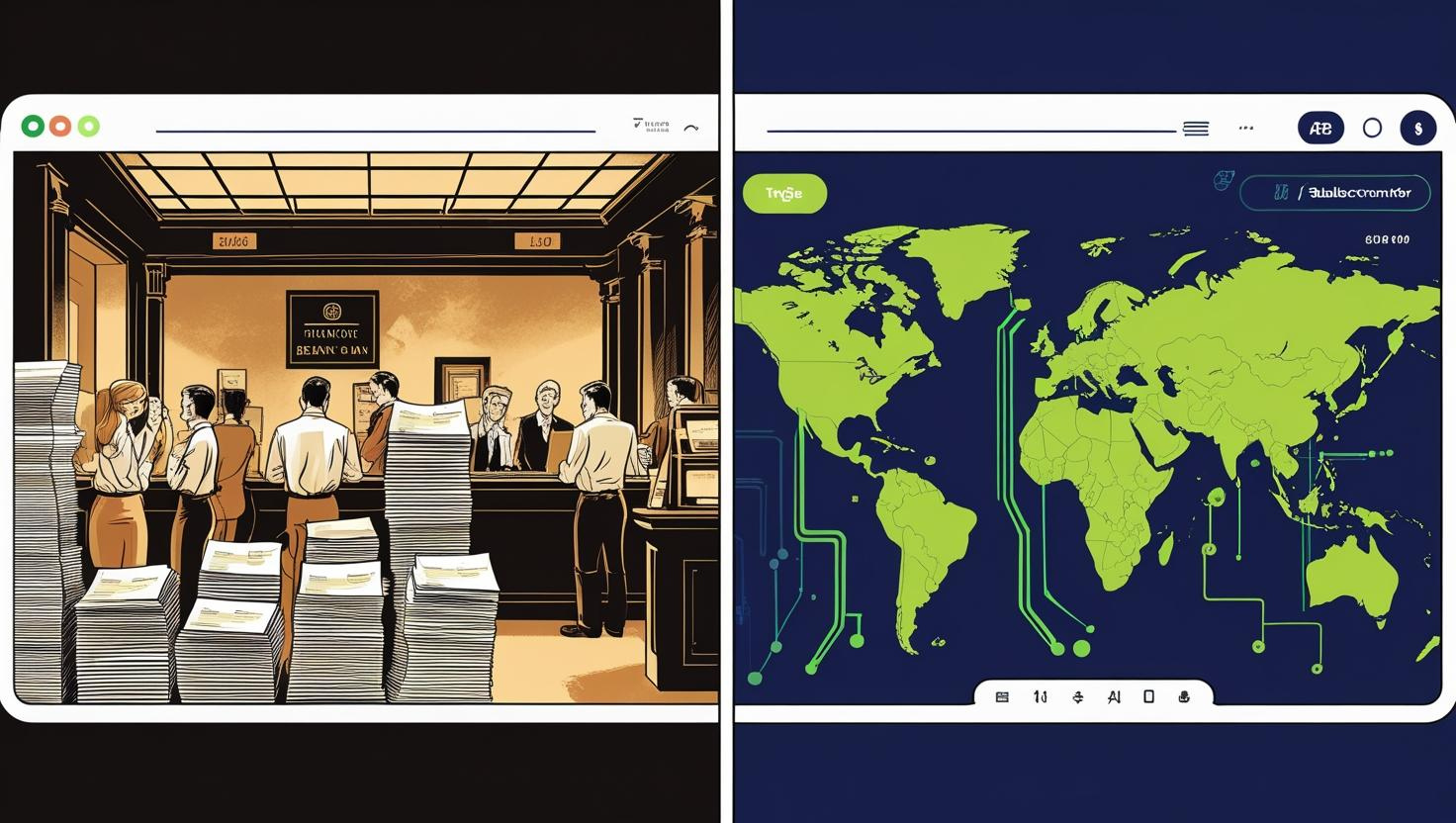

In a world increasingly driven by digital solutions, traditional banking systems are being challenged by modern financial innovations. One of the most significant disruptions is the rise of stablecoins in the realm of cross-border payments. So why are stablecoins touted as a better option compared to banks for international money transfers? Let's delve into the details.

Definition: What Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value relative to a fiat currency, like the U.S. dollar or euro. Unlike volatile cryptocurrencies such as Bitcoin, stablecoins aim to provide consistency and reduce market risk. They achieve this by being backed by reserves of real-world assets, including cash equivalents or treasuries.

How Stablecoins Work

Stablecoins operate on blockchain technology, which is a decentralized, digital ledger system ensuring security and transparency. When you want to transfer money using stablecoins, you send these digital tokens across the blockchain. The recipient can then convert the stablecoins back to their local currency, either through an exchange platform or directly into a bank account, depending on the infrastructure available.

Key Features and Benefits of Stablecoins

Stablecoins offer several advantages over traditional banking methods:

Speed: Stablecoin transactions are processed almost instantaneously, 24/7, regardless of time zones and banking holidays.

Cost-Effective: Traditional banks often charge hefty fees and apply high foreign exchange markups. In contrast, stablecoin transactions, typically having lower transaction costs, minimize these fees.

Transparency: Each transaction is recorded on the blockchain, resulting in a transparent and immutable history.

Accessibility: Stablecoins can be more accessible to individuals and businesses without bank access, offering a direct means to partake in global commerce.

Use Cases and Applications

Stablecoins are particularly useful in several scenarios:

Remittances: They provide a cheaper and faster alternative for sending money back home for many expatriates.

International Trade: Businesses can settle cross-border trades more efficiently without the need for intermediary banks.

Decentralized Finance (DeFi): Stablecoins are crucial in the DeFi space, allowing for stable transactions within peer-to-peer networks and financial services.

Getting Started with Stablecoins

To start using stablecoins, follow these basic steps:

Select a Cryptocurrency Wallet: Choose a digital wallet that supports stablecoins and has a strong reputation for security.

Purchase Stablecoins: Use an exchange platform to buy stablecoins using fiat or other cryptocurrencies.

Send/Receive Payments: Use your wallet to send stablecoins by inputting the recipient's wallet address.

Conversion: The recipient can convert the stablecoins into local currency or continue to hold them digitally.

Security Considerations

While stablecoins provide numerous benefits, users must consider security protocols:

Private and Public Keys: Ensure the safe storage of private keys and use secure systems for transactions.

Regulatory Compliance: Choose stablecoins whose issuers comply with regulatory standards, ensuring that the reserves are adequately managed and audited.

Fraud Prevention: Use exchanges with robust security measures to protect against hacking and fraud.

Conclusion

Stablecoins represent a formidable alternative to banks for cross-border money transfers due to their speed, cost-effectiveness, and accessibility. While the technology continues to evolve, and as regulatory frameworks become clearer, stablecoins may play an integral role in international finance. As you explore their potential in your financial endeavors, ensure the selection of secure and compliant platforms. With a broad understanding of stablecoins, you're well-equipped to consider their role in enhancing your cross-border financial transactions.