RedStone (RED) Crypto: A New Giant in the Making?

RedStone (RED), a modular blockchain oracle supporting over 1,250 assets across 70+ chains, is gaining massive traction in the crypto market. Binance, the world’s leading exchange, has confirmed RedStone’s listing as its 64th Launchpool project, sparking speculation on the listing price. Additionally, MEXC has also announced its plans to list RED, further fueling market excitement.

With pre-market trading coming to an end and spot trading set to launch, traders are now asking: What will be the listing price of RedStone (RED) on Binance & MEXC? Let’s analyze market trends, predictions, and potential price movements.

Binance & MEXC Listing Details: When and Where to Trade RED?

Binance RED Trading Pairs:

RED/BTC

RED/USDT

RED/USDC

RED/FDUSD

RED/TRY

Deposits Open: March 6, 2025, at 10:00 (UTC)

Withdrawals Start: March 7, 2025, at 13:00 (UTC)

Binance has applied a Seed Tag, signaling potential high volatility due to the project’s early stage.

MEXC RED Listing Details:

MEXC has listed RED in its Innovation Zone & Convert Zone to enhance liquidity.

However, trading will only begin once liquidity conditions are met between 12:45 and 13:00 (UTC) on March 6, 2025.

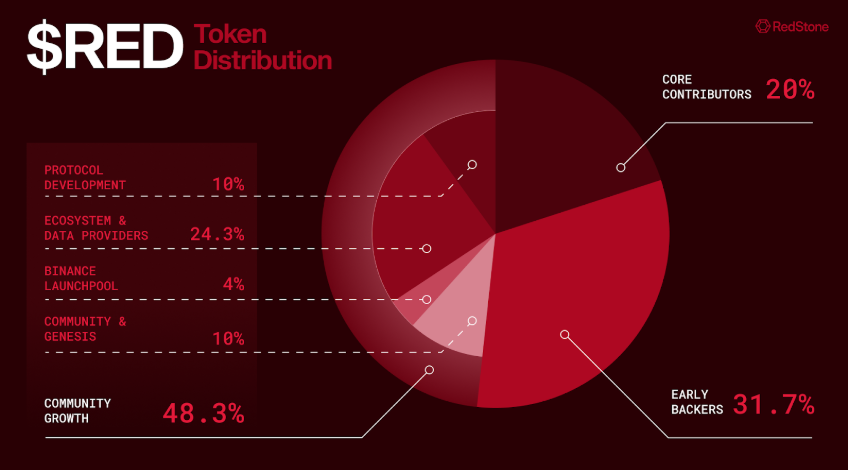

RedStone (RED) Tokenomics: How Are Tokens Distributed?

A crucial factor influencing RED’s market performance is its token distribution:

Community Growth – 48.3%

Early Backers – 31.7%

Core Contributors – 20%

Protocol Development – 10%

Ecosystem & Data Providers – 24.3%

Binance Launchpool – 4%

Community & Genesis – 10%

With 48.3% of tokens allocated for community growth, RedStone aims to establish a strong user base, which could drive long-term adoption.

RedStone (RED) Price Prediction: What Will Be the Listing Price?

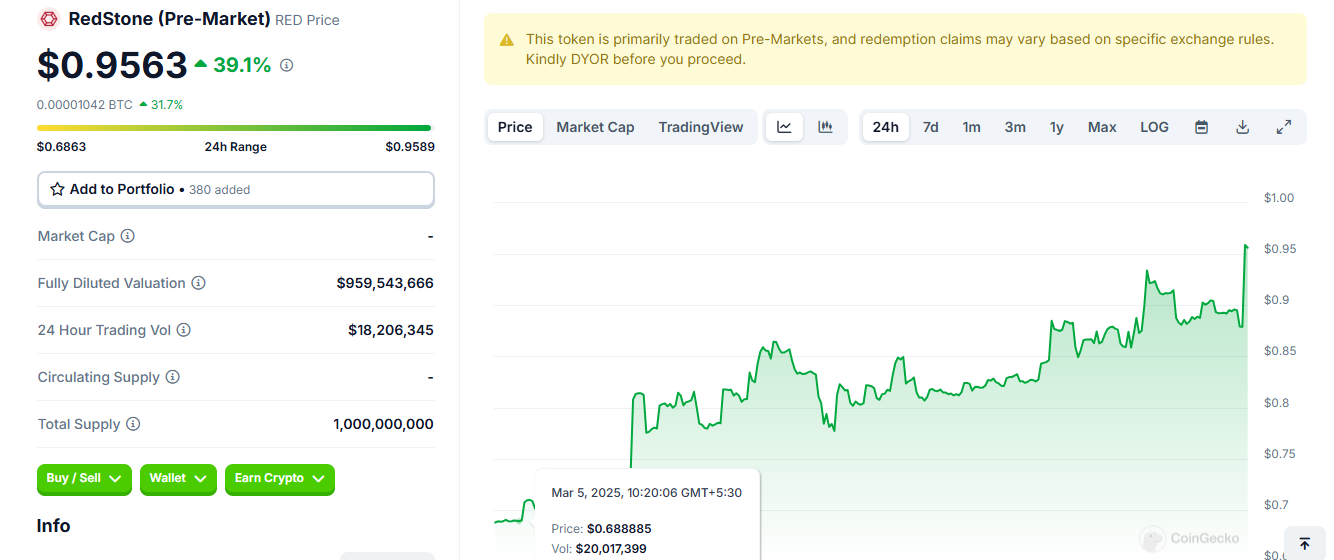

Pre-Market Insights & Current Trends

RedStone (RED) is already very bullish, with a 39.1% uptrend on the last 24 hours from $0.6863 to $0.9563. The price formed higher highs and higher lows, an evident sign of aggressive buying pressure.

Short-Term Prediction (March 6-7, 2025):

Given the current market dynamics, RED is expected to test the $1.00 resistance level upon listing. If demand continues, a breakout towards $1.20 - $1.50 could occur.

However, profit-taking by early investors may lead to a temporary pullback toward the $0.75 - $0.85 support zone before another upward push.

Medium-Term Prediction (March 2025):

If market sentiment remains bullish, RED could target $1.50 - $2.00 in the coming weeks.

Increased trading volume and ecosystem expansion could push RED beyond $2.50 by Q2 2025.

A bearish scenario could see RED stabilizing around $0.90 - $1.10 before its next major move.

Source: Coinmarketcap

Key Factors Influencing RED's Price on Binance & MEXC

Binance & MEXC Listing Hype

Major exchange listings often trigger price surges due to increased demand.

High Trading Volume & Liquidity

With over $18M in 24-hour trading volume, RED has strong market interest.

Community & Developer Adoption

A well-balanced token distribution ensures long-term ecosystem stability.

Overall Crypto Market Conditions

Bitcoin’s performance and macroeconomic trends could impact RED’s trajectory.

Should You Invest in RedStone (RED)?

RedStone (RED) presents an exciting opportunity, especially with its Binance and MEXC listing. However, as with any new token, volatility is expected.

For short-term traders: Watch the $1.00 resistance and potential profit-taking zones around $0.85.

For long-term investors: If RED holds above $1.20, a move toward $2.00+ in the next few months is possible.

Will RED Hit $1.50?

With strong pre-market momentum and a highly anticipated Binance & MEXC listing, RedStone (RED) has a strong chance of crossing $1.50 in the short term. However, volatility will be high, making risk management crucial.