The Euler (EUL) price has surged over 30% after Bithumb confirmed KRW trading.

Euler’s TVL hit $1.52B, marking rapid DeFi growth in 2025.

Coinbase and Pendle integrations have boosted Euler’s ecosystem momentum.

Bithumb , South Korea’s second-largest cryptocurrency exchange, has announced that trading for Euler (EUL) will begin today at 5:00 pm Korean Standard Time.

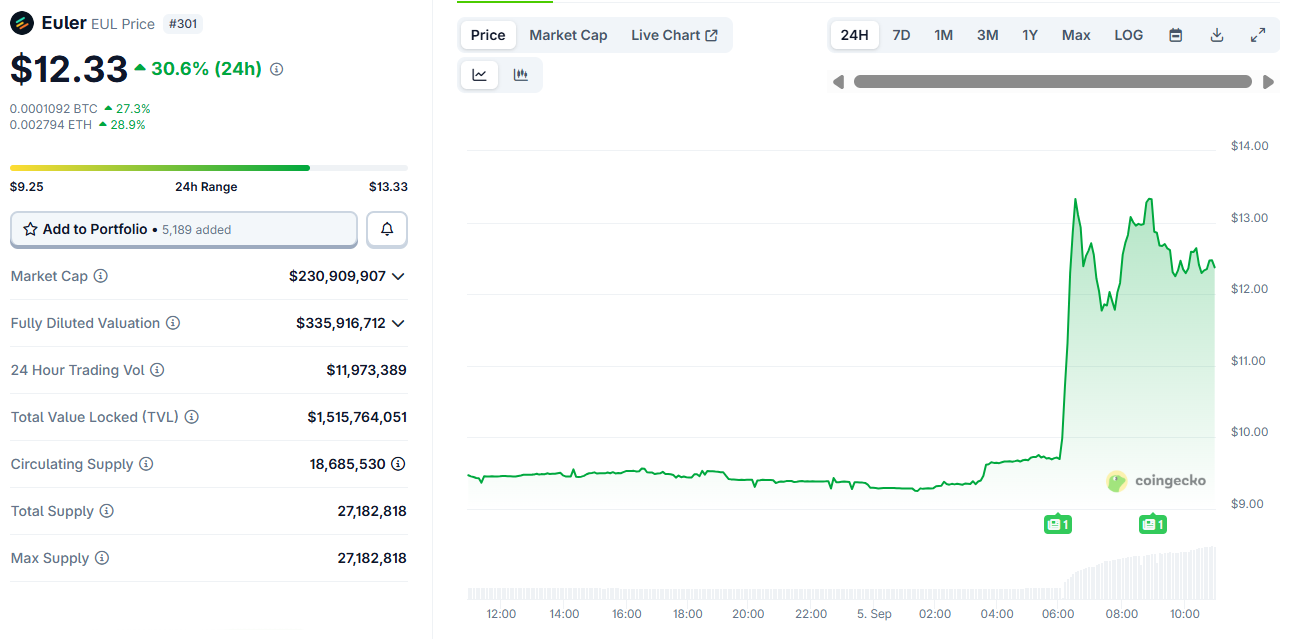

The news has sent the EUL price surging more than 30% within hours, with intraday fluctuations taking the token from lows of $9.25 to as high as $13.33.

By press time, the token was hovering around $13.02, still up more than 30.6% from the previous day.

Besides impacting the altcoin’s market price, the listing also fueled an immediate spike in trading activity.

EUL’s daily volumes jumped nearly 292%, reaching $9.58 million, with a significant portion of the trades taking place on Asian exchanges.

Notably, this surge in key market metrics has positioned EUL among the day’s top gainers in the global crypto market, drawing attention to a project that had already been gathering momentum throughout 2025.

Expanding ecosystem and new integrations

The listing comes at a time when Euler has been expanding its ecosystem with new products and integrations.

In early August, the token was listed on Coinbase , a move that gave US investors easier access to the protocol.

Euler also unveiled EulerEarn , a passive yield strategy backed by $50,000 in USDC incentives in August.

Euler has also introduced isolated ETH markets on Linea, an Ethereum layer-2 network designed to boost scalability and cut transaction costs.

More recently, it integrated with Pendle, unlocking additional yield opportunities for decentralised finance users.

Today, the protocol is also celebrating its first anniversary of its V2 upgrade , which included the launch of the Euler Vault Kit, a modular system for creating customised lending markets.

These developments highlight the project’s ongoing effort to cement its role in a competitive sector.

According to data from DeFiLlama , Euler’s total value locked has reached $3 billion, a sharp rise from just $100 million at the start of 2024.

This growth reflects a surge in user adoption and positions the protocol among the more dynamic projects in the decentralised finance sector.

Revenues and fees collected by the network have also increased more than fivefold this year, according to Token Terminal.

Euler (EUL) price analysis points to a bullish momentum

From a technical perspective, Euler’s momentum remains bullish.

Notably, the sharp price surge pushed EUL above its upper Bollinger Band, a signal of strong market demand but also of potential overextension.

The Relative Strength Index now stands at 67, just below overbought levels, while moving averages across 10, 20, and 30 days remain aligned in a bullish pattern.

If the current rally continues, EUL could retest its July peak of $15.81 in the coming weeks.

However, traders should be cautious of profit-taking, which could drive the token back into the $10.50 to $11.00 range in the near term.

Euler Finance network growth

The price rally lifted Euler’s market capitalisation to roughly $242 million, while its fully diluted valuation stood at about $353 million.

But despite the gains, the token remains nearly 20% below its all-time high of $15.81, reached on July 11.

According to the market outlook, although the sentiment remains firmly positive, the resistance at the current price level could prove difficult to break in the short term.