PIPPIN has been one of the strongest movers this week. The token jumped more than 57% in the last 24 hours and has climbed sharply since the October 10 low. Even with this speed, the PIPPIN price rally still looks healthier than before. Two key chart signals support the trend, although one of them now hints at a short cool-down first.

This mix creates a setup where dips may show up briefly, but the broader structure stays intact.

Momentum Shows Pull-Back Risk While Buyer Strength Still Holds

The two-day PIPPIN price chart shows why this move may pause but not break.

RSI (Relative Strength Index), which measures momentum on a 0–100 scale, is deep in the overbought zone again. When RSI sits this high, traders often expect a short pull-back. The same thing happened on January 11 when PIPPIN hit its old high near $0.33.

That time, the drop quickly escalated into a crash-like move. This time, the pattern is different. Price made a lower high, and RSI also made a lower high. That means no bearish divergence, and that the price and momentum are in agreement. So the signal still points to a mere cool-down (pullback), courtesy of the 90+ overbought RSI level.

PIPPIN Price History: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

CMF gives the opposite signal. CMF (Chaikin Money Flow) tracks whether large wallets are adding or removing tokens.

Between January 11 and December 1, CMF made a higher high even while the PIPPIN price made a lower high. This is a bullish divergence, indicating that larger buyers are active.

CMF has also stayed above zero for most sessions since September 6 on the two-day chart, which is usually a sign of steady spot demand. When this metric stays positive, the trend often recovers quickly, even if a pullback surfaces. Last time when the PIPPIN price crashed, the CMF was lower and quickly broke below the zero line. This time, the big money flow looks healthier.

Bullish Divergence Appears: TradingView

Together, the two signals show why PIPPIN may cool briefly but still stay in a strong uptrend.

PIPPIN Price Levels: Where Cool-Down Ends And The Next Push Starts

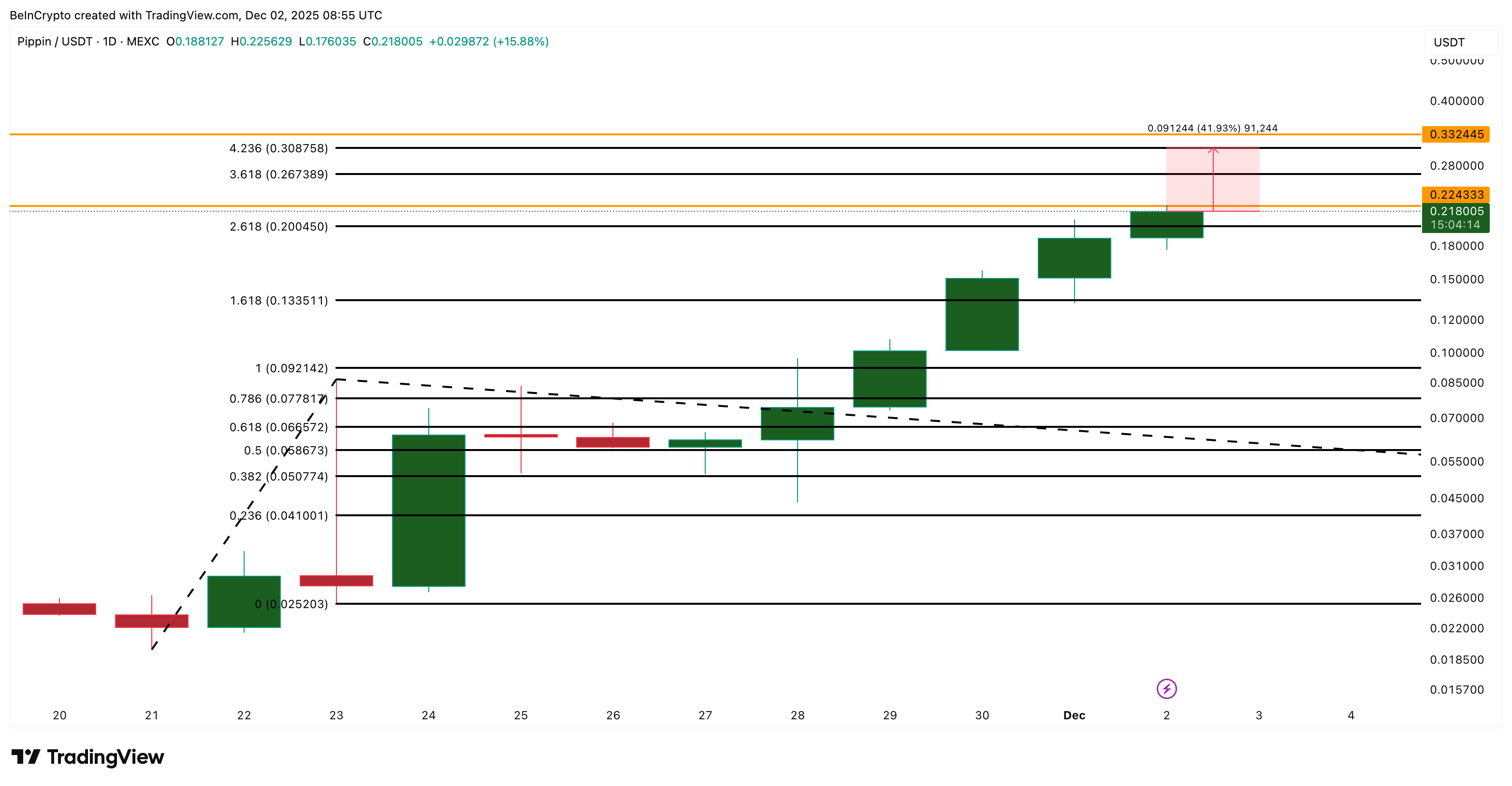

PIPPIN trades near $0.21 and faces resistance close to $0.22, where the latest Fibonacci extension capped the move. If the rally picks up again, the next targets sit around $0.30 and then $0.33, which is the January all-time high. A daily close above $0.33 can set up a short-term price discovery phase.

If a pull-back forms, the structure stays healthy above $0.13.

The trend weakens below $0.13, and a fall under $0.09 would invalidate the current rally setup.

PIPPIN Price Analysis: TradingView

For now, the signals are clear. RSI warns of a pause, CMF shows strong buyer support despite the early December dip, and the key PIPPIN downside levels remain far above invalidation.

So the PIPPIN price rally may cool, but large money action could heat it up real soon.