OM crypto is up nearly 100% in July. Prices dropped by over 90% in April 2025. Mantra has been stabilizing prices. Bitcoin Hyper raises over 44 million.

In April, the OM crypto token, powering Mantra, a layer-1 platform focused on real-world asset (RWA) tokenization, crashed by over 90%. The sell-off, which took place on a Sunday, shocked investors and dealt a blow to holders who believed in the project.

Three months later, crypto has yet to recover fully, but there are hints of strength. Following a strong upsurge in Ethereum and some of the best cryptos to buy, like Solana, OM began printing encouraging higher highs on Sunday.

OM Crypto Up 100% in July

From the OM crypto daily chart, the coin is up nearly 100% in July, doubling in value to the relief of holders. Despite lower lows in the past two days, the July 20 bullish engulfing bar remains intact, reinforcing the uptrend.

Technically, as long as prices stay within the July 20 bullish engulfing bar, the uptrend persists, and buyers can look for entries. A breakout above $0.40 could signal a continuation, possibly driving prices toward $0.60 and eventually $1.

Why is Mantra Rally?

Much of OM crypto’s recent upswing stems from the team’s efforts to stabilize prices.

The timing is also favorable. Crypto prices are surging, sentiment is bullish, and analysts believe RWA tokenization, including fiat and bonds, is the future.

Last week’s signing of the GENIUS Act, allowing tokenization of USD and treasuries, was a major boost for RWA tokens, with OM prominently featured.

Mantra has secured licenses in Dubai, positioning it as a leader in the tokenization market, projected to exceed $1 trillion by 2030.

.@dimitratech x @MANTRA_Chain—new chapter, big impact.

This is definitely an upgrade for the RWA and the global agricultural sector.

What truly amplifies this partnership’s potential is Mantra’s VARA license, which enables them to facilitate investments in the Middle East, and… pic.twitter.com/lPHrMDMX73

— DeFiScribbler (@DeFiScribbler) June 21, 2025

Beyond supportive regulations, Mantra has burned over 300 million OM tokens since April, with co-founder John Mullin burning the 150 million allocated to the team. Token burning reduces the circulating supply and boosts staking rewards, supporting prices.

The burn program details are in the final stages, and will be shared in the near future. Buyback program also well underway. We are working around the clock for the Sherpas/OMies. ??️

— JP Mullin (?, ?️) (@jp_mullin888) April 18, 2025

Additionally, Mantra launched a buyback initiative, using platform revenue to repurchase tokens, further stabilizing prices.

Mantra released transparency reports to rebuild trust, introduced real-time monitoring tools for token holdings, and committed to official channel updates only.

MANTRA is quietly becoming a beast in the RWA game

✅ Slashing internal validators, adding 50+ partners

? 300M $OM burn in progress

⚙️ No downtime during market chaos

? Real-world deals from e-motos in UAE to USDY integration

? Mainnet coming Oct 2024#HomeOfRWAs is getting… pic.twitter.com/tVWmDNBeEf— AMIRA ? (@Yagami_light77) July 15, 2025

To enhance decentralization, the project also halved internal validators and onboarded 50 external validators by Q2 2025.

Focus on Bitcoin Hyper: Over $4 Million Raised

If OM crypto surges, other quality projects, including some of the best crypto presales, will likely follow.

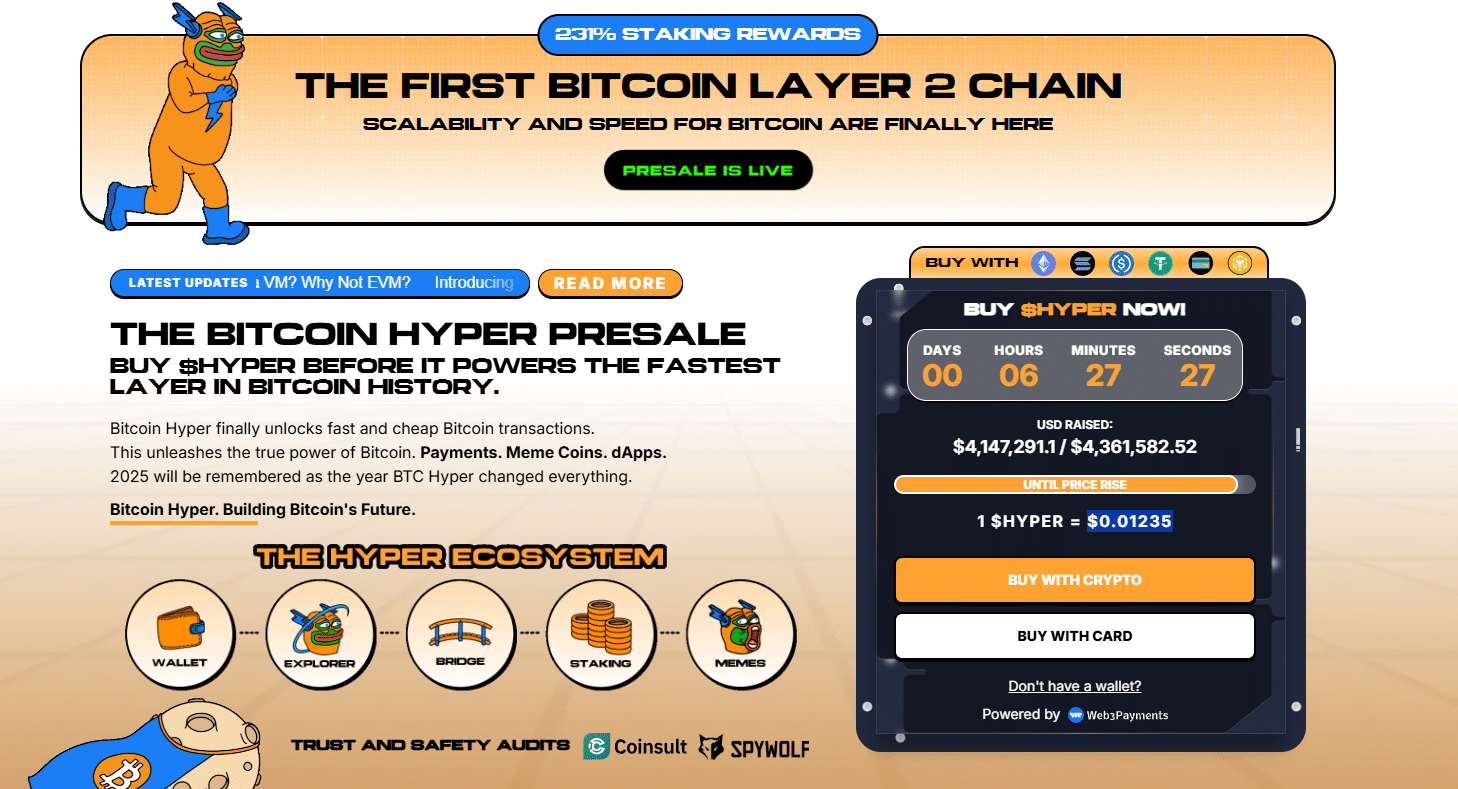

Bitcoin Hyper, for instance, is gaining traction, raising over $4 million in its ongoing presale.

HYPER, its native token, is priced at $0.01235 but will increase in the next six hours.

You can buy HYPER using USDT, ETH, or bank cards and stake it for a 231% APY yield.

For now, the Bitcoin Hyper appeal is growing. It’s building a Bitcoin layer-2 using rollups, leveraging the Solana virtual machine for high throughput and low fees instead of prioritizing the Ethereum virtual machine.

This design makes Bitcoin Hyper scalable and cost-effective. Once live, BTC holders can bridge to Bitcoin Hyper, engage with DeFi protocols, and earn yields on otherwise non-yielding assets.