Ethena (ENA) is showing renewed strength as bulls mount a strong defense at the $0.55 level, hinting at a potential bullish reversal and breakout ahead.

After weeks of sideways action and declining momentum, ENA’s price structure is finally tightening within a key support zone. With traders watching for confirmation signals, the current setup suggests a breakout toward the $0.65–$0.80 range could be imminent—if bulls can maintain control above $0.55.

Technical Outlook: ENA Holds at Key Support

After slipping during recent market turbulence, Ethena’s (ENA) native governance token has found renewed footing at the $0.55 support level. An 8-hour bullish buy signal triggered precisely at that support has drawn attention from traders, hinting at a possible reversal.

The 8-hour buy signal on ENA at the support level indicates strong price action and suggests the potential beginning of the next upward leg.

ENA’s 8-hour buy signal at support indicates potential for the next upward price move. Source: TheoTrader via X

This rebound arrives amid a modest 24-hour gain of 1.88%, outpacing the broader crypto market’s 1.15% advance. While the recent bounce is encouraging, the real test lies ahead—can ENA break through resistance near $0.65? If so, the path toward $0.75–$0.80 opens, assuming enough momentum carries through.

Accumulation and Pattern Formation on Higher Timeframes

Looking at the 2-day chart, ENA appears to be consolidating above a critical support/resistance zone, reinforcing the idea of accumulation and potential for a breakout. As another chartist noted, “ENA is trading above the critical support zone on the 2D timeframe. The consolidation around this breakout level shows accumulation—bulls are in full control.”

In this framework, ENA might be forming a symmetrical triangle or a wedge pattern. Such structures often precede strong directional moves once the price decisively breaks above resistance or slips below support.

ENA is consolidating above a key support zone on the 2D chart, showing strong bullish control and potential for a major upward move. Source: Butterfly via X

If bulls succeed in pushing ENA above the $0.65 level, a rapid follow-through toward higher targets is possible. However, failure to impress could open the door to a retest of $0.55 or even a dip toward $0.44 in a more bearish scenario.

Broader Context: Ethena’s Ecosystem Momentum

Ethena Crypto is strengthening its ecosystem through several key developments. Its flagship synthetic stablecoin, USDe, recently surpassed $6 billion in circulating supply, with some estimates suggesting the market cap could approach $9 billion, ranking it among the top three stablecoins globally.

In collaboration with Anchorage Digital, Ethena launched USDtb, a GENIUS-compliant onshore stablecoin built to meet U.S. regulatory standards, aimed at attracting institutional investors.

Ethena is also expanding on Solana with JupUSD, a native stablecoin backed by USDe and USDtb, supported by a plan to gradually convert approximately $750 million in USDC liquidity into JupUSD.

Ethena’s partnership with Jupiter showcases native liquidity sovereignty as JupUSD integrates stability directly into the ecosystem, creating self-sustaining value loops. Source: Sherif | DeFi via X

Additionally, the Ethena Foundation is preparing a $360 million ENA buyback program via a new entity called StablecoinX, intended to reduce circulating supply and strengthen long-term token stability.

These initiatives collectively position Ethena as a notable player in the stablecoin and synthetic asset space, emphasizing cross-chain scalability, regulatory compliance, and liquidity growth.

Risks & Considerations

The short-term outlook for Ethena (ENA) is bullish, but traders should remain cautious. Moves above $0.65 without strong volume may reverse quickly, so confirmation signals are important before entering positions.

ENA is consolidating within a trading pattern and testing a key support zone, signaling that a potential breakout may be approaching if confirmation signals emerge. Source: WaveRiders2 on TradingView

Large token unlocks can also create temporary sell pressure, as seen when a recent $101 million unlock caused a 10% drop to $0.45.

Additionally, Ethena’s synthetic stablecoin model relies on derivative hedging, which sharp market fluctuations can influence. Regulatory uncertainty surrounding stablecoins could also influence adoption and liquidity in the near term.

Final Thoughts

Ethena (ENA) stands at a crucial turning point. With bulls defending the $0.55 base and accumulation patterns forming, a breakout toward $0.65–$0.80 appears plausible. Still, traders should watch for clear confirmation before declaring a trend reversal.

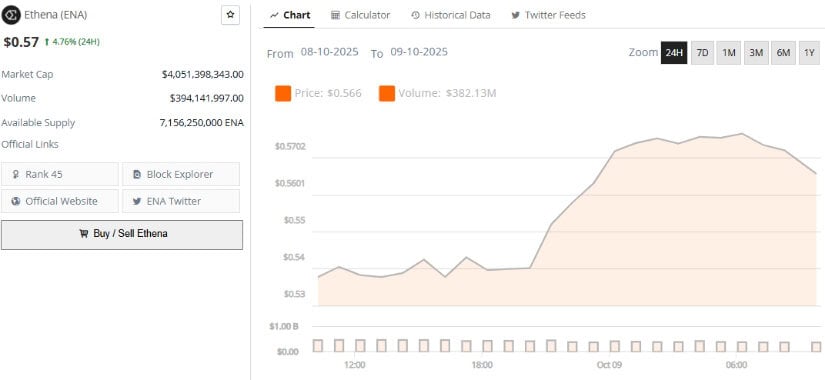

Ethena was trading at around $0.57, up 4.76% in the last 24 hours at press time. Source: Brave New Coin

Beyond price action, Ethena’s growing ecosystem—from USDe’s expansion and USDtb’s regulatory focus to multi-chain growth on Solana—adds substantial long-term value.

In essence, while short-term momentum hinges on technical confirmation, Ethena crypto continues to evolve into a major player in the synthetic stablecoin landscape—blending innovation, compliance, and expanding market influence.