Key Takeaways

– Katana Network is a DeFi-focused Layer-2 blockchain designed to unify fragmented liquidity and deliver sustainable yield.

– The KAT token powers governance, fee sharing, and liquidity incentives, with a 10 billion supply and a 9-month transfer lock.

– Core on-chain apps include Sushi for spot trades, Morpho for lending/borrowing, and Vertex for perpetuals, backed by Chain-Owned Liquidity.

– Users acquire KAT via Polygon POL airdrop, early Krates deposits, or ongoing vaults; risks include smart-contract complexity and token-unlock volatility.

Press enter or click to view image in full size

Katana Network (KAT) is a DeFi-focused Layer-2 blockchain built with Polygon Labs and GSR to tackle liquidity fragmentation on Ethereum. Imagine one single AMM (Sushi), a unified lending protocol (Morpho), and a perpetuals DEX (Vertex) all sharing deep liquidity. That means lower slippage and more reliable yields from sequencer fees, VaultBridge strategies, and revenue from core apps.

Its native token, KAT, powers governance votes, fee sharing, and incentive programs. Read on to learn What is Katana Network, What is the KATANA Token, and how to get involved in its ecosystem.

Table of Contents

Katana Network (KAT) Project Overview

Katana (KAT) Tokenomics, Distribution, Burning

Katana Network dApp Core Applications and Ecosystem dApps

How to Participate & Acquire the KAT Token

Katana Network Competitive Landscape

Katana (KAT) Token Risks & Considerations

Katana (KAT) Outlook

Katana Network (KAT) Project Overview

Katana Network is a DeFi-focused Layer-2 that was born out of a partnership between Polygon Labs and GSR. Think of it as a purpose-built ecosystem where liquidity isn’t scattered across dozens of protocols but concentrated in just three core building blocks. First, there’s Sushi v3 for spot trading. Next comes Morpho for borrowing and lending. Finally, Vertex handles perpetual futures. By funneling activity into these flagship apps, Katana delivers deeper pools, tighter spreads, and more predictable user experiences.

Press enter or click to view image in full size

Image Credit: Katana Network dApp Interface

Key design principles:

– Unified Liquidity: One AMM (Sushi v3), one lending protocol (Morpho), one perpetual DEX (Vertex), preventing fragmentation.

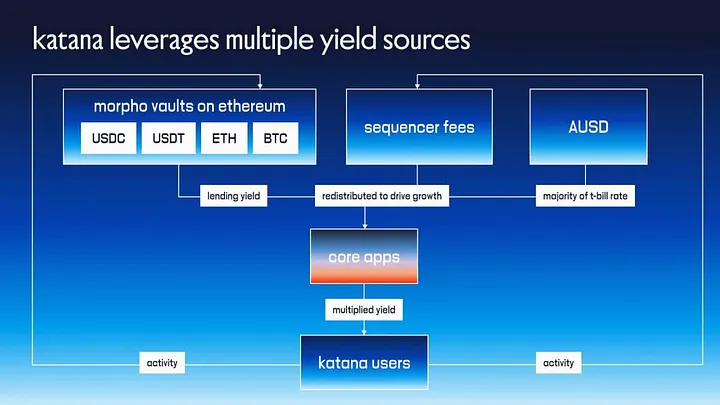

– Chain-Owned Liquidity (CoL): Sequencer fees and core-app revenue accumulate in CoL, which seeding pools to ensure deep, stable liquidity even in market dips.

– Embedded Yield (VaultBridge): Bridged assets into Katana can optionally earn yield on Ethereum’s Yearn or Morpho vaults before arriving, so deposits are productive from day one.

Under the hood, Katana uses Polygon’s AggLayer for seamless cross-chain bridges, while an Optimism-based rollup is bolstered by Succinct Labs’ zero-knowledge proofs to speed up finality and withdrawals. Every transaction fee and a share of core-app revenues flow into a Chain-Owned Liquidity treasury that helps cushion markets during volatility. On top of that, VaultBridge lets you earn yield on Ethereum’s Yearn or Morpho vaults as soon as you bridge assets in, so your funds start working right away.

Press enter or click to view image in full size

Image Credit: Katana Network Blog

Katana went live on private mainnet in May 2025 and opens to everyone in late June 2025. Its native token, KATANA, was distributed to POL stakers and early liquidity providers, and it powers governance, fee sharing, and incentive programs. With ETH as gas and a governance model designed for long-term alignment, Katana is built for DeFi traders, liquidity providers, and dApp creators who want sustainable yields and a unified, high-performance environment.

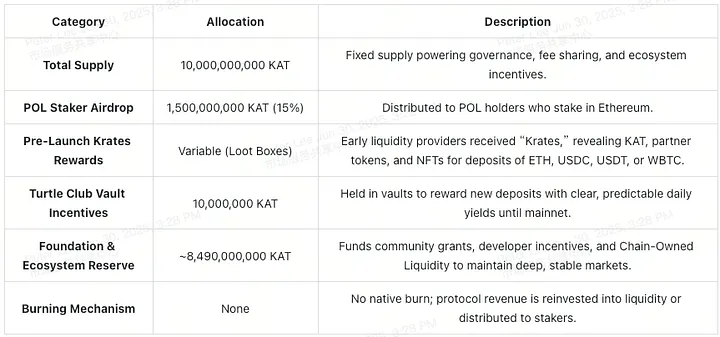

Press enter or click to view image in full size

Image Credit: Katana Network Blog

Katana (KAT) Tokenomics, Distribution, Burning

Supply and Purpose

KATANA (KAT) has a fixed supply of 10 billion tokens, and powers governance, fee sharing, and ecosystem incentives.

Press enter or click to view image in full size

Distribution

– 15% Airdrop to POL Stakers: About 1.5 billion KAT went to users who stake POL on Ethereum.

– Pre-Launch Krates Rewards: Early liquidity providers earned “Krates” that opened to reveal KAT, partner tokens and NFTs in exchange for depositing ETH, USDC, USDT, or WBTC.

– Ongoing Vault Incentives: Turtle Club vaults hold 10 million KAT to reward new deposits with predictable daily yields.

– Foundation & Ecosystem Reserve: The balance of KAT tokens funds community grants, developer incentives and Chain-Owned Liquidity to keep markets deep and stable.

Lock-Up Period

All KAT distributed at launch is locked for nine months. That prevents immediate sell-pressure and encourages holders to stay engaged. Transfers are expected to open around February 2026, or possibly sooner if the community agrees.

Utility and Governance

– vKAT Voting: Lock your KAT to receive vKAT and cast governance votes under a modified ve(3,3) model.

– Fee Sharing: vKAT stakers earn a slice of trading fees, borrowing spreads, and vault revenue.

– Incentive Direction: Governance decides how KAT rewards flow to Sushi, Morph,o and Vertex liquidity.

Burning Mechanism

There is no native burn. Instead, protocol revenue is reinvested into liquidity or paid out to stakers, creating what the team calls a real-yield model rather than relying on token burns.

Katana Network dApp Core Applications and Ecosystem dApps

Core Applications

Katana focuses on three flagship apps that share deep liquidity rather than competing for the same pools.

Sushi v3 (Spot AMM)

– It’s the only automated market maker on Katana, so pools for KATANA/USDT, ETH, USDC and WBTC are combined in one place.

– Deep liquidity means you get tighter prices and liquidity providers earn swap fees more reliably.

Morpho (Lending & Borrowing)

– Delivers optimized rates by matching peers directly and tapping into pooled liquidity for larger trades.

– A single lending market concentrates demand and supply, which means more stable borrowing costs for everyone.

Vertex (Perpetuals DEX)

– Offers perpetual futures with full margin controls and integrated risk management.

– Uses the same Chain-Owned Liquidity that underpins spot and lending, so even high-leverage traders benefit from deeper markets.

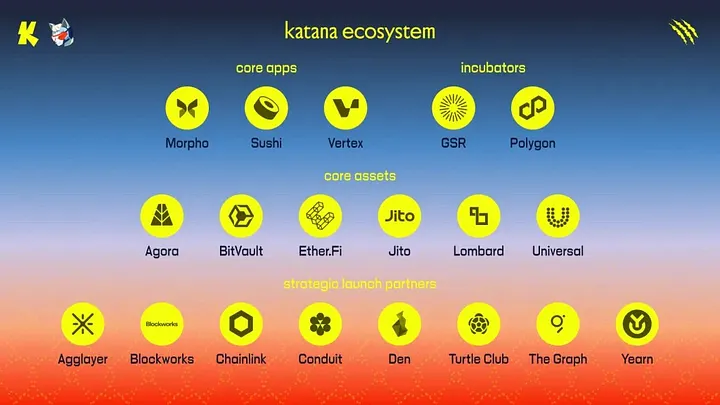

Press enter or click to view image in full size

Image Credit: Katana Network Blog

Native Asset Protocols

Beyond the core apps, Katana supports a range of built-in assets:

– AUSD (Agora USD): A fully backed stablecoin whose stability fees flow back to users.

– LBTC (Lombard Bitcoin): A Bitcoin wrapper that earns interest, so your BTC can work for you.

– Liquid Staked Tokens: Assets like Ether.fi staked ETH and Jito staked SOL bring cross-chain staking yields into Katana.

Yield Infrastructure

– VaultBridge lets you route bridged assets into Yearn or Morpho vaults on Ethereum before they land on Katana, so your deposit starts earning right away.

– Chain-Owned Liquidity (CoL) uses protocol fees and vault revenue to seed and stabilize core pools, smoothing out volatility.

Ecosystem Integrations

Katana integrates with top builders and data providers:

– Turtle Club offers transparent vaults where you can continue earning KATANA rewards.

– Chainlink and The Graph handle price feeds and indexing.

– Den powers governance front-ends, and Blockworks brings media exposure to keep you in the loop.

This focused, interconnected ecosystem is designed so every app and asset feeds into the same liquidity flywheel, creating a more predictable and rewarding DeFi experience.

Press enter or click to view image in full size

Image Credit: Katana Network

How to Participate & Acquire the KAT Token

1. POL Airdrop

– Stake your POL on Ethereum before the snapshot date and automatically receive your share of 15 percent of the KAT supply.

2. Pre-Launch Krates (Closed)

– Early supporters who deposited ETH, USDC, USDT, or WBTC into the Katana Krates contract earned loot boxes.

– Each Krate contained KAT and partner tokens, unlocked at mainnet with a nine-month token lock.

3. Turtle Club Vaults

– Until mainnet, you can deposit the same assets into Turtle Club’s Katana vaults.

– Vaults display public rates and let you claim daily KAT rewards once the network goes live.

4. Post-Launch Trading

– After KAT becomes transferable, swap KAT/USDT on Sushi or on centralized platforms like XT.com.

– You can also add KAT liquidity to pools to earn swap fees and incentive rewards.

5. Staking for Governance

– Lock your transferable KAT to mint vKAT.

– Use vKAT to vote on proposals and receive a portion of network fees.

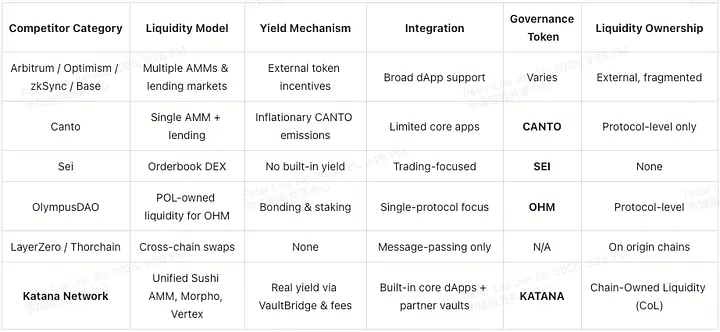

Katana Network Competitive Landscape

Press enter or click to view image in full size

Katana operates in a busy DeFi and Layer-2 arena but brings a fresh approach by focusing on unified liquidity and real yield. Let’s explore how it stacks up against various competitors.

General-Purpose Layer-2s

Typical Model

– Many rollups like Arbitrum, Optimism, zkSync, and Base host a variety of AMMs, lending markets and tokens. That often means liquidity gets split across too many options.

Katana’s Edge

– By offering just one AMM (Sushi), one lending protocol (Morpho), and one perpetuals DEX (Vertex), Katana concentrates liquidity in deeper pools. Chain-Owned Liquidity and VaultBridge yield give it sustainable real yield that neutral L2s don’t provide.

DeFi-Specific Chains

– Canto relies on a single AMM and lending market with inflationary rewards.

– Sei prioritizes a high-speed orderbook DEX but lacks native yield strategies.

– Katana brings together spot swaps, borrowing, perps and cross-chain yield in one integrated environment, making it a one-stop DeFi hub.

Protocol-Owned Liquidity Models

– OlympusDAO focuses on its OHM token owning liquidity for a single protocol.

– Katana takes that idea to a higher level by owning liquidity at the chain level, funding every core app’s pools to smooth out volatility.

Cross-Chain Liquidity Aggregators

– LayerZero and Thorchain let you swap across chains but leave assets scattered.

– Katana bridges assets into its ecosystem so liquidity becomes sticky and productive through VaultBridge.

Polygon Ecosystem Synergy

– Katana benefits from Polygon Labs’ backing and a dedicated 15 percent KAT airdrop to POL stakers. It complements other Polygon rollups like zkEVM by serving as the go-to DeFi destination.

Katana (KAT) Token Risks & Considerations

1. Security Complexity

– Multiple protocols (VaultBridge, Sushi, Morpho, Vertex) raise the attack surface despite thorough audits

– Dependencies on Yearn and Morpho vaults mean a bug or exploit off-chain can affect your assets

2. Centralization Concerns

– Early sequencing by Conduit and bridging via AggLayer carry censorship and single-point-of-failure risks

– Full decentralization of these services is planned, but not yet live

3. Liquidity & Withdrawal

– Your deposits may be earning yield off-chain, so mass withdrawals could stretch reserves and Chain-Owned Liquidity (CoL)

– In extreme market stress, you might face delays

4. Economic & Market Risks

– Yields hinge on DeFi activity and external strategies; a downturn could compress rewards

– A nine-month lockup on airdrop and vault-earned KAT (unlocking in February 2026) could cause price swings

5. Regulatory Uncertainty: Managing liquidity and yield at the chain level may attract scrutiny under securities or banking rules in some regions.

Katana (KAT) Outlook

What’s Going Well

– Strong Backing from Polygon Labs and GSR provides resources and early liquidity.

– Built-In Community via the POL airdrop ensures a ready user base.

– Real-Yield Model through VaultBridge and Chain-Owned Liquidity can set Katana apart if yields stay attractive.

Press enter or click to view image in full size

Image Credit: Katana Network

Challenges Ahead

– Post-Unlock Dynamics: When the nine-month lock expires in early 2026, price swings are possible as new tokens enter the market.

– Security & Execution: Complex integrations must remain secure, and the team needs to hit roadmap milestones on time.

– Competitive Landscape: Other Layer-2s may copy Katana’s incentives, so ongoing innovation will be key.

Bottom Line

Sentiment around Katana is cautiously optimistic. If it maintains its yields, deep liquidity, and robust governance, Katana could draw TVL from Ethereum, neutral rollups, and DeFi-specific chains. Success will depend on execution, security, and community participation in governance.