As the INJ price prediction 2025 draws new attention, Injective now trades in the critical $6–$7 multi-year support zone, a region that has repeatedly triggered strong reversals in its history. With bullish fundamentals, ETF anticipation, and a major network upgrade ahead, Injective appears positioned for one of its most important rebounds yet.

With INJ price today hovering near $7.81, Injective sits on a support range that has consistently acted as a long-term reversal zone. Its previous interactions with the $6–$7 area have produced sharp multi-week rallies, and traders now expect a similar response as the broader market stabilizes.

The technical structure also reinforces this outlook. The INJ price chart shows price compressing at the lower boundary of a long-term range, aligning with an decending wedge which is active since August 2024. While, historically, each touchpoint on this trendline has sparked rallies, creating optimism that a breakout toward $21 before year-end remains achievable.

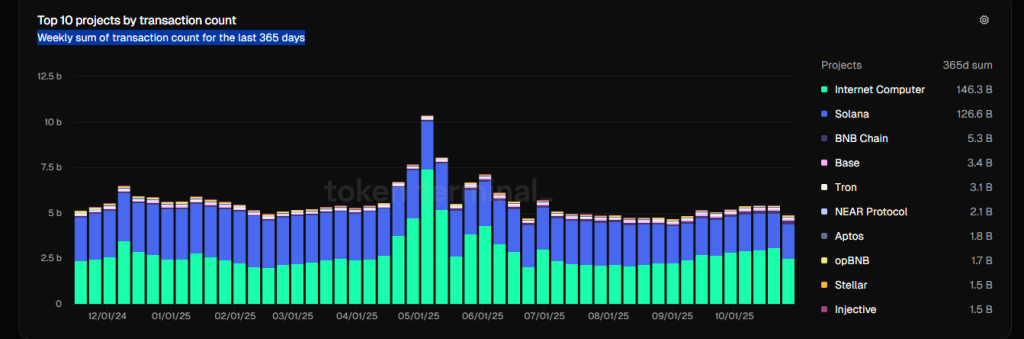

Beyond price action, Injective’s fundamentals continue to strengthen. It currently ranks 1 in weekly code commits across all blockchains , demonstrating top-tier development activity. With over 1.5 billion transactions processed, Injective also ranks 10th globally in t otal transaction count based on yearly data .

This level of growth signals expanding network adoption and increasing developer confidence in the ecosystem. Rising activity often precedes aggressive price discovery, reinforcing the positive INJ price forecast 2025 outlook.

Institutional interest is emerging strongly as well. In October, 21Shares filed an S-1 application with the SEC to launch the first-ever INJ ETF. Once the U.S. government resumes full regulatory operations, this filing will be reviewed, and the odds of approval appear promising.

ETF approval would unlock new liquidity channels, significantly expanding market access for Injective crypto. This mirrors how ETF inflows boosted Bitcoin and Ethereum earlier this year.

Meanwhile, Injective is preparing to launch its Altria Mainnet Upgrade (IIP 583) within the next five days. This upgrade is viewed as a major step forward and has amplified community expectations that momentum is shifting decisively bullish.

Although long-term indicators look constructive, some technical tools still show mixed signals. The RSI near 37.50 indicates the market is cooling further, potentially dipping into a deeper undervalued zone near 30. MACD and AO remain subdued, suggesting consolidation is still underway.

However, the Chaikin Money Flow at 0.14 reveals growing positive inflows, hinting that accumulation is already happening beneath the surface. Once momentum flips bullish, INJ price USD has potential to revisit $21, extend toward $44, and possibly retest $52 ATH in 2026.

As these catalysts align, the INJ price prediction 2025 continues to strengthen, making Injective one of the most closely watched recovery plays in the market.