Analysts have drawn attention to Sei’s striking resemblance to Sui’s market structure just before its 2024 bull run, suggesting that history may be on the verge of repeating itself.

The chart comparison highlights how the asset is currently forming a similar accumulation base, marked by steadily higher lows and tightening price action — a setup often seen ahead of major breakouts.

Parallels Between SEI and SUI’s Pre-Rally Setup

In a recent X post, analyst Ali shared a side-by-side chart comparison between Sei and Sui, noting striking similarities in their market structures. According to Ali, “$SEI is starting to look like $SUI in 2024! Get ready for a massive bull run.”

Source: X

The chart shows SEI in a consolidation phase resembling the point where SUI began its parabolic climb last year. This “We’re here” marker, as highlighted by the analyst, suggests SEI could be entering a key accumulation stage before a potential explosive upside — one that could propel prices toward the $1 region if momentum builds in the coming weeks.

Such comparative analysis often attracts attention from technical traders who track fractal patterns and repeating structures across timeframes that hint at similar outcomes under comparable market conditions.

SEI Holds Steady Amid Broader Volatility

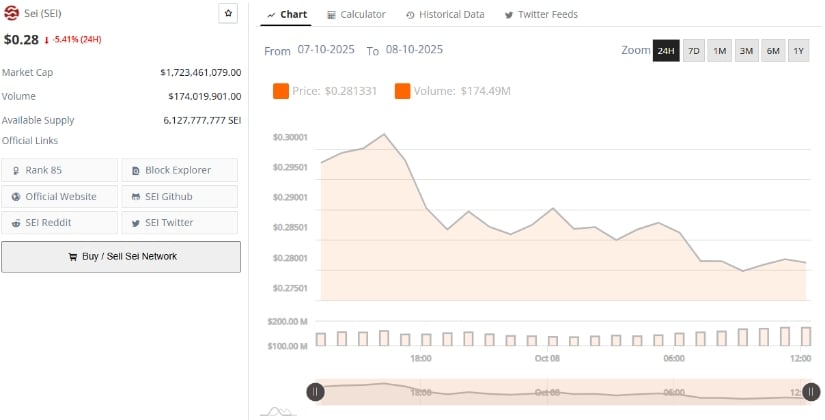

Additionally, data from BraveNewCoin shows that Sei currently maintains a market capitalization of $1.72 billion with 24-hour trading volume near $174 million, reflecting steady market engagement despite recent pullbacks.

Source: BraveNewCoin

The asset has been under short-term pressure, aligning with broader crypto consolidation trends, but continues to trade above a key structural base near the $0.27–$0.28 zone, which has repeatedly acted as a demand region. Analysts consider this support critical for preserving the bullish setup outlined by Ali.

From a fundamental perspective, the coin’s narrative as a high-performance Layer 1 blockchain optimized for trading continues to attract institutional and developer attention, strengthening its long-term outlook even amid near-term market softness.

Technical Outlook: Weak Momentum, but Structural Setup Remains Intact

On the other hand, data from TradingView indicates that SEI/USDT has been in a mild downtrend since its July high of $0.39, currently moving sideways with muted volatility. The Chaikin Money Flow (CMF) reading of -0.11 reveals persistent selling pressure, suggesting that more capital is exiting than entering the asset. This lack of accumulation has capped any strong rebound attempts for now.

Meanwhile, the MACD sits near the neutral line, with a reading of -0.0050 and a flat histogram, signaling low momentum and market indecision. This neutral technical stance suggests that the coin is at a pivotal junction — where renewed bullish volume could reignite upward momentum, or sustained weakness might extend the correction toward $0.16 support.

Despite these mixed near-term signals, the broader chart pattern, as Ali highlights, suggests a potential reaccumulation zone rather than a breakdown, giving weight to the bullish thesis if sentiment shifts positively.