Near Protocol price prediction is something many new crypto users search for when they try to understand if this project is worth holding. If you feel a bit lost in the world of blockchain, don’t worry. This guide explains every part of NEAR in a simple, friendly, and easy-to-follow way. You don’t need any advanced knowledge. You will get clear answers, real examples, and a balanced look at the future of this token.

At the moment, NEAR trades around $2.1. The price has been moving a lot in recent weeks. It dropped to about $1.8 on November 5, and then quickly recovered toward $3.1 on November 10. These swings show one thing: NEAR is active, and people are paying attention. Such movements often signal growing interest from traders and long-term investors.

This article will walk you through everything step by step. You will learn what NEAR Protocol is, why it was created, and how it works. You will also see NEAR price predictions for 2025, 2026, and long-term forecasts all the way to 2050. The goal is simple: help you understand the project so you can decide whether NEAR fits your investment style.

| Current NEAR Coin Price | NEAR Protocol Prediction 2025 | NEAR Protocol Price Prediction 2030 |

| $2.1 | $5 | $30 |

NEAR Protocol (NEAR) Overview

NEAR Protocol is a modern blockchain designed to make building and using decentralized applications simple for everyday users. Many blockchains struggle with slow transactions, high fees, and complicated tools. NEAR was created to solve these problems and open the door to faster and more user-friendly Web3 experiences.

The project started in 2020, founded by Illia Polosukhin and Alexander Skidanov. Both founders came from strong engineering backgrounds. Illia worked on artificial intelligence at Google, while Alexander specialized in high-performance systems. Their goal was clear: create a blockchain that feels as smooth as using a normal app.

NEAR uses a unique technology called sharding. In simple terms, sharding splits the network into smaller parts so it can process many transactions at the same time. This allows NEAR to stay fast even when usage grows. As a result, users enjoy quick confirmations and low fees, which is something beginners appreciate.

At the core of the network is the NEAR token. It pays for transactions, secures the network through staking, and rewards validators who keep the system running. Developers also use NEAR to deploy smart contracts, while users rely on it when interacting with apps.

One of the most impressive features is its focus on accessibility. NEAR supports human-readable account names, like “john.near,” instead of long crypto addresses. This small detail makes the experience feel much more familiar to newcomers.

NEAR also aims to support developers with easy tools. Its smart contracts use languages such as Rust and JavaScript, which encourages more builders to join the ecosystem. Over time, this has led to the growth of DeFi platforms, gaming projects, and AI-related apps on the network.

In short, NEAR is a fast, simple, and developer-friendly blockchain created to bring Web3 to a mainstream audience.

NEAR Coin Market Information Data

| Current Price | $2.1 |

| Market Cap | $2,684,209,030 |

| Volume (24h) | $493,911,833 |

| Market Rank | #36 |

| Circulating Supply | 1,280,357,764 NEAR |

| Total Supply | 1,280,357,783 NEAR |

| 1 Month High / Low | $3.1 / $1.8 |

| All-Time High | $20.44 Jan 16, 2022 |

NEAR Price Chart

CoinGecko, November 20, 2025

NEAR Protocol (NEAR) Price History Highlights

2020: The Launch and Initial Testing Phase

NEAR entered the market on October 14, 2020, with a starting price of $1.18. As a brand-new project, it went through the typical early volatility. The price dropped to $0.526 in November, losing more than half its value. Despite this weak start, NEAR managed to bounce back and close the year at $1.39. The average for 2020 stayed near $0.94, showing investors were still figuring out the project’s value.

2021: The Explosive Bull Market Year

2021 changed everything for NEAR. It opened the year at $1.35 and ended at $14.6, gaining almost 1,000%. NEAR even touched a high of around $16.39 during the year. This period brought huge interest from investors as DeFi and NFTs exploded in popularity. The average price climbed to $5.63, reflecting strong momentum and growing trust in NEAR’s technology.

2022: The Devastating Bear Market Collapse

The excitement from 2021 faded quickly in 2022. NEAR started strong at $15.16 and even hit its all-time high of over $20 in January. After that, the entire crypto market turned bearish. High inflation, rising interest rates, and major industry failures caused NEAR to fall sharply. By the end of the year, it had dropped to $1.25, losing more than 90% from its peak. The yearly low reached $1.23, and the average price settled at $6.93.

2023: Recovery and Renewed Optimism

2023 brought new life to the project. NEAR began the year at $1.27 and climbed to $3.64 by year-end, gaining over 180%. It reached a high of $4.62 during the recovery phase. The low of $0.97 showed that the market was still testing support levels, but overall sentiment improved. With an average price of $1.74, NEAR started building a stronger foundation for growth.

2024: Steady Gains and Plateau Formation

In 2024, NEAR saw calmer but steady progress. It opened at $3.79 and closed at $4.89, up almost 30%. The price hit $9 in May before stabilizing. The lowest point of the year was $2.45. The average price rose to $5.28, the highest since the 2021 bull run. This showed more maturity, real usage of the network, and growing interest from institutions.

2025: Significant Decline and Ongoing Volatility

2025 has been a rough year so far. NEAR started at $5.27 but has fallen to about $2.1 by November, dropping nearly 60%. The yearly high of $6.23 came early in January before a long decline set in. This shows that NEAR, like many altcoins, is still sensitive to market conditions, investor sentiment, and broader macroeconomic trends.

NEAR Protocol Price Prediction: 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $1.94 | $8.68 | $5 | +140% |

| 2026 | $4.62 | $14.84 | $10 | +375% |

| 2030 | $10.20 | $56.08 | $30 | +1,300% |

| 2040 | $121.69 | $2,222 | $1,100 | +52,000% |

| 2050 | $209.14 | $2,933 | $1,500 | +71,000% |

NEAR Protocol Price Prediction 2025

DigitalCoinPrice expects NEAR to reach a maximum of $4.74 (+120%) in 2025. Its lowest level may drop to $1.94 (-10%).

PricePrediction analysts see NEAR hitting $3.12 (+45%) at its lowest point and rising toward $3.48 (+60%) at the top of its range.

Telegaon is more bullish. Their forecast shows a minimum of $3.51 (+60%) and a potential pump to $8.68 (+300%) in 2025.

NEAR Price Prediction 2026

DigitalCoinPrice believes NEAR could climb to $5.52 (+155%) in 2026, while its downside sits at $4.62 (+115%).

PricePrediction shows similar expectations, with a low of $4.63 (+115%) and a high of $5.66 (+160%).

Telegaon predicts a much stronger year, expecting a minimum of $8.02 (+270%) and a maximum spike to $14.84 (+585%).

NEAR Protocol Price Prediction 2030

DigitalCoinPrice forecasts a 2030 maximum of $11.79 (+445%) and a minimum of $10.20 (+370%).

PricePrediction sees NEAR pushing much higher, with a low of $22.71 (+950%) and a top level of $25.73 (+1,100%).

Telegaon presents the most optimistic scenario for 2030, showing a minimum of $45.03 (+2,000%) and a peak of $56.08 (+2,500%) per coin.

NEAR Crypto Price Prediction 2040

PricePrediction expects massive long-term growth. Their 2040 forecast suggests a low of $1,778 (+82,000%) and a high of $2,222 (+103,000%).

Telegaon offers more conservative numbers, showing a minimum of $121.69 (+5,550%) and a maximum of $145.34 (+6,600%).

NEAR Protocol Price Prediction 2050

PricePrediction expects NEAR to hit a 2050 low of $2,597 (+120,000%) and a potential maximum of $2,933 (+135,000%).

Telegaon predicts that by 2050 NEAR may reach a minimum of $209.14 (+9,700%) and a maximum of $231.62 (+10,700%).

NEAR Protocol (NEAR) Price Prediction: What Do Experts Say?

Michaël van de Poppe remains one of the strongest long-term believers in NEAR Protocol. He has repeatedly described NEAR as one of the most promising accumulation plays in the market. In early November 2024, he noted that NEAR had spent nearly a year building strength, even though it faced rejection at several resistance zones. According to him, this structure is still bullish and prepares the token for a major breakout once momentum fully returns.

His main prediction points to a potential 275% rally toward $10. To get there, NEAR must first break above the key $3.6 resistance zone. If that breakout takes place, he expects intermediate targets between $5 and $5.3. Earlier in the year, he called for a move to $5 as the first significant step before any larger upward expansion. He also highlighted the $1.60–$2 range as the strongest support zone and encouraged accumulation during dips while waiting for confirmation of the next big move.

Van de Poppe has also described NEAR as a “significant opportunity” and even a “once-in-a-lifetime chance” around the $2 range. In a late October update, he projected a possible 3–6x move against Bitcoin if NEAR breaks out of its long consolidation pattern. He marked the $2.39–$2.94 area as the first resistance cluster and suggested NEAR could reach $13.63 by 2028 if the long-term structure holds. His bullish view is tied not only to technicals but also to NEAR’s fundamentals, including its AI-driven capabilities and the growing interest in AI-related crypto projects. He also pointed to the upcoming $TAO halving as a catalyst that may lift the entire AI-focused sector.

Analyst CryptoBullet provided a more cautious but still positive outlook. After the steep drop below $1.8 on October 10, he observed a strong recovery and described NEAR’s structure as “solidly bullish.” His short- to mid-term target is $4.5, based on the token’s rebound to $2.8 and the formation of a continuation pattern that often signals further growth. His projection aligns with Van de Poppe’s first major target range, making $4.5 one of the most commonly cited price zones among analysts watching NEAR.

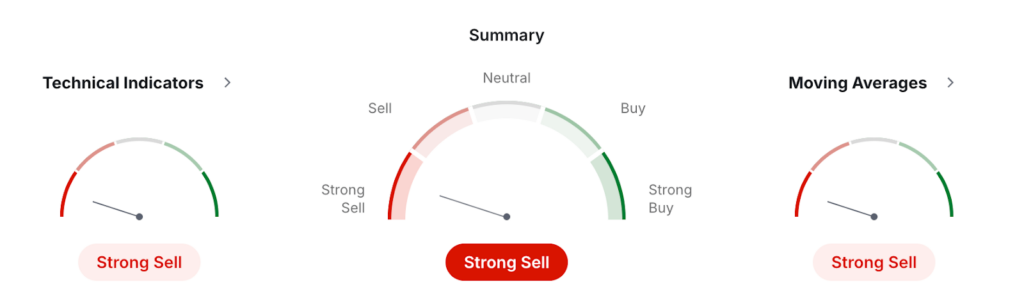

NEAR USDT Price Technical Analysis

Monthly technical data from Investing.com (updated late November 2025) shows a clearly bearish picture for NEAR on the long-term chart. The overall rating is Strong Sell, with both Moving Averages and Technical Indicators pointing to continued downward pressure. This suggests that NEAR remains in a weak trend on higher timeframes, even though short-term relief rallies may still appear.

Investing, November 20, 2025

The indicator breakdown shows zero buy signals across major oscillators. Out of eight tracked indicators, all eight flash Sell or Oversold. The RSI (14) sits at 43.89, which is below the neutral zone and supports a bearish bias. Both Stochastic and Stochastic RSI remain in Oversold territory, showing that price has been pushed down aggressively. Momentum tools confirm the weakness. The MACD prints a negative reading at -0.717, while the ADX at 22.18 shows a trend that is present but not strong enough to signal a reversal. Additional indicators like Williams %R (-92.24), CCI (-67.53), and ROC (-59.13) all point to continued selling pressure.

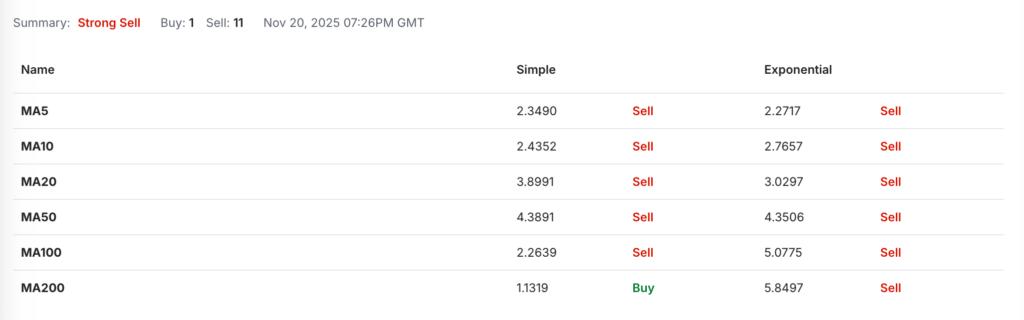

Moving Averages strengthen the bearish outlook. Eleven signals are Sell, with only one Buy coming from the simple MA200. This means NEAR is trading below most important long-term averages, which reflects a long-lasting downtrend. Shorter and mid-range MAs, including MA5, MA10, MA20, MA50, and MA100—all flash Sell in both Simple and Exponential measurements.

Pivot Points suggest that NEAR is trading near the lower range of its monthly structure. The classic pivot sits at 2.325. The main support zones appear near S1 at 1.427 and S2 around 0.7561. The resistance zones begin at R1 near 2.996 and extend upward to R3 at 4.5649.

Taken together, the monthly chart shows strong bearish pressure with no confirmed signs of reversal yet. However, oversold readings may create opportunities for short-term bounces if buyers step in.

What Does the NEAR Price Depend On?

The price of NEAR does not move randomly. It reacts to a mix of market, technical, and fundamental factors. If you understand these drivers, you can read price moves with more confidence, even as a beginner.

First, overall crypto market sentiment plays a huge role. When Bitcoin and major altcoins rise, NEAR often follows. In strong bull markets, investors are more willing to take risk on Layer 1 projects. In deep bear markets, most altcoins, including NEAR, usually drop together, no matter how good their technology is.

Second, NEAR’s network usage and ecosystem growth matter a lot. When more users interact with dApps, DeFi platforms, and AI projects built on NEAR, demand for the token usually increases. Key drivers here include:

New dApps, games, or DeFi protocols launching on NEAR;

Rising total value locked (TVL) in NEAR-based DeFi;

Real-world partnerships and integrations.

Third, technology and upgrades influence long-term value. Improvements in scalability, security, developer tools, and AI-related features can attract builders. When developers choose NEAR over other chains, they help grow demand for the token.

Fourth, the price reacts strongly to news and analyst coverage. Bullish forecasts, like calls for multi-X upside, can trigger new interest. At the same time, negative headlines or regulatory fears usually create selling pressure.

Fifth, tokenomics also shape price behavior. Staking yields, emission schedules, and the share of tokens locked versus circulating all affect supply and demand. If many holders stake NEAR long term, less supply sits on exchanges, which can support higher prices during demand spikes.

Finally, macroeconomic factors—interest rates, liquidity, and risk appetite in global markets—impact NEAR just like they impact stocks and other crypto assets. When money flows into risk assets, NEAR tends to benefit.

Near Features

NEAR Protocol offers a wide range of features designed to make blockchain faster, more scalable, and easier to use. These features work together to create a strong foundation for developers, businesses, and everyday users. The following overview explains NEAR’s core strengths in a simple and clear way while capturing the depth of its technology.

NEAR’s architecture centers around Nightshade sharding, a system that divides the network into multiple shards running in parallel. Each shard processes its own transactions while sharing the same execution environment, which allows NEAR to scale linearly as demand grows. This design helps the blockchain avoid congestion and keeps fees low even when activity increases. Validators on the network operate under Thresholded Proof-of-Stake (TPoS). They stake NEAR tokens to secure the chain, and the protocol randomly assigns them to shards, ensuring decentralization and safety across the system. To support fast confirmation, NEAR uses DoomSlug, a finality mechanism that allows blocks to finalize after a single round of communication. This gives users near-instant settlement and makes transactions feel quick and responsive.

Scalability remains one of NEAR’s biggest advantages. The network currently averages around 63 transactions per second (TPS), but real-world stress tests have shown bursts of more than 4,000 TPS. The theoretical upper limit sits around 16,000 TPS. NEAR also keeps block time at about 600 milliseconds, making it one of the fastest blockchains in the market. As of March 2025, the network operates with eight shards, upgraded from six, and plans to introduce dynamic resharding soon. This upgrade will allow the network to split or merge shards automatically based on usage, giving NEAR the ability to scale as needed without manual intervention.

On the development side, NEAR uses the WebAssembly (WASM) runtime, which supports near-native execution speeds and works across multiple platforms. Developers can write smart contracts in popular languages like Rust and JavaScript, making the ecosystem more accessible. NEAR also uses an account-based model similar to Ethereum, but with key improvements. Instead of long hexadecimal addresses, users can register named accounts like “alice.near,” which makes interacting with the network easier. For advanced users and developers, NEAR supports both FullAccess keys and FunctionCall keys, offering granular permission settings that increase security while enabling flexible app design.

NEAR also stands out in interoperability. The Rainbow Bridge allows trustless transfers between NEAR, Ethereum, and Aurora. Aurora itself is a full EVM-compatible environment running on NEAR, enabling developers to deploy Ethereum apps with minimal changes. NEAR also supports Virtual Chains, which allow custom EVM environments to run as smart contracts for specialized applications.

Finally, NEAR places emphasis on sustainability. Its Proof-of-Stake structure consumes far less energy than Proof-of-Work systems. NEAR has earned carbon-neutral certification from South Pole and offsets its footprint through environmental projects.

Near Protocol Price Prediction: Questions And Answers

Is NEAR Protocol a Good Investment?

NEAR can be a good investment for people who believe in scalable Layer 1 blockchains with strong developer activity. It offers low fees, fast transactions, and a growing ecosystem. However, it is still a volatile asset. Beginners should understand that NEAR may deliver strong gains in bull markets but can also drop sharply during bearish periods. Always balance expectations with risk management.

What Is NEAR Protocol For?

NEAR Protocol is designed to host decentralized applications, smart contracts, and Web3 tools. It helps developers build fast, user-friendly blockchain apps without high transaction fees. NEAR aims to make blockchain accessible by offering simple accounts, strong scalability, and support for popular programming languages. It’s used for DeFi, gaming, NFTs, and AI-related projects that need reliable and fast infrastructure.

Is Near Protocol an AI Coin?

NEAR is not an AI coin by design, but it has become closely linked with the AI sector. Many AI-driven projects choose NEAR because of its performance, scalability, and low fees. The network also supports tools like NEAR AI and integrations with AI-focused ecosystems. This connection has helped NEAR gain attention during the rise of AI-themed cryptocurrencies.

Does NEAR Coin Have a Future?

Yes, NEAR has a strong future if its ecosystem continues to grow. The project focuses on scaling, developer tools, and seamless user experience. It also benefits from strong interoperability through Aurora and the Rainbow Bridge. As long as developers keep building on NEAR and user activity increases, the token may remain relevant in the long term.

How High Will NEAR Protocol Go?

Price targets depend on market cycles. In strong bull markets, estimates suggest NEAR may retest the $10 range or higher based on expert forecasts. Long-term predictions from some analysts reach above $50 or even triple-digit values by 2030 and beyond. Still, these targets are speculative and depend on adoption, ecosystem growth, and global market conditions.

Will NEAR Coin Reach $100?

Reaching $100 is possible only in a strong long-term scenario. Some 2030–2050 forecasts place NEAR well above that level, especially during major bull cycles. However, this would require significant adoption, sustained developer activity, and a large expansion of NEAR’s ecosystem. It’s important to treat $100 as a long-term stretch target, not a short-term expectation.

How High Can NEAR Go in 2025?

Expert predictions place NEAR between $3.12 and $8.68 in 2025, depending on market conditions. Bullish scenarios show potential for a strong breakout if NEAR moves above key resistance levels. Conservative forecasts expect slow but steady growth. Market sentiment, Bitcoin trends, and ecosystem activity will influence how high NEAR can climb during the year.

What Will NEAR Crypto Be Worth in 2026?

Forecasts for 2026 range widely. Conservative models show NEAR between $4.6 and $5.6, while optimistic projections from Telegaon reach up to $14.8. The final outcome depends on adoption, technical upgrades, and market momentum. If Layer 1 platforms gain renewed popularity, NEAR could outperform many expectations.

How Much Will NEAR Be Worth in 2030?

Predictions for 2030 vary from moderate to extremely bullish. DigitalCoinPrice expects NEAR around $10–$12, while PricePrediction places it above $20. Telegaon has the most optimistic view, forecasting values above $45 and even exceeding $50. These long-range forecasts assume major adoption of NEAR-based apps and strong demand for scalable Web3 infrastructure.

Why Is NEAR Protocol So Good?

NEAR stands out because it combines speed, low fees, and strong developer tools. Its sharding system provides excellent scalability, while its simple account model improves user experience. Developers can code in Rust or JavaScript, which lowers barriers to entry. NEAR also supports Ethereum compatibility through Aurora and focuses on sustainability. These strengths make it attractive for both builders and users.

Who Is Behind NEAR Protocol?

NEAR Protocol was created by Illia Polosukhin and Alexander Skidanov. Both founders come from strong engineering backgrounds. Illia worked on artificial intelligence at Google, while Alexander specialized in distributed systems and high-performance computing. Together, they designed NEAR to solve real blockchain problems such as slow transactions, high fees, and poor user experience. Their leadership helped the project gain credibility and developer interest.

Is NEAR Better than Solana?

NEAR and Solana are strong Layer 1 blockchains, but each focuses on different strengths. Solana offers extremely high throughput, while NEAR prioritizes predictable performance, easy development, and user-friendly design. NEAR’s sharding model gives it long-term scalability, and its account system is simpler for beginners. Solana may handle more transactions today, but NEAR often provides a smoother developer and user experience.

Is Near Protocol Better than Ethereum?

NEAR is not better than Ethereum, but it solves different problems. Ethereum is the most established smart contract platform with the largest ecosystem. NEAR focuses on speed, low fees, and user-friendly design. It offers features like named accounts and sharding, which Ethereum does not yet fully support. Many developers use NEAR and Ethereum together through Aurora and the Rainbow Bridge, mixing strengths from both networks

Where to Buy NEAR Protocol Coin?

StealthEX is here to help you buy NEAR Protocol if you’re looking for a way to invest in this cryptocurrency. You can buy NEAR privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.