If you have been wondering what Berachain is or why people keep talking about it, you’re not alone. This chain has been getting a lot of attention for doing things differently, especially when it comes to how it handles rewards, validators, and on-chain activity.

In this Berachain review, we’ll break down exactly how the network works, what makes it stand out from other EVM chains, and how you can get started. Whether you’re a builder, investor, or just curious about the hype, this guide gives you the full picture in plain English.

Key Takeaways

Berachain uses Proof of Liquidity to reward actual activity, not just passive staking

You can use familiar Ethereum tools like MetaMask, Hardhat, and Foundry

The three-token system (BERA, BGT, HONEY) keeps things secure, stable, and active

Validators, users, and builders all rely on each other to grow the network

Block times are two seconds, and transactions are final the moment they are confirmed

Quick Facts About Berachain (BERA)

Launch Origin: Built using the Cosmos SDK and powered by a Proof of Liquidity (PoL) model.

Founders: Created by a pseudonymous team of developers known as Papa Bear, Dev Bear, Homme Bera, and Smokey the Bera.

Core Concept: Berachain is a new Layer 1 blockchain that rewards actual liquidity and chain usage instead of just locked-up tokens.

Native Token: BERA is used to pay for gas and staking on the network.

Ecosystem Tokens: Along with BERA, the chain uses BGT for governance and HONEY as a native stable asset.

Blockchain Type: EVM-compatible and modular. It’s built on Cosmos but works just like Ethereum when using smart contracts or apps.

Primary Focus: To connect real liquidity with chain security so the network can grow in a healthier and more useful way.

Key Strength: Its tri-token system and Proof of Liquidity setup are built to reward activity, not just staking or speculation.

What is Berachain: Summary

Berachain offers numerous opportunities for you to get involved. You can connect a crypto wallet like MetaMask, bridge in funds, and start using dApps without much setup. If you have used other EVM chains before, it’ll feel familiar, but the way rewards and activity are structured makes it stand out.

Want to earn through liquidity or vaults? You can. Want to build with tools you already know? That works too. Everything is designed to keep things moving, not just sitting idle. And with live data on Dune, dashboards on DeFiLlama, and tools like BeraScan, it’s easy to keep track of what’s happening in the ecosystem.

As the network grows, so do the opportunities. Just start small, stay cautious, and explore what the chain has to offer.

Berachain Review 2025

Berachain is a blockchain that works just like Ethereum but adds its own features to strengthen security and keep things running smoothly. It uses a different approach from most chains. Instead of handing out rewards to people who just lock up their tokens, it gives rewards to those who actually help keep the system active by providing liquidity.

This method is called Proof-of-Liquidity, and it’s designed to push rewards toward parts of the chain that are truly being used. Behind the scenes, it runs Ethereum-style systems but with its own setup called BeaconKit framework, which helps confirm transactions quickly while staying fully compatible with tools already built for Ethereum.

The Berachain network officially launched on February 6, 2025, and kicked things off with a big Berachain airdrop to bring in users. The goal was to reduce liquidity fragmentation while introducing a new governance token model.

History of Berachain

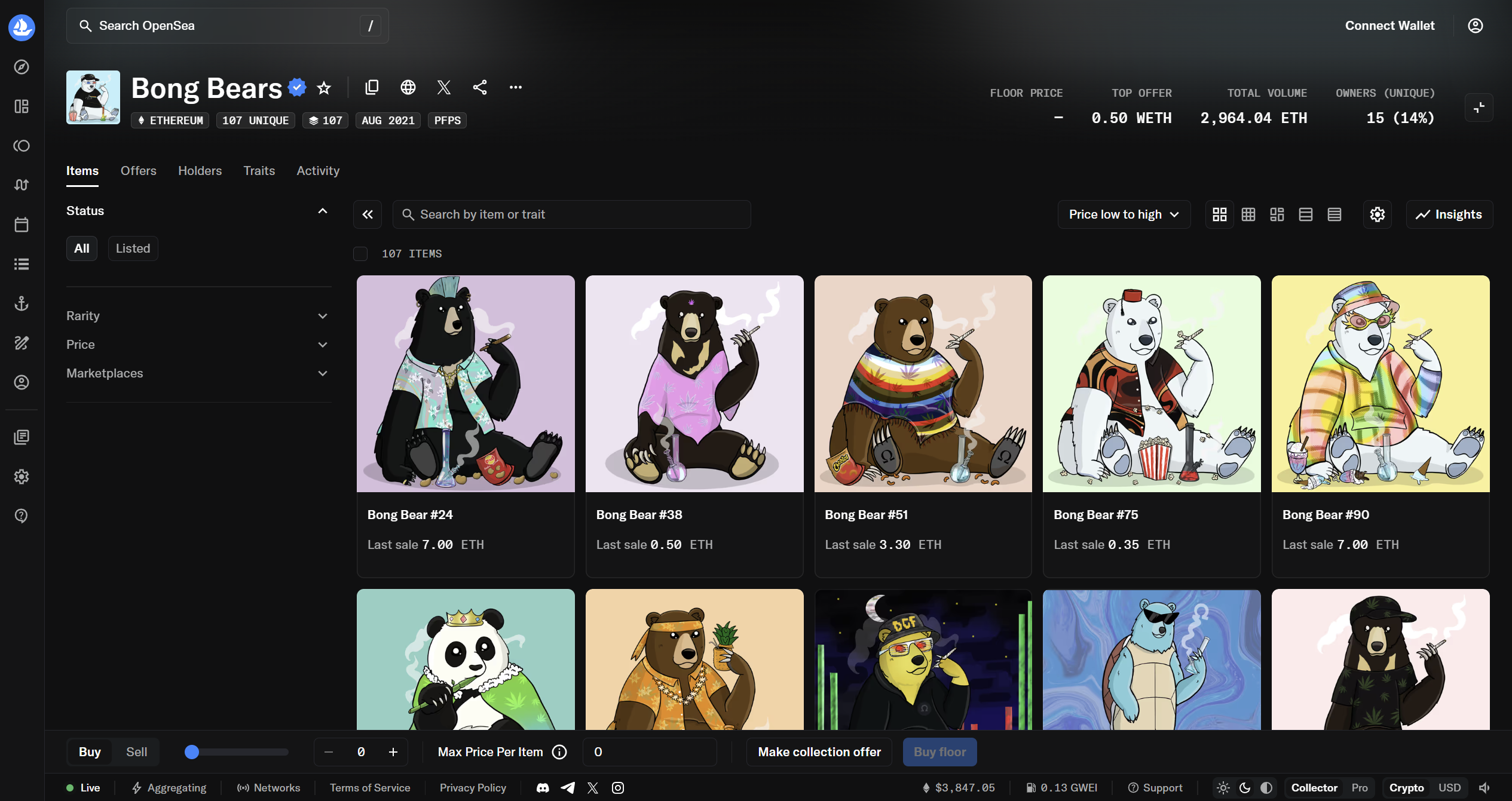

Berachain first came to life in 2021 as a fun bear-themed NFT project called “Bong Bears.” It quickly grew into a much larger community of builders. The project’s playful roots actually helped shape its long-term goals.

The idea was to create a blockchain where incentives and liquidity pools naturally work together. Berachain still supports its six original NFT collections, and there’s even a tool that lets people bring those collections onto the chain using engine API integration.

Before launching, the team Berachain raised funds in two major rounds. They brought in $42 million in April 2023 and another $100 dollars in April 2024. These rounds were led by groups like Framework Ventures and Polychain Capital. To prepare for the mainnet launch, Berachain set up a program that attracted more than a billion dollars in liquidity using vaults on Ethereum.

The official launch happened on February 6, 2025. A few months later, the network went through upgrades that added new features, including the ability for validators to withdraw and support for the latest Ethereum updates. This expanded its EVM compatibility and ensured smooth EVM execution and client performance.

About the Berachain Team

The development is led by a group called Big Bera Labs. The creators and core team members go by names like Smokey the Bera, Papa Bear, Dev Bear, and Homme or Man Bera. Two main groups manage the project. The Berachain Foundation handles the overall protocol, while the BGT Foundation focuses more on governance and community input. Both work together to make sure everything runs smoothly. The team shares updates through official posts, documentation, and social media.

Vision of the Berachain Blockchain Project

Berachain wants to bring together validators, users, and apps in a way that benefits everyone. The goal is simple: the same money that keeps the network secure should also help grow liquidity.

Instead of rewarding people just for locking up tokens, Berachain sends those rewards to special vaults tied to useful actions like providing liquidity or lending. Builders can offer incentives to get those rewards, and users who supply liquidity earn a token called BGT rewards, which they can then give to validators. This token can’t be traded, so users need to actively participate to earn it.

The chain itself still works just like Ethereum, so any apps built on Ethereum can be moved over easily. BeaconKit framework Berachain also allows for quick transaction finality and smoother upgrades in the future.

Berachain Tokenomics

Berachain runs on a three-token system. Each token has its own role, and together they keep things running smoothly while rewarding people who actively use the chain. The goal is to separate utility, governance, and stability so each part of the system does one job well.

Berachain uses three cryptocurrency tokens, each with its own role:

BERA is the main gas token used for fees and staking. It can be staked directly or through vaults. When people pay transaction fees with BERA, those tokens are burned. This token also decides how much power a validator has in the network.

BGT, which stands for Berachain governance token, is earned by depositing approved POL eligible assets into vaults. It helps boost validators so they can direct more rewards, and it also earns holders a cut of fees from key apps if those apps are boosted. BGT can be swapped 1-for-1 into BERA, but it can’t be traded between users. You have to earn it through activity on the network.

HONEY is a native stablecoin that stays close to the value of the U.S. dollar. It’s backed by other accepted assets like USDC, pyUSD, USDT0, and USDE. It has a feature called basket mode that keeps it stable even if one of its backing assets drops in value. Any fees from creating or redeeming HONEY are shared with BGT holders.

All block rewards come in the form of BGT emissions. Validators get a base amount per block and then an extra amount that they can direct to reward vaults. The more BGT that gets delegated to a validator, the more rewards that validator can control.

This helps keep rewards flowing to the most active parts of the network. There are 69 validators at a time, and the more BERA a validator holds, the more likely they are to be chosen. This design supports network security and keeps DeFi protocols running efficiently.

BERA Token Supply

At launch, there were 500 million BERA tokens.

Each year, around 10% more tokens are added through BGT emissions, depending on how the network is set up. Since BGT can be swapped into BERA, it slowly adds more BERA into circulation.

The token has 18 decimal places, just like many other tokens in the Ethereum ecosystem.

BERA Coin Distribution & Allocation

When Berachain launched, it created 500 million BERA tokens to kickstart the ecosystem. These tokens were divided across investors, the core team, and the broader community to support early growth, development, and long-term engagement. Here’s how the initial supply was split up.

Out of the 500 million BERA tokens created at the start:

171.5 million went to investors. That’s about 34.3%, spread across early and later funding rounds.

84 million were set aside for the core team and advisors, which is 16.8%.

244.5 million were kept for the community, which makes up the remaining 48.9%.

This group (holding 48.9% BERA) was split like this:

79 million went to the Berachain airdrop, which is about 15.8%.

65.5 million were set aside for future community programs, or 13.1%.

100 million was allocated to ecosystem growth and research, which is 20%. From that amount, 9.5% was unlocked at launch to support tools, liquidity provision, and validator programs.

Everyone receiving tokens follows the same schedule: nothing for the first year, then equal portions over the next two years.

Utility & Use Cases

Berachain rewards activity. Users who provide liquidity, validators who secure the chain, and developers who build on it all play a role in keeping things moving. Here’s how the system turns that into real utility.

If you are a user or liquidity provider, you can earn BGT by depositing LP or receipt tokens into reward vaults. You can then delegate that BGT to boost a validator and receive a portion of their rewards, and a share of fees from apps like BEX and Honey Swap. You can also use HONEY for transactions or mint it using other accepted assets.

If you are a validator or node operator, you need to stake BERA to be part of the active validator group. You also decide where rewards go by setting up vault allocations. The more BGT you receive from users, the more control you have over how rewards are distributed. The staking rewards system encourages ongoing engagement and price stability.

If you’re a builder or developer, you can apply to get your vaults approved, ask validators to send rewards your way, and grow your app’s activity using the built-in reward system. Since Berachain works just like Ethereum, you don’t need to change much to bring your apps over. You can also deploy DeFi applications and lend on a lending platform.

Everything feeds into the same loop. Users support validators, validators boost builders, and rewards stay tied to what actually matters. It’s all designed to keep the network useful, active, and aligned.

Governance & Protocol Control

The people who hold BGT make the big decisions. They vote on things like which vaults get approved and how rewards are handled.

Here’s how it works:

Someone proposes a change.

There’s a short waiting period.

Then there’s a five-day voting window.

At least 20% of all BGT must be used in the vote.

After the vote passes, there’s a two-day delay before it goes into effect.

There’s also a safety system in place. A group of nine trusted members, known as a multisig, can cancel bad proposals during the delay period if needed. Meanwhile, fees from major apps are turned into WBERA and shared with BGT holders who are boosting those apps. This keeps everything aligned and encourages smart decisions that help the network grow.

With a modular framework, smart contracts, and an EVM-compatible execution layer, Berachain supports the entire DeFi ecosystem and allows users to earn rewards through token generation event participation or use cases like a perpetual trading platform. The consensus layer operates under a unique consensus mechanism, separate from traditional proof methods, but designed to ensure consensus model reliability with EVM identical performance.

How Does Berachain Work?

Most blockchains focus on security or speed, but Berachain was built with a different priority: making activity matter. Instead of rewarding users for doing the bare minimum, it’s designed to support the people and apps that keep the chain alive.

Everything about the system, from how tokens are earned to how validators are chosen to how apps grow, is meant to keep things moving. It’s not just a chain you build on. It’s a chain that pushes capital where it’s most useful. Every part of the structure was built with that in mind, using proven tools alongside a few new ideas that make it stand out.

Berachain’s Blockchain Structure

The chain splits its work into two parts. One part runs transactions, and the other makes sure everything is agreed on. The transaction part uses slightly tweaked versions of Ethereum software, so developers can use familiar tools like Solidity. The consensus part uses BeaconKit, which helps confirm each block immediately. This setup keeps things fast and smooth without changing the developer experience.

There are 69 validators at a time. A validator’s chance of creating a block depends on how much BERA they’ve staked, but there are minimum and maximum limits to keep things fair and stable.

Token Standards & Smart Contracts

If you’ve built anything for Ethereum, you’ll be right at home here. All the usual tokens and NFTs like ERC-20, ERC-721, and ERC-1155 work the same way. Developers can use tools like Foundry, Hardhat, Viem, Ethers, and Remix. You can also verify smart contracts on BeraScan, just like you would on Etherscan.

Berachain even supports new wallet features that allow you to group actions together or enable apps to cover gas fees for users. There are simple guides if you want to try these out.

Scalability & Performance

Blocks are fast and confirm instantly. Berachain aims for two-second block times, and each block is final the moment it’s created. The network’s gas limit is around 30 million, which lets it handle plenty of activity without slowing down. This makes things like trading, minting, or sending tokens feel quick and responsive.

Proof of Liquidity (PoL) Explained

Proof of Liquidity, or PoL, is the system that makes Berachain work differently. Instead of just rewarding people for locking up tokens, it rewards those who keep the network active through real usage, apps, and liquidity.

Here’s how it works, step by step:

Validators secure the network by staking BERA. Their chance of creating a block depends on how much BERA they have staked.

When a validator creates a block, two rewards are given out. One is a fixed reward, and the other changes based on how much BGT has been delegated to that validator. This extra support is known as a “boost.”

Validators send the flexible part of their rewards to Reward Vaults. These vaults are connected to specific apps or liquidity pools on the chain and receive the distributed BGT rewards.

Users provide liquidity to these apps or pools. When they do, they get tokens that prove their contribution (like LP tokens). They can then deposit those tokens into Reward Vaults to earn BGT, helping both the network and the apps grow.

Popular vaults attract more attention. The more active a vault is, the more validators and users want to get involved. Some projects also offer extra rewards to encourage validators to send BGT to their vaults. This creates a competitive and rewarding ecosystem.

BGT is earned through real participation. Since it can’t be traded and is only earned through activity, it naturally keeps the system focused on users and apps that add value.

What makes Proof of Liquidity different from older systems is its focus on action. It’s not about locking tokens and waiting for rewards. It’s about putting your capital to work in ways that help the whole network.

In practice, validators care about how much BGT support they get, users care about providing liquidity to earn BGT, and apps care about keeping both groups engaged. Proof of Liquidity links all three groups, validators, users, and apps, into a single system where everyone benefits from one another’s activity. That shared activity is what keeps Berachain running and growing.

Berachain Airdrop Overview

When Berachain launched, it created 500 million BERA. Out of that, 79 million went to an airdrop, which is about 15.8%. The airdrop was aimed at people who helped early on, used the testnet, held Berachain NFTs, or added liquidity to approved apps.

Airdrop Criteria and Patterns

Projects like Berachain usually reward people who actually use the network in real ways. That could include being active on testnets, owning certain NFTs, using early apps, or providing liquidity before launch.

Activities that often count include bridging assets, using the testnet, holding approved NFTs, or interacting with key apps. You can usually check this by looking at wallet addresses, token balances, and past activity using tools that read the blockchain.

To stay safe, always:

Use only the official claim page linked in the main documentation or blog.

Check the site’s address and security certificate. Don’t click on random links from strangers.

Make sure you’re using the right claim contract and interface before signing anything.

Limit what permissions you give and remove any you’re not using.

Check updates on Berachain’s official social media or trusted data partners.

You can also confirm real announcements by seeing if they show up across all Berachain’s official sources. Tools like Dune or Goldsky often reflect the same contracts and data once a claim starts.

Mainnet Status and Launch Updates

Berachain launched on February 6, 2025. From day one, the network supported token transfers, analytics, and ecosystem apps. It uses BeaconKit to confirm transactions instantly.

You can track stats and explore dApps using the explorers and dashboards available. To stay updated, check Berachain’s official blog and docs, along with third-party tools like Dune and Goldsky. The docs also have a changelog to track any protocol changes.

If you’re moving from testnet to mainnet, here’s what to know:

Switch to the correct chain ID and RPC. Mainnet uses chain ID 80094, and the RPC URL is https://rpc.berachain.com.

Redeploy and re-verify any contracts, because testnet addresses won’t carry over.

If you tested on bArtio or Bepolia, update your tools and re-index your data to point at mainnet.

Current Network Phase

Right now, Berachain runs on a two-second block schedule. Each block is confirmed instantly. There are 69 active validators, and the gas limit is set to handle plenty of activity. You can see live block times, gas use, and other stats on BeraScan.

RPC, Nodes, and Tooling

To connect your wallet to Berachain, you can either use a one-click option or enter the settings manually. The chain ID is 80094, the currency symbol is BERA, and the main explorer is BeraScan. There’s also a simple guide to walk you through adding it to MetaMask.

There are public RPC options you can use for casual testing, including the official one, plus others from services like dRPC, Ankr, Alchemy, and Chainstack. If you’re building something more serious, you might want to run your own node or get a dedicated endpoint from one of these services for more stability.

Tools that support Berachain include:

Explorers like BeraScan, which lets you verify contracts and track transactions. There’s also Beratrail, another option with a different view.

Indexers like Dune and Goldsky, which help track data, build dashboards, and create custom analytics.

Developer tools like Hardhat and Foundry, which are supported with step-by-step guides. There are also ready-made templates for common token contracts and wallet flows.

Berachain Wallets and Custody

Getting started with Berachain is pretty simple, especially if you’ve used Ethereum before. Since Berachain is fully compatible with EVM wallets, you can use the same tools you’re already familiar with.

Whether you’re just dipping your toes in or managing serious capital, there are plenty of wallet options that cover mobile, browser, and even hardware setups.

Top Wallets for BERA

The most popular wallet for Berachain right now is MetaMask. You can use it as a browser extension or on your phone. It works smoothly with Berachain once you add the network manually.

Other great picks include Rabby Wallet, Coinbase Wallet, and Brave Wallet. They all support custom networks and give you full control over your keys. If you’re planning to hold BERA long-term or interact with dApps regularly, any of these will work just fine.

For advanced users or teams, Safe (formerly Gnosis Safe) also works on Berachain. It’s a great option if you need multisig protection, which means multiple people have to approve a transaction before it can go through.

Setting Up a Wallet on Browser and Mobile

Once you’ve picked a wallet, the setup process is pretty straightforward. In MetaMask, for example, you can click “Add Network” and enter the details for Berachain:

Network name: Berachain

Chain ID: 80094

Currency symbol: BERA

RPC URL: (Use the one listed in the official docs or on Chainlist)

Once added, your wallet is connected to Berachain. You’ll be able to see your BERA balance, use dApps, and send or receive tokens like you would on any other chain. The process is basically the same on mobile. MetaMask mobile, Trust Wallet, and OKX Wallet all support Berachain through manual network setup or WalletConnect.

Using Hardware Wallets for Extra Safety

If you’re holding a large amount of BERA or you just want that extra peace of mind, using a hardware wallet is a smart move. Both Ledger and Trezor can be connected to MetaMask.

You’ll use the Ethereum app on the device and add Berachain to MetaMask as a custom network. Once connected, you’ll sign all transactions from your hardware wallet, which keeps your private keys off the internet.

Keep in mind: some tokens might not show up directly in the Ledger or Trezor interface, so you’ll want to double-check your balance on BeraScan or any supported block explorer. Also, make sure you enable blind signing or contract data in the device settings, this helps when using dApps that require interaction.

Bridge and Interoperability

Once your wallet’s ready, the next step is usually bridging funds. Whether you’re moving assets from Ethereum, Arbitrum, or another chain, Berachain supports a few solid options, but like any bridge, there are some things you’ll want to be careful with.

Bridge Options and Directions

One of the main bridges used right now is deBridge, which supports multiple assets from Ethereum and other EVM chains into Berachain. You can also keep an eye on future native bridge solutions being built by the Berachain team, but most bridging traffic today happens through third-party tools. There’s also the Wrapped Asset Bridge, a tool built by the Berachain team.

This bridge is designed for projects that want to migrate an ERC-20 token from the Ethereum mainnet into Berachain. The asset gets “wrapped” and deployed on Berachain, but it’s a one-way move; you can’t bridge those tokens back out unless specifically supported.

So before bridging, always confirm that your asset is supported, the direction is correct, and you’re using an official or trusted tool.

When bridging, most transfers are one-way; assets flow into Berachain, but not always back out (unless support for that direction is clearly listed). So always double-check the asset, source, and destination before you click confirm.

Things to Know Before You Bridge

Bridges work differently from swaps. They often use validators, message relayers, or external contracts, which means things aren’t always instant. Depending on the bridge and the chain, you might wait 1-15 minutes, or even longer during peak times.

Also, never search “Berachain bridge” on Google and click a random link. Use official docs, pinned posts from the team, or trusted listings like Chainlist or DeFiLlama. If a link looks off or the domain feels weird, don’t risk it.

Safe Bridging in 3 Simple Steps:

Test with a small amount first: Always bridge a small test transaction before sending your full amount.

Watch the confirmation: Use explorers like BeraScan to confirm your funds arrived.

Don’t multitask during bridging: Stay focused and avoid clicking around while your wallet is processing the transaction.

BERA’s TVL and On-Chain Activity

Berachain has seen some major activity in terms of value locked and overall usage. According to DeFiLlama, the network currently holds about $427.6 million in native TVL and another $236.8 million in bridged assets.

That brings the total to roughly $664.5 million locked in the ecosystem at the time of that snapshot. Earlier in the year, Berachain reached a peak TVL of over $3.2 billion, which briefly put it ahead of Base and Arbitrum in terms of total value locked. Since then, reports show TVL has dropped by about 70%, at one point dipping as low as $990 million.

In terms of on-chain activity, Berachain has processed more than 175 million transactions and has over 3.1 million unique addresses. Daily trading activity on decentralized exchanges sits at around $16.1 million, with the past week adding up to $79.6 million in volume. These numbers come from dashboards like Blockworks and Dune, which track usage across the network.

What TVL Tells You?

The early $3.2 billion in TVL showed strong demand and excitement, likely driven by high-yield opportunities and aggressive liquidity programs. But the sharp 70% drop that followed suggests much of that capital was opportunistic. Users came for rewards, then pulled out when the incentives slowed.

Even with the drop, holding over $600 million today shows there’s still confidence in the network. The fact that nearly half of that value comes from native apps, not just bridged funds, means builders are active and users are engaging directly with the ecosystem. On-chain activity, like millions of transactions and steady trading volume, backs that up. People aren’t just parking tokens; they’re actually using the chain.

So while the hype has cooled, Berachain still has a working ecosystem, committed users, and real value flowing through it.

Sector Breakdown

Berachain’s ecosystem is currently dominated by trading and liquidity-focused apps. Most of the value locked is sitting in platforms that let users swap tokens, earn yield, or provide liquidity.

Daily DEX volume: Roughly $22 million, with a weekly volume of about $121 million

Stablecoins on-chain: Around $122 million worth of stablecoins, giving users a liquid base for trading and lending

Bridged value: About $678 million has been brought in from other chains

Native TVL: Roughly $426 million locked in apps built directly on Berachain

While most of the activity is still centered around DEXs and yield farming tools, other sectors are starting to grow:

Liquid staking is gaining momentum, letting users stake assets while staying flexible with their funds

Lending platforms exist, but they currently hold a much smaller share compared to swaps and staking

This shows that while Berachain is still trading-heavy, it’s slowly building out a more complete DeFi ecosystem. You can view live TVL metrics at DeFiLlama or dashboards on Dune Analytics.

How to Read TVL Changes

If TVL spikes overnight, it usually means one of two things:

A new incentive was launched (like rewards for LPs or stakers)

A new app went live and drew attention

If TVL drops, check whether a farm ended, rewards dried up, or people bridged funds out. Once your wallet’s ready and you’ve bridged some BERA, you can start exploring. Keep an eye on the charts, track TVL growth, and look out for legit projects launching in the ecosystem.

Like any new chain, there’s opportunity, but also risk, so go slow, do small tests first, and keep checking trusted tools like DeFiLlama, BeraScan, and 99Bitcoins to stay informed.

Berachain Ecosystem Guide

Once your wallet is set up and you’re holding some BERA, the next step is exploring what you can actually do on Berachain. The ecosystem is growing fast, with new projects popping up across DeFi, staking, analytics, and more. Some are early experiments, others already have strong traction.

DEXs, Lending, Liquid Staking, Launchpads

If you want to swap tokens or provide liquidity, head to one of the native DEXs like Berachain BEX, Kodiak, BEX, or BurrBear. These are where most of the action happens, from basic trading to farming LP rewards. They’re fast, simple, and feel a lot like Uniswap.

What is Berachain BEX?

BEX is the main trading hub on Berachain. It’s where you can swap tokens, add liquidity, and earn a share of the trading fees. Think of it as Berachain’s built-in exchange, no need to go off-chain or use third-party tools. Everything happens directly on the network.

How does Berachain BEX work?

BEX runs on liquidity pools. You pick a pool (like BERA-HONEY or BERA-WETH), deposit both tokens, and earn a cut of the fees every time someone trades through that pool.

There are two types of pools:

Standard pools, where tokens are split evenly (like 50-50 between BERA and HONEY)

Stable pools, made for tokens that stay close in price, like HONEY and USDC

Each pool also has its own reward rate and fee setup. Here are a few examples:

BERA-HONEY (50-50): Gets about 35% of all rewards, with a 0.30% trading fee

BERA-WETH (50-50): Gets 25% of rewards, also with a 0.30% fee

USDC-HONEY (stable pool): Gets 7.5% of rewards, with a lower 0.01% fee

Rewards are given out based on how useful the pool is to the ecosystem, so the more volume it gets, the more it earns, and the more you earn if you’re in it.

Things to Keep in Mind

Some of the code behind BEX comes from another project called Balancer. That means certain risks still apply, especially when creating new pools or using less-known tokens.

Stick to the main pools unless you know what you’re doing. They tend to be safer and more active.

Always check what tokens a pool uses, how much it charges in fees, and how much of the rewards it gets. That can help you decide where it’s worth putting your funds.

Lending, Borrowing & Other Protocols

When it comes to additional protocols, the ecosystem seems to be fairly active. Need to borrow or lend? Berachain-native money markets are already live. You can deposit BERA or other tokens and earn interest, or borrow against your holdings if you’re trying to rotate between plays.

Liquid staking is also starting to take off. Instead of locking up your BERA and forgetting about it, you can stake through a protocol that gives you a liquid receipt token. That way, you still earn rewards and stay liquid, ready to trade, borrow, or farm with your staked position.

Some projects are also launching launchpads that let early users buy into new Berachain apps. These are higher risk but often come with airdrop potential or early perks. Always double-check the contracts and audits before jumping in.

Infra, Oracles, Custody, Analytics

On the infrastructure side, Berachain has the basics covered. You can connect through public RPCs or use providers like dRPC for more reliable access. Explorers like BeraScan let you track transactions, token balances, and contract activity.

For price feeds, oracles like Switchboard and Pyth are plugged in and powering dApps across the chain. That means you’ll get real-time pricing for swaps, lending, and derivatives.

Custody is also in place if you’re managing funds with a team. Safe (formerly Gnosis Safe) works on Berachain and lets you require multiple approvals before moving funds, great for projects or shared wallets.

If you’re into data, Dune has Berachain dashboards that cover everything from trading volume to gas usage. Goldsky supports indexing and analytics tools if you’re building something custom.

How to Evaluate New Apps on Berachain

Berachain is still young, so new apps show up almost every week. Some are polished and audited, others are rough MVPs with no docs.

Before you dive into anything new, do a quick check:

Read the docs – See if the app uses Berachain’s PoL vaults or native token standards.

Check the contracts – Are they verified on BeraScan?

Look for audits – Not every app will have one, but if they claim security, make sure they prove it.

Review incentives – Is the app giving out BERA or something else? Where does it come from?

Compare TVL – Use DefiLlama to check how much value is actually in the app. If it’s tiny or all from one wallet, that’s a flag.

Watch for token versions – If a project uses bridged assets, make sure they match the versions used in the main liquidity pools.

Research and Risk

Before you start locking up tokens or chasing yields, it’s worth understanding how Berachain works behind the scenes. That includes how it’s governed, what risks to watch for, and how to stay up to date without falling for hype or scams.

Governance and Upgrades

Holders of BGT, the Berachain Governance Token run Berachain’s governance system. Proposals are submitted, voted on, and, if passed, go through a time delay before being executed. This gives the community time to react if anything goes wrong.

There’s also a guardian multisig in place, a group that can cancel a malicious proposal before it gets through. That layer of protection is meant to keep the network secure while it’s still maturing.

Risks to Keep an Eye On

Every chain has risks, and Berachain is no different. Some of the key ones to track include:

Changing incentives – Berachain uses Proof of Liquidity, so token rewards are tied to how liquidity is provided and used. If emissions drop or move, users might shift between apps quickly.

Bridge risk – Whenever you move assets between chains, you’re trusting the bridge. If the bridge gets hacked or paused, your funds could be stuck or lost.

Token confusion – Watch out for fake versions of BERA or other tokens, especially on DEXs or third-party explorers. Stick to official listings.

RPC and network stability – If you’re running bots or apps, you’ll want reliable RPC access. Public nodes can lag or rate-limit during busy times.

Security of smart contracts – New apps often launch fast. If something has no audit, you’re trusting the devs. Use small amounts first and monitor your approvals.

For shared wallets, multisig setups like Safe are your best bet. Always require at least two signers if you’re managing a treasury or pooled funds.

How to Stay Informed and Avoid Misinformation

The best way to stay on top of Berachain developments is to follow official sources, like the docs site, Twitter, and BeraScan. For breakdowns in plain English, right here at 99Bitcoins is a great place to follow along. We cover the big updates and explain what they mean without the fluff.

You can also track TVL and app launches on DefiLlama, explore data on Dune, or use Discord groups to hear what other users are seeing. Just stay cautious with calls and influencers. Stick to verified info and take your time before diving into anything new.

Berachain’s ecosystem is growing quickly, and that comes with both opportunity and risk. From wallets and staking to DEXs and new apps, there’s a lot to explore, but you’ll want to take a smart, informed approach. Use trusted tools, double-check contracts, and lean on sources like 99Bitcoins to stay updated as things evolve.

Conclusion: What Is Berachain?

Berachain is doing things differently. Instead of paying people just to lock up tokens and wait, it rewards the ones actually keeping the chain active. That includes validators, liquidity providers, and builders, all working together in a loop that keeps the network alive.

The setup is familiar if you’ve used Ethereum before, but the way it runs is more focused. Every part of the system pushes capital toward the places where it’s most useful. And with fast block times, low fees, and a growing list of apps, there’s already a lot going on.

Whether you want to stake, build, trade, or just explore, Berachain gives you a place to do it without needing to learn everything from scratch. It’s still early, but it’s already showing real promise.