Takeaways:

Vanguard opening crypto ETF access to tens of millions of clients marks a structural shift in how retirement capital can engage with Bitcoin.

As institutional demand flows into spot $BTC and $ETH, capital increasingly rotates toward higher-risk infrastructure projects building on Bitcoin’s base layer.

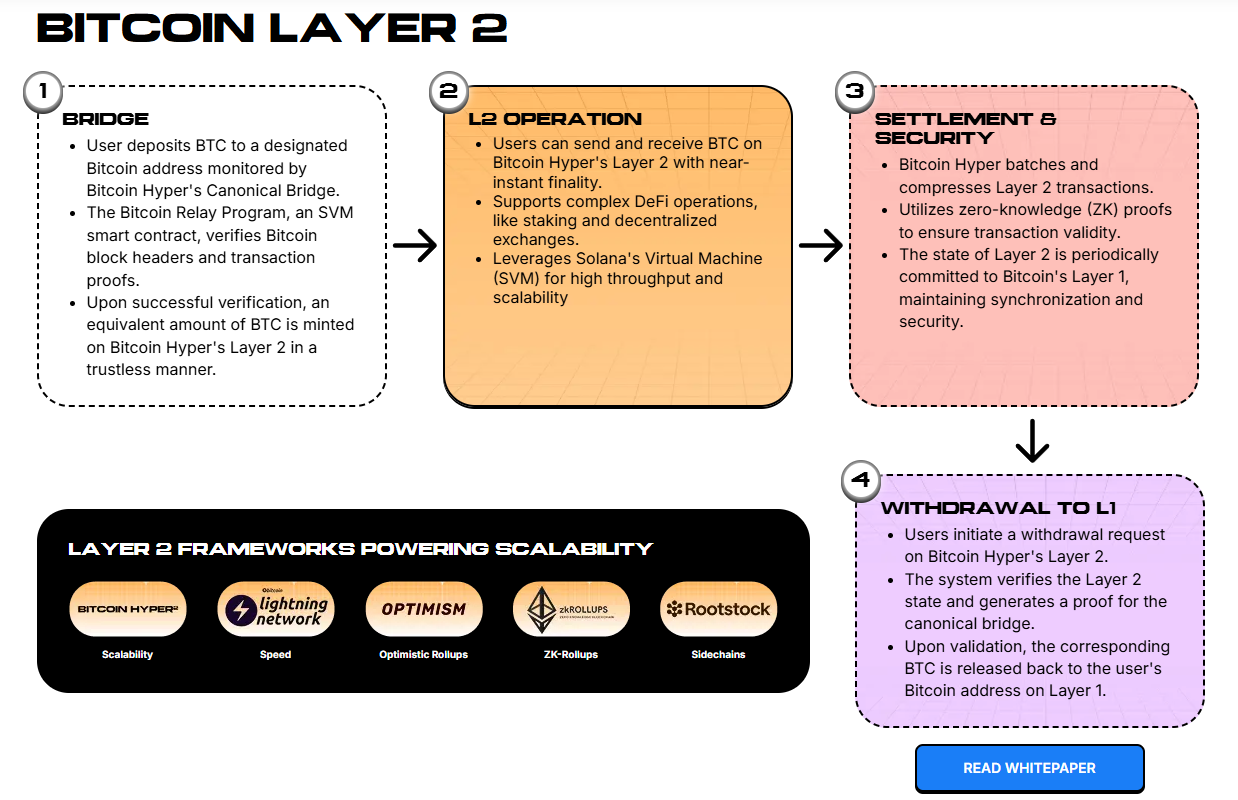

Bitcoin Hyper leverages an SVM-powered Layer 2 anchored to Bitcoin to address slow throughput, high fees, and limited programmability in the BTC ecosystem.

Competition among Bitcoin Layer-2s and sidechains is accelerating, with developers prioritizing EVM or SVM compatibility and clear pathways to $BTC liquidity.

Vanguard’s decision to lift its internal ban on crypto ETFs is a genuine regime change for Bitcoin access.

Around 50M clients can now get exposure to spot Bitcoin and Ethereum funds in the same interface they use for broad index products and retirement portfolios, without touching an exchange.

The move has been brewing for months, with early reporting highlighting how big the move would be.

<img alt="Vanguard Lifts Crypto ETF Ban, Reveals Bitcoin Hyper’s High-Upside Narrative" title="Vanguard Lifts Crypto ETF Ban, Reveals Bitcoin Hyper’s High-Upside Narrative" src="/d/file/articles/uploads/2025-12-02/zhs5iwudfxt_23592.png" s potential move."/>

That matters because this is not retail speculation in isolation. It’s slow-moving, rules-driven retirement capital that tends to compound over years, not weeks.

As allocations shift, even from 0% to 1–2% $BTC in large retirement accounts, the incremental demand can be structurally significant for Bitcoin’s float and long-term price dynamics.

Once that kind of conservative capital starts edging into $BTC, the risk curve usually reorders itself.

Some investors are content with ETF-style beta exposure, but more active traders look further out on the spectrum, toward Bitcoin-native infrastructure and higher-volatility ecosystem plays that can potentially outperform the underlying asset in bull phases.

And now, with Vanguard’s move finally here, that’s possible; and it comes from one of the largest and previously crypto-averse asset managers around.

That’s where Bitcoin Hyper ($HYPER) enters the narrative. As capital and attention flow back to Bitcoin, infrastructure that tries to fix Bitcoin’s throughput, fee volatility, and programmability gaps becomes a more obvious bet.

Bitcoin Hyper positions itself as a Bitcoin Layer 2 with Solana Virtual Machine (SVM) execution, pitching Solana-level performance or better while anchoring to Bitcoin’s settlement layer and brand.

Why New Bitcoin Capital Is Looking Beyond ETFs

The first-order effect of Vanguard’s policy reversal is clear: more flows into spot $BTC and $ETH ETFs, more liquidity, and a stronger ‘Ok’ signal for trustees that previously avoided crypto on policy grounds.

But the second-order effect is the re-rating of Bitcoin as core infrastructure rather than a fringe asset, which historically pulls in developer talent and venture risk.

If $BTC reclaims narrative dominance, bottlenecks return to the foreground: roughly 7 transactions per second on L1, unpredictable fee spikes during peak demand, and a scripting model that never evolved into full smart contracts.

Competing solutions now include Lightning for payments, rollup-style Layer 2s, and emerging Bitcoin sidechains trying to capture DeFi and gaming flows without leaving the Bitcoin universe entirely.

In that competitive mix, Bitcoin Hyper differentiates by leaning into SVM compatibility and sub-second execution, pitching itself to developers who already know Rust and the Solana tooling stack, but want Bitcoin security and $BTC liquidity as the base asset.

Bitcoin Hyper’s SVM Layer 2 Pitch to $BTC Holders

Where many Bitcoin scaling projects focus on incremental gains, Bitcoin Hyper goes straight for a high-performance architecture: Bitcoin L1 for settlement plus a real-time SVM Layer 2 for execution.

The idea is to deliver Solana-style parallel processing and extremely low-latency block production, while periodically anchoring state back to Bitcoin for finality and dispute resolution.

That design directly targets Bitcoin’s three structural frictions:

slow base-layer confirmation times

high and spiky fees

lack of native smart contracts

On Bitcoin Hyper, developers can deploy SVM-based smart contracts in Rust, spin up SPL-compatible tokens tailored for the L2, and build DeFi, NFT, and gaming applications that feel closer to sub-second, low-fee Solana UX than legacy Bitcoin transactions.

From a capital-formation angle, the project already has traction: the presale has raised $28.8M, with tokens priced at $0.013365. Whales are taking an interest: purchases of $379K and $500K have contributed to $HYPER’s steady growth. Don’t miss out; learn how to buy $HYPER to join in.

Whilst $HYPER is the coin that funds it all, you can still benefit right now by taking advantage of the 40% staking rewards currently on offer. Hurr though, as these rewards are dynamic, so change as the presale progresses.

If execution matches the SVM performance claims, $HYPER could become a levered way to express a view on Bitcoin’s next infrastructure cycle.

Consider joining the $HYPER presale.