In today’s market landscape, the spotlight was split across distinctly different sectors. Bitcoin and Ethereum led the charge with institutional momentum and key upgrades, while Litecoin rode the ETF speculation wave.

At the same time, KAITO saw a staggering 48% rally powered by creator economy dynamics, contrasting sharply with the sharp decline in memecoins like Fartcoin, which saw double-digit losses after a hype-driven rise. These five coins captured investor attention, each telling a different story about where the market's energy is shifting.

Bitcoin (BTC)

Price Change (24H): +2.40% Current Price: $96,792.18

What happened today

Bitcoin surged amid a cascade of bullish institutional developments. Coinbase launched a Bitcoin Yield Fund for non-U.S. institutional investors, offering passive income of 4–8% annually through cash-and-carry arbitrage. Simultaneously, New Hampshire became the first U.S. state to legislate a Bitcoin Strategic Reserve Law, allowing Bitcoin in treasury holdings. Meanwhile, Riot Platforms sold 475 BTC in April, breaking its 15-month HODL streak, while BlackRock’s iShares Bitcoin Trust ETF acquired a staggering 41,452 BTC ($3.92B), raising its total holdings to 614,639 BTC signaling strong institutional conviction.

Market Cap: $1.92T 24-Hour Trading Volume: $38.2B Circulating Supply: 19.86M BTC

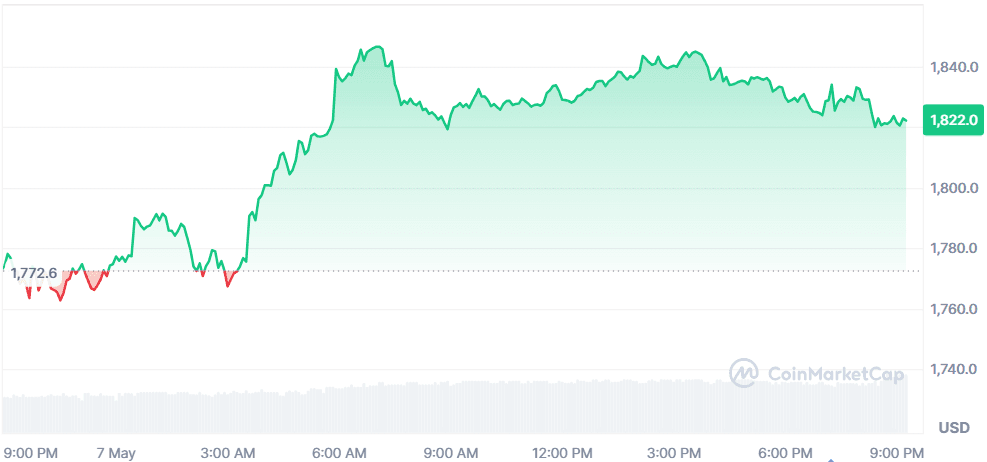

Ethereum (ETH)

Price Change (24H): +2.75% Current Price: $1,813.84

What happened today

Ethereum gears up for the highly anticipated Pectra hard fork, scheduled for May 7 at 10:05 AM UTC.

This upgrade, which merges the Prague and Electra layers, includes 11 EIPs like EIP-7702 (smart accounts) and EIP-7251 (staking cap increase to 2,048 ETH), aiming to boost scalability, reduce fees, and improve staking UX. Despite testnet issues, core developers remain confident. While end-user hype is muted, the dev community sees Pectra as a quiet revolution in Ethereum’s evolution, potentially paving the way for gasless transactions and seamless L2 integrations.

Market Cap: $218.98B 24-Hour Trading Volume: $17.96B Circulating Supply: 120.73M ETH

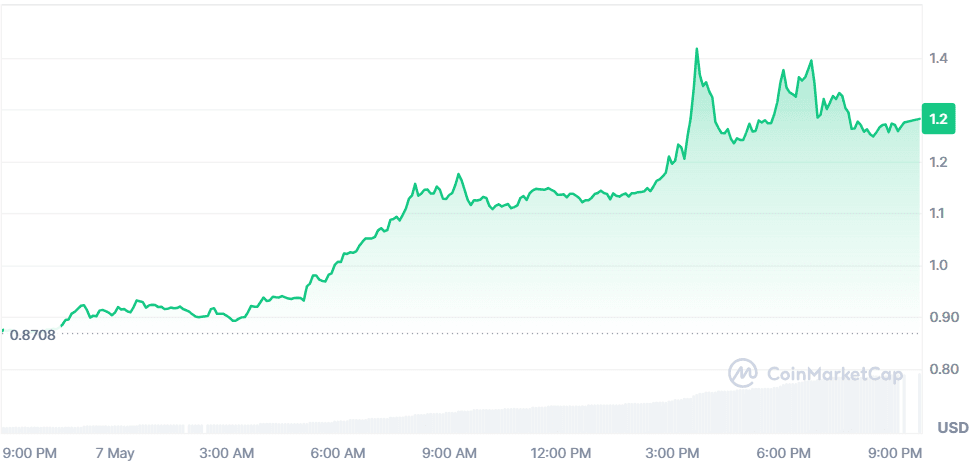

Kaito (KAITO)

Price Change (24H): +47.84% Current Price: $1.28

What happened today

Kaito skyrocketed nearly 48% following a flurry of bullish catalysts. The token rallied after integrating Huma Finance’s Yapper leaderboard, which incentivizes crypto content creators on X. This follows founder Yu Hu’s announcement of a new “Earn and Drop” season in partnership with PayFi Network. Technicals showed KAITO breaking above major resistance levels, while on-chain data confirmed over 2M tokens withdrawn from exchanges—indicative of accumulation. Community growth is explosive, with over 200K monthly active Yappers and $71M in rewards distributed, fueling demand and long-term optimism.

Market Cap: $309.73M 24-Hour Trading Volume: $683.11M Circulating Supply: 241.38M KAITO

Litecoin (LTC)

Price Change (24H): +7.97% Current Price: $88.57

What happened today

Litecoin rallied ahead of the SEC’s expected ruling on Canary Capital’s spot LTC ETF proposal. While the decision was eventually delayed, it generated significant momentum, pushing LTC above multi-year resistance. Trading volumes soared past $907M as investors speculated on potential institutional inflows. Whale activity has surged, with large-value transactions surpassing $8B. Although approval remains pending, analysts believe Litecoin could be among the first altcoins to get ETF approval, especially under the new SEC leadership, reflecting heightened regulatory optimism.

Market Cap: $6.71B 24-Hour Trading Volume: $907.92M Circulating Supply: 75.82M LTC

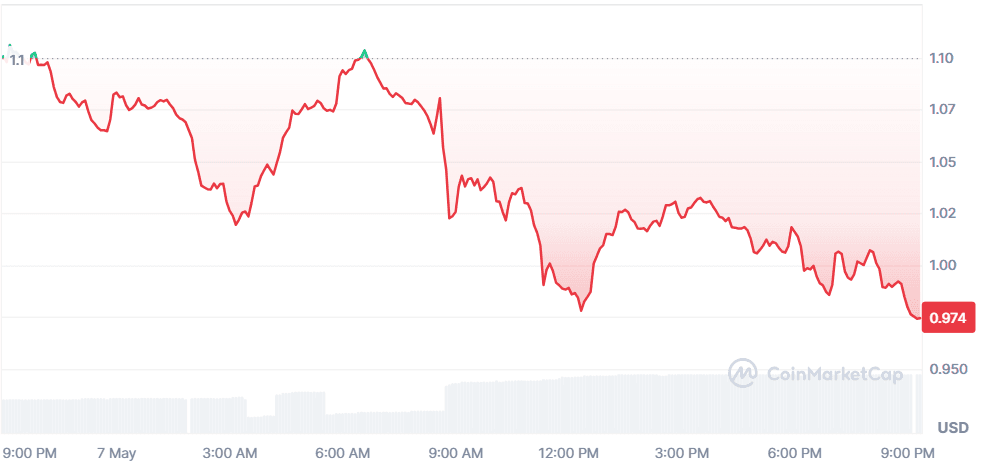

Fartcoin (FARTCOIN)

Price Change (24H): -13.55% Current Price: $0.9506

What happened today

Fartcoin plunged nearly 14% amid a broader meme coin selloff and bearish sentiment triggered by a viral tweet from Kook Capital declaring “it’s over for Fartcoin.”

The token saw high trading volume on the FART/ETH pair (~$1.2M), but RSI indicators show oversold conditions at 32. On-chain metrics suggest retail capitulation, with a 12% drop in unique wallet addresses in 48 hours. Meme coins like DOGE and SHIB also dipped, while traders shifted toward traditional markets like tech stocks. Still, high-volume scalping persists, offering tactical opportunities for short-term players.

Market Cap: $950.68M 24-Hour Trading Volume: $224.69M Circulating Supply: 999.99M FARTCOIN

Global Market Snapshot

The global markets were gripped by uncertainty as Trump’s tariff policies and semiconductor export curbs to China weighed heavily on chip stocks. AMD slashed revenue expectations by $1.5B due to AI chip restrictions, while Super Micro withheld 2026 guidance.

Marvell postponed its investor day, underscoring the sector’s lack of clarity. Despite these headwinds, Nvidia’s CEO remains bullish, calling for America to “go race” in AI. Meanwhile, Indian markets remained resilient despite strikes on Pakistan, buoyed by structural reforms, trade optimism, and investor confidence in India’s macroeconomic fundamentals.

Closing Thoughts

Investor sentiment appears to be undergoing a quiet recalibration. The sharp rally in KAITO hints at growing appetite for utility-based altcoins tied to real ecosystems, especially in the AI-content and Web3 creator economy space. Litecoin’s move reinforces the idea that legacy coins with strong fundamentals still have room to run—especially if they get the ETF greenlight. Meanwhile, Ethereum’s upcoming hard fork shows the developer community remains active and ambitious, even if retail enthusiasm lags.