Binance Coin has cleared the key psychological milestone at $1,000, marking a significant shift in its technical outlook.

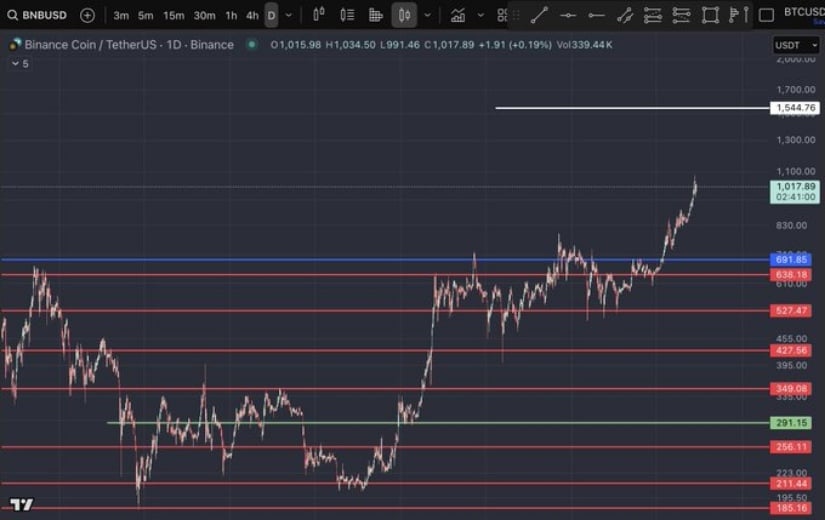

The breakout from consolidation above $830 has unleashed a strong continuation rally, pushing the asset into new price territory. At $1,014.35, the asset is building momentum toward higher resistance zones, with analysts highlighting $1,550 as the next major upside target.

Breakout Fuels Bullish Momentum

According to market analyst Cihan Turkmen on X, the decisive break above $1,000 validates the underlying strength of the current uptrend. He emphasizes that the market structure remains firmly bullish, characterized by higher highs and higher lows on the daily chart. Volume expansion has confirmed the breakout, signaling genuine demand rather than a false move.

Source: X

Turkmen points to Fibonacci projections and historical supply levels that align with the $1,550 zone, underscoring its importance as a medium-term price target. The analyst also highlights $830–$850 as a crucial support area, which has now flipped into a demand base. Holding this zone will be crucial for sustaining momentum as the asset continues its upward march.

Market Data Shows Strength

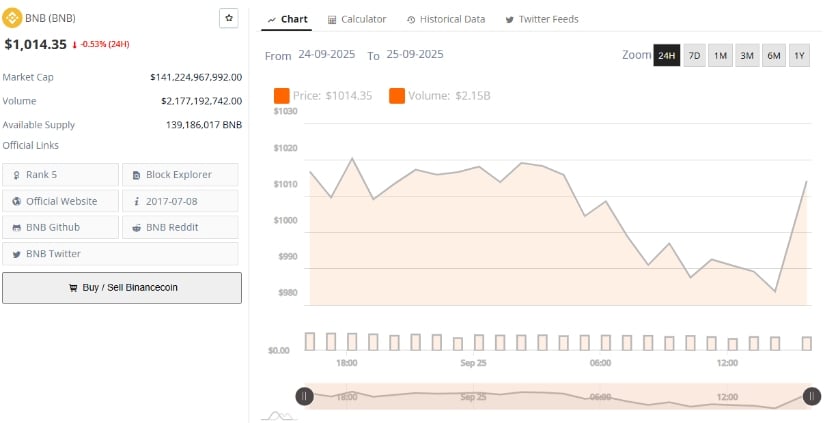

On the other hand, data from BraveNewCoin highlights the coin’s current market position. The coin trades at $1,014.35 with a market cap of approximately $141.2 billion and a 24-hour trading volume of $2.17 billion. Despite a modest 0.53% dip in the last day, liquidity remains strong, reflecting broad participation across exchanges.

Source: BraveNewCoin

The token’s circulating supply sits at 139.1 million tokens, creating a balance between accessibility and scarcity. Average daily volume trends show consistent interest from both institutional and retail traders, reinforcing the healthy state of the order book. September 2025 forecasts suggest the asset will likely maintain a trading range between $980 and $1,050, with upside expansion scenarios targeting beyond $1,200.

This stable backdrop provides confidence that the asset is not only consolidating but also preparing for the next leg of growth. With fundamentals aligned, the crypto is well-positioned for a potential push higher once technical signals confirm broader market demand.

Technical Indicators Support Trend

Further analysis of technicals reflects the continuation of bullish momentum. On the daily timeframe, BNB recently tested resistance at $1,083.47 before retracing to $989, a move seen as healthy profit-taking rather than a reversal. The broader structure remains intact as long as the $950–$960 support zone holds firm.

Source: TradingView

The MACD indicator remains in positive territory, with the MACD line above the signal line, signaling underlying strength. Although the histogram has narrowed, buyers remain in control unless a bearish crossover develops. Meanwhile, the Relative Vigor Index (RVI) stands at 65.42, close to its MA of 67.38, suggesting strong but slightly cooling momentum.

With higher lows forming and resistance levels clearly defined, analysts emphasize that holding above $950 keeps the bullish case intact. A breakout above $1,083 could accelerate gains toward $1,200, while the medium-term path continues to point toward the $1,550 target highlighted by Türkmen.