Dogecoin (DOGE) is back in the spotlight as the popular memecoin hovers near the crucial $0.22 support, drawing attention from whales and institutional investors alike.

After a week of volatile trading, DOGE has faced pressure but remains at a key technical level. Analysts and traders are closely watching whether this support can sustain a rebound or trigger further downside. Renewed whale activity and ETF-driven interest have added a new dimension to Dogecoin’s market narrative, making this a pivotal moment for both retail and institutional participants.

Whales Drive Accumulation

Despite selling pressure from retail investors, blockchain data shows that large holders, or “whales,” are actively increasing their Dogecoin positions. Wallets holding between 100,000 and 1 billion DOGE absorbed approximately 2 billion tokens within just 48 hours, representing nearly $480 million in market value. With these recent purchases, total whale reserves have now exceeded 29 billion DOGE, signaling strong conviction among major investors.

Whales bought 2 billion DOGE in 48 hours, signaling strong long-term confidence and potential bullish momentum for the cryptocurrency. Source: Ali Martinez via X

Crypto analyst Ali Martinez highlights the significance of this trend: “Whale accumulation of this magnitude has historically preceded bullish momentum, suggesting that DOGE could move higher in the coming weeks.” This pattern indicates that large investors are preparing for potential upward movements, which could positively influence Dogecoin’s price and market sentiment in the near term.

Institutional Influence and ETF Buzz

Institutional flows are reshaping Dogecoin’s market profile. The newly launched REX-Osprey Dogecoin ETF has already recorded over $8.7 million in inflows. With broader spot crypto ETF approvals in the U.S., products from competitors such as Grayscale, Bitwise, and 21Shares are expected to follow, potentially transforming Dogecoin from a retail-driven meme asset into a regulated institutional investment.

On September 18, 2025, Dogecoin ($DOGE) made history by launching its first U.S.-listed spot ETF, marking a major step toward institutional adoption. Source: Crynet via X

Thumzup Media has also increased its Dogecoin holdings to 7.5 million tokens, integrating DOGE into its corporate crypto treasury strategy. Analysts suggest that corporate interest may drive further adoption and technological integration across blockchain projects.

Exchange Outflows Indicate Long-Term Confidence

Adding to Dogecoin’s bullish narrative, a major whale recently moved 122.4 million DOGE from Binance to a self-custodial wallet. This type of transaction, known as an exchange outflow, often signals that large investors intend to hold their assets for the long term rather than trading them on exchanges. Such strategic moves can reduce circulating supply on platforms, creating potential upward pressure on prices.

DOGE broke its bearish trendline and $0.23 support; targets $0.308–$0.4842, stop-loss $0.18254. Source: UA CAPITAL on TradingView

Holders often move coins away from exchanges when planning to retain them, a practice that can have a bullish impact on the asset. This latest withdrawal comes amid market volatility, indicating that long-term conviction among whales could help stabilize Dogecoin and support future price momentum.

Outlook and Price Predictions

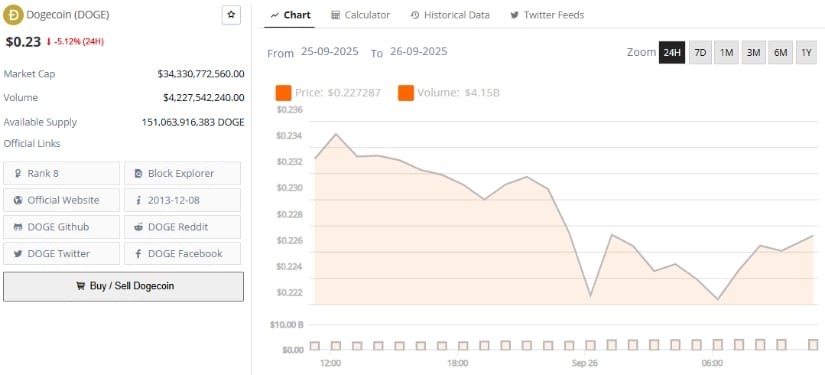

At the time of writing this article, DOGE is trading around $0.22, down slightly in the past 24 hours. Analysts are forecasting continued whale accumulation and institutional support to propel DOGE to resistance levels of $0.30 and $0.35. Historical trends suggest a short-term move to $0.78 and potentially $1.30 in the longer term, if history is to repeat itself.

Dogecoin was trading at around $0.23, down 5.12% in the last 24 hours at press time. Source: Brave New Coin

Market observers, nonetheless, remain watchful, noting technical pressures and a general risk-off sentiment in cryptocurrencies that is likely to put a lid on upside. Currently, $0.23 is the battleground between conviction buyers and hesitant sellers, all waiting for the next critical jump higher in Dogecoin price.