What is Mantle (MNT)? At its core, it’s a new kind of Layer 2 built to make Ethereum faster, cheaper, and easier to scale. But it doesn’t stop there. With modular architecture, community-driven governance, and one of the largest treasuries in crypto, Mantle is quietly becoming one of the most capable networks in the space.

In this Mantle review, we’ll break down how it works, why the design matters, and what you can actually do with it. This beginner’s guide to MNT tokens will cover everything from gas fees and staking to governance and ecosystem funding.

Key Takeaways

Mantle separates execution, data availability, and settlement into different layers. This improves scalability and makes upgrades easier without disrupting the whole network.

Built to work seamlessly with the Ethereum Virtual Machine (EVM), so developers can migrate or build using familiar tools like Solidity, Hardhat, and Remix.

MNT holders vote directly on proposals, funding, and upgrades. Decisions are made transparently through DAO-based governance instead of being controlled by a central team.

With billions in its community-controlled treasury, Mantle can fund new apps, partnerships, liquidity programs, and long-term ecosystem growth.

Mantle is actively developing zero-knowledge rollups (via Succinct SP1) and planning to decentralize its sequencer, making the protocol more efficient and trust-minimized.

With low gas fees, fast block times, and a future-focused roadmap, Mantle is positioned to handle everything from DeFi and NFTs to real-world applications.

99Bitcoins’ Take on Mantle (MNT) Crypto Project

Mantle is one of those projects that focuses more on function than flash. It doesn’t rely on gimmicks or trends to stand out. Instead, it’s using smart design to tackle the most frustrating parts of Ethereum: high fees, limited throughput, and rigid infrastructure.

Rather than cramming everything into one chain, Mantle breaks it apart. Execution happens separately from data storage and final settlement. It’s a simple idea with a big payoff: lower costs, faster speeds, and more room to grow.

The protocol also gives users a real voice. Through MNT-based voting, the community decides how to allocate funds, approve upgrades, and guide ecosystem direction. That kind of hands-on participation is rare in most Layer 2s.

What stands out most is how focused Mantle has remained. It hasn’t constantly rebranded or changed direction. The roadmap is steady, the upgrades are meaningful, and the core idea hasn’t wavered. It’s building something that works, not something that tries to impress every passing trend.

Mantle might not always trend on Twitter, but it’s quietly turning into one of the most capable Layer 2s in the market. And in an ecosystem full of noise, being consistent, usable, and community-owned is a pretty solid advantage.

Mantle Review: Summary

In this guide, we’ll break down what makes the Mantle crypto project different from other Ethereum Layer 2s. We’ll look at how the Mantle modular blockchain is structured for speed and scalability, and how it separates execution, settlement, and data availability to reduce gas fees and improve performance.

We’ll also cover MNT token use cases, from governance and staking to gas payments and treasury participation. You’ll learn how the protocol is governed by its community, how proposals are passed, and how the ecosystem is funded through one of the largest treasuries in the space.

By the end, you’ll understand how Mantle works under the hood, why it matters for the future of Ethereum scaling, and what to watch as the project continues to evolve. Whether you’re a builder, investor, or curious user, we’ll give you everything you need to know about this next-generation Layer 2.

Terms You Need to Know Before Understanding Mantle

Mantle is a powerful new Layer-2 on Ethereum, but to really understand why people are paying attention, you’ll want to get familiar with a few key terms.

Mantle Network: This is Mantle’s high-performance Layer-2 built on Ethereum. It’s designed to handle more transactions at lower fees by splitting up how things get done, processing, storing, and settling, all handled by different modules to keep things fast and cheap.

BIT: Originally, the governance token of BitDAO. If you were part of the BitDAO community, you held BIT. It gave holders a say in how the massive BitDAO treasury was spent and used across crypto projects.

MNT: The new native token of the Mantle ecosystem. BIT holders migrated their tokens to MNT, which is now used to pay gas fees, secure the network, and vote on important decisions. It’s the backbone of Mantle going forward.

Mantle Governance: This is the DAO structure behind Mantle. It’s not just a group of insiders calling the shots, anyone holding MNT can vote on upgrades, treasury use, or ecosystem funding proposals.

Modular Architecture: Unlike older blockchains that do everything in one place, Mantle splits the workload. Think of it as separating the kitchen, dining room, and storage instead of cramming everything into one room. That means it scales better and runs cheaper.

Rollups: Mantle uses Optimistic Rollups, which is a fancy way of saying it batches transactions and sends the summary to Ethereum instead of processing everything on-chain. It’s how Mantle keeps things fast without compromising security.

Mantle Treasury: One of the largest community-controlled treasuries in crypto. It started as BitDAO’s war chest and is now governed by Mantle holders. It funds new projects, partnerships, and other ecosystem tools.

Mantle Staking: You can stake MNT to support the network and earn rewards. This is one way Mantle encourages long-term participation and helps keep the system secure.

Once you’ve got these terms down, everything else about Mantle, from its tokenomics to why developers are building on it, starts to make a whole lot more sense.

What is Mantle (MNT)?

Mantle is a modular Layer 2 blockchain built on Ethereum, designed to make things faster, cheaper, and easier for both users and developers. It works by separating key functions like execution, settlement, and data storage into different layers, which allows the network to scale more efficiently.

Mantle uses something called Optimistic Rollups, which basically means it bundles up a bunch of transactions off-chain, then sends a summary to Ethereum for final validation. This keeps costs down while still benefiting from Ethereum’s security.

At the center of the Mantle ecosystem is the MNT token. It powers the network by covering transaction fees, securing the protocol through staking, and giving holders a voice in governance. Whether you’re sending tokens, deploying smart contracts, or voting on proposals, MNT is what makes it all happen.

Mantle also puts a big focus on being developer-friendly. It’s fully compatible with the Ethereum Virtual Machine (EVM), which means developers can bring over their apps with minimal changes. Combined with low gas fees, high performance, and flexible architecture, Mantle is positioning itself as a serious contender in the world of Ethereum Layer 2s.

History of Mantle Crypto

Mantle started inside one of the biggest DAOs in crypto, called BitDAO. BitDAO was a massive treasury and governance project funded in part by Bybit, a well-known exchange. At one point, BitDAO had billions of dollars in its treasury and aimed to fund cutting-edge web3 tools and ecosystems. But there was one big piece missing: a high-performance Layer 2 that could connect everything together.

In mid-2022, the idea for Mantle started gaining traction within the BitDAO community. The concept was to build a modular Ethereum Layer 2 that could serve as the technical foundation for BitDAO’s long-term vision. Development kicked off with the goal of delivering low fees, high throughput, and support for serious builders.

In early 2023, Mantle’s testnet went live, and by July 2023, the mainnet alpha was launched. Around the same time, the community proposed a major transformation: merge BitDAO and Mantle into a single unified brand. The BIT token, which had been used for BitDAO governance, was migrated to MNT on a one-to-one basis. This wasn’t just a cosmetic rebrand. It marked a full pivot from being a passive treasury to building an active Layer 2 ecosystem with its own identity, tokenomics, and roadmap.

Since then, Mantle has rolled out major technical upgrades like the Tectonic and Everest releases. These upgrades brought in things like EIP-1559 gas mechanics, native MNT gas payments, faster block times, and support for decentralized data availability through EigenLayer. At every step, governance decisions have been made through community proposals and voting, keeping the project aligned with its decentralized roots.

About the Mantle Team

Mantle doesn’t have a single founder or a traditional startup-style executive team. Instead, it grew out of a decentralized community with backing from BitDAO and early supporters like Bybit. The development of the protocol has been carried out by contributors from around the world, with funding and coordination coming from the DAO.

That said, there are some important figures who helped get things off the ground:

Ben Zhou, co-founder and CEO of Bybit, was one of the most prominent backers and long-time supporters of BitDAO and Mantle.

Jordi Alexander, Chief Investment Officer at Selini Capital, was involved in shaping governance and strategic proposals.

Arjun Krishan Kalsy, who previously led growth at Polygon, joined Mantle as Head of Ecosystem to build out partnerships and developer tools.

JacobC.eth and Joshua Lapidus were early contributors involved in governance, technical direction, and economic strategy.

Key early figures involved in Mantle’s direction included well-known voices in the BitDAO community and crypto venture space. But instead of centralizing control, Mantle relies on working groups, proposal-based funding, and community-elected committees like the Mantle Economics Committee to manage the ecosystem treasury.

Because Mantle comes from a DAO-first background, the governance structure is baked into everything. Token holders decide on how the treasury is spent, what upgrades to implement, and which partners or protocols to support. This setup gives Mantle a unique advantage compared to top-down projects. It’s not just open source in code, but also in vision and control.

What Problems Does Mantle (MNT) Solve?

As Ethereum becomes more popular, the network faces a big problem: it just can’t handle the scale needed for mass adoption without slowing down or getting expensive. Mantle steps in to solve a range of problems that are holding web3 back from being ready for real-world use.

Scalability bottlenecks: Ethereum is powerful, but it can only process a limited number of transactions per second. When things get busy, it slows down and becomes costly. Mantle addresses this by using Optimistic Rollups, which bundle transactions off-chain and then post a summary to Ethereum. This allows it to handle more users at once without clogging the main chain.

High gas fees: If you’ve ever tried to use Ethereum during a busy time, you know how painful gas fees can be. Mantle reduces those fees significantly by processing transactions more efficiently and using off-chain data availability. This makes everyday transactions like swaps, staking, or minting NFTs much more affordable.

Limited data availability: Data availability refers to how transaction data is stored and shared across the network. Most chains store this data on-chain, which is expensive and slow. Mantle uses EigenLayer’s EigenDA system to store data off-chain in a decentralized way. This keeps things secure without overloading Ethereum and lowers the cost even further.

Rigid architecture: Most blockchains have a monolithic structure, where everything, execution, consensus, and data, is bundled together. Mantle takes a modular approach. Each layer can evolve separately, so developers and the network can keep innovating without breaking everything else. This flexibility gives Mantle a huge edge in long-term adaptability.

Centralized governance in L2s: Many Layer 2 solutions are still controlled by core teams or small groups of investors. Mantle flips that model on its head. Governance decisions are made by the community through on-chain votes. Treasury allocations, upgrades, new features, they’re all decided by MNT holders.

Barriers for developers: Developers often have to choose between cost and compatibility. Mantle solves that by staying fully EVM-compatible while also offering a low-fee environment. It’s easy for Ethereum developers to migrate their apps, and they get better performance without giving up familiar tools.

Mantle doesn’t just try to patch up Ethereum’s weak spots. It’s building a foundation for the future of web3, where the network can scale, stay affordable, and remain truly community-owned. That combination is what sets Mantle apart in a crowded Layer 2 landscape.

Mantle Tokenomics

Mantle’s main token, MNT, isn’t just a digital coin. It’s the central piece of a special kind of blockchain network called a Layer 2, designed to make things faster and cheaper. It combines practical uses, how the network is run, and ways to reward the community. Let’s break down exactly how it works and why it matters.

MNT Token Supply

Mantle has a fixed total supply of around 6.2 billion MNT tokens. This number isn’t random; it’s the result of merging BitDAO’s BIT tokens into Mantle. Basically, they decided to stick to a fixed amount so no new tokens will suddenly flood the market later on, which keeps things predictable for everyone.

As of early 2025, about 3.36 billion tokens are already circulating, so more than half are out there being traded or used in apps. The rest, about 3 billion tokens, are safely kept in Mantle’s Treasury. This reserve is important because it’s set aside for future projects, funding apps, rewarding contributors, and helping Mantle grow.

And here’s something cool: Mantle might introduce ways to reduce the token supply in the future, meaning tokens could become more valuable if there are fewer of them available.

MNT Coin Distribution & Allocation

Here’s how the tokens are shared out:

In Circulation (~51%): These tokens are already out there, being used by traders, everyday users, and those who create apps on the network.

Mantle Treasury (~49%): This large pool of tokens is managed by the community. It’s used to fund projects, create partnerships, offer rewards for providing liquidity, facilitate token swaps, and support programs like mETH and cmETH. It can even be used for buying other assets.

Ecosystem Fund (~$200M): This is a specific part of the Treasury, set aside to support developers, financial applications (DeFi), digital collectibles (NFTs), games, and even projects involving real-world assets.

MNT holders decide everything, including when and how Treasury tokens are used, through a system called on-chain governance. This means decisions are made by the community, not by a small group of people.

MNT Utility & Use Cases

MNT is designed to power the entire Mantle ecosystem, on both the technical and governance layers. It has actual roles to play, and those roles are deeply integrated into the way the network runs.

Gas payments: MNT is the fuel for the network. Every transaction, every smart contract interaction, every bridge transfer, all of it is paid for in MNT.

Governance: MNT holders vote on proposals that shape the protocol. That includes upgrades, budget allocations, grant approvals, and more.

Staking and rewards: You can stake MNT to earn yield while supporting the network. In the future, this will tie into fraud proof systems and other validator services.

Collateral for validators and infrastructure: Node operators and other service providers may need to lock up MNT as collateral, aligning economic incentives with protocol security.

Ecosystem incentives: From DeFi rewards to community growth programs, the Treasury distributes MNT to fund innovation and adoption.

Bridging and liquidity: MNT is used in the asset bridge and liquidity pools, helping to secure and balance cross-chain transfers.

The point is simple: MNT isn’t just something you buy and hold, it’s something you use to participate in every layer of the network.

Governance & Protocol Control

Governance is where Mantle sets itself apart. Instead of creating a token just to raise funds or generate hype, MNT was built with on-chain governance in mind. Token holders are in full control of the protocol’s future.

Proposal creation: Anyone can submit a governance proposal if they meet the minimum requirements.

Discussion and feedback: Proposals go through open forums for community input and iteration.

Voting: MNT holders vote directly on-chain. The more tokens you hold, the more weight your vote carries.

Execution: If a proposal passes, it gets implemented. That could mean releasing funds, deploying upgrades, or forming new committees.

Supporting all of this is the Mantle Economics Committee, elected by the DAO to help review proposals and ensure treasury funds are used wisely. But even they answer to the token holders. This structure keeps Mantle adaptable without sacrificing transparency, and it gives the community a real stake in everything from tech development to ecosystem expansion.

Mantle’s Market Dynamics & External Factors

Tokenomics can lay the foundation, but market behavior is what shapes how a token performs in the wild. MNT’s value is influenced by a mix of internal activity and external forces, some you can control, some you can’t, but all of them matter.

Ecosystem growth: As more dApps and users launch on Mantle, demand for MNT increases. More transactions mean more gas usage, and more staking or yield programs tie up supply.

Treasury usage: Large-scale funding proposals, ecosystem grants, or new liquidity programs can shift community sentiment and attract outside interest.

Ethereum correlation: Since Mantle is built on Ethereum, it often mirrors ETH’s broader price movements. Bullish ETH markets tend to lift MNT too.

Liquidity and exchange support: Listings on major CEXs and strong DEX activity make it easier for users to buy, sell, and trade MNT, which directly affects market dynamics.

Staking and restaking programs: When MNT gets staked or restaked into protocols like EigenLayer, it reduces active supply that can create scarcity and upward pressure on the price.

Governance activity: A responsive, involved community that consistently votes on smart proposals increases long-term trust in the project and helps stabilize demand.

This combination of internal incentives and external exposure is what ultimately defines MNT’s position in the market. The more usage and participation the ecosystem sees, the more resilient the token becomes across market cycles.

How Does Mantle Crypto Work?

Mantle is designed from the ground up to solve Ethereum’s most pressing pain points, slow transactions, high gas fees, and limited scalability. But it doesn’t do this by copying what others have done. It takes a modular approach, letting each part of the system focus on what it does best.

Transactions are executed off-chain, final security is handled by Ethereum, and data availability is outsourced to a faster, cheaper system. What you get is a blockchain that feels fast, costs less, and can adapt over time. Let’s dive into exactly how that’s possible.

Architecture Behind the Mantle (MNT) Coin

Mantle’s architecture is what sets the foundation for everything else it can do. At its core, it’s modular, which means it separates the different jobs of a blockchain into different layers. Unlike traditional blockchains that cram consensus, execution, and data into one bulky system, Mantle breaks it up and gives each layer its own optimized space to perform.

Optimistic Rollups: Mantle groups transactions together off-chain, then posts a summary of what happened to Ethereum. This is faster and cheaper than doing everything directly on Ethereum.

EVM-Compatible Execution Layer: Developers can build apps on Mantle the same way they do on Ethereum. No need to learn a new coding language or framework. It just works.

Consensus and Settlement on Ethereum: Even though transactions are handled off-chain, final verification happens on Ethereum’s mainnet. That gives Mantle the same level of security without carrying the same load.

Data Availability with EigenDA: Instead of putting transaction data directly on Ethereum, Mantle stores it off-chain using a decentralized layer called EigenDA. This makes data handling significantly cheaper and more scalable.

By splitting these layers apart, Mantle becomes more flexible and efficient. Each layer can evolve without dragging the rest of the system with it. That makes the protocol adaptable over time and helps keep performance high as usage grows.

Mantle Blockchain Structure

Mantle’s internal structure is built to be lean, powerful, and modular. This means that every core part of the blockchain, from execution to settlement, is broken into separate, purpose-built layers that interact seamlessly.

Execution Layer (EVM): This is where smart contracts live and run. It handles the logic and computation that powers decentralized apps.

Sequencer Layer: Responsible for ordering transactions and bundling them efficiently. It controls what goes into the next block and in what order.

Settlement Layer: After a batch of transactions is finalized, it’s posted to Ethereum for security. This is where Mantle taps into Ethereum’s trust model.

Data Availability Layer (EigenDA): All the raw transaction data is stored off-chain but in a secure, decentralized system. This layer ensures that all transaction details are available when needed, without cluttering Ethereum.

This separation of responsibilities allows Mantle to run with fewer bottlenecks. Execution is faster, settlement is secure, and data is cheaper to store. It’s like giving each part of the blockchain its own lane on the highway so they can all move at full speed without getting in each other’s way.

Token Standards & Smart Contracts

One of Mantle’s biggest advantages is how easy it is for Ethereum developers to build on it. There’s no learning curve, no new language, and no special workarounds. Everything is designed to work just like Ethereum, only faster and cheaper.

ERC-20 Token Standard: MNT follows Ethereum’s most common token format, which makes it instantly compatible with wallets, exchanges, and apps.

EVM-Compatible Smart Contracts: If you’ve written contracts in Solidity, they’ll run on Mantle with minimal or no changes. You can use familiar tools like Hardhat, Remix, or Truffle to deploy and test.

Security and Development Tools: Standard best practices apply. Developers are encouraged to audit, simulate, and test smart contracts exactly as they would on Ethereum.

This compatibility means Mantle can easily onboard Ethereum developers and existing projects without friction. It removes one of the biggest barriers to adoption: technical migration. Instead, projects can move or expand to Mantle while keeping the same infrastructure and dev experience they’re used to.

Scalability & Performance

Mantle was built with performance in mind, and it shows. It doesn’t just improve on Ethereum, it leaps ahead by orders of magnitude in throughput, latency, and cost.

High Transactions Per Second (TPS): Mantle can process hundreds of transactions per second, far beyond Ethereum’s typical range. This makes it suitable for high-volume use cases like gaming, trading, and social apps.

Fast Block Finality: Transactions are confirmed quickly, often within two seconds, making the user experience feel nearly instant.

Low Gas Fees: Thanks to off-chain execution and EigenDA data handling, Mantle users pay a fraction of Ethereum’s gas costs. Fees are consistently low, even during high network demand.

Future-Proof Scaling: While it currently uses Optimistic Rollups, Mantle is also exploring support for ZK rollups and other advanced scaling methods. The modular design makes it easy to upgrade specific components without starting from scratch.

Mantle doesn’t just scale, it does it intelligently. The network can grow without slowing down, and developers don’t have to choose between speed and security. It’s the kind of infrastructure that can support real-world demand.

Benefits and Drawbacks of MNT Crypto

Like any blockchain project, Mantle comes with its own set of strengths and trade-offs. Understanding both gives a clearer picture of what it can realistically achieve and where caution is still needed.

Benefits

Fast and low-cost transactions: Great for end-users and developers building anything from DeFi platforms to games.

EVM compatibility: Makes developer onboarding and smart contract migration simple.

Strong security: Relies on Ethereum’s battle-tested consensus for settlement.

Flexible modular design: Each layer can improve independently, keeping the network adaptable.

DAO governance: Token holders have real influence over the protocol’s evolution.

EigenDA integration: Off-chain data availability keeps fees low while maintaining transparency.

ZK rollup potential: Mantle is future-ready, with plans to add zero-knowledge technology for even better performance.

Drawbacks

Still early-stage: As with any new protocol, bugs, vulnerabilities, or inefficiencies could emerge over time.

Ethereum dependency: If Ethereum slows down or changes, Mantle’s performance could be affected.

Operational complexity: Modular systems require active coordination and monitoring.

Fraud proof limitations: With Optimistic Rollups, withdrawals require a delay period to allow for challenges.

Reliance on third-party DA: Using EigenDA means trusting another network layer for data availability.

Despite these challenges, Mantle offers one of the most complete and forward-thinking Layer 2 experiences in the ecosystem today. Its design isn’t just efficient, it’s built to evolve.

Mantle’s Analytics

When it comes to assessing the long-term strength of any crypto project, numbers talk. On-chain metrics and developer activity offer a clear window into how alive, secure, and active the protocol actually is. So before throwing money into MNT, it’s worth examining what’s happening behind the scenes. Here’s a deep dive into Mantle’s token concentration, developer presence, and GitHub commit activity.

On-Chain Metrics

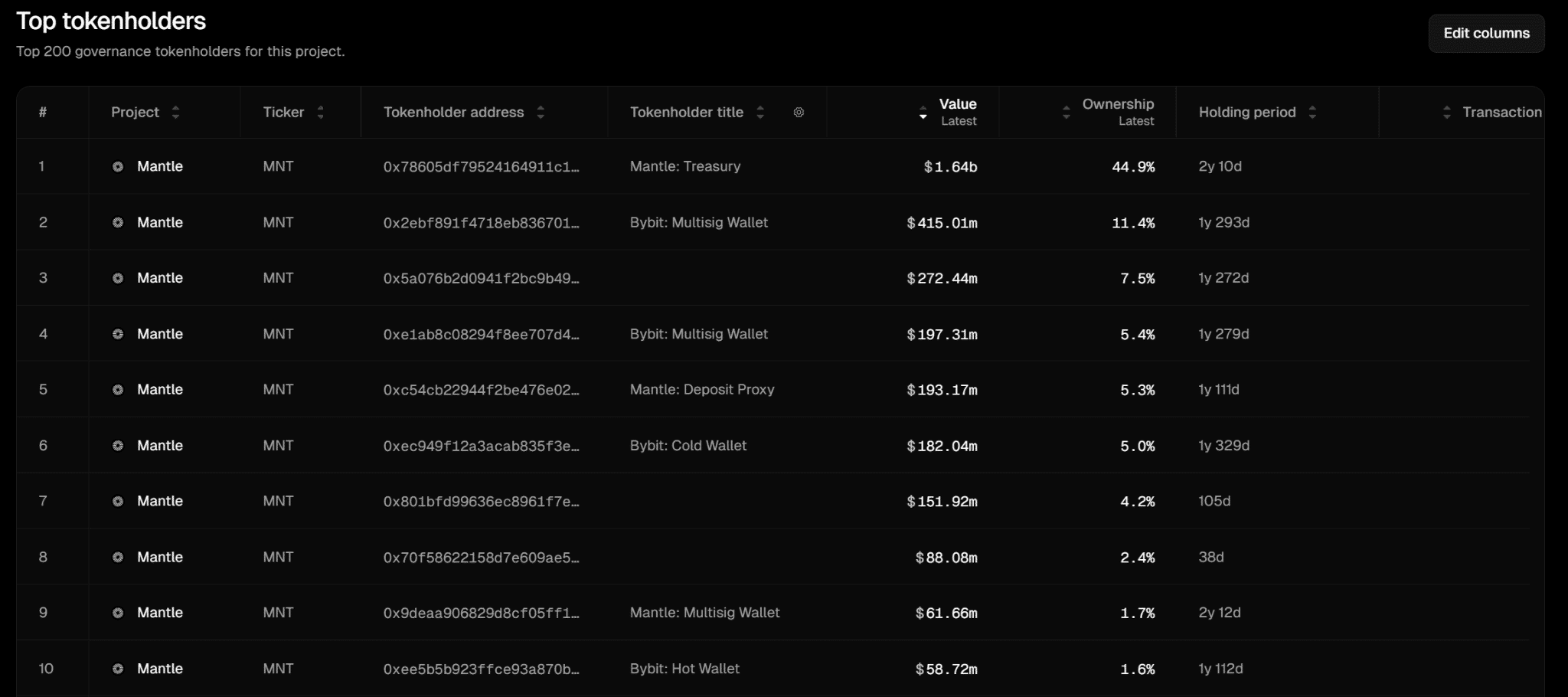

Let’s start with where the money is sitting. Token distribution can reveal how decentralized (or centralized) a project truly is. In Mantle’s case, over 44.9% of the total MNT supply is held by the Mantle Treasury, worth roughly $1.64 billion. That’s nearly half the supply under one entity. The next biggest holders are a mix of Bybit wallets and Mantle deposit proxies, with ownership ranging from 11.4% to 1.6% individually.

Here’s the top-line breakdown of the top 10 holders:

Mantle Treasury: $1.64b (44.9%)

Bybit Multisig Wallets: $415m, $197m (11.4%, 5.4%)

Mantle Deposit Proxy: $193m (5.3%)

Bybit Cold & Hot Wallets: $182m, $58m (5.0%, 1.6%)

Other addresses (presumed team or ecosystem wallets): $151m to $61m

While this setup isn’t unusual for early-stage Layer 2s, it does highlight a high concentration of tokens in institutional or protocol-controlled wallets. That can be good for funding and stability, but it’s also something to monitor, especially in terms of sell pressure or governance voting power down the line.

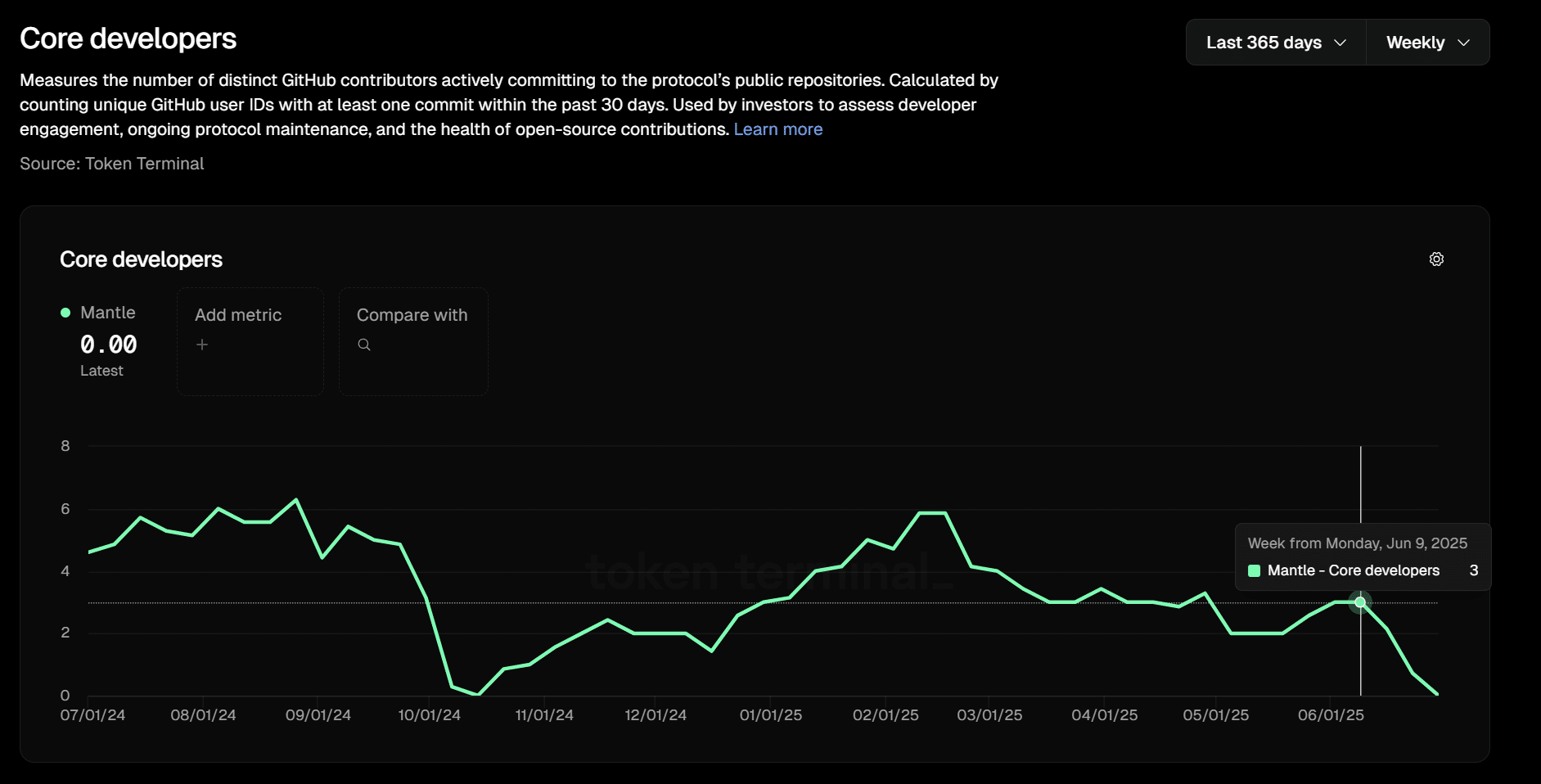

Development Activity: Core Developers and GitHub Commits

Now let’s talk code. A project with no commits or core contributors is like a car running on fumes, it might coast for a while, but it’s not going far. So what’s Mantle’s engine telling us?

Based on data from Token Terminal, the number of core developers contributing to Mantle’s GitHub repos recently dropped to zero. While that sounds harsh, it’s important to understand what this metric actually tracks: GitHub accounts that made at least one commit in the last 30 days. So while it doesn’t necessarily mean the devs are gone, it does point to a current lull in core-level contributions.

Zooming out, we can see more nuance:

101 commits in the past 365 days across Mantle’s tracked GitHub repositories.

Activity spiked in early 2025 (especially February), then tapered off gradually.

Most weeks saw under 5 commits, and in many cases, just 1 or none.

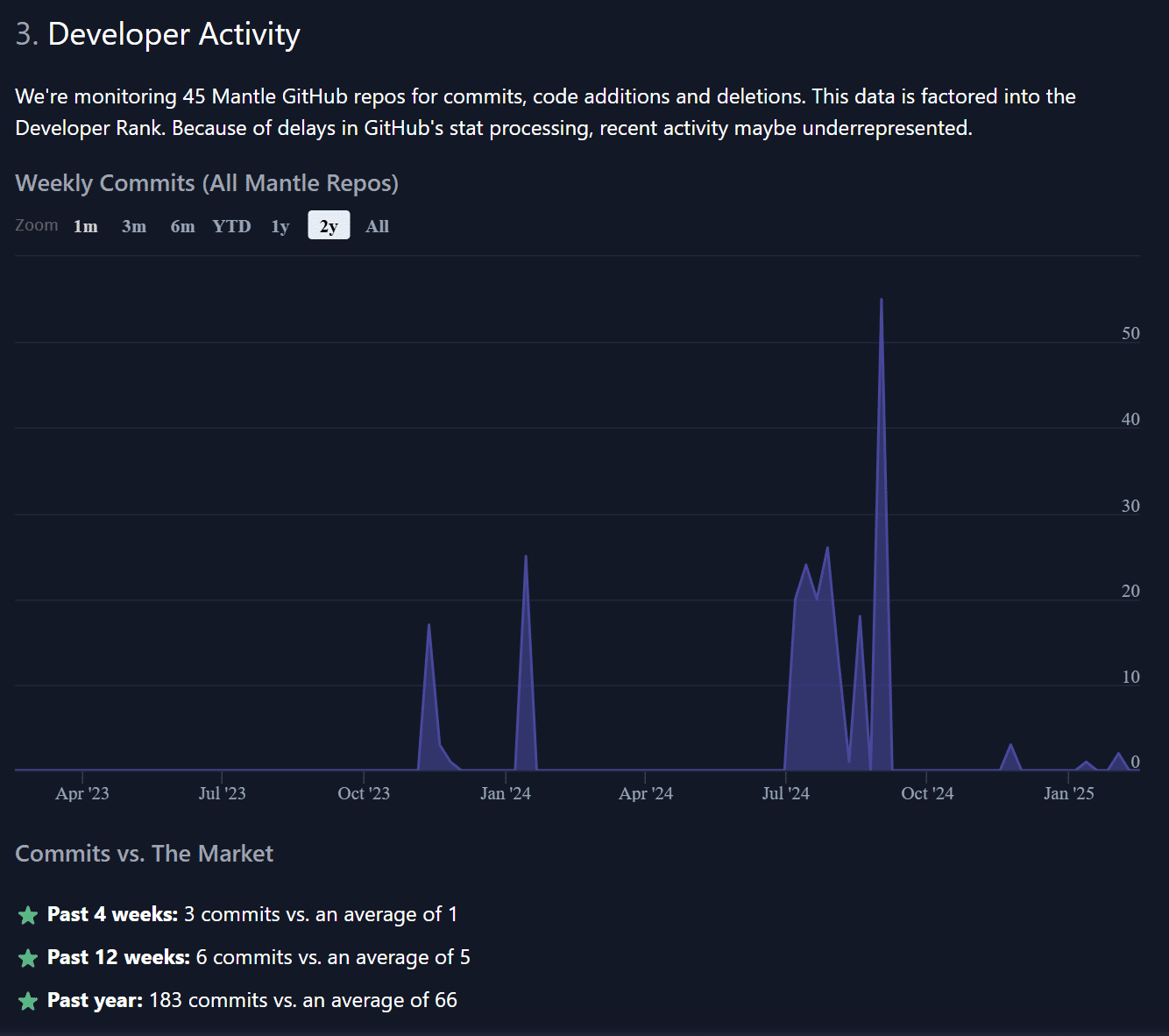

Looking at Stack.money, which monitors a wider range of Mantle’s GitHub repos (45 total), the full picture comes into focus:

Past 4 weeks: 3 commits vs. a 1-commit market average.

Past 12 weeks: 6 commits vs. a 5-commit market average.

Past year: 183 commits vs. an industry average of 66.

So despite recent dips, Mantle’s dev activity is still relatively healthy when viewed on a 12-month timeline. The project might be taking a breather, or preparing for its next major push.

Is Mantle (MNT) a Buy?

MNT is currently trading around $0.56, which is a far cry from its $1.50 peak back in April 2024. That’s more than a 60% drop from the top, which might look scary at first glance, but it also screams opportunity if you understand where the project is headed.

This kind of pullback is common in crypto, especially after a major rally. The bigger question is whether Mantle still has momentum behind it, and if the current price reflects fear, or simply undervaluation.

Here’s why it might be worth considering:

Undervalued potential: Mantle is working on some serious tech under the hood, including ZK-validity rollups via Succinct SP1 and an upgraded version of EigenDA. These upgrades could drastically improve performance and attract new developer attention.

Ecosystem traction: With over $1.3 billion in total value locked and multiple listings on major platforms like Coinbase, Mantle is no longer flying under the radar. It’s part of the mainstream Layer 2 conversation now, which wasn’t the case a year ago.

Solid long-term projections: Analyst outlooks are leaning bullish, with some forecasting MNT to hit $1.25 or more within the next 12 months. While no prediction is guaranteed, that would be more than a 2x from today’s price.

But it’s not without risk:

Still early: Mantle is relatively young in blockchain terms. The network is growing fast, but it’s still finding its footing. If key upgrades get delayed or underdeliver, the price could stay stuck or even drop further.

Highly correlated with ETH: Like many Layer 2 tokens, MNT tends to move in sync with Ethereum. If ETH dumps, MNT usually follows. That’s great in a bull market, but risky in a downtrend.

Mixed technical signals: While the fundamentals look promising, some technical indicators are still flashing red. It’s not in full breakout mode yet.

If you want to buy Mantle safely, we suggest heading straight to any of the reputable platforms below. In case you want a step-by-step guide to purchasing MNT, consider checking out our “How to buy Mantle” article.

Best Mantle Wallets

After buying Mantle, you need a wallet that supports MNT, protects your funds, and makes daily interaction smooth and secure. Here are three top options:

Best Wallet: A flexible mobile and desktop wallet with full Mantle support, ideal for everyday use with a clean interface and self-custody setup.

Trezor Safe 5: A hardware-based, user-friendly non-custodial wallet and support for multiple cryptocurrencies, including MNT.

Ledger Flex: A hardware wallet that offers military-grade security and offline storage, perfect for anyone holding large MNT balances long term.

Mantle’s Future: What To Expect?

What makes Mantle exciting isn’t just its current price or how many apps are already live. It’s what’s coming next. And if you’ve followed their roadmap or read their recent updates, you’ll know the team is laying serious groundwork for the future.

ZK-validity rollups via Succinct SP1: This isn’t just a tech buzzword. Zero-knowledge rollups could make transactions faster, more secure, and significantly cheaper. Mantle is already testing this upgrade and plans to roll it out in production soon.

EigenDA v2: The next version of Mantle’s data availability layer will further reduce transaction costs and increase throughput. That means more apps, more users, and better scalability across the board.

Sequencer decentralization: Right now, many Layer 2 networks rely on centralized sequencers. Mantle is working toward a decentralized alternative, which would give users more trust and eliminate single points of failure.

$200 million ecosystem fund: This isn’t a hypothetical budget; it’s already being deployed. Grants are flowing to DeFi protocols, NFT platforms, infrastructure tooling, and AI-integrated apps. Developers follow funding, and Mantle’s making itself a magnet.

Add to that a governance system that actually works, where token holders can vote on real upgrades and funding, and you’ve got a roadmap that balances speed with sustainability.

The community vibe? Cautiously optimistic. Builders are engaged, governance is active, and sentiment is quietly bullish. It’s not a hype-driven project. It’s a builder-driven one. And that’s what tends to perform best over the long run.

Conclusion: What is Mantle (MNT)?

Mantle was built with a specific goal in mind: to improve how Ethereum scales, without compromising speed, cost, or decentralization. It does this by separating the blockchain into distinct layers that each serve a focused purpose, creating a system that is more efficient and easier to maintain over time.

Its success depends on how effectively developers and users adopt the network. With tools that support Ethereum standards, active governance, and one of the largest treasuries in the space, Mantle is well-positioned to attract real usage. The pieces are already in place, from its modular architecture to its plans for ZK rollups and decentralized sequencing.

What happens next will rely on continued upgrades, smart treasury deployment, and real-world demand. But as a Layer 2 designed for performance and community ownership, Mantle is on track to deliver on what it was built for.