KEY TAKEAWAYS

BIO surged 45% after its Upbit listing, reigniting interest in the DeSci sector.

The token broke above a descending triangle with strong MFI and AO readings.

Sustained momentum could push BIO toward $0.22 if it breaks resistance.

BIO, native to AI-driven biotech platform, has seen its price rise by 45% in the last 24 hours. This development happened after Upbit listed the Bio Protocol crypto.

The listing sparked renewed interest in the Decentralized Science (DeSci) narrative, fueling a broader rally across related tokens.

Following the move, several DeSci-linked assets posted notable gains. ResearchCoin (RSC) climbed 16%, VitaDAO (VITA) jumped 35%, and CryoDAO (CRYO) matched that increase within the same period.

Here is a breakdow of how it happeneed and what lies ahead for BIO’s price.

Bio Protocol Ends Downtrend

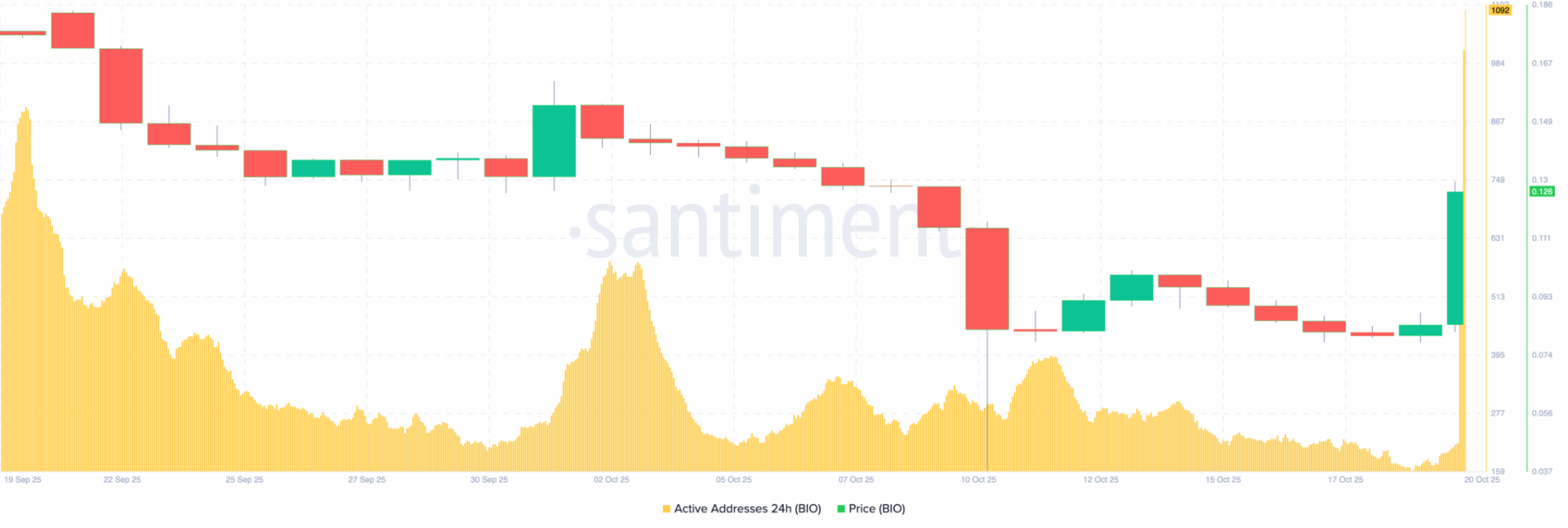

Since Oct. 1, the Bio Protocol crypto has been stuck in a month-long downtrend. During that period, it slid from $0.15, finally finding its bottom around $0.078.

Today, BIO’s price has climbed to $0.12 after Upbit dicslosed listing the cryptocurrency.

On the 4-hour chart, the BIO tokenhas broken above the resistance line of a descending triangle — a typically bullish signal that precedes further uptrend.

Supporting this breakout, the Money Flow Index (MFI) has risen to 87.35, indicating rising buying pressure.

In addition, the Awesome Oscillator (AO) has flipped positive for the first time since last Wednesday.

Combined, these indicators suggest that buying pressure is intensifying, potentially driving BIO’s price toward new short-term highs if the breakout holds.

Network Activity Supports Demand

Amid this rally, the 24-hour active addresses of the Bio Protocol crypto have surged to their highest level since August 25.

This spike in participation often reflects growing investor interest and increased transaction demand, both strong indicators of rising market confidence.

If the trend continues, the sustained network activity could drive price stability in the short term and fuel further upside. In many cases, such on-chain growth precedes follow-through buying pressure, suggesting BIO’s price breakout may extend if activity remains elevated.

BIO Price Prediction:

Similar to the 4-hour setup, the daily chart also reveals a bullish structure. In this timeframe, BIO has broken above the upper trendline of its falling channel.

However, the red segment of the Supertrend indicator remains positioned above the token’s price, signaling that resistance persists near $0.13.

A clean breakout above this level would likely confirm a stronger upward continuation.

Meanwhile, the Money Flow Index (MFI) has moved above the midpoint, reflecting growing buying pressure and renewed capital inflows into the token.

If this momentum continues, BIO’s price could rise toward $0.16, aligning with the 0.382 Fibonacci retracement level.

Beyond that, an extended rally might push the token toward $0.22, corresponding to the 0.618 golden pocket ratio.

Conversely, a rejection near $0.13 would invalidate the bullish thesis, potentially driving the token below $0.10 as profit-taking and short-term corrections set in.