KEY TAKEAWAYS

Illiquidity turned routine liquidations into a catastrophic 90% price collapse for OM.

Excessive leverage in a thin market created a perfect storm of forced selling.

On-chain movements signaled potential risks before the downturn.

Rebuilding trust after such a crash requires more than promises—it demands transparency and action.

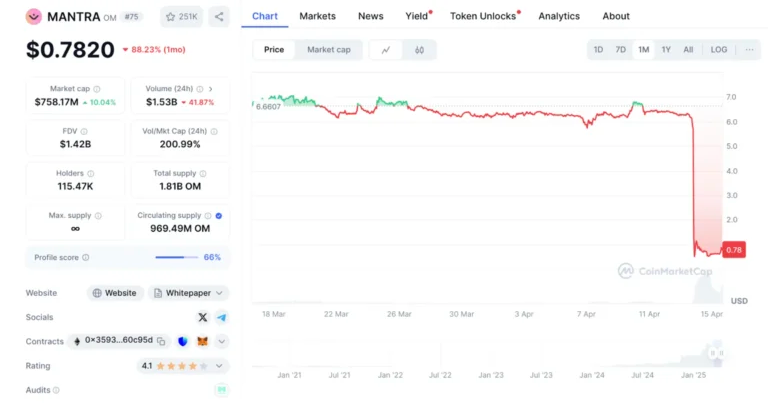

On April 13, 2025, Mantra’s OM token crashed fast—dropping 90% in minutes. It fell from around $6.32 to as low as $0.49.

Mantra co-founder John Patrick Mullin said the cause was due to “massive forced liquidations” of large OM holders. He called the actions “reckless forced closures” by centralized exchanges (CEXs), stating they liquidated OM positions without warning during low-liquidity hours.

But was this just one bad day? The OM crash might have revealed how thin the market was.

This article explores the connection between the Mantra (OM) crash and illiquidity, why liquidity plays a crucial role in crypto markets and the key lessons this event reveals.

What Is Mantra?

Mantra is a decentralized platform and layer-1 blockchain built for real-world asset (RWA) tokenization.

It supports institutions and developers, giving them tools to issue, manage, and trade tokenized assets. Mantra aims to bridge the gap between traditional and decentralized finance (DeFi) by turning assets like real estate, bonds, and private equity into on-chain products.

Key Details About Mantra:

Network: Built on Cosmos SDK, enabling high interoperability and scalability.

Token: OM is the native utility token used for staking, governance, and fee payments.

Focus: Specializes in RWA tokenization, regulatory compliance, and DeFi infrastructure.

Use cases: These include DeFi lending, staking, and launching compliant tokenized products.

As of April 2025, it worked closely in the Middle East and North Africa (MENA) to help tokenize financial instruments under regulatory frameworks.

Leverage Gone Wrong: How Borrowed Money and Low Liquidity Crushed OM

Some OM holders used leverage—trading with borrowed money. This works when prices rise. But when OM’s price started falling, exchanges automatically liquidated their positions to prevent losses. This dumped a large amount of OM into the market at once.

Bybit and Binance were at the center of the storm.

Key events behind the OM crash:

Early red flags ignored: Critics had flagged issues with Mantra long before the crash.

False investment claims: The project also faced backlash for falsely claiming investment from FTX, which the now-defunct exchange later denied.

DAO governance questioned: In 2021, Colin Wu raised concerns about Mantra’s decentralized autonomous organization (DAO), citing alleged ties to the online gambling platform 21Pink and issues with team transparency.

$71 million liquidated on Bybit: Bybit saw the bulk of liquidated OM positions, many executed during low-liquidity hours. These closures happened without warning, intensifying the selling pressure and accelerating the price drop.

$227 million in OM tokens moved before the crash: On-chain data showed that 17 wallets deposited 43.6 million OM tokens to Binance and OKX shortly before the sell-off.

These movements raised flags about possible strategic dumping ahead of the liquidation wave.

Binance acknowledged that liquidations across platforms played a major role in the crash. The exchange pointed to coordinated actions, volatility, and changes in OM’s tokenomics as key triggers.

No Buyers, Just Sellers: Why OM’s Collapse Was a Liquidity Death Spiral

In a healthy market, such liquidations do not crash prices. But OM had low liquidity—not enough buyers to absorb the sell-off, so the price collapsed.

It is like trying to sell rare items in a town with no collectors—you must keep lowering the price to find a buyer. That happened with OM—too much supply, not enough demand.

Loonkonchain linked two of the wallets involved to Laser Digital and Shorooq Partners, key investors in Mantra. While there is no confirmed wrongdoing, some in crypto believe their actions contributed to the token’s sharp drop.

Who dropped the price of $OM?

Before the $OM crash(since Apr 7), at least 17 wallets deposited 43.6M $OM($227M at the time) into exchanges, 4.5% of the circulating supply.

According to Arkham’s tag, 2 of these addresses are linked to Laser Digital.

Laser Digital is a strategic… pic.twitter.com/zB8yAPRPSO

— Lookonchain (@lookonchain) April 14, 2025

Five hours before the $OM crash, a wallet that had been dormant for one year transferred 2M $OM to a wallet potentially linked to Shane Shin(@KeunShane).

Is this related to the rumored OTC deals?

This wallet received 2M $OM at $12.58M, but it is now only worth $1.57M.

Shane… pic.twitter.com/d94cvh6hBp

— Lookonchain (@lookonchain) April 14, 2025

Both LaserDigital and Shorooq Partners have declared no involvement in the crisis.

1/ We want to directly address recent speculation around Laser Digital’s involvement in the price action of $OM (Mantra) @MANTRA_Chain.

2/ Laser has no involvement in the recent price collapse of $OM.

Assertions circulating on social media that link Laser to 'investor selling'…— Laser Digital (@LaserDigital_) April 14, 2025

The last 24 hours have been turbulent for the @MANTRA_Chain community following the sharp price drop of the $OM token.

Let’s set the record straight:

✅ No tokens were sold by Shorooq funds, founding partners or MANTRA teams during the crash

❌ There was no exploit—on-chain…— Shorooq (@ShorooqPartners) April 14, 2025

OM vs. LUNA: Different Crashes, Same Crypto Lessons

Traders have been quick to draw parallels between Mantra’s OM crash and Terra’s LUNA collapse — and while the mechanics differ, the warning signs feel familiar.

LUNA fell apart due to a flawed algorithmic stablecoin model, but OM’s 90% plunge was triggered by centralized exchange liquidations, poor liquidity, and concentrated token movements.

What connects them is a lack of transparency, overexposure to leverage, and unchecked risk in token design. The concern is that retail traders often bear the brunt, whether it’s an algorithmic death spiral or a forced liquidation wipeout.

$OM is the $LUNA of this cycle.

$6B+ wiped out within 30 minutes.

But why did it happen?

?: THE $OM CRASH DECODED?

( MUST REPOST AND LIKE ) pic.twitter.com/7Cz8ymsrHH

— Sjuul | AltCryptoGems (@AltCryptoGems) April 13, 2025

While OM didn’t have a stablecoin component like UST, its crash exposed similar structural weaknesses that can rapidly erode trust — and capital.

Given these incidents, investors should prioritize transparency, diversify across assets, and avoid projects with unclear tokenomics or high insider concentration. Always assess liquidity risks and avoid overleveraged positions. Most importantly, treat high-yield promises with caution, and do your own research instead of following hype or influencer-driven narratives. Preservation beats blind participation.

What Is Illiquidity In Crypto Markets?

Illiquidity in crypto means there aren’t enough people buying or selling a token at any given time, making the market fragile. One large move can trigger a cascade, especially if buyers disappear. When trading activity is low, even a normal sell-off can cause the price to collapse—not because the project failed but because the market could not handle the pressure.

Illiquidity is the opposite of liquidity, in which traders can exchange assets easily without major price swings.

Factors Contributing To Illiquidity In Crypto

Several factors can affect liquidity, leading to illiquidity in crypto. This makes an asset harder to trade and increases the risk of volatility. The following are some of the most important elements to consider:

Concentrated holdings: When a small number of crypto wallets hold most of a token’s supply, selling pressure from just one can disrupt the market.

Low market capitalization: Smaller-cap tokens usually have fewer participants and less trading activity, which weakens liquidity.

Limited adoption and use: Tokens without clear utility or real-world application tend to attract fewer long-term holders or active traders.

Fewer trading pairs: When a token can only be swapped against a handful of assets, it narrows trading options and restricts liquidity flow.

Geographical fragmentation: Liquidity scattered across multiple regional exchanges makes building strong, unified order books harder.

Overreliance on leverage: Leveraged trading can temporarily inflate activity, but it also increases the risk of forced liquidations, which can overwhelm a weak market.

Lack of market makers: Without active buyers and sellers managing price gaps, spreads widen, making the market harder to trade.

Regulatory uncertainty: Harsh or unclear rules can scare away participants and market makers, draining liquidity from the ecosystem.

Negative market sentiment: Fear, rumors, or bearish news reduce buying interest, exposing markets during volatility.

The next section examines what happened to Mantra’s OM token and how these elements contributed to its crash.

OM’s Collapse Shows Why Liquidity Matters in Crypto

OM didn’t collapse because of one bad trade. It collapsed because leverage met illiquidity—a toxic mix that turns routine events into market breakdowns.

Without enough buyers, the market cannot be sustained. One domino falls, and the whole structure can collapse. In crypto, liquidity is a major element that keeps prices from crashing, but OM blacked it. When pressure hit, the market failed.

JP Mullin: Mantra (OM) Is “Down, But Certainly Not Out”

JP Mullin thanked the Web3 community, investors, and partners for their support in the 36 hours following the crash.

He said Mantra had survived multiple market cycles and would keep building even after a setback like this one.

Mullin claimed that massive forced liquidations on Bybit, involving large OM token holders, triggered the sudden price collapse. Mullin addressed OM traders directly, acknowledging the pain and losses many faced.

Additionally, he praised Shorooq Partners and Laser Digital for backing Mantra and staying transparent with the public.

Mullin said the team would release a post-mortem report within 24 hours, using both on-chain and off-chain data to show what happened.

1) A quick note to say how much I appreciate all the support the MANTRA team has received in the past 36+ hours. The support and kind words have come from many sources – from partners, investors, friends, and from the wider Web3 community. Thank you.

— JP Mullin (?, ?️) (@jp_mullin888) April 15, 2025

He also announced plans for an OM token buyback and supply burn to rebuild trust and prove long-term commitment.

Mullin credited Mantra’s team for their fast response, saying the past two days showed their strength. He promised to keep sharing verified updates only through his account and Mantra’s official channels.

Recovery Efforts By Mantra

In response to the crash, Mantra has initiated several measures aimed at restoring confidence and stabilizing the OM token:

Token buyback program: The team is considering purchasing OM tokens from the market using their own funds to boost demand and support the token’s value.

Token burn: Mantra plans to burn up to 300 million OM tokens, including 150 million from CEO John Mullin’s personal holdings, to reduce the total supply and potentially enhance staking rewards.

Governance reforms: The company announced plans to improve the platform’s governance mechanisms, aiming to increase decentralization, transparency, and community trust.

Transparency initiatives: Mantra released a transparency report detailing wallet holdings to give the community a clearer view of token management.

As of May 6, 2025, OM is trading at approximately $0.396, showing signs of stabilization. The effectiveness of these recovery efforts will depend on the team’s ability to maintain transparency, implement the proposed measures, and rebuild investor trust.

Conclusion

The April 13, 2025, crash of Mantra’s OM token shows the vulnerabilities in crypto markets, particularly when leverage and illiquidity intersect.

The rapid 90% decline, exacerbated by forced liquidations and low market depth, emphasizes the importance of robust liquidity and risk management.

As Mantra’s team addresses the aftermath with clear communication and corrective measures, this incident is a cautionary tale for investors and projects trying to make it in crypto.