Cardano price holds the crucial $0.42 zone as bullish wedge patterns, cycle resets, and renewed accumulation signals shape its next major price move.

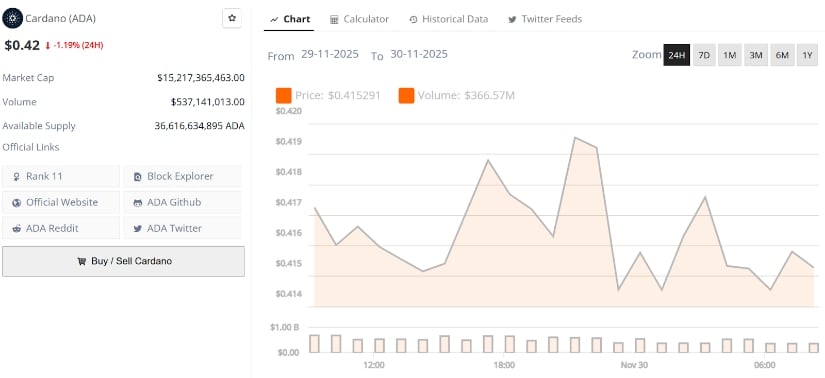

Cardano price today sits at $0.42, struggling to build momentum but still defending a historically significant range. Despite broader market weakness, ADA continues to show early signs of structural resilience, supported by long-term cycle comparisons and fresh bullish setups forming across lower timeframes. Market sentiment remains mixed, but analysts are beginning to highlight conditions that could shape ADA’s next decisive move.

Cardano price is trading around $0.42, down 1.19% in the last 24 hours. Source: Brave New Coin

Long-Term Structure Shows ADA Resetting to Historic Lows

A striking observation shared by Milk Road emphasized that ADA is currently trading near the exact same level it held in 2017, around $0.4167. This “eight years, two cycles, one price” chart highlights how deep the drawdown has been and how Cardano has returned to long-term value zones that previously acted as generational accumulation ranges.

Cardano has returned to its 2017 cycle support near $0.4167, signaling a major long-term value zone. Source: Milk Road via X

Cycle symmetry doesn’t guarantee upside, but historically, assets returning to multi-cycle support levels often attract strategic buyers looking for long-duration exposure.

Bullish Wedge Structures Form Across Multiple Timeframes

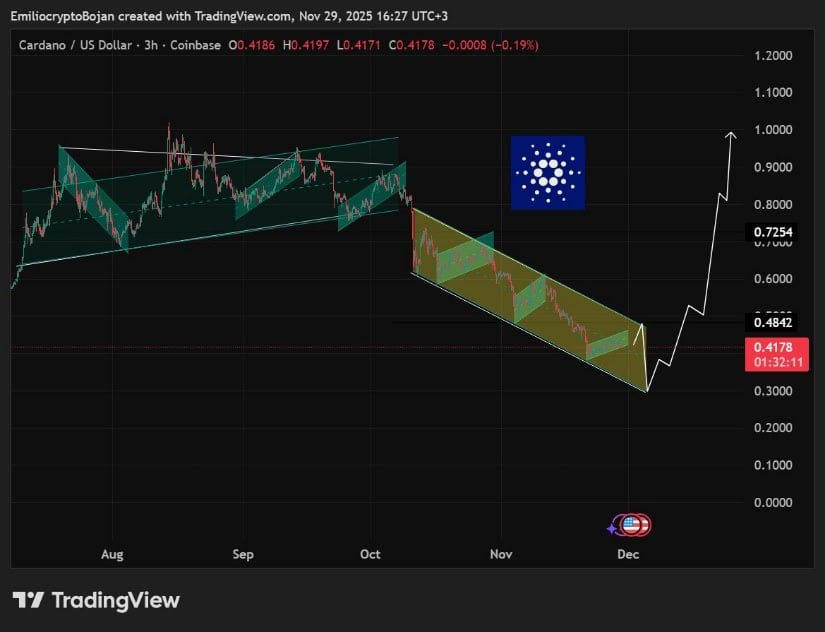

From a structural standpoint, ADA is still compressing inside bullish wedge patterns. Emilio Crypto Bojan highlighted a broad multi-week descending wedge that remains intact, with ADA slowly drifting towards the bottom of the pattern, near the $0.30 zone, for what he described as a potential “final tap” before expansion.

ADA continues to compress inside a multi-week descending wedge, with price drifting towards a potential “final tap” near $0.30. Source: Emilio Crypto Bojan via X

Short-term charts echo the same idea. A clean falling wedge on the 1-hour chart, tracked by CryptoJoeReal, shows ADA attempting to break out towards a target of $0.4393. Lower-timeframe volatility remains elevated, but the pattern itself fits the classic bullish-reversal structure that ADA has formed during previous cycle basing periods.

A 1-hour falling wedge shows ADA gearing for a breakout towards $0.4393, mirroring classic reversal patterns. Source: CryptoJoeReal via X

If Cardano price maintains stability above $0.41–$0.42, the wedge breakout scenario becomes more compelling, especially with growing interest from contrarian traders looking to position at structural lows.

Accumulation Narrative Re-Emerges as ADA Stays Under $0.50

Accumulation themes around ADA have resurfaced strongly. One community insight from ADA_ONEVETCOTI argued that accumulating ADA below $0.50 “will go down as one of the best gifts in crypto this cycle.” While sentiment-driven statements are not predictive in themselves, they align with the increasing discussions around ADA’s deep valuation reset.

What adds weight is that these accumulation calls are appearing at the same time as wedge structures and long-term cycle symmetry patterns, a combination that historically has preceded major ADA recoveries, though confirmation requires market-wide support.

Cardano Price Prediction: What Comes Next?

Short term, Cardano price remains trapped inside a slow-grinding wedge with limited momentum, but the setup is constructive. A confirmed breakout above $0.44 would strengthen the case for a higher target around $0.48 to $0.50, aligning with the next liquidity cluster.

Medium-term projections vary, but if ADA Cardano price repeats its historical cycle behavior, a recovery phase towards $0.70 to $0.90 remains plausible. More aggressive cycle-driven models stretch into the $1+ zone, but such outcomes depend heavily on broader market conditions.

For now, ADA sits at one of its most important levels in years, deeply undervalued by historical standards, technically compressed, and drawing fresh attention from both analysts and long-term holders.