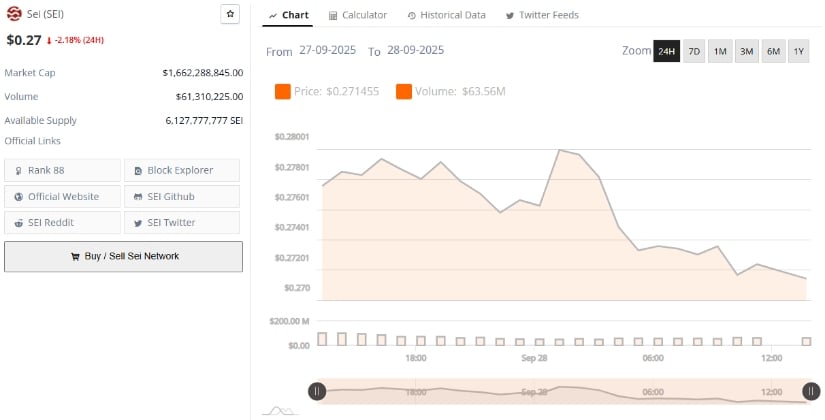

Sei is trading at $0.27, down 2.18% in the last 24 hours, according to BraveNewCoin data. With a market capitalization of $1.66 billion and a trading volume of just over $61 million, the token is consolidating near a critical support level.

Analysts suggest that the asset may be preparing for a breakout from its current descending channel, though caution remains as sellers still control short-term momentum.

Breakout Potential from Descending Channel

The 1-hour SEI/USDT chart on X shows the token trading inside a well-defined descending channel, with the most recent bounce coming near a highlighted support zone around $0.2719.

This defense by buyers has prevented a deeper breakdown, at least for now. The chart’s projection outlines a possible breakout scenario, with near-term targets set at $0.2768, $0.2805, and $0.2858 if bullish pressure builds.

Source: X

Key technicals support this case. Multiple moving averages remain overhead as resistance, signaling that momentum is still tilted against bulls. However, the RSI at 36.72 has dipped into oversold territory, which often precedes a relief rally or short-term reversal. In other words, while the asset remains trapped in its channel, conditions may favor buyers if they can seize control and push past the upper boundary.

Failure to hold this green support area, however, would invalidate the bullish thesis. A breakdown below $0.27 could open the door to lower retests and hand back full control to sellers.

Stagnates Near Support

Additionally, Market data from BraveNewCoin confirms the tight trading action. SEI is hovering around $0.2714, down modestly but still anchored to its key support zone. Daily trading volume at $63.5 million reflects steady participation, but not yet enough to fuel a decisive breakout.

Source: BraveNewCoin

Liquidity remains stable, with over 6.12 billion tokens in circulation, and the token ranked 88th by market cap. This ranking puts the asset firmly in the mid-cap bracket, where volatility is common and investor sentiment often swings quickly. For bulls, reclaiming the $0.28–$0.29 range could mark the first step toward reestablishing a more sustainable uptrend.

Technical Signals Warn of Persistent Selling Pressure

Additional insights from TradingView’s daily chart highlight the challenges still ahead for SEI. Price action has hugged the lower Bollinger Bands for several sessions, showing sellers continue to weigh heavily on the market.

Meanwhile, the Chaikin Money Flow (CMF) reading at –0.13 points to clear capital outflows, underscoring that institutional or large-scale buyers are not yet stepping in aggressively.

Source: TradingView

This setup paints a cautious picture: while RSI and intraday channel dynamics hint at rebound potential, broader money flows remain bearish. Unless CMF shifts back toward positive territory and prices reclaim levels above the Bollinger Band basis, downside risks remain in play.

Key supports to watch lie near $0.27 and the lower Bollinger Band zone, while resistance levels stack up at $0.28, $0.285, and eventually $0.30 if bulls stage a recovery.