Crepe (CREPE) is not just an ordinary token; it symbolizes the creativity and community-driven energy of DeFi culture. In the realm of decentralized finance, it merges cultural significance with modern blockchain technology, opening a new chapter in the cryptocurrency market.

With strong support from an active Polygon community and early DeFi adopters, Crepe (CREPE) is more than a passing trend—it presents fresh opportunities for investors seeking growth in emerging tokens. This article will guide you through every aspect of Crepe (CREPE), helping you understand its vision, features, and potential in today’s evolving crypto market.

Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

Key Takeaways

Crepe Coin (CREPE) is a fast-growing DeFi project on Polygon, designed for yield-farming and strategy sharing.

It’s a Polygon-based DeFi token powering yield-farming strategies known as “CREPE Cakes.”

Backed by an active community, Crepe positions itself as more than a trend, aiming for long-term relevance in DeFi.

What Is Crepe (CREPE) and Why It Matters?

Crepe (CREPE) is a DeFi governance token built on the Polygon blockchain that represents a modern, community-driven approach to decentralized finance. The project embodies the following values:

Creativity – enabling users to design and share custom yield strategies (“CREPE Cakes”).

Accessibility – lowering barriers for everyday investors to participate in DeFi.

Collaboration – rewarding strategy creators when others adopt their models.

Crepe (CREPE) not only channels the collaborative spirit of community finance but also applies it to the DeFi industry, aiming to build a sustainable, trustworthy, and innovation-led ecosystem.

Source: X

Crepe (CREPE), a Polygon-based DeFi token, is gaining traction with its unique “CREPE Cake” yield-farming model. Backed by an active community, it’s positioning itself as more than just another meme-styled coin, offering investors both creativity and growth potential in the fast-evolving DeFi space.

Crepe (CREPE) Price Prediction for 2025: What to Expect?

Factors such as market conditions, project fundamentals, and community trust shape cryptocurrency valuations. With strong community support and a growing DeFi presence, Crepe (CREPE) is anticipated to remain in the $0.00005–$0.00015 price range during 2025. If adoption in DeFi yield-farming and strategy-sharing accelerates, its value may rise to $0.00040–$0.00045 over the long term.

Key Drivers of Crepe (CREPE) Price Movement

Several factors shape the potential value of Crepe (CREPE):

Market Dynamics: CREPE is a highly speculative, low-cap token. Prices swing sharply with trading volume, exchange listings, and overall market sentiment. Recent activity shows both explosive short-term gains and steep corrections.

Adoption & Practical Use Cases: The token’s utility comes from “CREPE Cakes,” yield-farming strategies users can create and monetize. Widespread adoption of these tools will directly impact CREPE’s long-term sustainability.

Technological Development & Expansion: Future integrations with the Polygon ecosystem, improved liquidity pools, and potential cross-chain expansion will play a central role in boosting both usability and demand.

Future Growth Prospects

If Crepe (CREPE) maintains momentum in the DeFi sector, rising participation in yield-farming strategies could strengthen demand and stabilize prices. Experts note that with consistent development and user adoption, CREPE could move toward the $0.00040–$0.00045 range over time. Still, investors should approach with caution, given high volatility and the potential impact of regulatory shifts on DeFi tokens.

Source: CoinCarp

Key Features of Crepe (CREPE)

The standout features of Crepe (CREPE) include:

CREPE Cakes (Yield-Farming Strategies)

Users can design custom yield-farming strategies called CREPE Cakes. These strategies can be shared with others, and creators earn rewards when their models are adopted, turning DeFi knowledge into a monetizable asset.

Polygon-Based Scalability

Built on the Polygon blockchain, Crepe (CREPE) benefits from fast transactions and low fees. This makes it accessible to smaller investors who might otherwise be priced out of Ethereum-based DeFi platforms.

Community-Driven Growth

Crepe emphasizes decentralization and community participation. Its ecosystem rewards collaboration, encouraging users to contribute strategies, liquidity, and governance to strengthen long-term adoption.

How Does Crepe (CREPE) Work?

The operation of Crepe (CREPE) is based on its unique “CREPE Cake” yield-farming model and Polygon’s efficient blockchain infrastructure.

CREPE Cakes (Strategy Creation & Sharing)

Users design yield-farming strategies—known as CREPE Cakes—that can be published and shared. When other investors adopt these strategies, the original creators earn a share of the rewards, encouraging knowledge-sharing and collaboration.

DeFi Yield Aggregation

Crepe pools liquidity and aggregates yield opportunities across Polygon’s ecosystem. By simplifying DeFi strategy execution, it lowers the barrier to entry for casual investors who may not have the technical expertise to optimize returns on their own.

Token Utility & Governance

The CREPE token serves as both a utility and governance asset. Holders can stake CREPE for rewards, use it within the ecosystem, and participate in governance decisions that shape the platform’s future.

By integrating community-driven strategy creation and leveraging Polygon’s low-cost infrastructure, Crepe (CREPE) aims to establish itself as a sustainable and influential DeFi project within the cryptocurrency ecosystem.

The Companies and Organizations Supporting Crepe (CREPE)

The Team

Crepe (CREPE) is led by a community-driven DeFi development group with strong expertise in blockchain engineering, smart contracts, and yield-farming mechanics. Rather than a traditional corporate structure, the team emphasizes decentralization—focusing on building tools that empower users to create and share their own DeFi strategies. Their goal is not only to launch another token, but to establish Crepe (CREPE) as both a cultural and financial symbol of creativity and collaboration in DeFi.

The Vision

At its core, Crepe (CREPE) aims to democratize decentralized finance by making advanced yield-farming strategies accessible to all. The project’s vision is to build a sustainable DeFi ecosystem where collaboration, transparency, and community participation drive growth, lowering the barriers for small investors while rewarding innovation.

Partnerships

Crepe (CREPE) has engaged with Polygon’s DeFi ecosystem to leverage scalability and low transaction costs. In addition, it collaborates with community-led liquidity providers and DeFi enthusiasts who contribute strategies, liquidity, and governance input. These partnerships strengthen the token’s ecosystem and expand its reach into DeFi yield-farming, liquidity mining, and community governance sectors.

Key Use Cases of Crepe (CREPE): How It’s Transforming DeFi

Crepe (CREPE) serves a variety of purposes, including:

Yield-Farming Strategies (CREPE Cakes)

Users can design, publish, and monetize yield-farming strategies called CREPE Cakes. When others adopt these strategies, the creators earn rewards, turning DeFi know-how into an income stream.

Staking and Rewards

CREPE holders can stake their tokens within the ecosystem to earn passive income. This encourages long-term holding while supporting liquidity and platform stability.

Governance Participation

CREPE functions as a governance token, giving holders a voice in key decisions such as protocol upgrades, new features, and community incentives.

These applications highlight the practical value of $CREPE in the DeFi industry, positioning it as more than just another speculative token—it’s designed to foster collaboration, innovation, and sustainable growth.

Inside the Crepe (CREPE) Roadmap: Timeline of Upcoming Features

The roadmap for Crepe (CREPE) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | Expand CREPE Cake yield-farming strategies, launch user-friendly dashboard for strategy creation and sharing. |

| Q2 2025 | Introduce staking pools and liquidity incentives, enabling long-term holders to earn passive rewards while supporting ecosystem liquidity. |

| Q3 2025 | Launch governance features, allowing CREPE holders to vote on upgrades, new strategies, and community-driven initiatives. |

These milestones highlight the practical value of $CREPE in the DeFi industry, showing its ambition to evolve from a niche token into a collaborative and sustainable ecosystem.

How to Buy Crepe (CREPE) on Bitget Wallet?

Trading Crepe (CREPE) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

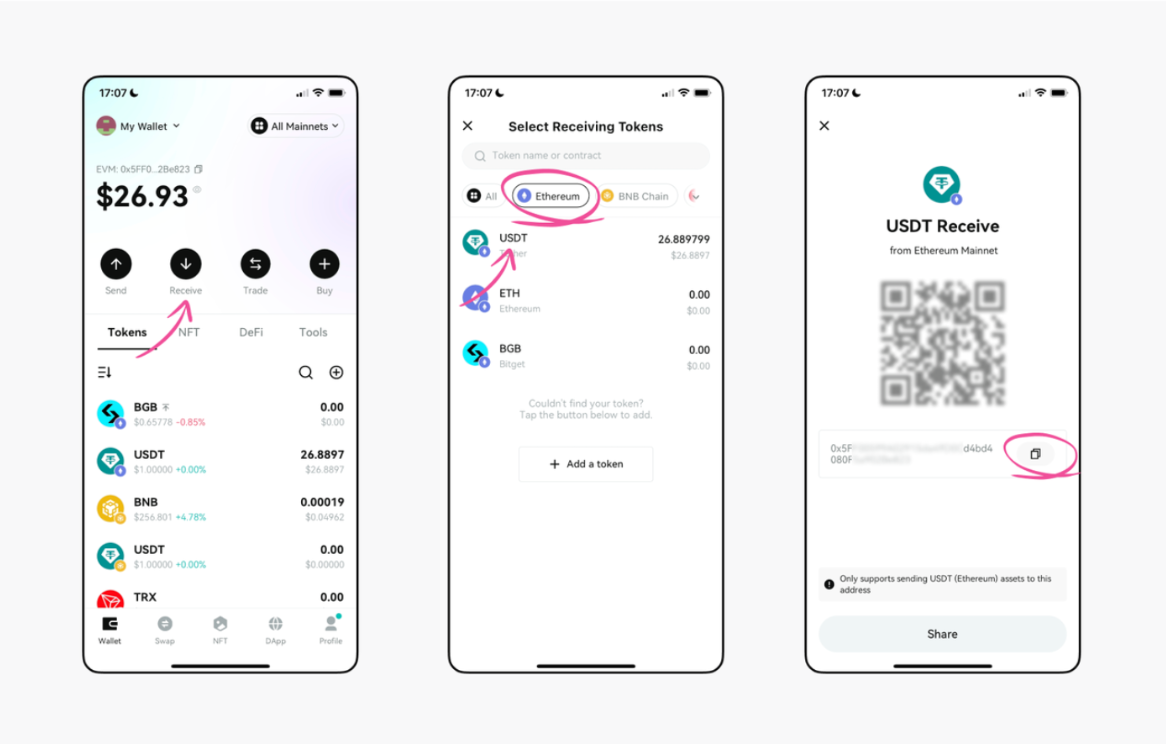

Once your account is set up, you need to deposit funds. You can do this by:

Transferring Cryptocurrency: Send crypto from another wallet.

Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Crepe (CREPE).

Step 3: Find Crepe (CREPE)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Crepe (CREPE). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

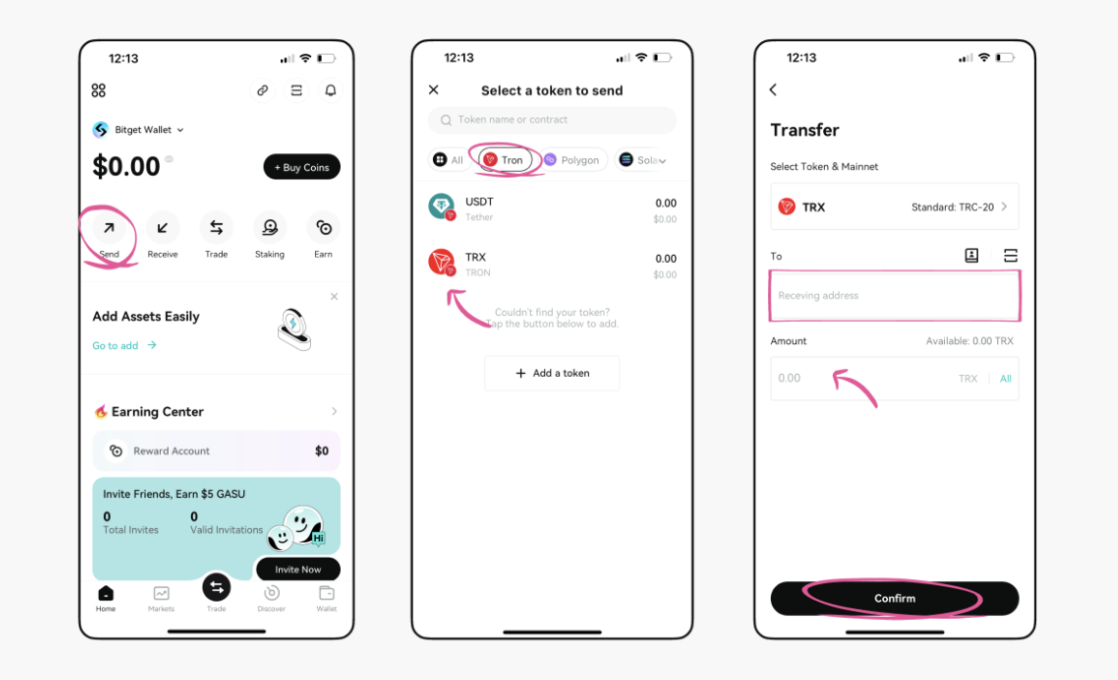

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as CREPE/USDT. This will allow you to trade Crepe (CREPE) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Crepe (CREPE) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Crepe (CREPE).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Crepe (CREPE) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶ Learn more about Crepe (CREPE):

What is Crepe (CREPE)?

Conclusion

Crepe (CREPE) stands out as a community-driven DeFi token on Polygon, designed to make yield-farming strategies accessible, collaborative, and rewarding. With features like CREPE Cakes, governance participation, and staking rewards, it’s carving a niche in the crowded DeFi landscape. Its community-first approach and innovative design suggest strong potential for long-term growth in the decentralized finance sector.

Buying and trading Crepe (CREPE) through Bitget Wallet offers added benefits: a secure, self-custodial environment, seamless cross-chain transactions, and user-friendly tools for both new and experienced investors. With Bitget Wallet, you stay in full control of your assets, enjoy low-fee swaps, and gain access to trending DeFi tokens early—making it one of the smartest ways to participate in the growth of CREPE and the wider crypto ecosystem.