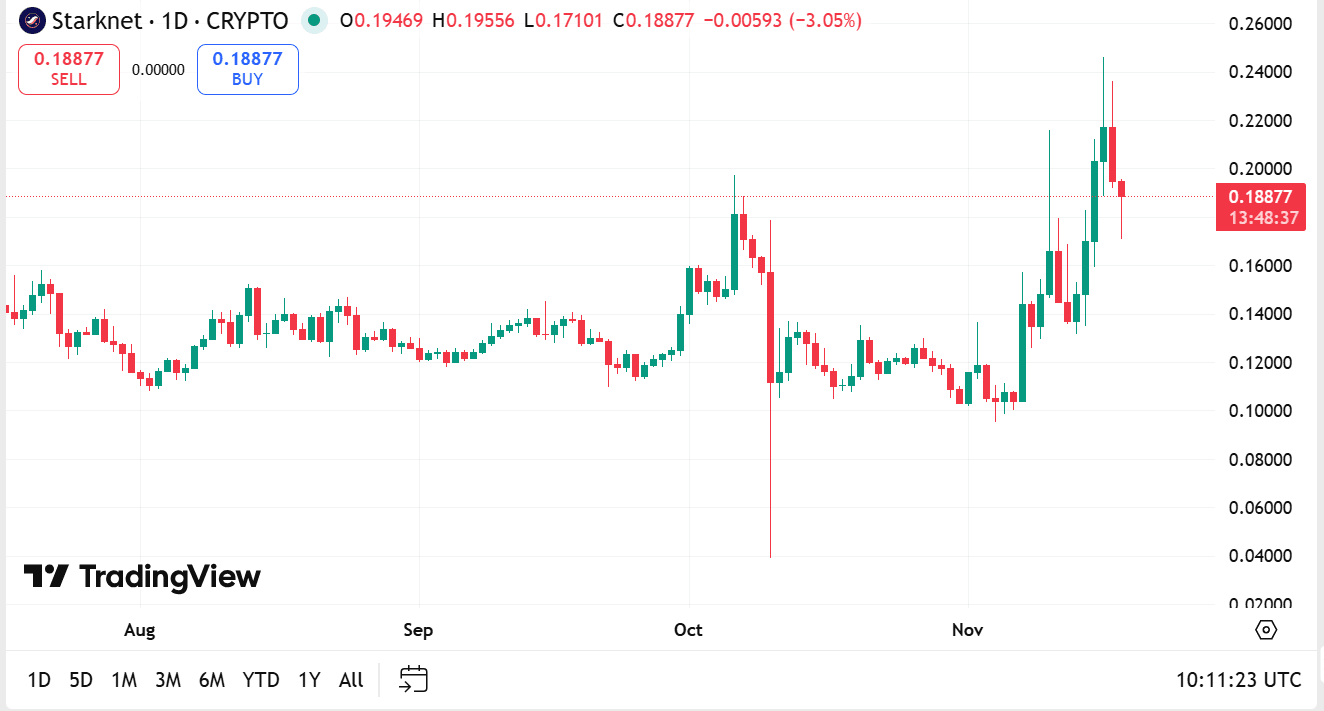

Starknet (STRK) Price Surges 95%: Cryptocurrency markets are often defined by rapid changes in sentiment and price movements.

Crypto market today: One of the projects that has recently captured attention is Starknet, accompanied by its native token STRK. The token has experienced a substantial price increase that has many curious about the project’s fundamentals, its development trajectory, and its future potential. In this article, we dive deep into Starknet, its token STRK, and what these developments mean for participants and watchers of the crypto space.

1. What is Starknet? Is it a Scam?

Understanding Starknet

Starknet is a Layer 2 scaling solution built on top of the Ethereum blockchain. It leverages zk-rollup technology to improve Ethereum’s scalability by bundling multiple transactions into a single proof, which is then verified on the Ethereum mainnet. This allows Starknet to increase transaction throughput significantly while reducing fees and maintaining the security guarantees of Ethereum.

Layer 2 solutions like Starknet are essential for Ethereum because the base layer faces limitations in transaction speed and cost, especially during times of high demand. Starknet’s approach uses zero-knowledge proofs to validate batches of transactions efficiently, thereby alleviating congestion on the mainchain.

source: tradingview

What Makes Starknet Unique?

Zero-Knowledge Rollups: Starknet uses zero-knowledge proofs (zk-STARKs) which are considered highly secure and efficient compared to other zk-rollup implementations.

Decentralized Execution: It supports permissionless smart contract deployment, allowing developers to build decentralized applications without needing approval.

Ethereum Compatibility: Starknet is fully compatible with Ethereum, enabling seamless asset transfers and contract interoperability.

Open Development: The project is open-source, with continuous updates and community contributions.

Is Starknet a Scam?

The question of legitimacy is crucial in the crypto realm, where scams and fraudulent projects are unfortunately common. Starknet is developed by StarkWare, a reputable company with a strong track record in cryptographic research and blockchain development. The team includes recognized experts in zero-knowledge proof systems and has partnerships with Ethereum developers and major blockchain projects.

Additionally, Starknet’s codebase and protocols are open to public scrutiny, which adds to its transparency. The project has undergone thorough audits, and its technology is actively used in multiple decentralized applications.

Given these factors, Starknet is not considered a scam but a serious, technically sophisticated project aiming to solve real scalability challenges on Ethereum.

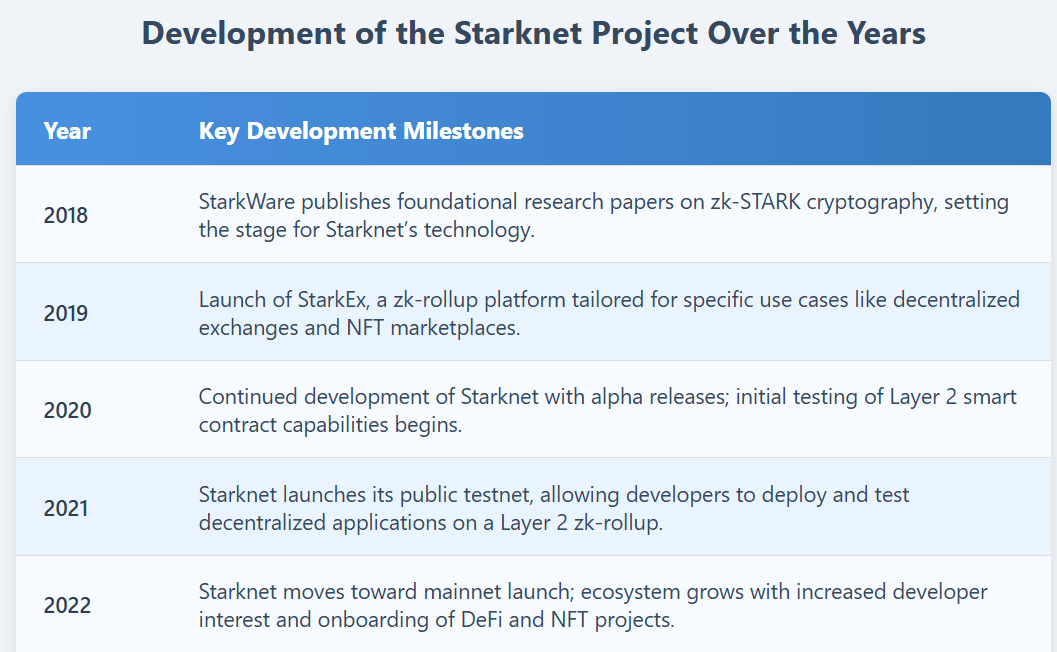

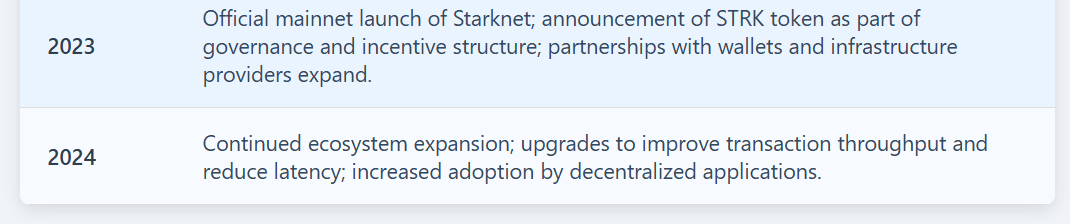

2. Development of the Starknet Project Over the Years

Early Foundations and Research

Starknet’s origins can be traced back to StarkWare, which began publishing research on zk-STARKs in 2018. This cryptographic breakthrough provided the theoretical foundation for scalable, trustless proofs that do not require trusted setups, setting it apart from other zero-knowledge proof systems.

Milestones and Launches

Initial zk-Rollup Deployments: StarkWare initially launched zk-rollup solutions for specific use cases, such as StarkEx, which focused on scaling applications like decentralized exchanges and NFT marketplaces.

Starknet Alpha Release: The early version of Starknet was introduced to developers, allowing them to experiment with deploying smart contracts and testing network performance.

Mainnet Launch: Starknet moved from testnet to mainnet, enabling real-world usage and asset transfers.

Token Launch Announcement: The introduction of the STRK token as a governance and utility token was a significant step towards decentralizing the network and incentivizing participation.

Ecosystem Growth

Over time, Starknet has seen growing interest from developers building DeFi protocols, gaming applications, and NFT projects on its platform. The network’s scalability benefits and Ethereum compatibility make it an attractive choice for projects looking to overcome Ethereum’s gas fee challenges.

Partnerships and Collaborations

Starknet has collaborated with major players in the crypto space, including wallets, blockchain infrastructure providers, and DeFi protocols. These partnerships help enhance user experience, security, and cross-platform integrations.

3. What is the STRK Token? Detailed Specifications

Overview of STRK

STRK is the native token of the Starknet ecosystem, designed to facilitate governance, incentivize network participants, and support the platform’s growth.

Token Role and Utility

Governance: STRK holders can participate in protocol governance by voting on proposals related to upgrades, fee models, and other network parameters.

Staking and Incentives: STRK can be staked by participants to secure the network, earn rewards, and encourage long-term commitment.

Fee Mechanism: The token may be used to pay transaction fees or participate in fee distribution models.

Ecosystem Growth: STRK serves as an incentive for developers, users, and liquidity providers to contribute to the network’s expansion.

Tokenomics

Total Supply: The token has a fixed maximum supply, designed to create scarcity and support value appreciation.

Distribution: Tokens are distributed across various stakeholders, including the team, investors, community incentives, and reserves for ecosystem development.

Vesting Periods: To align interests, certain allocations are subject to vesting schedules to prevent immediate sell-offs.

Security and Transparency

Audits: Smart contracts managing STRK are audited by reputable firms to ensure security and reliability.

Transparency: Token distribution and treasury management are publicly accessible, contributing to community trust.

4. Pros and Cons of Starknet: Is STRK a Good Investment Right Now?

Pros of Starknet

Cutting-Edge Technology: Starknet’s use of zk-STARKs represents one of the most advanced scaling technologies available.

Ethereum Compatibility: Seamless interaction with Ethereum makes Starknet attractive for developers and users already familiar with Ethereum.

Growing Developer Ecosystem: An increasing number of projects are building on Starknet, enhancing its network effects.

Strong Backing: StarkWare’s experienced team and partnerships lend credibility and technical expertise.

Governance Token: STRK empowers holders to influence the network’s future, potentially increasing engagement and alignment.

Cons and Risks

Competition: Starknet faces stiff competition from other Layer 2 solutions and alternative blockchains, some with larger ecosystems.

Adoption Uncertainty: While promising, the success of Starknet depends on sustained developer and user adoption.

Regulatory Environment: Like all crypto projects, regulatory changes could impact Starknet and STRK’s future.

Market Volatility: STRK, like other tokens, is subject to price swings that can be influenced by broader market trends.

Technical Complexity: Understanding and integrating zk-STARK technology can be challenging, potentially slowing ecosystem growth.

Is STRK a Good Buy Right Now?

Whether STRK is a worthwhile addition depends on individual objectives and risk tolerance. The project’s fundamentals and technology are strong, but the crypto market remains dynamic with inherent uncertainties. Careful consideration of the project’s roadmap, community sentiment, and your investment horizon should guide your decision.

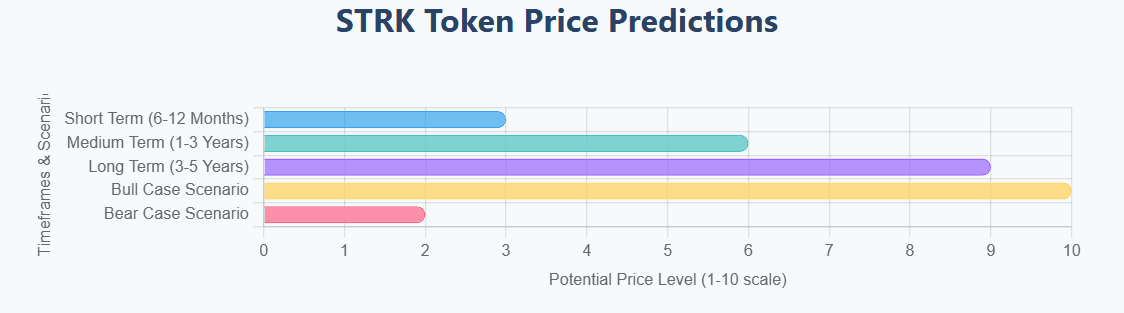

5. STRK Token Price Predictions

Factors Influencing STRK’s Price

Network Growth: Increased activity, dApp launches, and user transactions on Starknet can drive demand for STRK.

Governance Participation: Active voting and staking can increase token utility.

Market Sentiment: Overall crypto market trends and investor sentiment influence token price dynamics.

Technological Advancements: Successful upgrades and enhancements to Starknet can boost confidence.

Partnerships and Integrations: Collaborations with other projects and platforms may expand STRK’s reach.

Analyst Views and Community Expectations

While precise price forecasts are speculative, many in the community view STRK as having high potential due to its underlying technology and role in the Ethereum scaling landscape. However, potential investors should approach price predictions cautiously, considering market volatility and external factors.

Long-Term Outlook

If Starknet continues to achieve adoption milestones and expands its ecosystem, STRK could see sustained demand. Its governance role also adds intrinsic value as the network decentralizes further.

6. Summary

Starknet represents a promising Layer 2 scaling solution that leverages advanced zero-knowledge proof technology to address Ethereum’s scalability challenges. Developed by StarkWare, the project has made significant progress through research, development, and ecosystem growth.

STRK, the native token, plays a central role in governance, staking, and incentivizing participation within the network. Its detailed tokenomics and security measures contribute to transparency and community trust.

While Starknet offers exciting potential, it operates in a competitive and rapidly evolving environment. Prospective participants should weigh the innovative technology and growing ecosystem against market uncertainties and adoption challenges.

In conclusion, Starknet and the STRK token have positioned themselves as key players in Ethereum’s Layer 2 scaling future. Those interested should keep a close eye on the project’s developments, network usage, and broader market conditions to make well-informed decisions.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!