NEAR is a modular, AI-focused protocol enabling high-speed, low-fee transactions to power decentralized applications (dApps) with a seamless user experience.

This blog will explore NEAR Protocol’s Price Prediction from 2025, 2026, and up to 2030, studying its key growth drivers, market trends, and what the future holds for its token value.

What Is NEAR Protocol (NEAR)?

When it comes to combining AI and blockchain, NEAR stands out as a protocol purpose-built to power autonomous agents acting on behalf of users. NEAR goes beyond simple computation — it enables AI to transact, coordinate, and evolve.

In this model, AI becomes the user-facing layer, interpreting intent and carrying out actions, while NEAR’s blockchain works quietly in the background to handle identity, trust, and data integrity.

What makes NEAR powerful is its infrastructure for running secure and verifiable AI agents, with support for encrypted model execution and cross-chain operations. By abstracting away the complexities of wallets, bridges, and tokens, NEAR makes blockchain interactions seamless. Agents only need to define outcomes, and the protocol takes care of execution behind the scenes.

On top of that, NEAR leverages dynamic sharding, achieving sub-second finality and scaling to thousands of parallel agents. This means low-latency performance that can keep up with the demands of a global, AI-driven future.

NEAR Coin Price Prediction: How Do VentureBurn Experts Analyze It?

VentureBurn analysts combine fundamental and technical factors when forecasting NEAR’s price. The forecasts are based on statistics, historical price patterns, and a variety of technical indicators, including RSI, MACD, support and resistance, trendlines, Fibonacci levels, and momentum.

Trained AI models and manual reviews are also utilized to improve prediction accuracy. This information is provided for informational purposes only and does not constitute financial advice—always do your own research (DYOR).

The research highlights that expectations for a Fed rate cut and greater risk-on sentiment are driving more capital into crypto.

Current Market Background

On September 17, the Federal Reserve cut its key interest rate by 0.25%, marking the first rate reduction of the year. The markets welcomed the move, as lower rates typically boost liquidity and encourage investors to take on more risk.

For crypto, this shift could be especially significant: capital may flow out of lower-yielding fixed-income assets and into higher-volatility digital assets, potentially driving prices upward in the near term.

Adding to this momentum, money market funds are now holding a record $7.6 trillion, according to Crane Data. With yields expected to fall following the Fed’s decision, crypto investors are closely watching whether this massive pool of cash will begin moving into Bitcoin, altcoins, and other digital assets. If so, the influx of liquidity could trigger both rallies and heightened volatility across the crypto market.

NEAR Fundamental Analysis

From a fundamentals perspective, NEAR Protocol has continued to demonstrate steady growth. Its ecosystem now spans DeFi, NFTs, gaming, and key infrastructure partnerships, supported by a technically strong leadership team and a vibrant developer community. Since its launch in 2020, NEAR has consistently delivered mainnet upgrades and rolled out innovative solutions.

While this progress highlights NEAR’s solid foundation and respected leadership within the blockchain space, its overall impact is still considered strong but not yet groundbreaking, particularly when compared to leading smart contract platforms like Ethereum or Solana. Nonetheless, NEAR remains a credible contender with room to capture greater market share as adoption expands.

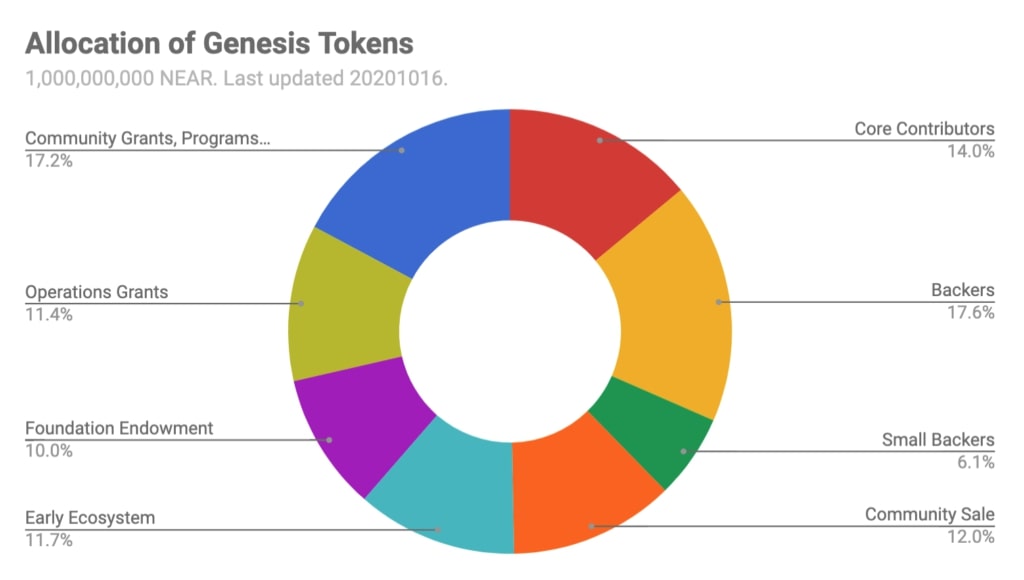

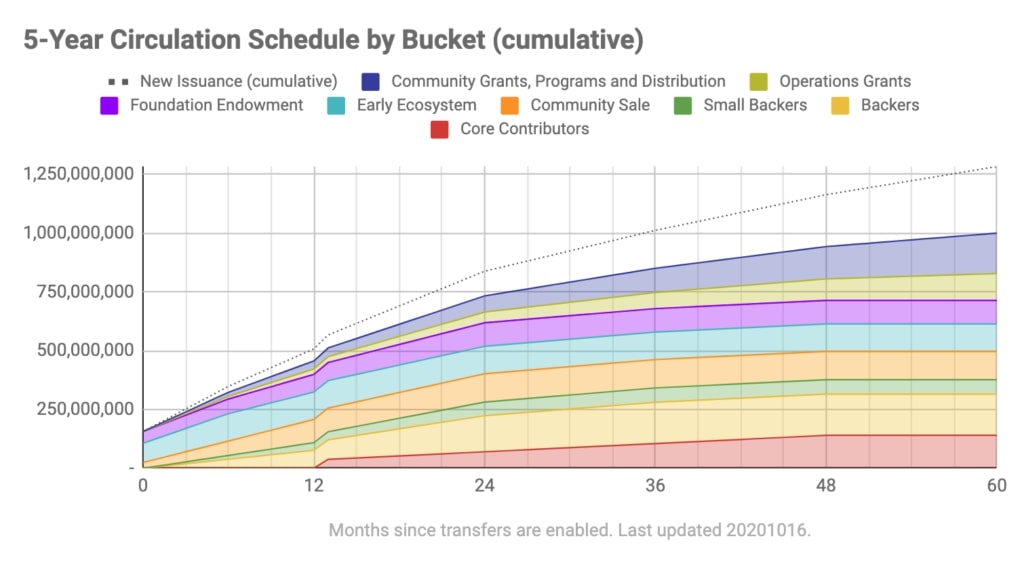

NEAR has just crossed an important milestone in its journey — virtually all of its initial token supply is now fully unlocked, reaching nearly 100% circulation. The final phase of the long-term vesting schedule, which stretched over the past 4–5 years, was completed only a few days ago.

Why does this matter? With the unlock process now finished, there’s no longer a looming risk of sudden supply shocks from early investors or large institutional holders. This shift creates a more predictable and stable supply dynamic, which is a positive sign for both long-term holders and new investors.

At present, the circulating supply stands at around 1.26 billion NEAR tokens, already accounting for inflation from staking rewards. With the fear of periodic token dumps now behind it, NEAR enters a new phase where price stability has stronger fundamentals — a crucial factor for building confidence in the ecosystem.

NEAR Technical Analysis

Near Coin Price History

Over the past six months, NEAR has been trading in a tight range between $1.80 and $3.20. This sideways action has formed a symmetrical triangle — with higher lows and lower highs converging toward the apex. For technical traders, this is a classic sign that volatility is brewing.

Such patterns usually represent a period of accumulation, where buyers and sellers are building positions ahead of a major move. With support tested several times around $1.80 and resistance holding strong near $3.20, the market is coiling up.

As the triangle formation nears completion and volatility compresses, the stage looks set for a sharp breakout — possibly a strong rally if the price pushes convincingly above the upper trendline.

Key Price Levels

Support Levels

$2.60–$2.80: A reliable demand zone where buyers consistently step in. Multiple rebounds have started from this range, making it a strong support level.

$2.30: A deeper support area that has historically stopped downtrends and sparked recovery moves, acting as a safety net for bullish reversals.

Resistance Levels

$3.30: A critical ceiling where NEAR has faced repeated rejection. Each approach has triggered heavy selling, confirming it as a key supply zone.

$4.60: A stronger resistance from previous market swings. This level marks the top of the last big rally and serves as both a technical barrier and a psychological profit-taking zone.

What to watch closely

The most important level to monitor right now is $3.30. If NEAR struggles to break and hold above this zone — showing repeated rejection, fading momentum, or long upper wicks — it could signal that bulls are running out of steam.

In that case, a short retracement toward $3.00 is possible before another attempt higher. On the flip side, a clean breakout above $3.30 with strong volume would confirm bullish momentum and open the door to higher targets.

NEAR Price Prediction 2025

| Time | Expected Price | Potential ROI |

| September 2025 | $3.0000000 | -5.24% |

| October 2025 | $3.7800000 | 19.39% |

| November 2025 | $4.3000000 | 35.82% |

| December 2025 | $5.0000000 | 57.93% |

NEAR Price Prediction 2026

| Time | Expected Price | Potential ROI |

| Q1 2026 | $5.2000000 | 64.25% |

| Q2 2026 | $6.5000000 | 105.31% |

| Q3 2026 | $7.8000000 | 146.37% |

| Q4 2026 | $7.5000000 | 136.89% |

NEAR Price Prediction 2027

| Time | Expected Price | Potential ROI |

| Q1 2027 | $8.0000000 | 152.68% |

| Q2 2027 | $10.0000000 | 215.86% |

| Q3 2027 | $11.0560000 | 249.21% |

| Q4 2027 | $13.4700000 | 325.46% |

NEAR Price Prediction 2028

| Time | Expected Price | Potential ROI |

| Q1 2028 | $13.3210000 | 320.75% |

| Q2 2028 | $13.4560000 | 325.02% |

| Q3 2028 | $13.7800000 | 335.25% |

| Q4 2028 | $14.5000000 | 357.99% |

NEAR Price Prediction For Years 2025, 2026, 2027, 2028, 2029, and 2030

| Year | Expected Price | Potential ROI |

| 2025 | $5.0000000 | 57.93% |

| 2026 | $7.5000000 | 136.89% |

| 2027 | $13.4700000 | 325.46% |

| 2028 | $14.5000000 | 357.99% |

| 2029 | $20.0000000 | 531.71% |

| 2030 | $18.0000000 | 468.54% |

Final Thoughts

In our base case scenario, NEAR may continue to suffer from the current downturn for a short while before staging a strong comeback, potentially as powerful as 40%-50%, with the token likely to break its previous high again as soon as the end of this year, supported by favorable market conditions heading into 2026.