KEY TAKEAWAYS

After the platform was hacked, Unus Sed Leo was set up to offer discounts on the Bitfinex exchange.

The LEO token reached an all-time high in early March 2025 but has fallen slightly since.

Our Unus Sed Leo price predictions suggest LEO could reach $14.38 this year.

Interested in buying or selling UNUS SED LEO LEO? Read our review of the best exchanges to buy and sell UNUS SED LEO LEO.

UNUS SED LEO Price Prediction

Here are the LEO price predictions from CCN for March 18, 2025. It is important to remember that price forecasts, especially for something as potentially volatile as crypto, are often wrong.

| Minimum LEO Price Prediction | Average LEO Price Prediction | |

|---|---|---|

| 2025 | $5.96 | $8.20 |

| 2026 | $2.83 | $4.09 |

| 2030 | $16.35 | $21 |

UNUS SED LEO Price Prediction 2025

LEO has done pretty well this year. However, this does not imply that the token will not necessarily be corrected soon.

Due to low liquidity, LEO could drop as low as $5.96 at some point this year. However, the token’s value might rally toward $14.38 in a highly bearish situation.

UNUS SED LEO Price Prediction 2026

In 2026, LEO might experience low demand, which could make it hard for the price to go up. Also, the broader crypto market might have fallen into a bearish phase then. If that is the case, LEO might trade between $2.83 and $6.27.

UNUS SED LEO Price Prediction 2030

2030 could well be to be a good year for LEO and the broader market at large. By this period, the cryptocurrency might have seen a significant adoption. As a result, the token could be worth between $16.35 and $27.18.

UNUS SED LEO Price Analysis

From a technical perspective, the daily chart shows that LEO’s price has been forming both higher lows and higher highs for some time.

As a result, the Chaikin Money Flow (CMF) is above the zero signal line, indicating rising buying pressure. Like the CMF, the Money Flow Index (MFI) reading has also increased, even though it is yet to surpass the neutral line.

In line with this, LEO’s price might break the $10 and rise to a new all-time high.

Alternatively, if the LEO token price fails to rise past the upper trendline at $9.98, this prediction might not come to pass. In that scenario, the altcoin’s value might plunge near $8.37.

Short-term UNUS SED LEO Price Prediction

Zooming into the four-hour chart, it appears that LEO might bounce off the consolidation due to a breakout above the descending channel.

In line with the breakout, the green line of the Supertrend indicator is also below the price. This position indicates a buy signal, indicating that LEOs might experience respite soon.

Should that be the case, LEO’s price might rise above $10 in the short term. If demand for the token increases at this point, it could rally toward $12, which could mark a new all-time high.

However, if LEO drops below the lower support at $9.51, the price might decline to $9.21. The cryptocurrency’s value might drop below the $9 mark in a highly bearish scenario.

The UNUS SED LEO price prediction for the next 24 hours depends on whether LEO can stay above $9.51.

Looking for a safe place to buy and sell UNUS SED LEO? See the leading platforms for buying and selling UNUS SED LEO.

UNUS SED LEO Average True Range (ATR): LEO Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility.

On March 18, 2025, LEO’s ATR was just under 0.18, suggesting relatively high volatility.

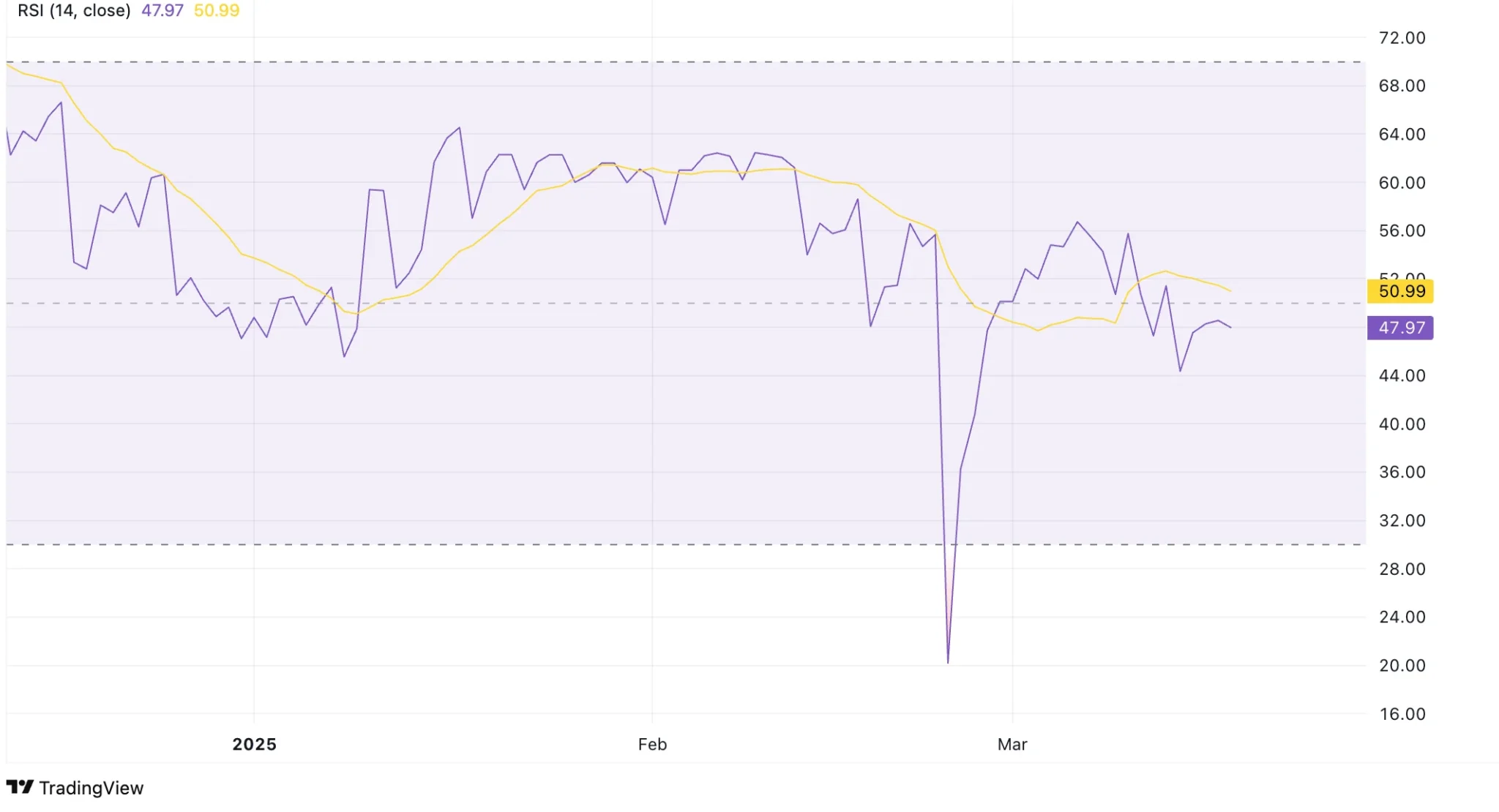

UNUS SED LEO Relative Strength Index (RSI): Is LEO Oversold or Undersold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold.

Movements above 70 and below 30 show over and undervaluation, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On March 18, 2025, LEO’s RSI was 47, suggesting slightly bearish conditions.

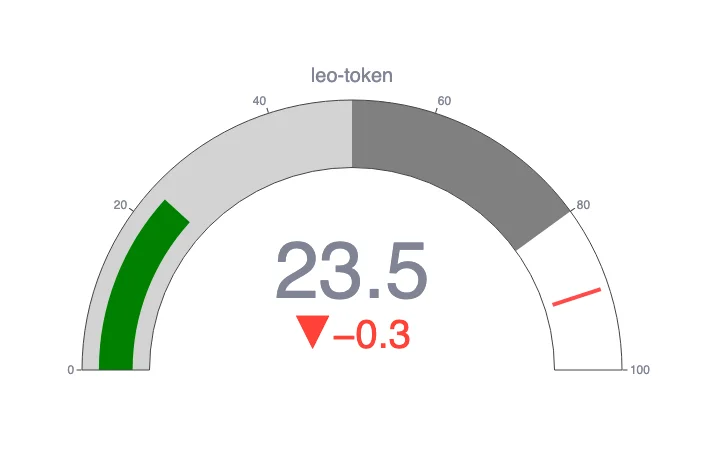

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but the score will slowly adjust back up as volatility decreases.

UNUS SED LEO scored 23.5 on the CCN Index, suggesting weak momentum.

UNUS SED LEO Price Performance Comparison

LEO is a centralized exchange-based token, so let’s compare its performance with that of similar projects.

| Current Price | One Year Ago | Price Change | |

|---|---|---|---|

| LEO | $9.75 | $6.19 | +57.5% |

| BNB | $633.85 | $586.51 | +8.07% |

| CRO | $0.0797 | $0.1442 | -44.7% |

| OKB | $51.80 | $64.62 | -19.8% |

Best Days and Months to Buy UNUS SED LEO

We looked at the LEO price history and found the times when the price was at its lowest across certain days, months, quarters, and even weeks in the year, indicating the best times to buy LEO.

| Time to Buy LEO | Days, Months, and Quarters |

|---|---|

| Best Day | Tuesday |

| Best Week | 6 |

| Best Month | February |

| Best Quarter | First |

Advantages and Disadvantages of UNUS SED LEO

CCN’s Senior Research Analyst, Toghrul Aliyev, examined UNUS SED LEO and found the following advantages and disadvantages.

Advantages of UNUS SED LEO

Multi-Tier Benefits for Token Holders: UNUS SED LEO holders on the Bitfinex exchange receive tiered trading fee discounts of up to 25%, peer-to-peer lending fee discounts of up to 5%, and enhanced affiliate rewards based on their token holdings.

Burn Mechanism: Bitfinex uses 27% of its monthly revenue to buy back and burn LEO tokens. As of July 16, 2024, they have burned 7.4% of the total supply. The initiative reduces the overall supply and increases the value of the remaining tokens.

High Transparency in Token Burns: Bitfinex maintains high transparency regarding LEO token burns by providing detailed records of every transaction. Users can access comprehensive information on each burn, from the first to the most recent.

Fixed Supply: The total supply of UNUS SED LEO is fixed at 1 billion tokens, which can lead to increased scarcity and potentially drive up the token’s value over time. By limiting the number of tokens available, the value of existing tokens may appreciate as demand grows.

Trustworthiness: The UNUS SED LEO token gains credibility from its association with Bitfinex, which has been in the industry for 12 years. Despite numerous controversies, Bitfinex’s enduring presence fosters trust in the reliability and value of the UNUS SED LEO token.

Dual Blockchain Compatibility: The UNUS SED LEO token is available on both Ethereum and EOS blockchains. This setup provides users with more options for transactions and storage and enhances the token’s accessibility and flexibility.

Disadvantages of UNUS SED LEO

Dependency on Bitfinex: The success of LEO is closely tied to Bitfinex’s performance and reputation. Any negative events affecting the exchange, such as legal issues or hacks, can directly impact the token’s value.

Price Drop Cascade Risk: The exchange holds 21.76% of its assets in LEO tokens. Given that the token’s value is closely tied to the exchange’s performance, this causes concern. If Bitfinex faces issues, it may need to liquidate its LEO holdings, leading to a significant price drop. Conversely, a substantial decline in LEO’s price could create financial stress for the exchange, potentially triggering a negative feedback loop where each issue exacerbates the other. This cyclical risk could lead to severe instability for both the token and the exchange.

Limited Use Case: LEO provides significant benefits within the Bitfinex exchange, but outside of this environment, its value is primarily speculative.

High Centralization/Disproportionate Control: The UNUS SED LEO token is highly centralized, giving Bitfinex and its affiliates disproportionate influence over token-related decisions and the network.

LEO Price History

Let’s take a closer look at the UNUS SED LEO price history. While past performance isn’t necessarily indicative of future results, understanding what LEO has done can help us contextualize future LEO price predictions.

| Time period | LEO price |

|---|---|

| Last week (March 11, 2025) | $9.90 |

| Last month (Feb. 18, 2025) | $9.91 |

| Three months ago (Dec. 18, 2025) | $9.69 |

| Last year (March 18, 2024) | $6.19 |

| Five years ago (March 18, 2020) | $0.9676 |

| Launch price (May 22, 2019) | $1.03 |

| All-Time High (March 3, 2025) | $10.01 |

| All-Time Low (Dec. 25, 2019) | $0.8036 |

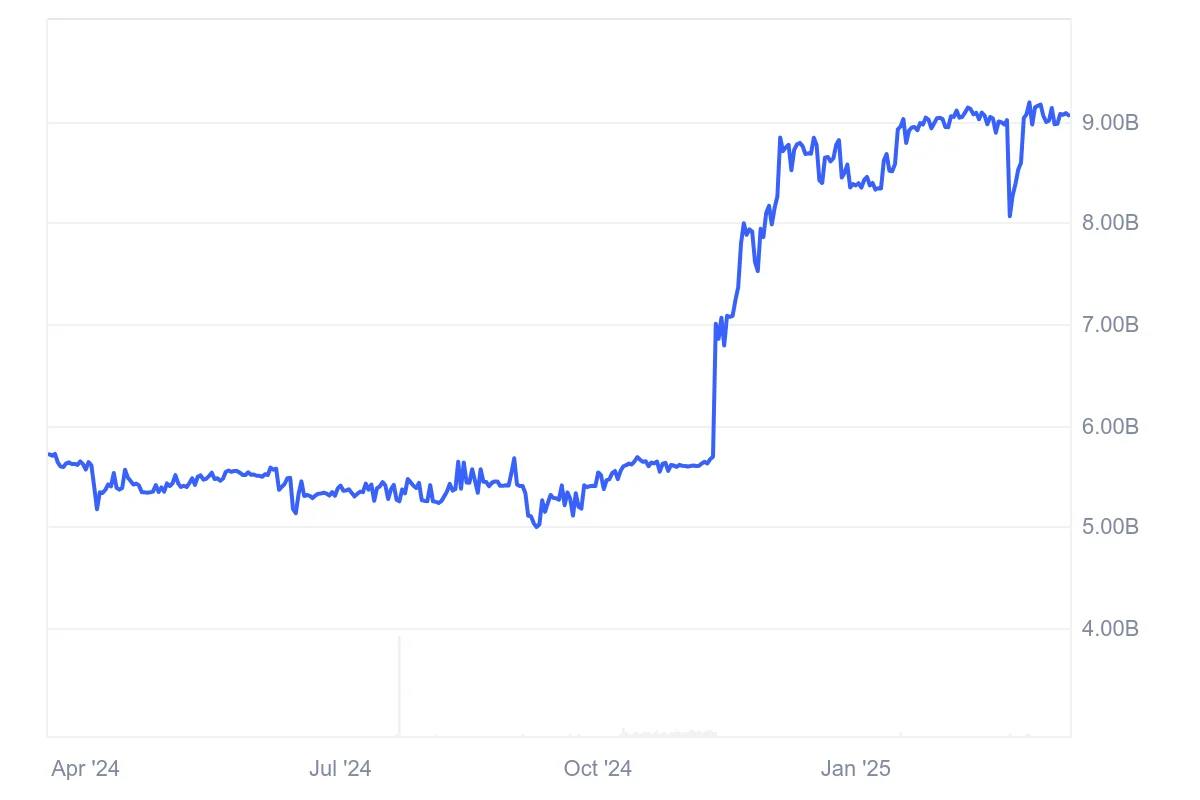

UNUS SED LEO Market Cap

The market capitalization, or market cap, is the sum of the total number of LEO in circulation multiplied by its price.

UNUS SED LEO Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Total supply | 985,239,504 |

| Circulating supply as of March 18, 2025 | 923,915,363 (93.77% of supply) |

| Holder distribution | Top 10 holders owned 65.94% of the total supply on March 18, 2025 |

From the UNUS SED LEO Whitepaper

In its technical documentation or whitepaper, iFinex says LEO is a key component of its platform, of which Bitfinex is a part. It says: “LEO will be the utility token at the heart of the iFinex ecosystem. Token holders will experience benefits across the entire portfolio and are expected to obtain benefits from future projects, products, and services.”

What is UNUS SED LEO?

Crypto entrepreneurs Raphael Nicolle and Giancarlo Devasini founded iFinex, the platform behind the LEO token, in 2012. The LEO token was founded to solve one particular problem. In 2016, hackers stole Bitcoin (BTC), worth more than $67 million at the time, from the Bitfinex exchange.

Unus Sed Leo was an attempt to compensate people who had lost out in the hack. LEO Holders are eligible for Bitfinex discounts, including money off trading fees, withdrawals, and deposits.

How UNUS SED LEO Works

LEO is, ultimately, designed to be destroyed. The idea is that iFinex will, over time, spend 27% of its gross revenues on buying back the token at the prevailing market rate.

It’s worth noting that because Unus Sed Leo is based on the Ethereum (ETH) and EOS blockchains, it is a token, not a coin. You might see references to such things as a Unus Sed Leo coin price prediction, but these are wrong.

Is UNUS SED LEO a Good Investment?

It is hard to say. On one hand, LEO has outperformed the market over the last year or so and is not too far from its all-time high. On the other hand, the token also does not have that much utility, although the buyback program that iFinex carries out has served, at least in theory, to keep the price high.

As always, you will need to do your own research before deciding whether or not to invest in Unus Sed Leo.

Will UNUS SED LEO go up or down?

No one can really tell right now. Although most of the UNUS SED LEO price predictions are optimistic, at least in the long run, price predictions are often wrong. You should also remember that prices can and do go down and up.

Should I invest in UNUS SED LEO?

Before you decide whether or not to invest in UNUS SED LEO, you will need to do your own research, not only on LEO but on other similar coins and tokens, such as Bitget (BGB).

More importantly, you should make it absolutely essential to never invest more money than you can afford to lose.