KEY TAKEAWAYS

STX could trade between $0.40 and $2.42, fueled by recent bullish momentum and its strong ties to Bitcoin’s ecosystem.

emand may taper, with price targets ranging from $0.32 to $1.03, suggesting a potential cooldown after a strong 2025.

Increased Bitcoin adoption and DeFi growth may push the Stacks crypto price to between $2.07 and $5.75 long-term.

STX has broken out of a descending channel and reclaimed bullish structure, targeting $1.45 short-term and possibly $2.

Earlier in the year, STX’s price experienced a brutal correction just like other cryptos in the market. But recently, the altcoin seemed to have gone past that phase.

In the last 30 days, Stacks’ value has increased by 70%, outperforming many other assets in the market. But does this mean that the price will continue to rise?

Whether that will be the case or not is something market participants will want to know. In this analysis, we reveal the latest about STX performance and what the Stacks price prediction could be from 2025 to 2030.

Stacks Price Prediction

In this section, we analyze the potential price targets that STX could reach in 2025. We also reveal the Stacks price prediction for 2026 and 2030 using several indicators.

It is important to note that these predictions are based on the current market reality and might be subject as time progresses.

| Minimum Stacks Price Prediction | Average Stacks Price Prediction | Maximum Stacks Price Prediction | |

|---|---|---|---|

| 2025 | $0.40 | $1.75 | $2.42 |

| 2026 | $0.32 | $0.82 | $1.03 |

| 2030 | $2.07 | $3.19 | $5.75 |

Stacks Price Prediction 2025

2025 started on a difficult note for STX. However, in recent days, the altcoin has experienced relief, rising 70% within the last 30 days.

By the look of things, Stacks. We might not face any notable corrections for the remainder of the year. As such, STX could trade between $0.40 and a maximum value of $2.42 in 2025.

Stacks Price Prediction 2026

In 2026, STX might not experience the demand it is expected to see in 2025. Due to that, the potential targets are lower, specifically between $0.32 and a ceiling of $1.03

Stacks Price Prediction 2030

Because of its ties to Bitcoin, the Stacks crypto could witness increased demand as crypto adoption surges in 2023. If that happens, STX price prediction for 2030 might be between $2.07 and a swing high of $5.75.

Stacks Price Analysis

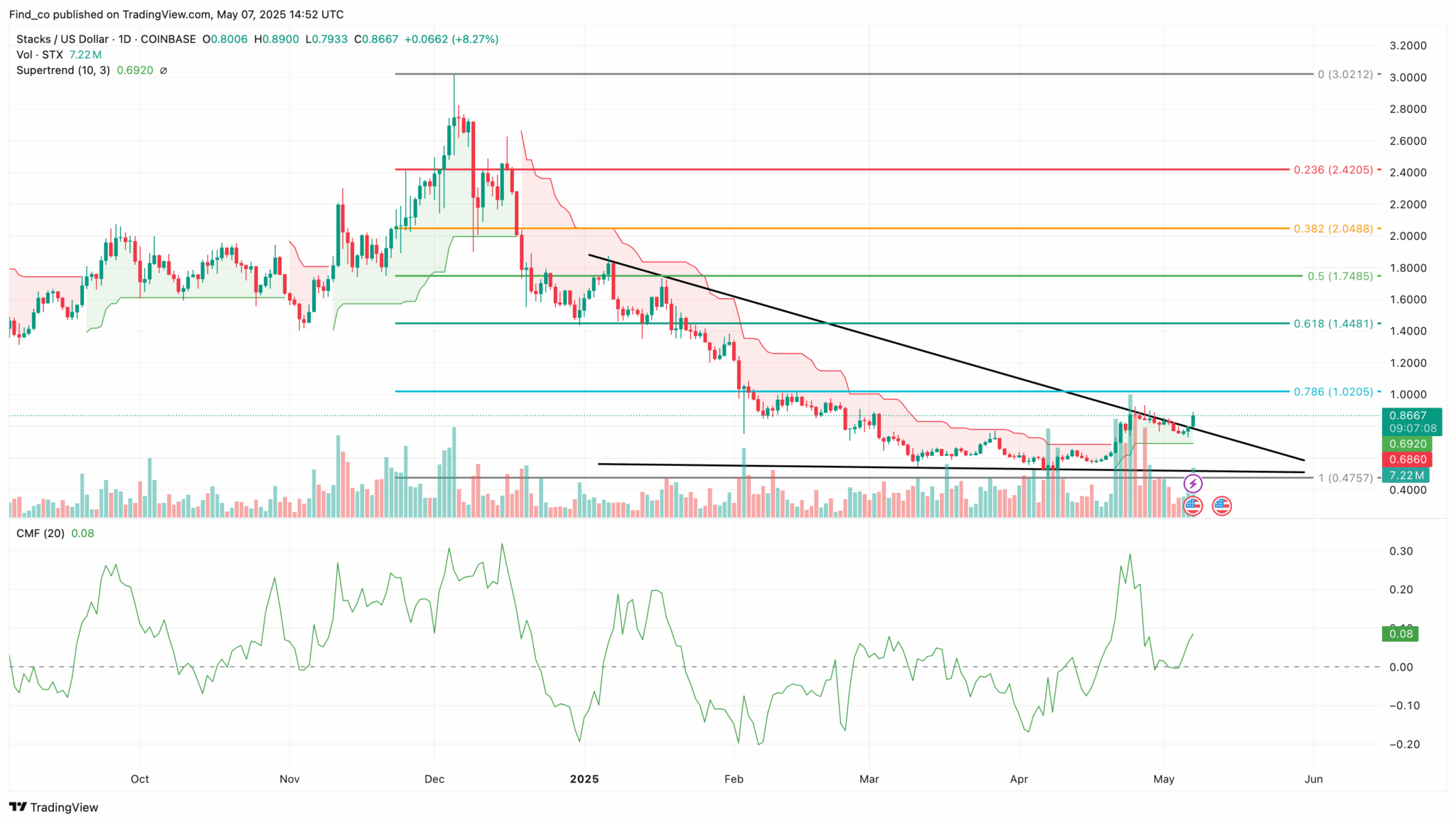

From a technical perspective, the weekly chart shows that STX’s price has broken out of a descending channel. In line with that, the Moving Average Convergence Divergence (MACD) reading has turned.

A bullish crossover has also appeared with the 12 EMA (blue) crossing above the 26 EMA (orange). The Stacks crypto price might breach the resistance at $1.21 if this remains the same.

If validated, this could drive the altcoin to $2. However, a breakdown below the upper trendline of the falling channel could invalidate this thesis and cause it to decline to $0.49.

Short-term Stacks Price Prediction

STX’s price might also experience an extended uptrend. For instance, today, the market value has increased by 16%.

This price increase happened as the altcoin surged past the upper trendline of the descending triangle on the daily chart. In addition, the Chaikin Money Flow (CMF) resisted dropping below the zero signal line.

This bounce off the line indicates that bulls fiercely defend the support at $0.48. Like the CMF, the Supertrend green line supports the uptrend.

Should this trend continue, STX’s price might climb and retest $1 in the short term. In a highly bullish scenario, STX might rise to $1.45.

On the other hand, if selling pressure increases, the price might decline toward the horizontal support line.

Stacks Market Cap to TVL Ratio

The market cap to Total Value Locked ratio (TVL ratio) measures the valuation of a decentralized finance (DeFi) project by comparing its market capitalization to the total value of assets locked in its smart contracts.

This ratio shows the project’s utilization and links the platform’s health to locked asset value.

A ratio above 1.0 indicates overvaluation because the market cap exceeds the value of assets used in the platform. A ratio below 1.0 indicates undervaluation because the market cap is lower than the value of locked assets. As of this writing, the Stacks market cap to TVL ratio was 12.60, suggesting overvaluation.

Stacks Price Performance Comparison

Stacks is a Layer-2 scaling solution, so let’s compare it with similar projects.

| Current Price | One Year Ago | Price Change | |

|---|---|---|---|

| STX | $0.88 | $2.20 | -60.06% |

| MNT | $0.71 | $1.04 | -32.90% |

| ARB | $0.31 | $1.06 | -70.68% |

| OP | $0.60 | $2.77 | -78.06% |

Best Days and Months to Buy Stacks

We looked at the stacks’ price history and found the times when the price was at its lowest across certain days, months, quarters, and even weeks in the year, indicating the best times to buy STX.

| Time to Buy Stacks | Days, Months, and Quarters |

|---|---|

| Best Day | Monday |

| Best Week | 28 |

| Best Month | February |

| Best Quarter | First |

STX Price History

| Period | Stacks Price |

|---|---|

| Last Week (April 30, 2025) | $0.82 |

| Last Month (April 7, 2025) | $0.59 |

| Three Months Ago (Feb. 7, 2024) | $0.90 |

| One Year Ago (May 7, 2024) | $2.20 |

| Five Years Ago (Ma7. 7, 2020) | $0.10 |

| Launch price (Oct. 29, 2019) | $0.213 |

| All-time high (April 1, 2024) | $3.84 |

| All-time low (March 13, 2020) | $0.045 |

Stacks Supply and Distribution

| Supply and Distribution | Figures |

|---|---|

| Total Supply | 1,818,000,000 |

| Circulating Supply as of May 7, 2025 | 1,511,956,691 (83.16% of total supply) |

From The Whitepaper

Stack’s whitepaper states it wants to bridge Bitcoin’s solidity and Ethereum’s development potential.

It says: “Stacks is a Bitcoin layer for smart contracts; it enables smart contracts and decentralized applications to trustlessly use Bitcoin as an asset and settle transactions on the Bitcoin blockchain.”

Software engineers Muneeb Ali and Ryan Shea founded Stacks. Princeton PhD Ali founded Trust Machines, a platform for Bitcoin-related applications, in 2021. Shea, meanwhile, helped set up Facebook’s GraphMuse app in 2012.

Stacks (STX) Explained

One of the most significant splits in crypto is between Bitcoin and Ethereum (ETH). At the heart of the debate is whether a blockchain should focus on supporting crypto, like Bitcoin, or should allow people to build their own programs, like Ethereum. Since Bitcoin is the largest crypto out there, people will want to use its reach and power to create decentralized applications (DApps), but the chain does not allow them to do so.

Stacks, which was founded in 2013, with the first version of its blockchain coming in 2018 and the current chain coming online in 2020, hopes to change that.

The platform, supported by the STX coin, is designed to connect with the Bitcoin blockchain. It allows users to create their applications by utilizing smart contracts and computer programs that automatically execute once certain conditions are met.

How Stacks Works

Stacks uses a Proof-of-Transfer (PoT) consensus mechanism to add blocks to the blockchain and earn rewards. This means that users transfer a, in this case, Bitcoin, to other participants in the network to secure and grow the blockchain, effectively paying with BTC to earn STX.

As far as the STX coin goes, the whitepaper explains how it works when it says: “Stacks miners use Bitcoin to mine newly minted Stacks. Stacks holders can lock their STX in consensus to earn Bitcoin, making STX a unique crypto asset that is natively priced in BTC and gives BTC earnings.”

Apart from miners, there are other STX users called Stackers. These people stake their STX for about two weeks or so. This means they can run a computer, or node, on the network, earning Bitcoin for doing so.

STX can also be bought, sold, and traded on exchanges.

Is Stacks a Good Investment?

It is hard to say. On one hand, the crypto market can be an unforgiving place. STX investors will have learned this when their coin lost more than 90% of its value in 2022, a worse performance than the market average. Indeed, the token is having another rough time, down around 75% since the start of April last year.

On the other hand, its links to Bitcoin could also see it ultimately emerge as a real winner during a tough time. As always with crypto, you will need to make sure that you do your own research before deciding whether or not to invest in Stacks.

Will Stacks go up or down?

No one can really tell right now. While many of the longer-term STX price predictions are optimistic, price predictions end up being wrong more often than not. You should also remember that prices can and do go down and up.

Should I invest in Stacks?

Before deciding whether to invest in Stacks, you must do your own research on STX and other similar coins and tokens, like Polygon (POL) or Immutable (IMX). Ultimately, though, you will have to make this decision for yourself, and, more importantly, you should ensure you never invest more money than you can afford to lose.