PIPPIN is one of the few AI agent tokens to make a recovery. The asset rallied to levels not seen since February, reawakening whale activity.

PIPPIN, one of the previously hot AI agent tokens, returned to levels not seen since February. For the past few days, PIPPIN was one of the day’s top gainers, recovering after months of sideways trading. The AI agent token held a near-vertical rally and started consolidating in its higher range.

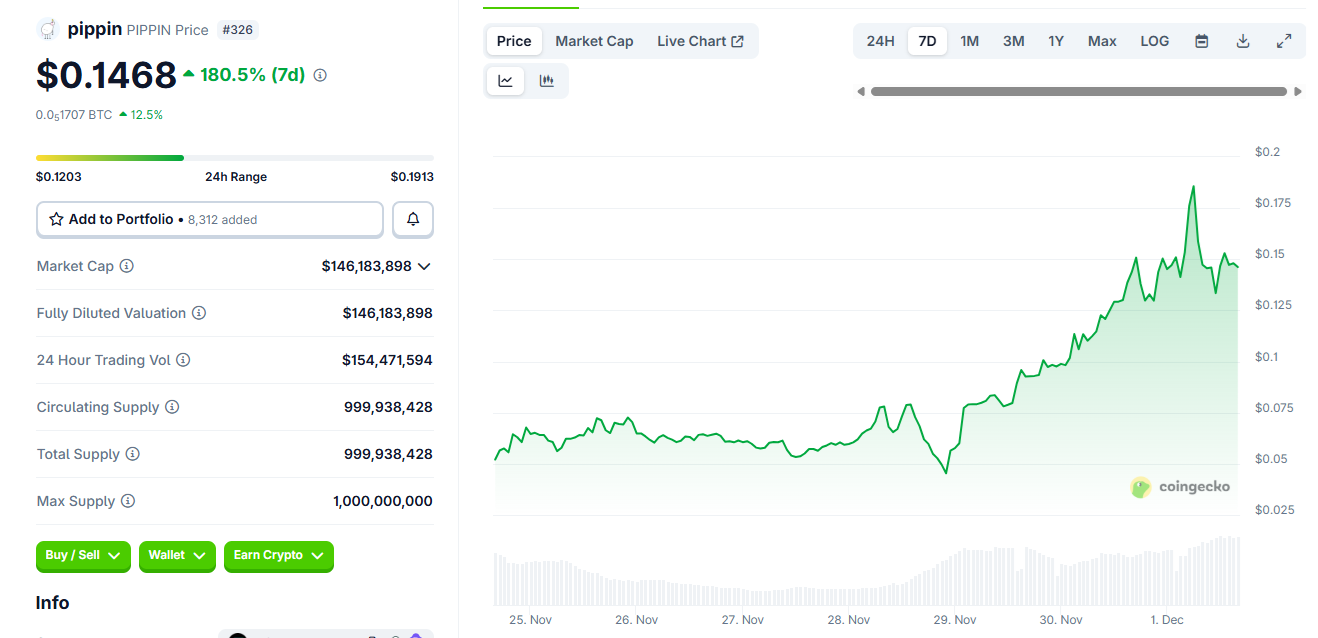

In the past week, PIPPIN peaked at $0.18, later retreating to $0.14. PIPPIN volumes also returned to their higher range for 2025, rising above $154M in the past 24 hours. The token gained additional hype on rumors of an airdrop, although the proposed airdrop page was not active.

The token expansion did not come as a result of any messages from the PIPPIN social media team either.

Why did PIPPIN reawaken in December?

The AI agent narrative has been relatively slow in the past months, with AI agent tokens barely breaking above $3B in total market capitalization. Even previously hot platforms and agent tokens returned to all-time lows. Most of the tokens are down by 99%, and only a handful have limited losses to 80%.

PIPPIN recovered from a recent local low of $0.023, outperforming the rest of the sector and entering the top 5 of AI agent tokens.

Most of the PIPPIN activity is still on Raydium, currently carrying over 47% of the token’s volumes. PIPPIN also accounted for over 50% of volumes on Raydium as of December 1, displacing all other Solana-based tokens.

For analysts, the current PIPPIN rally is not sustainable and may be the result of a deliberate pump of the relatively small decentralized market. The most active PIPPIN trading pair has around $7.4M in liquidity.

The two top whales achieved $2.3M and $2.2M in profits, with the second-best address causing rapid selling in the past day, crashing the price from $0.18 to $0.14.

PIPPIN whales awaken for the pump

As with other tokens trading near their lower range, PIPPIN inspired some accumulation from whales and smart money.

One whale built a wallet a month ago, when the token was still trading near its all-time lows. The wallet still holds 8.15M PIPPIN, valued at $1.2M, and at $1.5M at the recent local top.

Another whale used the current price pump to finally cash out. The whale acquired PIPPIN a year ago and was caught in the February crash.

The whale then held until finally cashing out, turning 450 SOL into 29,527 SOL. The whale sold all PIPPIN from their wallet, for a total of $3.74M, a significant return on an investment of $90K.

The price action of PIPPIN brought back memories of previous meme rallies for POPCAT and JellyJelly. However, those tokens rallied based on Hyperliquid speculation, while PIPPIN saw increased activity on Raydium.

Join Bybit now and claim a $50 bonus in minutes