KEY TAKEAWAYS

Stacks surged 16% today, climbing from $0.80 to $0.87 after breaking out of a bull flag pattern on the 4-hour chart.

The breakout was backed by a spike in trading volume to $120 million, suggesting strong buying interest.

If momentum holds, STX price could breach resistance at $1.02, but a reversal could send it toward the $0.48 level.

Stacks (STX), the native token of the Bitcoin layer-2 project, surged 16% today after printing six consecutive green candlesticks on the 4-hour chart. The Stacks crypto price climbed from $0.80 to $0.87 within hours.

This increase also comes despite no major announcements or project developments. With this sudden bullish momentum, traders may wonder if STX will extend its rally or if a pullback is close.

In this analysis, CCN examines whether the altcoin can sustain its uptrend.

Stacks Breaks Free From Downtrend

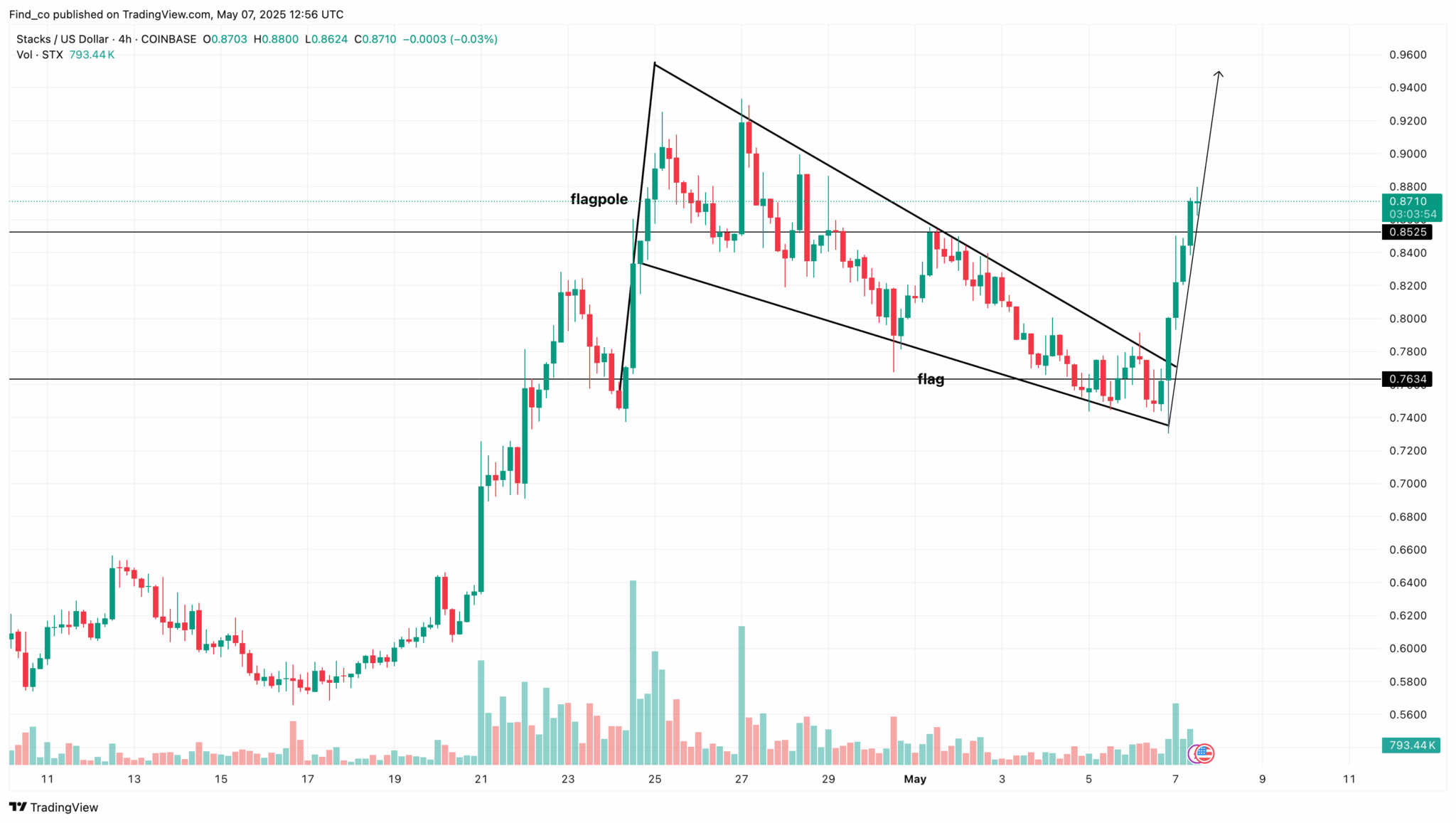

Based on the 4-hour chart, the Stacks crypto price experienced this surge after breaking out of a bull flag. A bull flag is a bullish continuation pattern that forms after a strong upswing (flagpole), followed by a brief consolidation or pullback that resembles a flag on a pole.

As seen in the image below, STX experienced a sharp price surge in high volume, which formed the flag. Later, it faced consolidation before the recent breakout above the flag’s upper trendline.

Following the uptrend, STX bulls have defended the support at $0.76 while successfully breaking the resistance at $0.85. Should bulls remain in control, Stacks’ price might keep up with the current trend.

Renewed Interest After it Escapes the Falling Channel

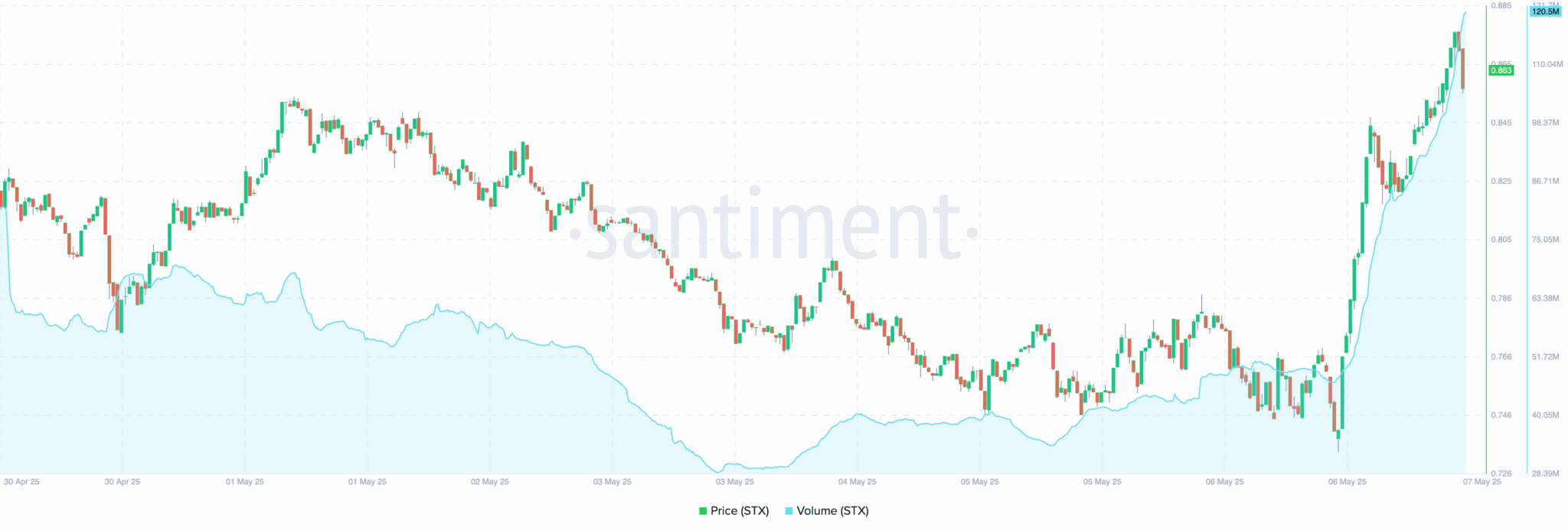

Furthermore, on-chain data from Santiment shows that the STX trading volume has surged to $120 million. Previously, the volume was less than $50 million on May 6.

Typically, a drop in volume alongside rising prices is a sign of weakness, suggesting that the uptrend could retrace. Therefore, this rise in volume plus soaring market value indicates that the Stacks crypto price will likely keep trending upwards.

STX Price Analysis: Moves Closer to Psychological Barrier

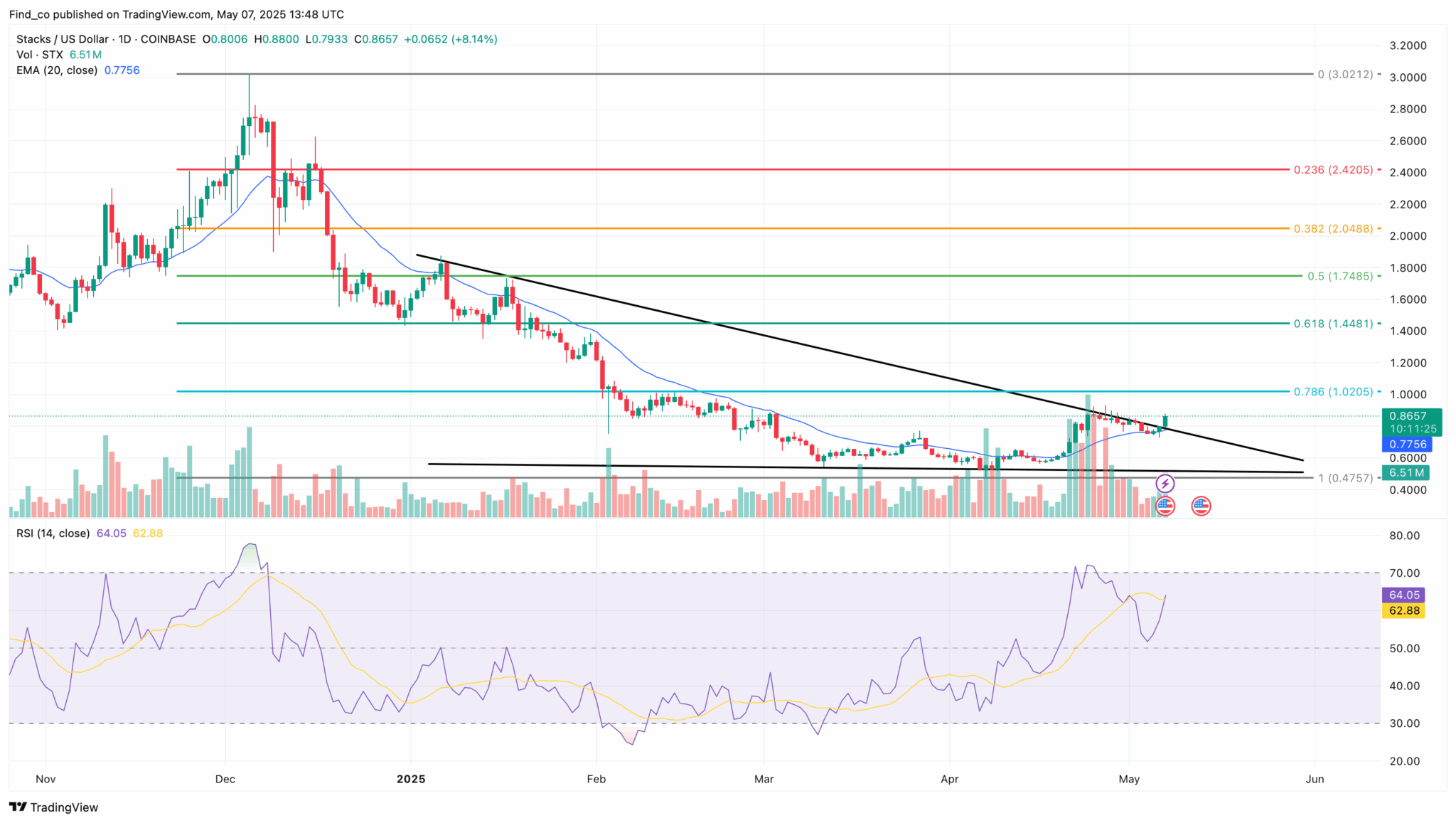

Like the 4-hour chart, analysis of the 4-hour chart also presents a bullish outlook. According to the chart below, STX previously traded in a descending triangle, which is bearish.

But today, the STX’s price has surged past the triangle’s upper trendline, indicating that the altcoin has invalidated the bearish thesis.

In addition, the Relative Strength Index (RSI) has soared to 64.03, indicating bullish momentum. The Stacks crypto price might surpass the resistance at $1.02 if this trend continues.

Also, the Bitcoin L2 project token has moved above the 20-day Exponential Moving Average (EMA). This indicates strong support for the uptrend.

If STX holds above this threshold, the price might rise to $1.45 at the 0.618 golden ratio. Should buying pressure rise at this level, STX might increase toward $2.

On the flip side, if bullish momentum fades, this trend might change. The cryptocurrency might drop below the horizontal support and fall toward $0.48 in that scenario.