The Ethereum blockchain has emerged as a cornerstone of decentralized applications, smart contracts, and the burgeoning world of decentralized finance (DeFi). However, as its popularity has surged, so too have concerns regarding its performance and scalability. This blog post explores the various factors influencing Ethereum's efficiency and the strategies being implemented to enhance its capacity. While the network has made significant strides, challenges remain that require innovative solutions. Understanding these dynamics is essential for developers, investors, and users who rely on the Ethereum ecosystem.

Understanding Ethereum's Current Performance

Ethereum's performance is a critical aspect of its functionality, impacting everything from transaction speed to network congestion. Currently, Ethereum operates on a proof-of-work consensus mechanism, which, while secure, is not the most efficient in terms of processing transactions. As the network experiences increased activity, users often face delays and higher fees, which can hinder the usability of dApps. The average transaction speed on Ethereum can fluctuate significantly, leading to unpredictable user experiences. These performance metrics underscore the need for improvements as the platform continues to grow.

Transaction speeds can vary widely, particularly during peak periods.

Network congestion often leads to increased transaction fees.

The proof-of-work model contributes to slower processing times.

Users may experience delays when trying to interact with dApps.

The performance issues can deter new users from engaging with the platform.

Scalability Challenges

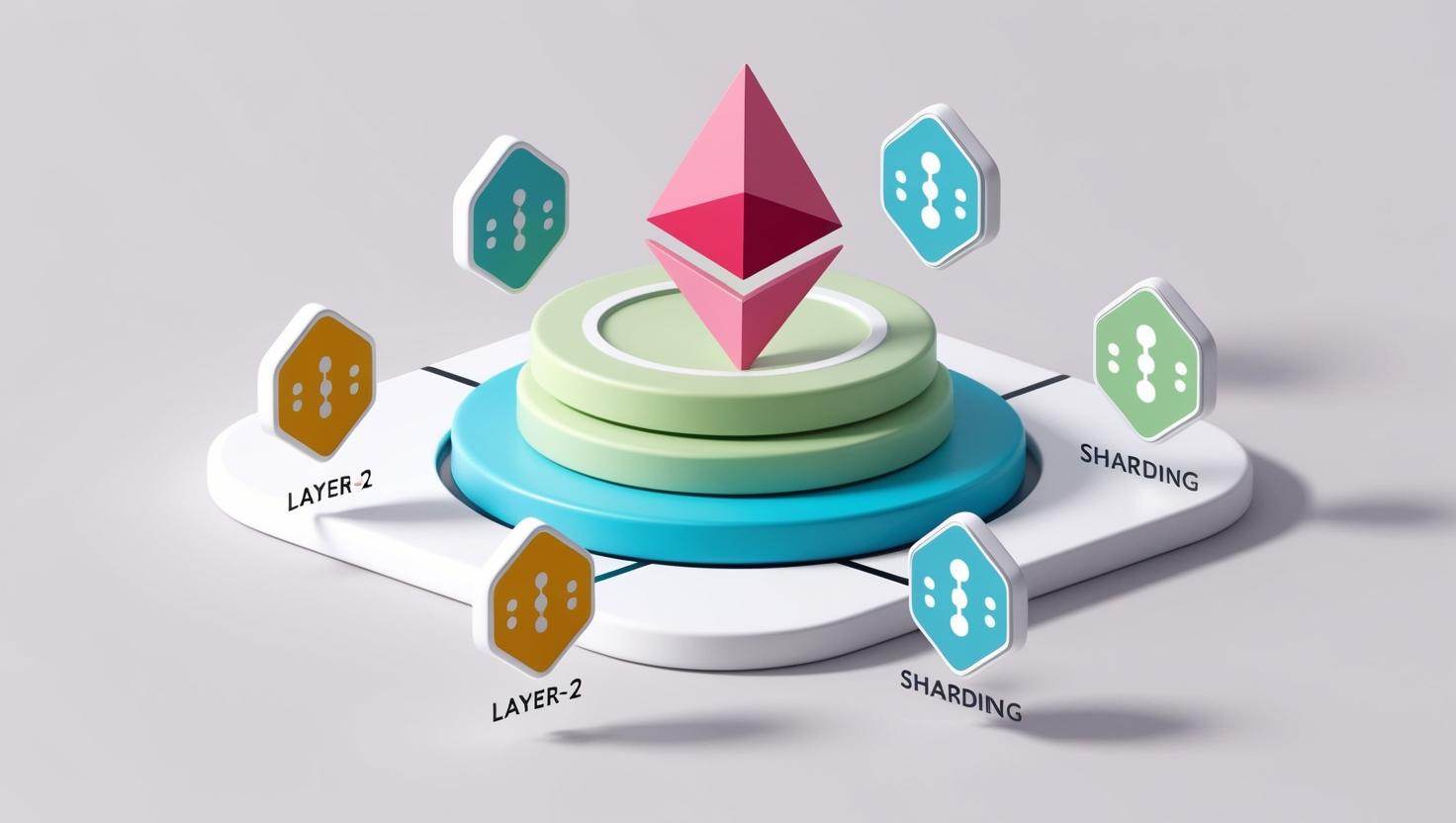

Scalability remains one of the most pressing issues for the Ethereum network. The current architecture limits the number of transactions that can be processed simultaneously, which can lead to bottlenecks. As the demand for Ethereum-based applications increases, the existing infrastructure must adapt to accommodate a growing user base. This challenge is compounded by the need to maintain security and decentralization, which are core principles of the Ethereum ethos. Various solutions are being explored to address these scalability concerns.

Layer 2 solutions, such as rollups, aim to increase transaction throughput.

Sharding is being considered as a method to divide the network into smaller, manageable pieces.

Sidechains offer alternative pathways for processing transactions off the main Ethereum chain.

Optimistic and ZK-rollups provide mechanisms to batch transactions before settling on the main chain.

Developers are actively researching ways to enhance the overall architecture of Ethereum.

Recent Upgrades and Developments

In response to the ongoing performance and scalability issues, several upgrades and developments have been implemented within the Ethereum network. The transition from proof-of-work to proof-of-stake is one of the most significant changes, aimed at improving both security and efficiency. This transition not only reduces energy consumption but also allows for more transactions to be processed concurrently. Additionally, Ethereum 2.0 introduces several features designed to enhance scalability and performance. These upgrades represent a major step forward for the network.

The shift to proof-of-stake is expected to enhance network security.

Ethereum 2.0 aims to significantly increase transaction throughput.

The introduction of shard chains will allow for parallel processing.

Upgrades are focused on reducing gas fees for users.

Continuous improvements are being made to the underlying technology.

The Role of Decentralized Finance (DeFi)

Decentralized finance has played a pivotal role in highlighting Ethereum's performance and scalability issues. The rapid growth of DeFi applications has resulted in increased network traffic, often leading to congestion and high fees. As more users flock to these platforms, the demand for efficient transactions has never been greater. The success of DeFi relies heavily on Ethereum's ability to process transactions quickly and affordably. Addressing these challenges is crucial for the long-term viability of DeFi on the Ethereum blockchain.

DeFi applications have dramatically increased the number of transactions on Ethereum.

Many users have reported frustration with slow transaction times.

High gas fees can be prohibitive for smaller investors.

The success of DeFi is directly tied to Ethereum's scalability solutions.

Future developments must prioritize the needs of DeFi users.

Future Prospects and Innovations

Looking ahead, the future of Ethereum's performance and scalability appears promising, with numerous innovations on the horizon. Ongoing research into advanced consensus mechanisms and alternative architectures is paving the way for a more efficient blockchain. Furthermore, community-driven initiatives are focusing on enhancing user experience and reducing costs associated with transactions. As developers continue to iterate on existing technologies, the Ethereum network is poised for significant advancements. The commitment to innovation will be key in maintaining Ethereum's position as a leading blockchain platform.

Research into new consensus mechanisms is ongoing.

Innovations in smart contract functionality could improve efficiency.

Community initiatives are fostering collaboration among developers.

The potential for cross-chain interoperability is being explored.

A focus on user experience will help attract and retain users.

Conclusion

Ethereum's performance and scalability are critical factors that will determine its future as a leading blockchain platform. While challenges remain, the network's commitment to innovation and improvement signals a bright future. By addressing current limitations and embracing new technologies, Ethereum has the potential to enhance its user experience significantly. As the ecosystem continues to grow, staying informed about developments in performance and scalability is essential for all stakeholders. The journey toward a more efficient and scalable Ethereum is just beginning, and the possibilities are limitless.