XRP (Ripple) is drawing attention from traders as a falling wedge pattern emerges on the daily chart, a setup often considered a bullish signal in technical analysis.

The current XRP price today is hovering near $2.75 on Bitstamp, with chart data showing converging trendlines between $2.60 and $2.70.

Well-known analyst @Steph_iscrypto noted that “a huge breakout could be incoming,” emphasizing the historical reliability of the structure. Falling wedge formations, according to a 2003 Investopedia study, have shown a 70% success rate in predicting trend reversals, giving further weight to the optimistic scenario.

The pattern follows a sharp rally earlier this year, making the consolidation phase particularly noteworthy. Traders are closely monitoring the XRP chart as the coin tightens within the wedge, suggesting that volatility expansion could be just around the corner.

Market Analysis and Price Targets

If XRP successfully breaks above the $2.90–$3.00 resistance zone, momentum could accelerate quickly. Initial targets lie around $3.20, followed by $3.60, with a potential measured move extending toward $4.00–$4.10.

A falling wedge pattern on the XRP/USD chart signals a potential bullish breakout above $2.94. Source: @Steph_iscrypto via X

Support levels remain equally important. Holding above $2.70 is key for bulls, while stronger support is observed near $2.50–$2.60. A close below this range could invalidate the bullish setup and push the XRP value lower.

In a bullish scenario, reclaiming the $3.00 level could open the door to a broader rally, while a neutral outcome would keep the price of XRP consolidating between $2.70 and $2.95. A bearish turn, however, risks declines back toward $2.50.

Broader Market Context

The wedge breakout prediction arrives during a period of heightened market uncertainty. The global cryptocurrency market cap recently fell by 7% before stabilizing, according to The Economic Times (September 24, 2025). The question now is whether Ripple XRP can defy this broader bearish sentiment and chart its own course higher.

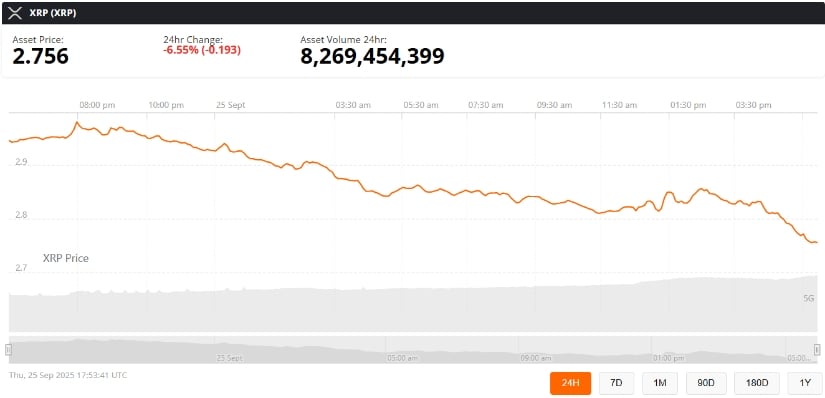

XRP was trading at around $2.75, down 6.55% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Large-cap altcoins, including XRP, are increasingly benefiting from investor rotation as traders seek relative stability in volatile conditions. Analysts suggest that if Bitcoin consolidates, altcoins like XRP could see renewed upside momentum.

Utility and Supply Dynamics

Beyond technical patterns, fundamental factors could play a role in shaping the XRP price forecast. The XRP Ledger (XRPL) incorporates a burn mechanism, destroying a small amount of XRP (0.00001 XRP) with every transaction. Over time, this creates a deflationary effect, gradually reducing supply as network usage grows.

XRP/USD price action is forming a bull flag channel, suggesting the uptrend may resume in October. Source: DrDovetail on TradingView

Additionally, entities like Flare Networks could strategically lock up portions of the circulating supply—estimated at around 30 billion XRP—potentially tightening liquidity in the market. Historical analysis from CryptoSlate highlights that such supply-side dynamics have correlated with price appreciation in past cycles.

Ripple executives have also pointed to XRP’s potential role in the $400 trillion derivatives market, especially after the CFTC approved stablecoins like RLUSD as collateral. Ripple’s Jack McDonald recently argued that these developments could strengthen the long-term case for Ripple XRP price prediction 2025 and beyond.

Final Thoughts

The XRP price prediction today rests heavily on the falling wedge pattern, with traders eyeing a decisive move above $2.95. While risks remain if support levels fail, the technical setup, combined with broader market stabilization and XRP’s evolving utility, suggests that the cryptocurrency could be preparing for its next major breakout.

As the market awaits confirmation, XRP’s position highlights the blend of technical, fundamental, and macroeconomic factors shaping the outlook for one of the most closely watched digital assets in the crypto space.