If you think that crypto lending/borrowing is limited to depositing an asset on a well-known platform and hoping for a return, then wait until you discover Morpho. Because yes, that's what it's about, but in an optimized, intelligent version, designed for the long term.

What is Morpho?

Created in 2021 by a Franco-European team — yes, cocorico ?? — the project has already attracted giants like a16z and Coinbase Ventures. And it's not for nothing: @Morpho Labs ? wants to reconcile performance and decentralization, two things often opposed in DeFi.

Morpho is a decentralized non-custodial protocol designed for the EVM (Ethereum Virtual Machine) that allows over-collateralized lending and borrowing of crypto assets (ERC20 & ERC4626 tokens).

In other words: you can deposit assets as collateral, borrow other assets, all while keeping control of your funds. The idea? Optimize efficiency, reduce interest rate gaps between lenders and borrowers, and open new markets.

$MORPHO was launched in 2021 by a Franco-European team (founded notably by Paul Frambot); it has already raised tens of millions from funds like a16z, Coinbase Ventures and many others.

Why it’s different

Here’s what makes Morpho really interesting:

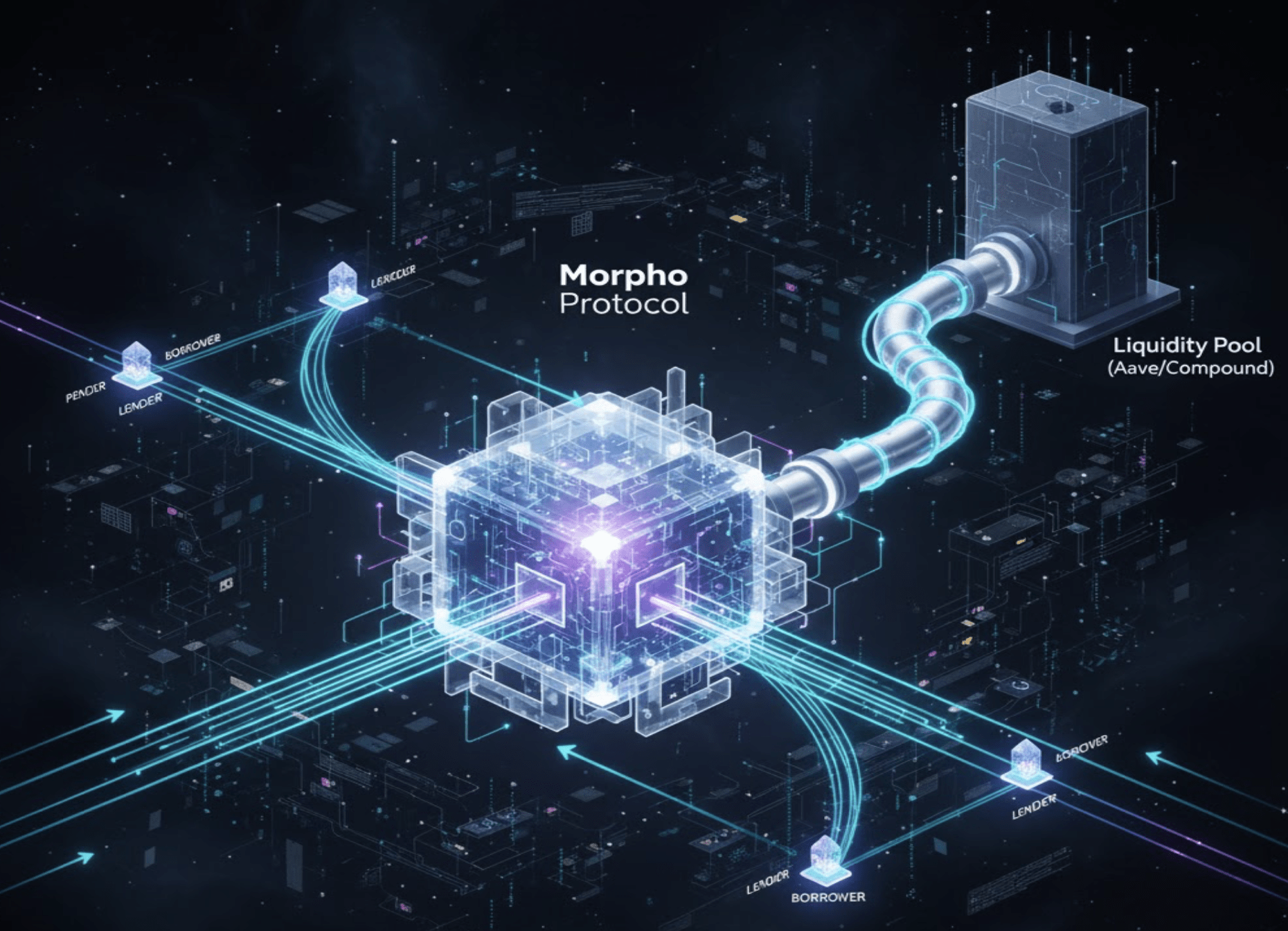

Matching peer-to-peer + fallback to pools: when a lender and a borrower can match directly, Morpho does it which reduces the “spread” (the difference between what the borrower pays and what the lender receives). If there is no match, Morpho redirects to a traditional pool.

Multi-chain capacity and efficiency: Morpho is not just on Ethereum. It deploys across multiple EVM networks, allowing it to attract more capital, liquidity, and use cases. We’re talking about several billion dollars locked (TVL).

Creation of permissionless markets: anyone can create a “market” for lending/borrowing with their own parameters (collateral, borrowing, oracles), within the limits set by the protocol governance.

So yes, it may seem technical, but for you and me it means: more options, more yield, and potentially less value “leakage” in the ecosystem.

Tokenomics & governance

The native token MORPHO plays a central role: it allows participation in governance, choosing improvements, and defining market parameters. OKX+1

Some key figures:

Maximum supply: 1 billion tokens.

Varied distribution: DAO reserves, strategic partners, founders…

In short: you do not just hold a “financial” token, you become a player in the evolution of the protocol.

Concrete use cases

Here’s what you can do with Morpho, or what it allows:

Deposit assets as collateral and borrow other tokens more efficiently than on traditional protocols.

Lend your liquidity as a lender, while opting for more attractive conditions (thanks to the P2P mechanism).

Create your own lending/borrowing market if you are a developer or bold.

Institutional integration & multiple chains: Morpho begins to attract serious players, which enhances its credibility.

To keep in mind

But of course, nothing is without risk:

As with any DeFi protocol: bugs, liquidations, volatility of collateral.

Some specific markets may have different parameters, which can increase risk.

Understanding how deposits, borrowing, and withdrawing your participation works is essential.

Why monitor Morpho?

In an increasingly mature crypto market, protocols that reduce inefficiencies, optimize yield, and open up to new capital are those that could play a major role tomorrow.

Morpho ticks a lot of these boxes: efficiency, multi-chain, solid infrastructure. And for a savvy investor, or a user who wants to do “more” with their assets, it’s a platform to keep an eye on.

In short, if you want to understand where decentralized finance is heading, look towards Morpho.

This might be where the future of crypto lending is being written.