracement

HEMI’s ascent to near ATH reflected strong speculative demand at listing time. The subsequent pullback suggests consolidation and profit-taking as early entrants exited.

Still strong relative gains from bottom

The fact that the ATH is an order of magnitude above the ATL indicates that the token has delivered substantial upside since its weakest levels. The ATL being ~$0.01668 and current prices hovering near ~$0.13–$0.15 signals strong cumulative growth.

Resistance around ATH region

The ~28–30 % drop from the ATH suggests that the ~ $0.18–$0.19 region may act as resistance, where sellers may shield further upward movement unless sustained demand returns.

Is HEMI Worth Buying?

HEMI offers a unique opportunity to engage with a modular Layer-2 protocol that combines Bitcoin’s security with Ethereum’s smart contract capabilities. By enabling native BTCFi applications and cross-chain interoperability, HEMI positions itself as a promising platform for developers and investors interested in the evolving DeFi and Layer-2 ecosystems.

For investors, HEMI provides access to a token that supports innovative use cases, including real Bitcoin usage in decentralized finance, secure cross-chain operations, and scalable applications through its Hemi Virtual Machine. Its listing on major exchanges like CoinEx ensures liquidity and accessibility for trading and investment.

While every investment carries inherent risks, HEMI’s design and growing ecosystem make it an attractive option for those looking to explore next-generation blockchain technology. It is particularly appealing to investors who want exposure to a project bridging Bitcoin’s reliability with Ethereum’s programmability in a single, integrated platform.

Frequently Asked Questions (FAQ) About HEMI

1. What is HEMI?

HEMI is a modular Layer-2 protocol that integrates Bitcoin’s security with Ethereum’s smart contracts. It introduces the Hemi Virtual Machine (hVM), Proof-of-Proof consensus, and trustless tunneling to support scalable, cross-chain decentralized applications.

2. What makes HEMI different from other Layer-2 projects?

Unlike many L2s that focus only on Ethereum, HEMI directly incorporates a Bitcoin node within its virtual machine. This allows developers to use actual Bitcoin in decentralized finance (BTCFi) without relying on wrapped or synthetic versions, while also benefiting from Ethereum’s programmability.

3. What risks should investors be aware of?

As with many new projects, HEMI carries risks including price volatility, reliance on ecosystem adoption, competition from other modular L2s, and potential security challenges in cross-chain operations. Token release schedules could also impact price if demand does not grow alongside supply.

4. How can I trade HEMI on CoinEx?

On CoinEx, HEMI is listed with the HEMI/USDT trading pair. Users can trade spot, participate in AMM liquidity pools, use Spot Grid strategies to automate trades, or set up Auto-Invest Plans for long-term accumulation.

*This article is for informational purposes only and does not constitute investment advice