Stacks prediction insights

Featured prediction **July 1st**

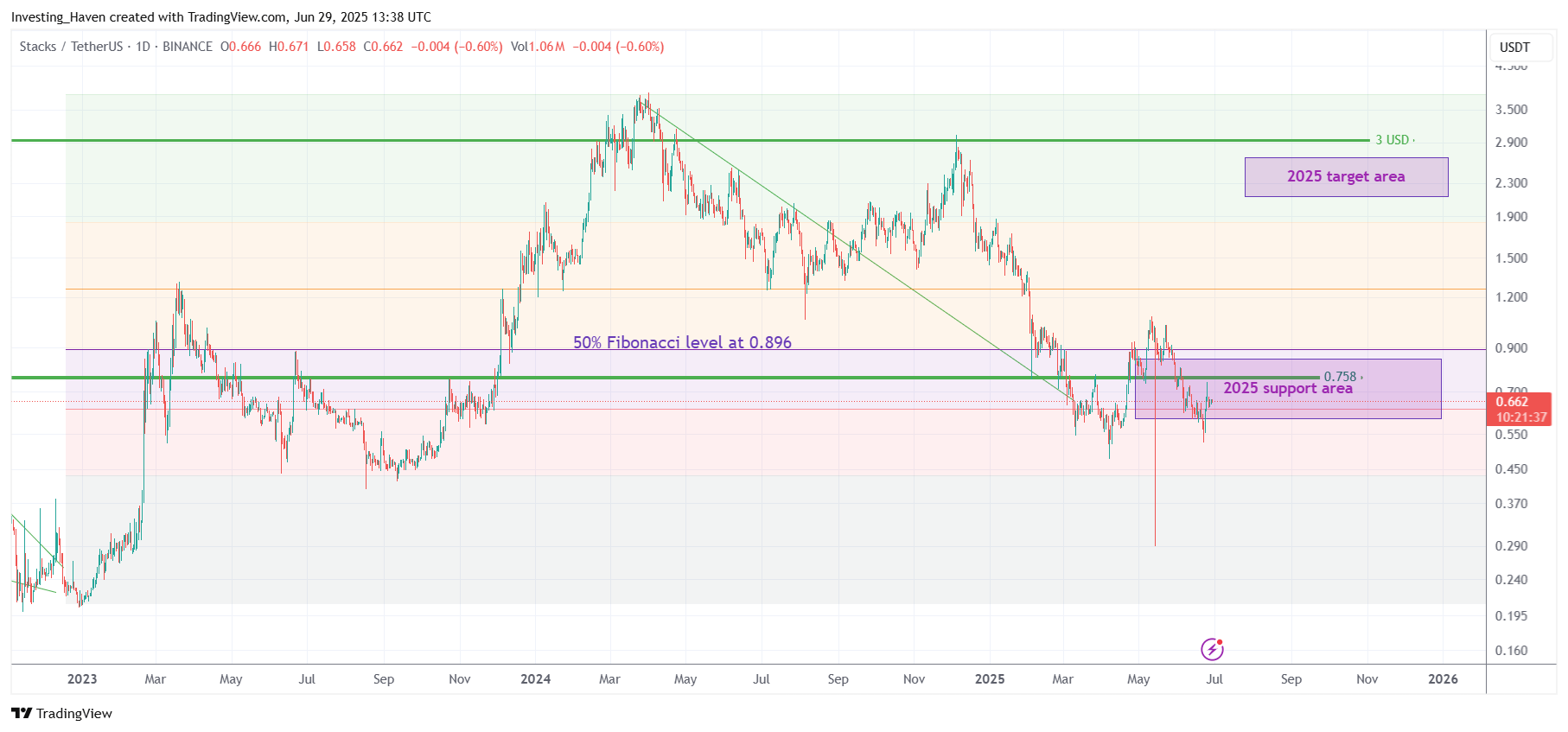

[ALERT] – Our long term Stacks forecast remains bullish. STX is creating a critical chart structure right below its 50% Fibonacci level, please scroll down to check the STX chart with our commentary.

Stacks price prediction 2025:

In 2025, Stacks is expected to fluctuate between $0.65 and $2.22, with a stretched target of $3.31. Continued adoption of its layer-2 solutions and growing institutional interest could propel its price higher. A key support level at $0.65 to $0.75 remains critical.

Stacks time forecast:

Stack predicted consolidation time window was March 14th – April 13th (accurate), our predicted bullish trend would start on May 10th (accurate). However, the rally was short-lived and not intense. The next bullish window should start somewhere mid-July to mid-August (TBC).

Stacks price prediction 2025

Stacks (STX) price prediction 2025:

For 2025, Stacks is projected to see significant price movement, with the 50% Fibonacci retracement level at $0.89 being a crucial support. A bounce from this level before summer 2025 could pave the way for the bullish target around $2.22 to be hit late 2025.

July 1st – The long term STX chart structure shows has giant bullish cup and handle structure (2022-2024). The chart pattern in 2025 looks like a W-reversal. STX will return to the $2-3 area as soon as its 50% Fib level at $0.91 is cleared. On the flipside, its 2025 lows must hold for a bullish resolution.

Stacks price predictions for 2025:

Year | Price move | STX price forecast |

|---|---|---|

| 2025 | Lows to highs | $0.65 to $2.22 |

| 2025 | Stretched | $3.33 |

| 2025 | Buy the dip | $0.62 to $0.72 |

| 2025 | Invalidation | < $0.21 |

Stacks price prediction 2026

Stacks (STX) price prediction 2026:

In 2026, the best-case forecast for Stacks (STX) is a trading range between $1.51 and $3.91. A strong breakout above current ATH must occur, not later than June 2025, in order for this bullish target in 2026 to be reached.

Stacks price prediction 2030

Stacks (STX) price prediction 2030:

By 2030, Stacks (STX) is anticipated to reach $6.6, reflecting long-term growth driven by ongoing adoption of its layer-2 solutions, scalability, and increased market presence.

Stacks peak price forecast

Stacks (STX) has a peak price prediction of $6.6 by 2030. This projection suggests significant long-term potential, assuming continued development and increasing use cases for its blockchain solutions.

Stacks peak predictions | Probability in time |

|---|---|

| Can STX hit $10 | Likely by 2030 |

| Can STX hit $50 | Unlikely before 2030 |

| Can STX hit $100 | Maybe closer to 2040 |

| Can STX hit $1,000 | Maybe closer to 2050 |

Stacks price drop forecast

Stacks (STX) buy the dip level:

In the short to medium term, Stacks may experience price drops, potentially reaching lows between $0.75 and $0.89. These levels represent a critical support zone, and a drop below $0.36 would signal a more bearish outlook.

Stacks prediction tomorrow

Today, STX trades at $0.31563708. Tomorrow, on December 4, 2025, STX is forecasted to move to $0, a change of 0.00%.

Stacks prediction day-by-day

Over the next 30 days, STX is expected to see the following prices:

We are renewing the predictive model with an AI capability – day by day predictions will be back soon.

Stacks price history

2020: Initial Buzz and Adoption

Stacks (STX) launched its mainnet in 2020, quickly gaining attention with its promise to bring smart contracts to Bitcoin. The price started at around $0.20 and grew steadily as community interest in its technology and ecosystem grew. By the end of 2020, STX was trading around $0.60.

2021: Rapid Growth and Market Surge

Stacks experienced rapid growth in 2021, driven by the increasing interest in Bitcoin and decentralized finance (DeFi). The price surged to around $8.40 in early 2021, fueled by the launch of the Stacks 2.0 upgrade. By the end of the year, STX traded at around $4.00, reflecting a market correction.

2022: Market Corrections and Resilience

In 2022, Stacks faced significant volatility, with the broader cryptocurrency market experiencing downturns. The price fluctuated between $1.50 and $4.00, as the project focused on enhancing its ecosystem and engaging with new partners. The year ended with STX trading around $1.80, indicating resilience amidst market challenges.

2023: Recovery and Expansion

By 2023, Stacks began to recover, with prices oscillating between $1.80 and $3.50. The focus on growing its decentralized applications (dApps) and increasing adoption led to a more optimistic outlook. The year is expected to close with STX trading around $2.50, indicating a recovery trajectory.

Stacks price prediction FAQ

Does Stacks (STX) have a future?

Yes, Stacks (STX) has a promising future, with its layer-2 solutions for Bitcoin driving increasing adoption. By 2030, it’s expected to reach $7. Continued tech innovation and growing institutional interest will fuel its long-term growth, making it a strong contender in the crypto space.

Is Stacks (STX) bullish or bearish?

Stacks (STX) is currently bullish, with strong support levels around $0.57 for 2025. A breakout above key Fibonacci levels, like $2.01, could lead to significant upward momentum, targeting $3.33. However, a drop below $0.21 (highly unlikely) would invalidate this bullish outlook.

Can Stacks (STX) reach 100 USD?

Reaching $100 for Stacks (STX) would require extraordinary growth and widespread adoption within the blockchain space. While this is highly speculative, achieving such a milestone would depend on significant technological advancements, widespread institutional support, and a surge in the overall market demand for layer-2 Bitcoin solutions.

What will Stacks (STX) be worth in 3 years from now?

In three years, Stacks (STX) is expected to range between $5 and $7, with the potential to reach a stretched target of $7. Key factors influencing its value will include technological advancements, market adoption, and institutional interest in layer-2 Bitcoin solutions.