Binance Coin is heating up again after a sharp rebound, with traders eyeing the $1,000–$1,100 range as the next milestone.

Market watchers suggest the uptrend remains intact despite short-term pullbacks, with technical indicators pointing to continued bullish control.

Trader Targets $1,100 as Momentum Builds

In a recent post on X, analyst BeLaunch revealed confidence in the coin’s trajectory, noting he had taken spot positions with a target between $1,000 and $1,100. His bullish call follows a strong rally that pushed BNB as high as $1,083.47 before easing into consolidation.

The price is currently hovering near $959, showing resilience after a modest retracement from recent highs.

Source: X (@BeLaunch_)

The upward trajectory reflects broader confidence in the Coin’s strength, with traders interpreting the latest dip as a possible staging ground for another leg higher. As long as the coin holds above key moving averages, optimism toward the $1,000 zone remains dominant.

Market Data Confirms Rising Strength

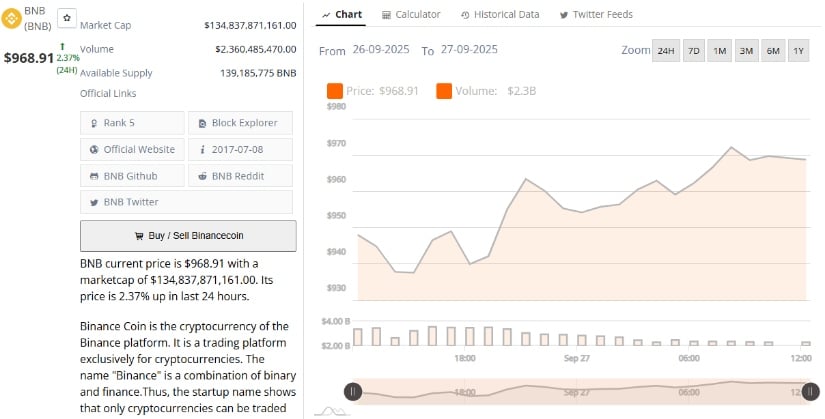

Additional data from BraveNewCoin shows BNB trading at $968.91, marking a 2.37% gain in the last 24 hours. The token carries a robust market capitalization of $134.83 billion, ranking it firmly as the fifth-largest cryptocurrency by market cap.

With a daily trading volume of $2.36 billion and an available supply of just over 139 million tokens, liquidity remains deep and attractive to both institutional and retail participants.

Source: BraveNewCoin

The consistent increase in volume during recent sessions underscores growing market attention, suggesting that traders are positioning themselves for higher levels. The $1,000 round number stands out as both a psychological barrier and a technical resistance, with market participants eager to see if the memecoin can decisively clear it.

Technical Setup Hints at Volatility Ahead

At press time, TradingView technicals reinforce the bullish bias while highlighting possible near-term consolidation. BNB is currently trading at $966, positioned above the Bollinger Band basis line at $958.09.

The upper band sits at $1,058, while the lower band rests at $858, creating a wide volatility channel. The repeated touches of the upper band in recent weeks reflect strong bullish momentum, though the latest dip suggests the price may consolidate before any breakout attempt.

Source: TradingView

The Chaikin Money Flow (CMF) at +0.02 signals mild buying pressure, aligning with the overall bullish setup. However, CMF spikes have slowed compared to earlier in the summer, hinting at reduced accumulation strength.

If momentum wanes, traders may look to support near $895–$858 for potential entry points. On the other hand, reclaiming and holding above $1,000 could open the way toward the $1,100 target projected by analysts.

In short, the cryptocurrency is holding firm in its bullish structure. Still, all eyes are on the $1,000 barrier, a level that could define whether the current rally matures into a sustained breakout or stalls in consolidation.