Crypto project Euler is gaining serious traction in the DeFi world, offering permissionless lending and borrowing with innovative features that give EUL users maximum control and yield opportunities.

The recent Coinbase listing and explosive TVL growth have fueled massive hype, positioning Euler as a major player among DeFi lending protocols heading into late 2025.

What is Euler Crypto

Euler Finance is a decentralized lending protocol that functions as a “Lending Super App”. allowing users to lend, borrow, and swap crypto assets without strict restrictions. Built primarily on Ethereum, Euler has expanded to chains like Arbitrum, Avalanche, Base, and the BNB chain.

What I love about Euler is that they don't stop shipping.

Euler is currently offering some of the most promising opportunities with the launch of two major products:

❶ @eulerfinance's EulerEarn allows users to effortlessly deposit assets and earn yield. They are offering… pic.twitter.com/lWavBlBBmV

— Eli5DeFi (@eli5_defi) September 4, 2025

Its modular architecture is a key advantage, with isolated lending vaults created via the Euler Vault Kit (EVK). These vaults offer customizable interest rates, collateral ratios, and risk settings, limiting contagion risk between assets.

The Ethereum Vault Connector (RVC) enables advanced strategies like looping, where users borrow against supplied assets to maximize yields, while also supporting flash loans and gasless transactions.

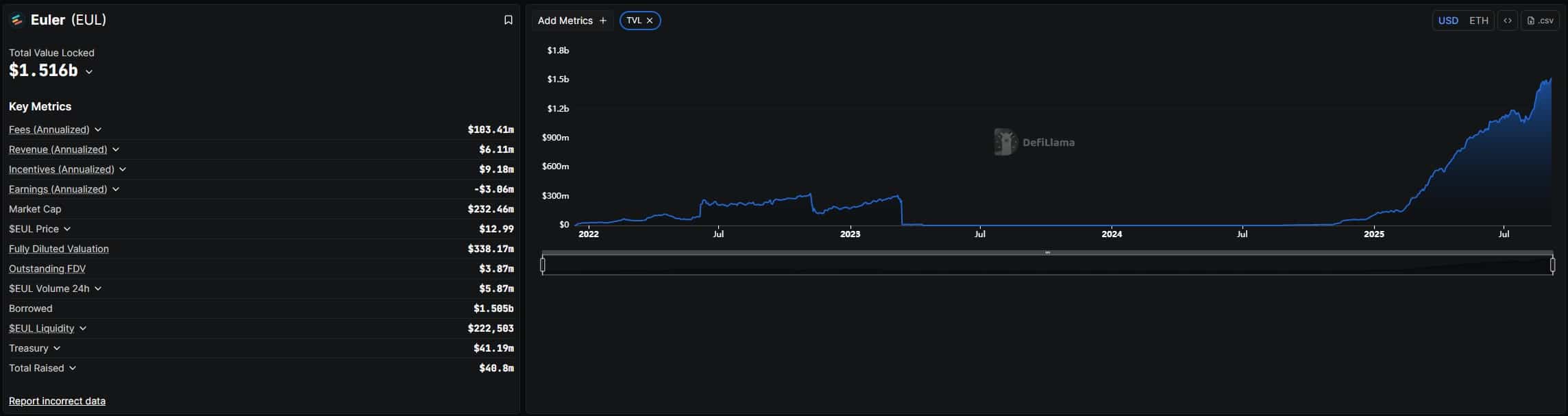

(Source – defillama.com)

(Source – defillama.com)

Launched as Euler V2 in late 2023 following a major hack, the protocol now emphasizes security and scalability. Recent innovations include EulerSwap, a built-in DEX, and EulerEarn, a passive yield vault offering up to 16% APY. With $1.15Bn TVL according to defillama, by August 2025, and integrations for real-world assets and privacy-focused lending, Euler is quickly becoming a top-tier DeFi hub rivaling Aave and Morpho.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Why Eul Price Skyrocketed 40%

Many factors contribute to the EulerEULPrice price skyrocketing violently, from listing on Coinbase to the recent barrage of collaborations with prominent DeFi actors. On August 6, 2025, Euler got listed on Coinbase, bringing more visibility and liquidity to the project.

That resulted in short volume and a price spike from $10 to around $11.6, resulting in 16% gains.

(Source – tradingview.com)

But that was just the beginning; later on, they announced many collaborations, like airdrops to amazing yield opportunities.

Lending, borrowing, swapping, and earning, this whole loop is created in one super lending app.

But the most recent news is most probably the biggest of them all, announcing syrupUSDC as collateral, welcoming Maple on the Arbitrum network.

Together is how DeFi scales.

Welcoming Maple to Euler on @Arbitrum.

syrupUSDC is live as collateral, with deep liquidity for seamless in-app looping. https://t.co/f6G8zckCe5

— Euler Labs (@eulerfinance) September 4, 2025

It is not just one event that led to this moment, but an accumulation of many opportunities that the project took and now is reaping the benefits.

DISCOVER: Top 20 Crypto to Buy in 2025

Snorter: Meme Energy Meets Next-Gen Trading Tech

As DeFi protocols like Euler Finance push innovation in decentralized crypto lending, traders are looking for the next big leap in trading tools. Snorter steps in with a unique blend of meme culture and serious market tech.

Built as a Telegram-based sniping bot, Snorter scans Ethereum and Solana in real time, spotting fresh meme coin launches before they go viral.

It executes traders instantly, helping users catch those early-stage gems before the crowd arrives.

Currently in presale, Snorter has already raised over $3,7M, with tokens available at just $0.1033. For those who prefer passive gains, staking offers a huge 124% APY, giving holders a strong incentive to lock their tokens while waiting for launch.

With mix of humor, community energy, and precision trading, Snorter has the potential to become every trader’s secret weapon in the next meme coin season.