KEY TAKEAWAYS

Golem’s GLM is a crypto that works in both AI and DePIN.

GLM first emerged as GNT in 2016 and changed its name in 2020.

Our Golem price prediction says GLM could reach $0.93 this year.

Interested in buying or selling GOLEM GLM? Read our review of the best exchanges to buy and sell GOLEM GLM.

Golem is a mainstay of the world of AI and DePIN crypto categories, launching in 2016.

Having spent much of its time recently outside the top 100 cryptos by market cap, investors will be curious to find out what, if anything, can be done to boost the value of its GLM token, formerly known as GNT.

On March 17, 2025, GLM was worth about $0.2905.

Let’s examine our March 17, 2025, Golem price predictions. We will also examine the Golem price history and discuss what Golem is and does.

Golem Price Prediction

Here are our Golem price predictions, made by CCN on March 17, 2025. While we take the utmost care with our price forecasts, we do need to remind you that price predictions, especially for something as potentially volatile as cryptocurrency, can often be wrong

| Minimum GLM price prediction | Average GLM price prediction | Maximum GLM price prediction | |

|---|---|---|---|

| 2025 | $0.17 | $0.47 | $0.93 |

| 2026 | $0.76 | $1.82 | $3.40 |

| 2030 | $4.25 | $7.09 | $10.50 |

Golem Price Prediction 2025

Although GLM has displayed resilience lately, the altcoin’s price might still face downward pressure because the market has yet to fully recover from a downturn. Because of this, Golem’s price might stand anywhere between $0.17 and $0.93 in 2025.

Golem Price Prediction 2026

In 2026, Golem might put up a better price performance. Next year, the market could have experienced some form of upturn, meaning demand for the token might be higher. If that does happen, GLM could trade between a low of $0.76 and a high of $3.40.

Golem Price Prediction 2030

By 2030, the total crypto market cap might have exceeded $10 trillion. If that happens, the market value of many tokens, including GLM, could be higher by then. Should that be the case, Golem’s price might be between $4.25 and $10.50 in 2030.

Golem Price Analysis

From a technical point of view, Golem’s recent decline has forced it below key support levels — specifically, the key Exponential Moving Averages (EMA).

On the daily chart, GLM trades below the 20 EMA (blue) and 50 EMA (yellow). Also, the 50 EMA (yellow) has crossed above the 20 EMA (blue), indicating a death cross and bearish trend.

If this remains the same, GLM’s price could drop to $0.21. However, the price could be higher if Golem’s value rises above these levels.

If that happens, GLM might climb to $0.49. The token’s value could rise to $0.67 in the longer term.

Short-term Golem Price Prediction

The Golem price prediction for the next 24 hours could suggest that the price might experience a respite from its recent downturn, according to the signs from the Supertrend indicator.

According to the four-hour chart, the green line of the Supertrend has dropped below GLM’s price, indicating a buy signal. The Chaikin Money Flow (CMF) has also risen above the zero signal line, indicating rising buying pressure.

If things stay the same in the short term, GLM might trade for nearly $0.32. If sustained, this could push the price higher to $0.38.

Alternatively, if Golem bulls fail to sustain this buying pressure, the uptrend might not continue. Instead, GLM could fall to $0.21.

Looking for a safe place to buy and sell GOLEM GLM? See the leading platforms for buying and selling GOLEM GLM.

Golem Average True Range (ATR): GLM Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On March 17, 2025, Golem’s ATR was 0.033, suggesting relatively high volatility.

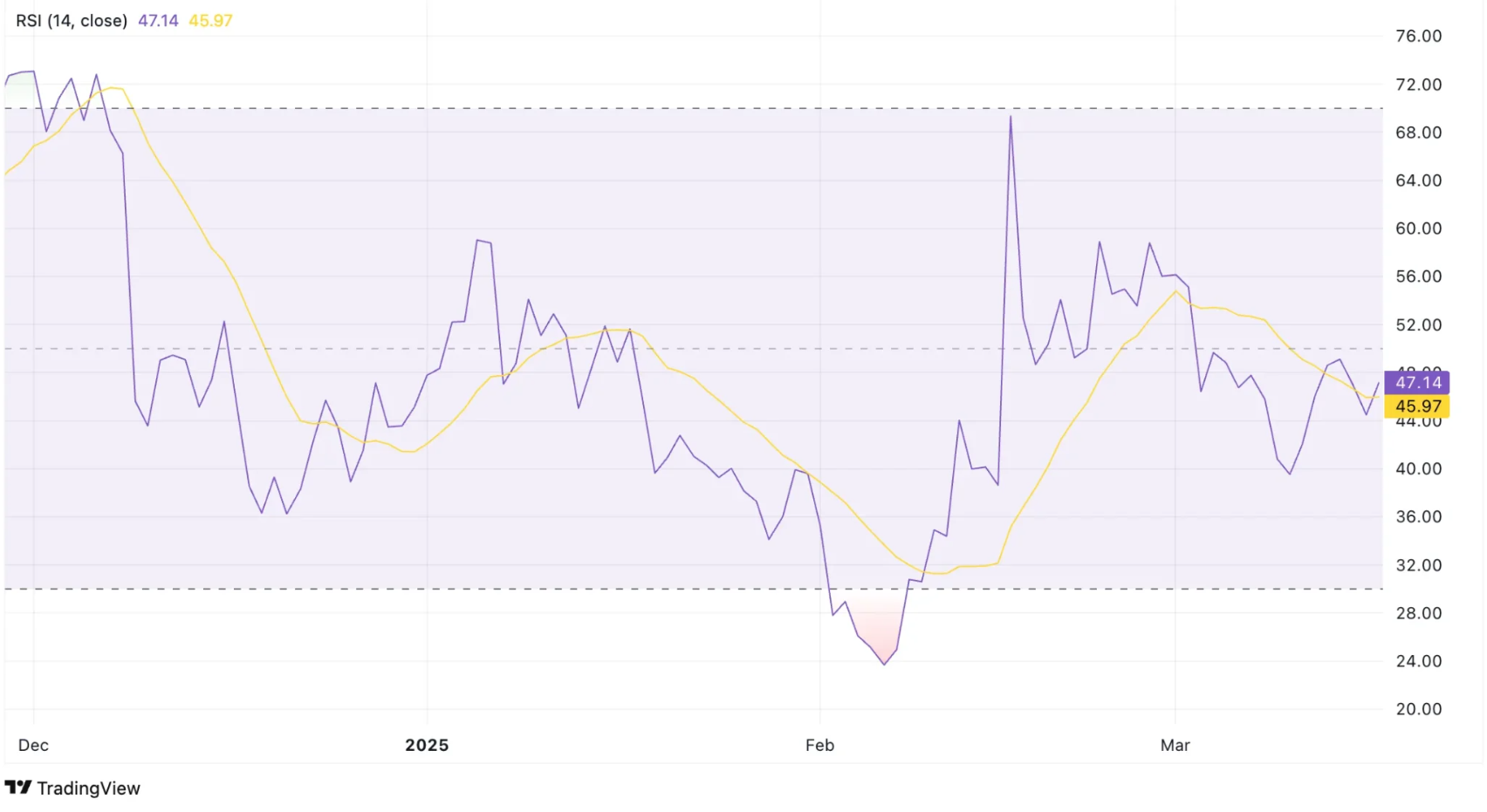

Golem Relative Strength Index (RSI): Is GLM Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold. Movements above 70 and below 30 show over and undervaluation, respectively.

Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On March 17, 2025, the Golem RSI was at 47, indicating slightly bearish conditions.

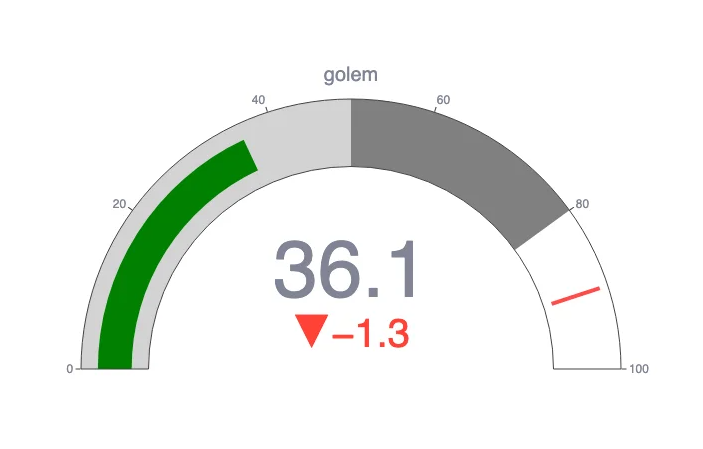

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but as volatility decreases, the score will slowly adjust back up.

On March 17, 2025, Golem scored 36.1 on the CCN Index, suggesting moderate momentum.

Golem Price Performance Comparisons

GLM is a token that straddles the AI and DePIN crypto sectors, so let’s compare it to some other tokens that do the same thing and have similar market caps.

| Current price | One year ago | Price change | |

|---|---|---|---|

| GLM | $0.2905 | $0.5536 | -47.5% |

| AIOZ | $0.289 | $0.907 | -68.1% |

| AKT | $1.30 | $6.10 | -78.6% |

| LPT | $5.50 | $24.10 | -77.1% |

Best Days and Months to Buy Golem

We looked at the Golem price history and found the best times to buy GLM.

| Day of the Week | Friday |

| Week | 18 |

| Month | March |

| Quarter | First |

GLM Price History

Now, look at some of the key dates in the Golem price history. While past performance should never be taken as an indicator of future results, knowing what the crypto has done in the past can give us some useful context when it comes to either making or interpreting a GLM price prediction.

| Time period | GLM price |

|---|---|

| Last week (March 10, 2025) | $0.2826 |

| Last month (Feb. 17, 2025) | $0.4035 |

| Three months ago (Dec. 17, 2025) | $0.4507 |

| One year ago (March 17, 2024) | $0.5536 |

| Five years ago (March 17, 2020) | $0.03152 |

| Launch price (Nov. 19, 2016) | $0.01357 |

| All-time high (Jan. 8, 2018) | $1.25 |

| All-time low (Dec. 12, 2016) | $0.008797 |

Golem Market Cap

The market capitalization, or market cap, is the sum of the total number of GLM in circulation multiplied by its price.

On March 17, 2025, Golem’s market cap was $288 million, making it the 143rd-largest crypto by that metric.

Who Owns the Most Golem?

On March 17, 2025, one wallet held more than 15% of the GOLEM supply.

Richest GLM Wallet Addresses

As of March 1,7 2025, the five wallets with the most GOLEM were:

0x879133fd79b7f48ce1c368b0fca9ea168eaf117c. This wallet held 154,103,028 GOLEM or 15.41% of the supply.

0x413ec849a403504e806b4c1cce19defbbc9c303f. This wallet held 102,348,442 GOLEM or 10.23% of the supply.

0x70a0a7be87deb51e1fab16d4f2bf00be1510e476. This wallet held 86,161,451 GOLEM or 8.62% of the supply.

0x7da82c7ab4771ff031b66538d2fb9b0b047f6cf9. This wallet held 50,001,000 GOLEM or 5% of the supply.

0xf977814e90da44bfa03b6295a0616a897441acec. This wallet, listed as Binance, held 45,780,237 GOLEM or 4.58% of the supply.

Golem Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Maximum Supply | 1,000,000,000 |

| Total supply (as of March 17, 2025) | 1,000,000,000 (100% of maximum supply) |

| Holder distribution | Top 10 holders owned 49.56% of the supply as of March 17, 2025 |

From the Golem Whitepaper

In its technical documentation or whitepaper, Golem claims to be “the first truly decentralized supercomputer, creating a global market for computing power.”

It adds, “We believe the future Internet will be a truly decentralized network, enabling users to securely and directly exchange content without sharing it with corporations or other middlemen. Accordingly, Golem will be useful not only to compute specific tasks but also to bulk-rent machines to perform operations within a self-organizing network. Of course, this will require the simultaneous development of other technologies, many of which have gained significant traction in recent years.”

What is Golem?

Golem set up in 2016, is a platform that aims to provide computing power to the artificial intelligence (AI) industry. Based on the Ethereum (ETH) blockchain, it has two different kinds of users. Requestors are one group, and they rent computing power from the other group, called providers.

Golem is supported by its native token, GLM, which was known until 2020 as GNT.

Because GLM is based on Ethereum, it is a token, not a coin. You might see references to such things as a Golem coin price prediction, but these are wrong.

How Golem Works

GLM pays for transactions on Golem. People can also buy, sell, and trade GLM on exchanges.

Is Golem a Good Investment?

It is hard to say right now. Golem has been around for a long time, but other cryptos that deal with AI and DePIN have caught up with and overtaken GLM. It’s not easy to see what, if anything, Golem can do to help it stand out in an increasingly crowded sector. On the other hand, while Golem has gone down over the last year, it hasn’t gone down by anywhere near as much as some of its closest competitors. A lot will depend on how the overall crypto market performs.

As always with crypto, you should do your own research before deciding whether or not to invest in Golem.

Will Golem Go Up or Down?

No one can really tell right now. While the Golem crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind that prices can and do go down and up.

Should I Invest in Golem?

Before you decide whether or not to invest in Golem, you will have to do your own research, not only on GLM but on other related coins and tokens such as Bittensor (TAO) and RENDER. Either way, you must also ensure you never invest more money than you can afford to lose.