Is Bitcoin Hyper a legitimate project? In this article we analyze its team, tokenomics, utility, audits, and more.

Bitcoin Hyper is an emerging Layer 2 solution designed to boost Bitcoin’s scalability and programmability. It integrates advanced technologies like the Solana Virtual Machine (SVM) and zero-knowledge (ZK) rollups, all to address Bitcoin’s limitations in speed, cost, and smart contract functionality.

Bitcoin Hyper is a relatively new crypto project that is still in its presale phase. Naturally, as an investor, you’d want to learn if it is a legit project worthy of your time and money. In this post, we will explore what Bitcoin Hyper is, how legit it is, and how to buy it if you decide to dive in.

Is Bitcoin Hyper Legit? Key Takeaways

Bitcoin Hyper uses Solana Virtual Machine (SVM) and zero-knowledge proofs for programmability and more efficient transaction batching.

So far, the project has raised over $17.45M in its presale, indicating strong demand and investor interest.

The project has undergone security audits, which boost its trustworthiness.

The $HYPER token facilitates gas fees, staking, and governance.

The project’s team lacks transparency, and a minimum viable product (MVP) is not yet available.

What Is Bitcoin Hyper and How Does It Work?

Bitcoin Hyper is a Layer 2 network built atop the Bitcoin blockchain to enhance its capabilities and scalability. It leverages the Solana Virtual Machine to enable smart contract execution and facilitate decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs) on the network.

The core components of the Bitcoin Hyper ecosystem are:

Solana Virtual Machine (SVM): Implements SVM to support high-speed smart contract execution.

Zero-knowledge rollups (ZK-rollups): Batch transactions off-chain for vastly reduced costs and faster processing, while maintaining Bitcoin’s security.

Canonical bridge: Allows users to wrap their BTC 1:1, enabling its use within the Layer 2 ecosystem and seamless withdrawal back to the Bitcoin blockchain.

$HYPER tokens: Serve multiple purposes, including transaction fees, staking rewards, and governance within the network.

How to Buy Bitcoin Hyper Tokens

If you do decide to buy $HYPER tokens, the process is very simple. You can currently buy the tokens from the Bitcoin Hyper presale on the project’s official website. Let’s go through the steps.

Step 1: Get a Crypto Wallet

Before you can buy $HYPER, you’ll need a compatible crypto wallet. Your options include Best Wallet, MetaMask, Base Wallet, and Wallet Connect.

Make sure your wallet is secure and that you safely store your seed phrase. You’ll need it to access your $HYPER tokens after purchase.

Step 2: Buy a Base Cryptocurrency

While you can use a credit/debit card to buy $HYPER, you still need a crypto wallet to claim your tokens, and most investors choose to use crypto. You can fund your wallet using Ethereum, Binance Coin, or USDT. Ensure you have enough of the chosen cryptocurrency to cover the amount of $HYPER tokens you decide to purchase (plus a bit of ETH for transaction fees).

Step 3: Visit the Official Bitcoin Hyper Presale Website

Now it’s time to navigate to the official Bitcoin Hyper presale page. Once you do, click on “Buy with Crypto” or “Buy with Card”. Select your wallet provider from the list, and follow the prompt to connect your wallet to the Bitcoin Hyper platform.

Connect your wallet to Bitcoin Hyper. Source: Bitcoin Hyper

Step 4: Select Purchase Method and Amount

Once you have a connected wallet on the platform, choose the payment method (crypto or credit/debit card) and enter the purchase details. The presale widget will display the equivalent amount of $HYPER tokens you will receive, depending on what you’re paying.

Step 5: Confirm and Complete the Transaction

Now, review your purchase details before you confirm the amount of $HYPER tokens and the total cost. You’ll also need to approve the transaction in your wallet.

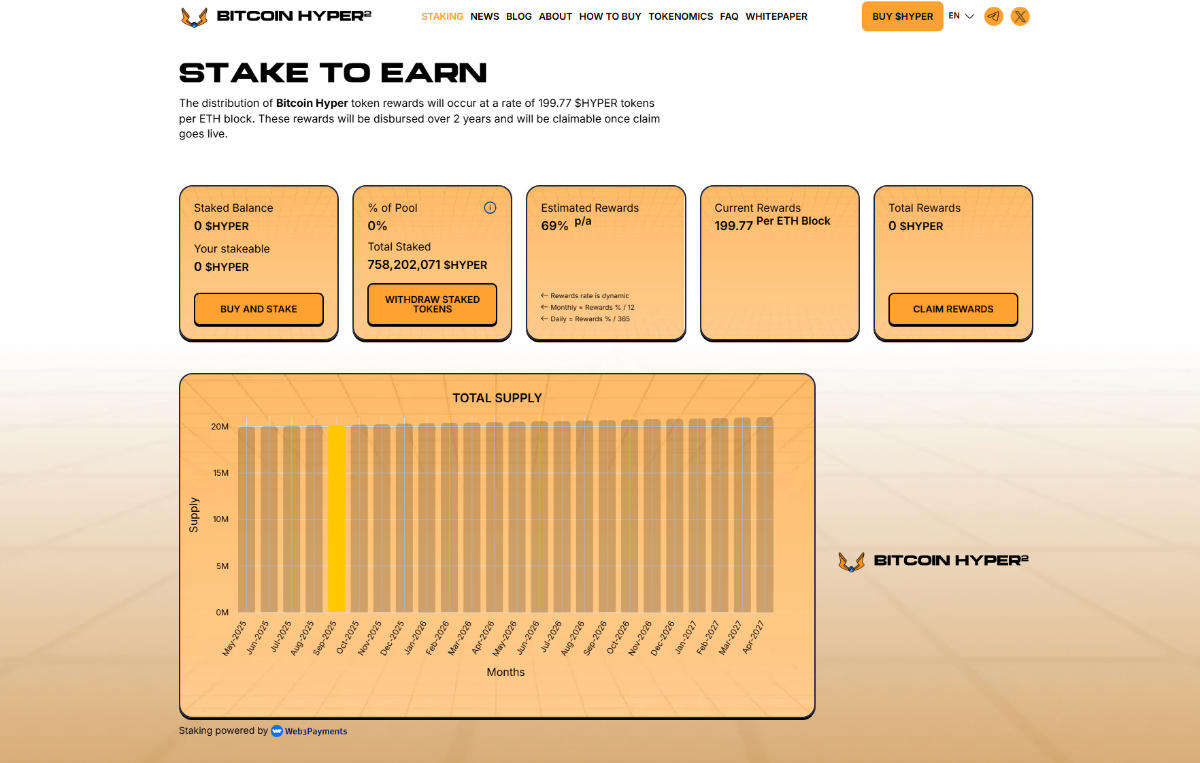

If you want, you can stake your $HYPER tokens and earn passive rewards. You can do this directly through the presale platform for up to $17.45M Annual Percentage Yield (APY). Staking rewards are dynamic and may decrease as more participants join the staking pool.

You can unstake your tokens at any time, but rewards will be unlocked over 2 years.

Bitcoin Hyper staking page showing staked balance and rewards. Source: Bitcoin Hyper

Note:

Always make sure you are on the official Bitcoin Hyper website to avoid phishing scams. The presale is ongoing, and token prices may increase as milestones are reached. The exact date for the Token Generation Event (TGE) has not been announced yet, but it is expected to happen between Q3 and Q4 of 2025.

Is Bitcoin Hyper Legit? Vital Questions to Ask

When you are evaluating a new crypto project like Bitcoin Hyper, it is important to ask the right questions about legitimacy, security, and long-term potential. Let’s take a look at the project fundamentals and the main aspects to consider.

Who Is Behind the Project?

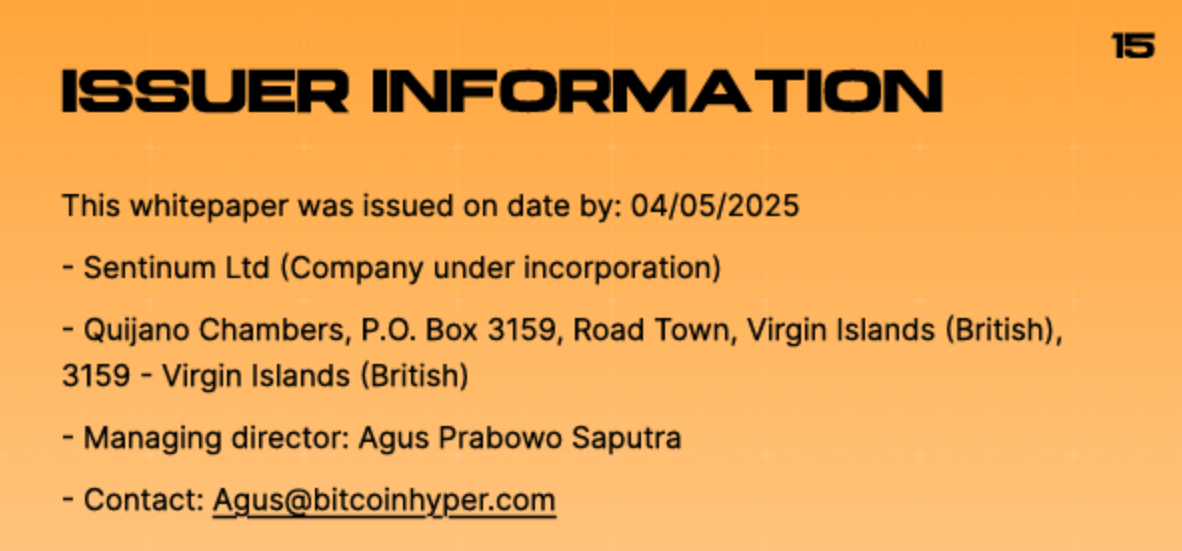

Bitcoin Hyper is developed by a company called Sentinum Ltd, registered in the British Virgin Islands. According to the project’s whitepaper, the managing director of the project is Agus Prabowo Saputra. The team claims experience in blockchain engineering, Web3 development, and cryptography.

Now, while the official whitepaper and the website highlight the team’s expertise and experience, there is very limited independent verification of their past projects.

A strong team usually has a verifiable track record, but, as of now, public details about Sentinum’s past projects are sparse. Also, no other team members have been mentioned, so team transparency isn’t this project’s strong suit.

Bitcoin Hyper issuer information. Source: Bitcoin Hyper Whitepaper

Analysis:

A project with a partially anonymous team isn’t necessarily a bad one. Remember, Bitcoin’s founder remains pseudonymous to this very day, and he created the first and most successful cryptocurrency worldwide. Countless other anonymous and semi-anonymous coins have performed well. Still, transparency is a good sign for a new crypto project, so this isn’t ideal for Bitcoin Hyper.

How Reliable Are Bitcoin Hyper’s Tokenomics?

The Bitcoin Hyper tokenomics are quite reliable. The $HYPER token has a total supply of 21 billion tokens with the following allocation:

30% for development

25% for treasury

20% for marketing

15% for rewards

10% for listings

Bitcoin Hyper tokenomics. Source: Bitcoin Hyper

The presale is public and divided into multiple stages, with no private allocations or insider deals reported. Prices start at $0.0115 and increase per stage, all with the goal to reward early investors.

Staking is available immediately after the Token Generation Event (TGE), with rewards distributed over two years.

Analysis:

The allocation for this project favors development and marketing, which seems to be a good sign and somewhat of a standard for new projects.

The public presale and gradual staking model can reduce early market dumps, which can be a major problem for new projects.

Still, while this is all positive, it is important to note that the project remains to be listed on major exchanges. This means that liquidity will likely depend on future listings.

Does Bitcoin Hyper Have Real-World Utility?

Bitcoin Hyper claims to solve Bitcoin’s speed, cost, and programmability limitations by introducing a Layer 2 network integrated with the SVM. Key utilities here include:

Near-instant BTC transactions on Layer 2

Smart contract execution and decentralized applications

DeFi capabilities like staking, swaps, and lending

NFT and gaming platforms

Analysis:

While the proposed technology is promising, real-world adoption remains untested. This project is still in its early stages, which means that it can face integration and user adoption challenges in the future.

Still, a project with numerous utilities and real-world uses sounds like a promising and legitimate project.

Have Security Firms Audited Its Smart Contracts?

The official website mentions two safety audits by Spywolf and Coinsult, one of the most trusted auditing bodies for crypto projects. Neither firm found any issues of moderate or high risk. You can check out the audits from Coinsult and Spywolf yourself if you want to dive deeper.

Bitcoin Hyper ecosystem and safety audits. Source: Bitcoin Hyper

Analysis:

Audits are standard in reputable projects and provide confidence in contract safety and bug mitigation. Passing audits from two separate auditors is a great sign for the security of the smart contract. However, because the project has not finished its full Layer 2 tech, it remains to be seen whether it is as secure as the token contract.

What’s the Roadmap Progress?

Bitcoin Hyper’s roadmap is structured in five phases:

Foundation (Q2 2025): Website, branding, community building, whitepaper release.

Presale and staking (Q2-Q3 2025): Token presale, staking launch, first security audit.

Mainnet launch (Q3 2025): Layer 2 deployment, Canonical Bridge activation, dApp support.

Ecosystem expansion (Q4 2025): Developer toolkit, exchange listings, DeFi/NFT partnerships.

Decentralization and governance (Q1 2026): DAO launch, node operator incentives, governance programs.

Analysis:

The project is in the presale phase, and it has raised over $17.45M, so the roadmap is going as planned so far. Still, there is a lot more to come, seeing how the project is in its early days now.

Bitcoin Hyper vs Its Competition

| Feature | Bitcoin Hyper | Lightning Network | Stacks | Ethereum Layer 2 |

| Layer 1 base | Bitcoin (BTC) | Bitcoin (BTC) | Bitcoin (BTC) | Ethereum (ETH) |

| Smart contract support | Yes, via modified Solana Virtual Machine (SVM) | Limited | Yes, through Proof-of-Transfer (PoX) | Yes, through rollups (e.g., Optimism, Arbitrum) |

| Transaction speed | Near-instant, sub-second latency | Sub-second | Moderate (due to PoX mechanism) | Fast (depending on rollup solution) |

| Transaction cost | Low (<$0.01) | Low | Low | Low to moderate (varies by rollup) |

| Security model | Anchored to Bitcoin’s security via Canonical Bridge | Secured by Bitcoin’s base layer | Secured by Bitcoin’s base layer via PoX | Secured by Ethereum’s base layer |

| Developer ecosystem | Emerging, with focus on DeFi, NFTs, and dApps | Mature, with extensive Lightning Network applications | Growing, with emphasis on Bitcoin integration | Extensive, with many dApps and protocols |

| Strengths | Combines Bitcoin’s security with Solana’s speed and Ethereum’s programmability | Proven scalability and adoption for microtransactions | Uses Bitcoin’s security for smart contract support and execution | Established developer tools and infrastructure |

| Weaknesses | New project and limited track record | Limited programmability and adoption for complex applications | Complex consensus mechanism and slower transaction finality | Centralization concerns and higher gas fees during congestion |

Red Flags in New Crypto Projects to Watch Out For

When you evaluate crypto presales or projects to invest in, it is important to look for the red flags that may indicate risks or, in some cases, even fraudulent activities. Here are some common warning signs you should consider:

Anonymous or unverified teams: Little or no transparency regarding the team’s members and their backgrounds.

Unclear or unrealistic roadmaps: Absence of a clear development timeline or promises of rapid returns without any substantiated plans.

Aggressive marketing tactics: Overhyping the project through exaggerated claims and unrealistic projections.

Lack of independent audits: Failure to undergo third-party security audits.

Unverifiable endorsements and partnerships: Claims of endorsements and partnerships that cannot be independently verified.

Unclear tokenomics: Lack of transparency regarding token distribution, utility, and/or incentives.

Conclusion: Is Bitcoin Hyper a Legit Project?

Bitcoin Hyper aims to enhance Bitcoin’s scalability and programmability, which is one of the most pressing issues in the crypto market. It has undergone audits by Coinsult and Spywolf without critical issues reported, which promotes transparency and security. Also, the project is engaged in marketing and community-building efforts, which indicates active development.

On the negative side, the development teams remain somewhat anonymous, except for the name mentioned for the director and the company. This raises some questions about accountability. The project also doesn’t have listings on major exchanges just yet, given that it is still in its presale stage. Going forward, this could affect accessibility and liquidity.

So, is Bitcoin Hyper legit? While the project presents quite an ambitious vision for enhancing the blockchain’s capabilities, it’s important for all investors to do their own research and approach new projects with caution. Carefully consider the risks involved, remain updated on developments related to Bitcoin Hyper (through its X and Telegram), and only invest what you can afford to lose.