Ethereum nears support at $4,050 as ETF demand cools, while Bitfrac token presale Stage 2 targets 4X ROI with $4M+ raised.

Ethereum is approaching a key bull market support band as investor activity in exchange-traded funds cools. At the same time, attention has shifted toward the Bitfrac token presale, which has entered Stage 2 with a growing base of participants. The project combines traditional bond investing with crypto mining, offering legally backed tokens tied to real mining infrastructure. This unique structure positions the Bitfrac token presale as one of the most watched events in the digital asset market today. With over $4 million raised, investors are tracking its rapid progress and potential returns. Stage 2 pricing at $0.024 marks a climb from the Stage 1 level of $0.017, giving early participants immediate gains.

Ethereum Tests Key Resistance Levels

Ethereum has regained strength by reclaiming the $4,050 support level, showing renewed buying interest after recent volatility. The next major target is $4,250, a resistance zone that could unlock further upside if successfully broken. A decisive move above this level may attract fresh liquidity and reinforce bullish sentiment. However, failure to reclaim $4,250 or hold $4,050 leaves ETH exposed to a potential pullback toward $4,000 – a critical level that will determine whether the short-term trend continues upward or shifts toward a deeper correction.

Source: X

Timeline of the Ongoing Token Presale

The Bitfrac token presale started at $0.017 per token during its initial stage. Strong demand quickly filled the allocation, moving the project into Stage 2 at $0.024. The next scheduled step, Stage 3, is set at $0.042. Reports show $313,280 of the Stage 2 allocation has already been secured, accounting for 9% of the current round. The sale ends in three days, after which bonuses such as the BFT20 code will expire. More than 2,000 investors are already engaged, attracted by the opportunity to earn income from industrial Bitcoin mining without operating costs.

Source: Bitfrac

Each Bitfrac token is supported by physical mining hardware and facilities purchased with presale funds. This gives the token presale a different profile compared to projects without tangible asset links. Returns come from two revenue channels: Bitcoin mining and hosting services for external miners. Data shows expected annual yields ranging from 15% to 35%, distributed monthly through smart contracts beginning in November 2025. Mining capacity targets 2.5 EH/s, supported by 75 MW of power. At current operations, estimated monthly profits reach $15.1 million.

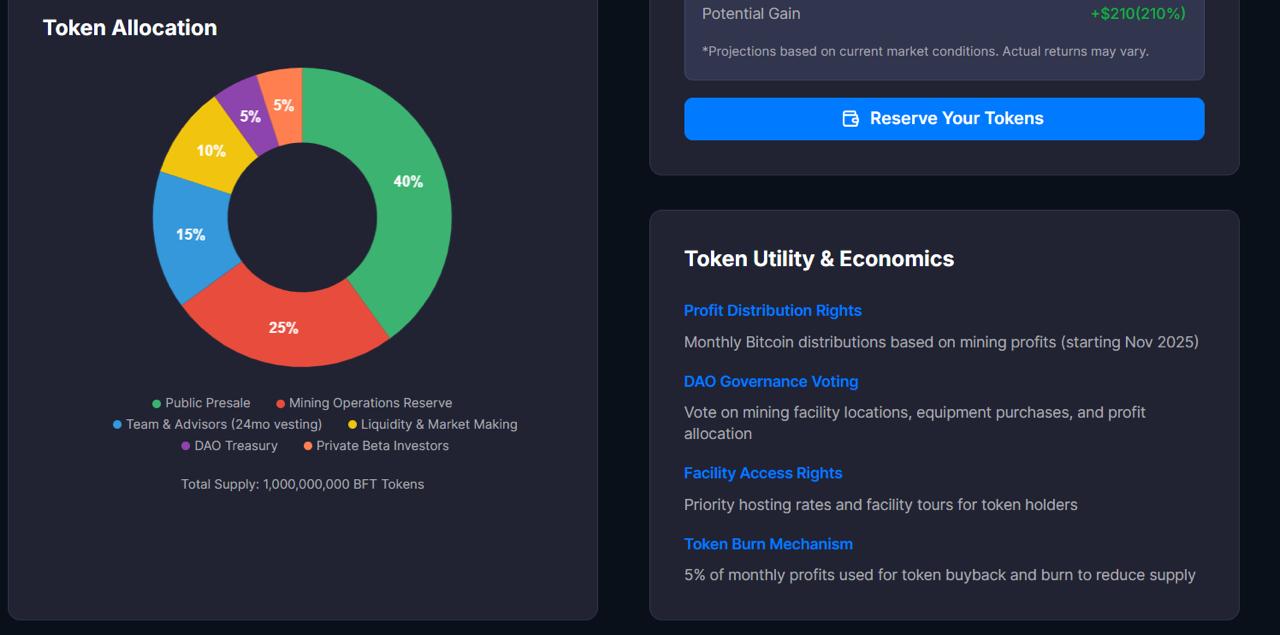

Distribution and Utility of Tokens

The Bitfrac token presale allocates 40% of the one-billion-token supply to the public. Mining reserves hold 25%, while 15% goes to team and advisors under a 24-month vesting schedule. Liquidity accounts for 10%, with the remaining 10% divided between a DAO treasury and beta investors. Utility functions include ownership representation, governance rights, facility access, and profit distribution. A buyback-and-burn system will further manage supply.

Source: Bitfrac

The cryptocurrency mining industry is forecast to exceed $7 billion by 2027, with growing demand for transparent structures. The Bitfrac token presale introduces fractional ownership in mining equipment and facilities, bridging digital and physical investments. By lowering barriers and enforcing compliance standards, it creates broader access to mining revenues.

Conclusion

Ethereum faces shifting market flows, but the Bitfrac token presale is advancing with clear demand and structured growth. Stage 2 continues to attract investors with the possibility of 4X returns in the coming year. With asset-backed security, monthly income distribution, and defined allocations, the project positions itself as a distinct player in the mining sector.

More Details:

Website: https://bitfrac.com/

Telegram: t.me/BitFracCommunity

X: https://x.com/BitFracProtocol

WhitePaper: https://bitfrac.com/docs/bitfrac-whitepaper.pdf