KEY TAKEAWAYS

HEMI’s price surged nearly 500% since its Aug. 22 TGE before pulling back

Trading volume skyrocketed to $893 million from $20 million in ten days.

HEMI is holding above its 20 EMA, suggesting it could break the $0.12 resistance.

HEMI, the utility token powering the Bitcoin programmable layer Hemi, has been on a tear. Over the past 30 days, HEMI’s price has soared nearly 500%.

As a result, it set a new all-time high at $0.12. Today, the token is trading about 16% below that peak.

However, signs have emerged that the explosive rally may not be over.

In this analysis, CCN explains the drivers behind HEMI’s surge and why its price could bounce again.

Hemi Mirrors Aster’s Run

For those unfamiliar, Hemi had raised $15 million to accelerate development for its Bitcoin programmability network. Eventually, the Token Generation Event (TGE) went live on Aug. 22.

Since then, HEMI’s price has increased by 489%. According to CCN’s findings, the rally tied directly to the hype around tokens listed on Binance Alpha and those backed by Yzi Labs (formerly Binance Labs).

More importantly, the incredible rally of Aster (ASTER) added fuel to HEMI’s rise.

Like HEMI, ASTER is backed by Yzi Labs. Thus, some market participants expect the explosive ASTER move to spill over, sparking more speculation and drawing fresh liquidity into HEMI.

Pullback Looks Temporary

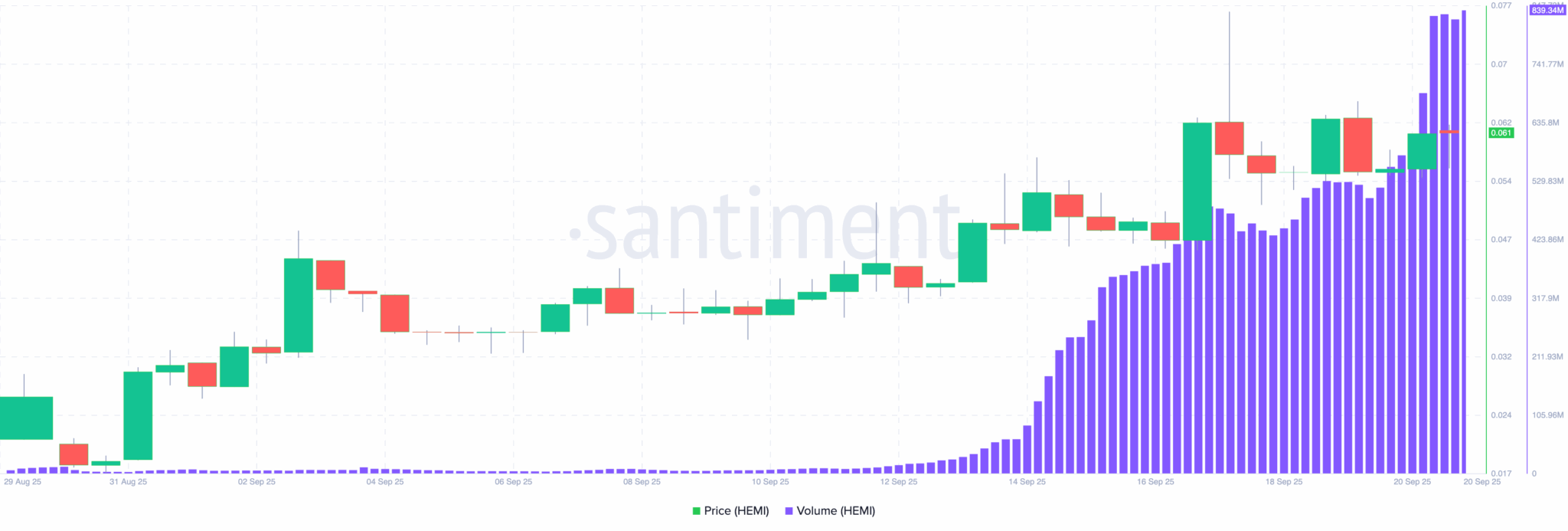

From an on-chain perspective, the altcoin’s trading volume has soared to $893 million. About ten days ago, the same metric was less than $20 million.

This massive spike shows how quickly liquidity has rushed into the token. While HEMI’s price may have dipped, it’s already bouncing from swing lows.

Therefore, if the trading volume pushes past $1 billion and the market value keeps climbing, the momentum could flip fast. In that case, HEMI might ignite a renewed rally.

HEMI Price Finds Support

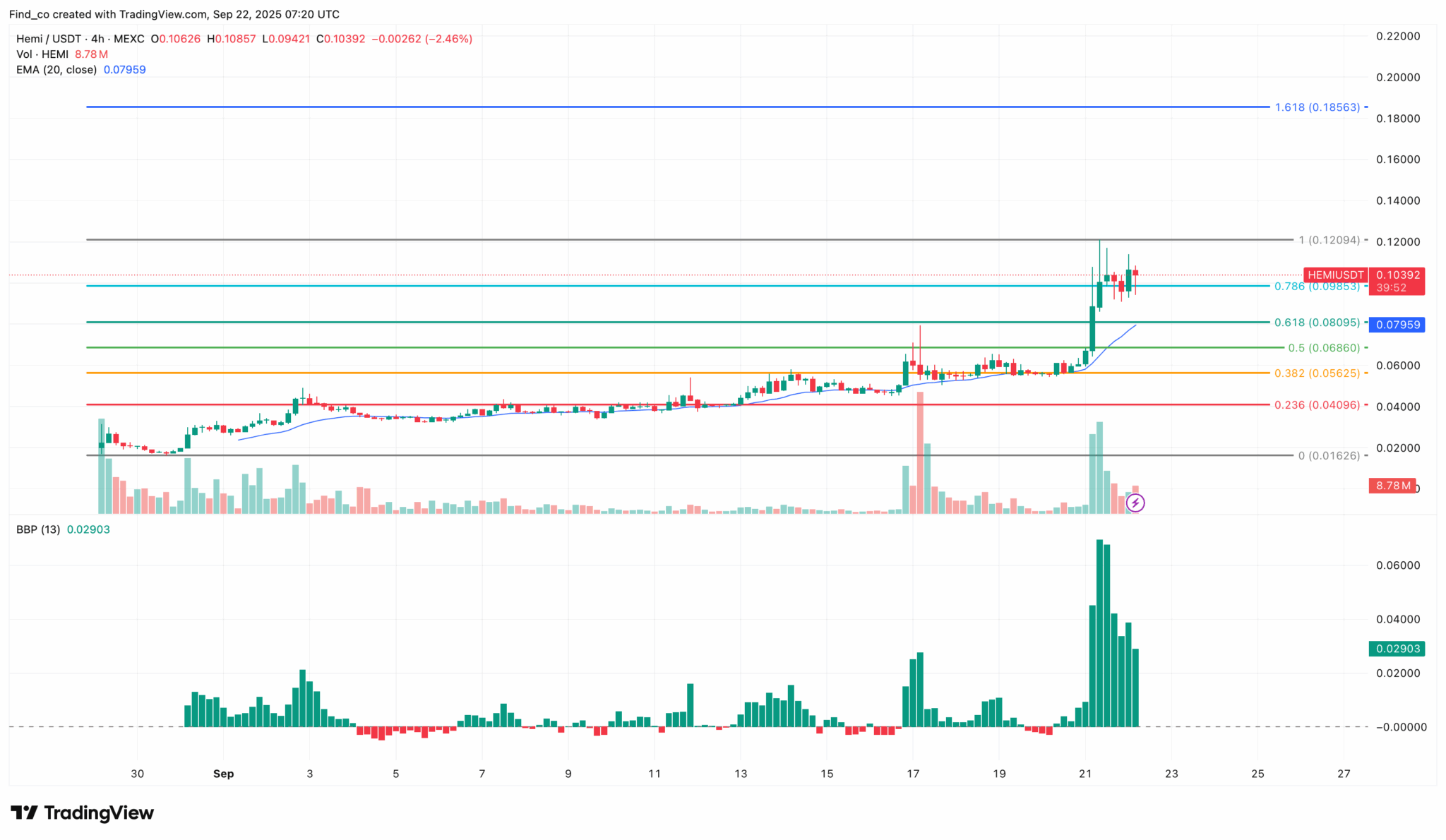

From a technical perspective, the 4-hour chart shows HEMI’s price trading above the 20-period Exponential Moving Average (EMA).

This signals that short-term momentum remains bullish, making it less likely for the token to break below the $0.081 support.

In addition, Bull-Bear Power (BBP) has stayed positive despite the recent dip. This suggests that HEMI buyers are still in control, and selling pressure hasn’t been strong enough to switch momentum to bearish territory.

When a token holds above key EMAs while BBP remains green, it points to accumulation phases, where dips are bought rather than sold off. For HEMI, this strengthens the case for stability above support and increases the probability of another leg upward if demand continues to build.

If momentum holds, HEMI’s price could break above resistance at $0.12. A successful breakout may allow for a rally toward $0.19, extending its explosive run.

However, rising selling pressure could invalidate this setup. In that case, HEMI may face rejection at $0.12, halting its momentum.

If the rejection sustains, the token risks a further breakdown below $0.081 support, shifting the trend back in favor of the bears.