KEY TAKEAWAYS

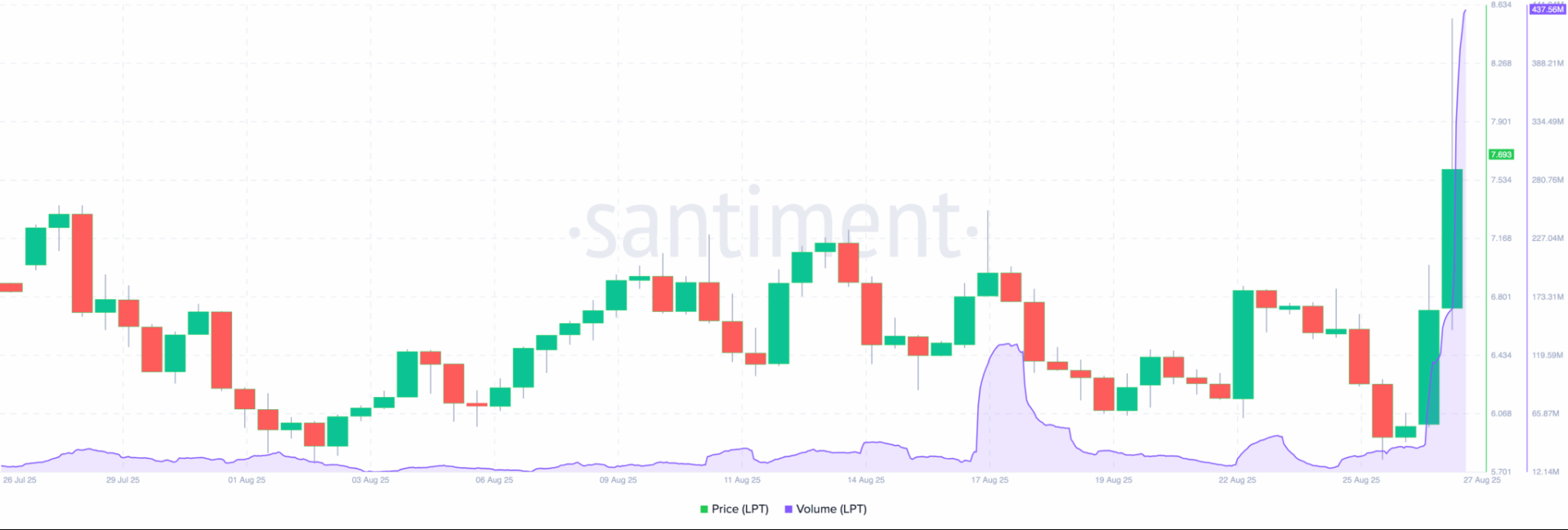

LPT surged 26% in 24 hours to $7.61, breaking above a 76-day resistance.

The volume spiked to $425 million, while the MVRV ratio remains at -31.17%.

LPT’s price could test $10.81, but if selling pressure picks up, it risks a pullback.

Livepeer’s native token, LPT, has surged 26% in the past 24 hours, climbing to $7.61. This move represents its highest level since June 12.

But price isn’t the only metric on the rise. In the same period, Livepeer’s trading volume has skyrocketed by more than 1,000%, reflecting a surge in market activity.

In this analysis, CCN breaks down what these developments mean for the altcoin’s long-term outlook and why LPT’s price may continue to rally.

Livepeer Breaks Out

On the daily chart, LPT’s price had traded within a descending channel before finally breaking out. The $7.60 level was a strong resistance zone during that bearish phase.

However, the altcoin has cleared that barrier today, breaking above a 76-day resistance. The move underscores the strength of the bulls, who have driven Livepeer’s token higher.

Adding to the bullish setup, the Bull Bear Power (BBP), which remained negative since the weekend, has now flipped into positive territory. This shift highlights growing buyer dominance and further reinforces the case for a continued uptrend.

Livepeer’s price will likely test the next resistance at $10.41 if this trend holds. A successful move above this level could confirm the breakout’s strength and open the door to even higher targets in the sessions ahead.

Volume Rises, Not Yet Overvalued

Furthermore, on-chain data reveals that Livepeer’s trading volume has spiked to $425 million. This activity surge reinforces the token’s heightened interest and adds weight to the recent price breakout.

Sustained high volume usually confirms the strength of a rally. Therefore, if the trading volume continues to rise alongside the market value, LPT’s price could break $10, as stated earlier.

Despite the recent bounce, Livepeer’s Market Value to Realized Value (MVRV) ratio remains at -31.17%. This negative reading suggests that most holders are still sitting on unrealized losses.

Historically, LPT’s price tends to approach a market top when the MVRV ratio rises into the 38.61%–59.06% range.

This indicates that the token may still have considerable room to grow before reaching overvalued territory compared to its current level.

LPT Price Rally Strengthens

On the 4-hour chart, Livepeer’s price has formed a bullish divergence.

While the price has pulled back slightly, the Chaikin Money Flow (CMF) remains above the zero line, indicating that buying pressure continues to outweigh selling volume.

This divergence suggests that despite the minor dip, capital inflows remain strong, and bulls may still have the upper hand in driving LPT’s next move higher.

If this trend continues, LPT’s price could break out toward $10.81, extending its bullish momentum.

However, if selling pressure picks up, the setup may weaken, leaving the token vulnerable to a pullback toward $6.61.