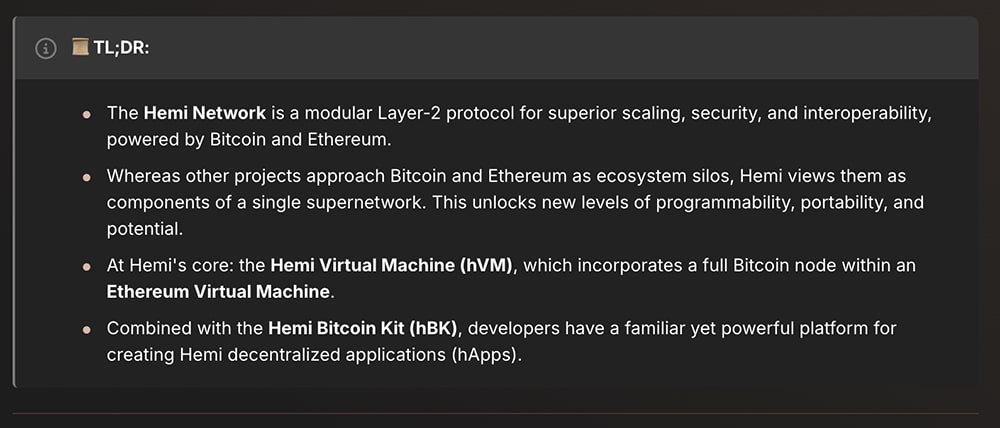

When hearing HEMI, and especially when it has been put together with Binance crypto backing, people just need to pay attention. Binance has stepped up its game, launching HEMI, a modular Layer‑2 crypto blockchain project designed to merge Bitcoin’s security with Ethereum’s programmability.

(source – Hemi TL;DR, HEMI)

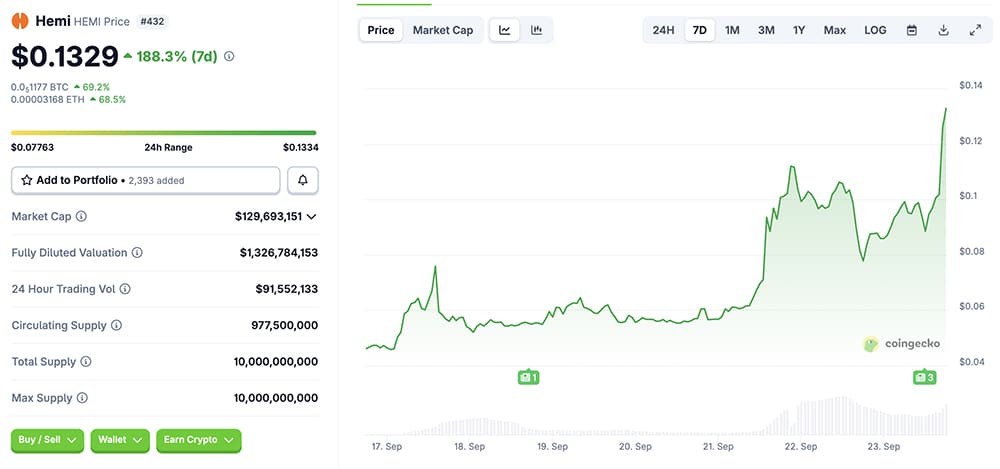

According to DefiLlama, press releases, X chatter, and data portals like CoinGecko, there is reason to believe HEMI might be one of the more serious Layer‑2 and/or Bitcoin‑DeFi crypto plays.

(source – CoinGecko)

DISCOVER: Best Meme Coin ICOs to Invest in Today

Why Binance Backed Hemi Crypto Promising?

First, the core data, HEMI was built by a team including Jeff Garzik, with a funding round of $15 million, led by Binance Labs among others in the crypto industry.

Then the tokenomics, a total supply of 10 billion HEMI, with allocations for community/ecosystem, investors, team, etc. We saw this kind of play in a few successful tokens like HYPE.

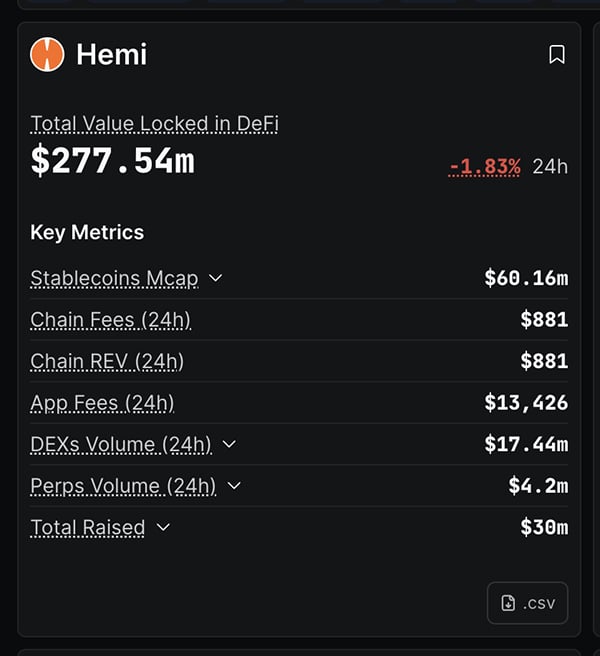

According to DefiLlama, HEMI’s Total Value Locked (TVL) on the network has reached more than $250 million as of its mainnet launch. A solid metric for a brand new Bitcoin‑Programmability layer, people are putting real assets to work.

(source – Defillama)

Additionally, Binance role, via its HODLer Airdrop program, is giving 100 million HEMI tokens (1% of total supply) to BNB crypto holders. The trading pairs launched include HEMI/USDT, HEMI/USDC, HEMI/BNB etc.

When looking at the chart, we can see HEMI’s price reacted quickly post‐listing, with notable market cap, volume, and interest.

(source – TradingView)

This level of financial backing + real TVL + strong design (modular, bridging BTC + ETH) suggests HEMI has more staying power than many crypto token launches that are purely hype.

Rapid growth often invites volatility, and Binance seed investor rounds tend to mean lock‑ups, dilution risks, etc. However, compared to many Layer‑2 / DeFi / Bitcoin hybrid projects, HEMI seems better structured. The community sentiment on X is generally bullish, with many saying it was “undervalued before listing.”

$hemi backed by yzi labs and currently sitting at 95m mcap

this kinda undervalued to me so i took a long. pic.twitter.com/SLxhNBadxc

— Kunle (@kunleofweb3) September 21, 2025

HEMI, powered by a crypto jurgennaut, Binance, is shaping a credible bridge between Bitcoin & Ethereum HEMI may be one of the smarter bets, but memecoin could be the sector that change lives.

DISCOVER: 20+ Next Crypto to Explode in 2025

Is HEMI The Best Crypto to Buy? Why PEPENODE Might Be the Next Big Play.

Switching gears, for those degens that target memecoins early, PEPENODE is one of the best. While HEMI is more institutional and infrastructure‑oriented, PEPENODE is very much trying to ride viral with reward‑driven momentum and mechanics that make it more than just crypto memes.

Here are the data points as PEPENODE’s presale began in early January, just a month ago:

The total supply is ~210 billion tokens, with no private rounds or insider allocations, which gives the public somewhat level access.

Staking and mining hooks are built in; you can stake PEPENODE tokens (or virtual mining nodes) even during presale, and rewards are extremely high. Current APY is 953%, a truly community reward-driven project.

There is also a deflationary mechanism coded on the coin itself. About 70% of tokens used for node purchases or upgrades are burned.

Right now, PEPENODE has raised more than $1.3 million in presale so far.

Once, not if, meme season returns, PEPENODE has 1000x potential, especially by buying early like today. The huge staking rewards is no doubt compelling.